Make ’em Take ’em

Remember playing neighborhood basketball? Moms would send us outside for hours.

We had to be creative with our game.

We’d start out with a game of horse to get things going. But, eventually we ended up in a heated match of make ‘em take ‘em.

It’s a game of momentum. Basically, the player that makes the basket keeps the ball. It starts out as fun, but then someone would usually dominate and embarrass everyone else.

There were some kids that could score at will and the others just had to stand and watch. Baskets would drain. The ball kept being checked back to the shot scorer.

It was humiliating for the player that couldn’t stop ‘em. But, for the kid making swoosh after swoosh – it was amazing.

Well, the interesting thing is, stocks are the same way. For most, the game is a back and forth. But with outliers, it’s utter domination. And in unusual times like now, outliers make it clear as day who the best in the game is.

The best stocks keep going higher and higher.

If your portfolio isn’t loaded with them, you’re simply just watching the other team rack up all the points. It’s impossible to catch up if you never get a stop. And many of these stocks haven’t slowed their rally for months.

This is happening even as market breadth is weakening.

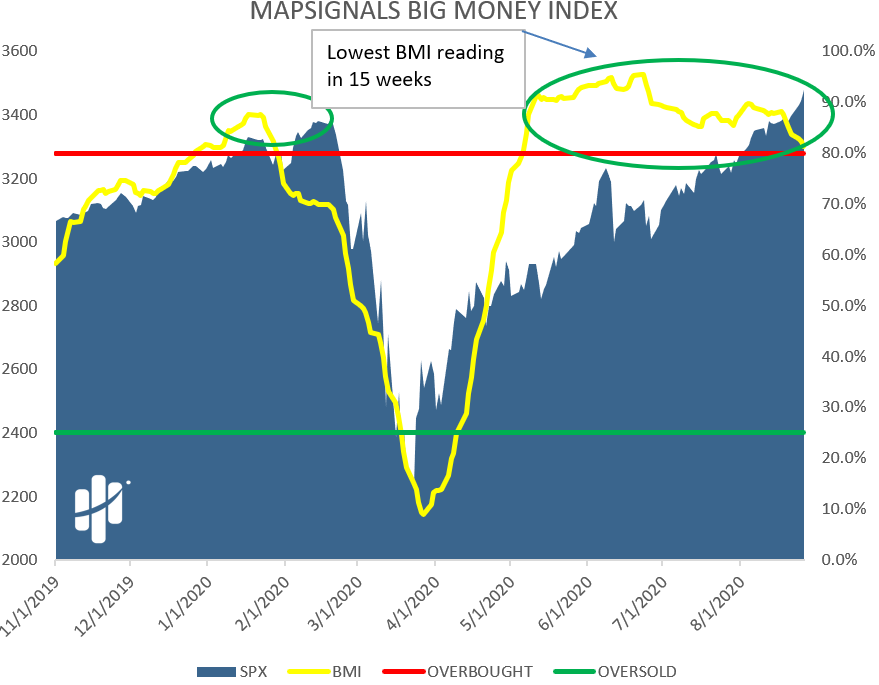

Big Money Index Is Slowly Falling

Watching the markets all day, you get the sense that everything is rallying. But, that isn’t the case.

Our Big Money Index has actually been in a steady downtrend for nearly 3 weeks. In fact, there’s a good chance that we won’t be overbought this time next week.

As you can see above, the BMI is slowly falling. This is happening even as the S&P 500 is gaining. When much of an index is heavily weighted towards mega-cap tech, this happens. Especially when outlier stocks get bid up day after day.

The BMI falling is just one data-point out of many that we look at. Currently, there’s no indication that the party in stocks is over. They still hold the ball.

But, the good news with make ‘em take ‘em is that the other team eventually gets the ball. A sleeper stock that we’ve held for years has finally sprung to life.

Outlier Stocks Make ’em Take ’em

Making hay in stocks is simple when you learn to hold. A great example occurred this week.

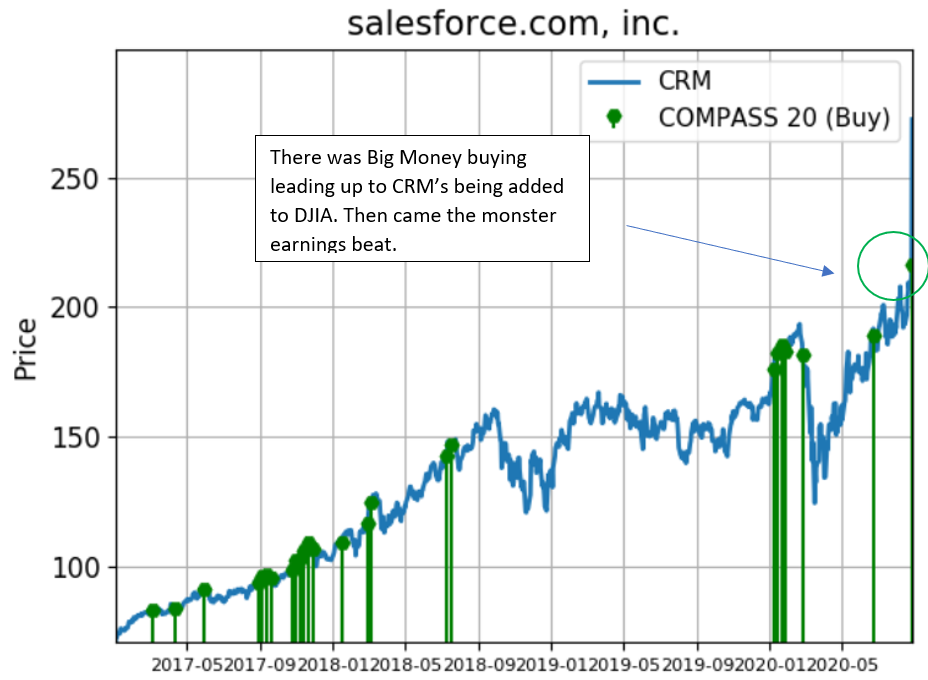

Over years we’ve been creating personal portfolios that hold many stocks that continually see Big Money buying. One of those bets was Salesforce.com (CRM).

And while we tend to never sell, what happened this week is a major reason why.

News hit days ago that Salesforce.com was being added to the Dow Jones Industrial Average. That’s an elite team of stocks. That headline sent the shares up a few percent on big volumes.

But, that was just goal one. The slam-dunk came soon after.

The company absolutely destroyed earnings Tuesday night. I mean, it was a thing of beauty. A complete beat on top and bottom lines set the tone for the initial ramp after hours.

And then came the raised guidance. Wall Street loves a beat and raise by great companies. Typically, money rushes into those stocks.

It looks like this:

Source: MAPsignals, End of day data sourced from Tiingo.com

Those are all of the all of the times that CRM was a Top 20 stock for MAPsignals. Learn about that report here.

You can see the stretch of green that occurred from 2017 – 2018. That’s what stock market make ‘em take ‘em looks like.

What happened yesterday was a repricing. The +26% move lifted the whole Software space. It was awe inspiring to watch.

Just like with a fun game of b-ball, momentum eventually takes hold. The same thing happens when you follow the stocks that Big Money loves. When the epic runs start, you’ve gotta be along for the ride.

Waiting for a stop, sucks. Outlier stocks are running on a hot streak.

If you feel like you’re on the sidelines watching the scoreboard run away, give MAPsignals a shot.