3 Easy Reasons to Buy Semiconductors Hand Over Fist

It’s a wonderful time to be a stock investor.

Not only are markets making all-time highs, select names have incredible multi-year tailwinds.

Many of those reside in the Technology space.

Here are 3 easy reasons to buy semiconductors hand over fist.

A lot has happened the past week:

- Apple (AAPL) knocked the cover off the ball in this year’s WWDC, bringing Apple Intelligence (AI) to the masses later this year

- The May Consumer Price Index (CPI) came in lower than expected proving that inflation is falling…that’s a trend we expected, signaling this bull market still has legs

- And let’s not leave out the mega earnings announcements from Technology stalwarts like Oracle (ORCL) and last night’s semiconductor behemoth, Broadcom (AVGO)

With markets and high-quality tech stocks reaching new heights, you may be inclined to think chip companies have gotten ahead of themselves.

We respectfully disagree.

Today we’ll showcase hard-hitting evidence signaling more upside for the chip industry. This mega-trend has years of runway ahead.

3 Easy Reasons to Buy Semiconductors Hand Over Fist

A.I. has absolutely taken the investing world by storm and for good measure.

Day after day we’re greeted with companies blowing past earnings estimates, proving how many Wall Street analysts need to keep pace by raising their estimates.

NVIDIA’s (NVDA) forward Q2 guide last month pointed to ~$28B in revenue, easily outpacing the analyst community’s $26.62B estimates.

Then last night Broadcom provided a monster report with Q2 sales clocking in at $12.49B…trouncing Wall Street estimates of $12.06B.

Let’s not forget both of these bellwethers announced 10 for 1 stock splits.

When business is booming, there’s only one direction for their share prices to travel: NORTH.

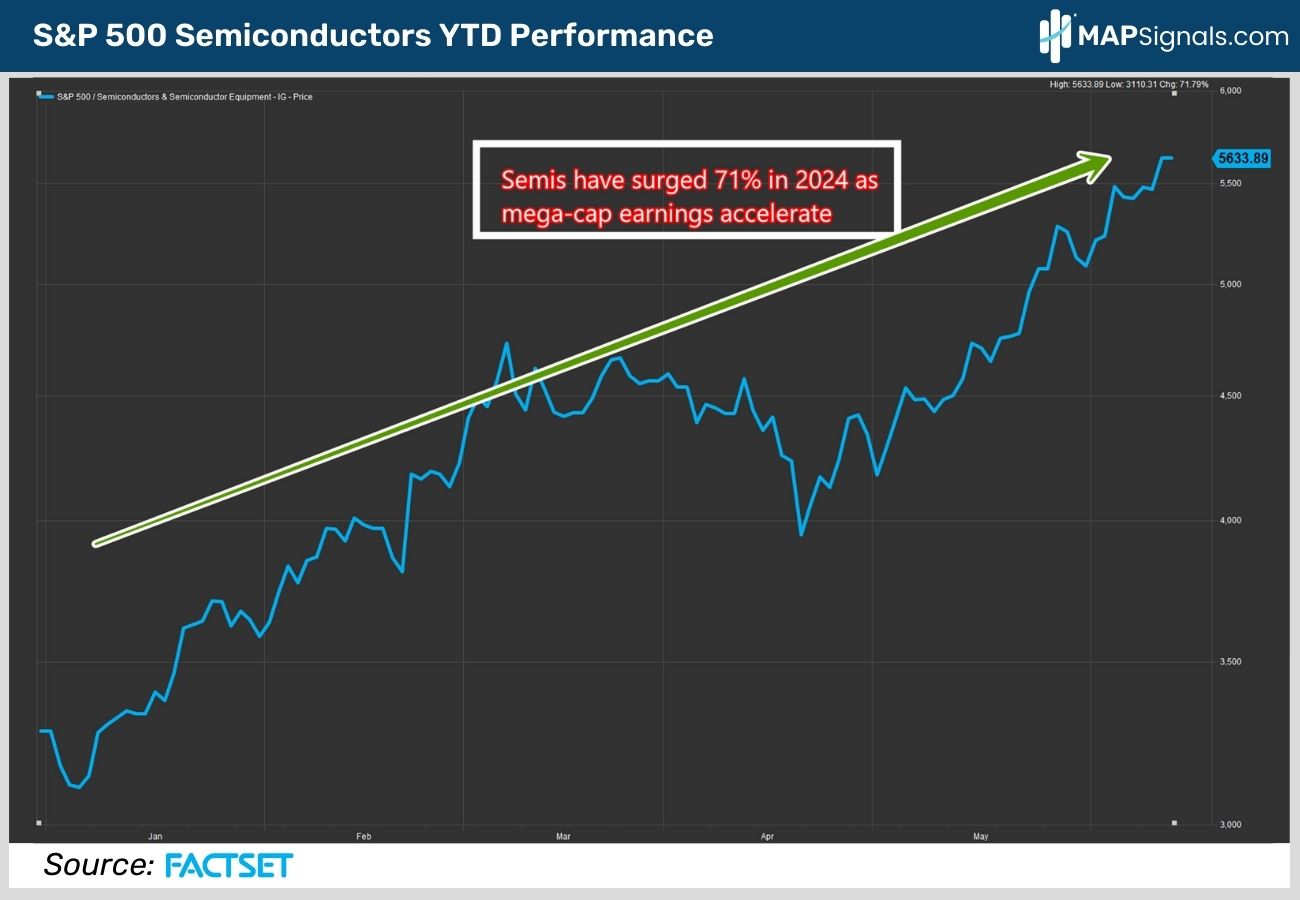

Below shows the remarkable YTD climb of the S&P 500 Semiconductors & Semiconductor Equipment Industry. The group has gained a staggering 71% in 2024:

And while I’ve been very vocal on my bullish stance on Technology stocks this year, we’ll keep beating that drum by focusing on one of the biggest multi-year tailwinds in the marketplace today: Semiconductor firms.

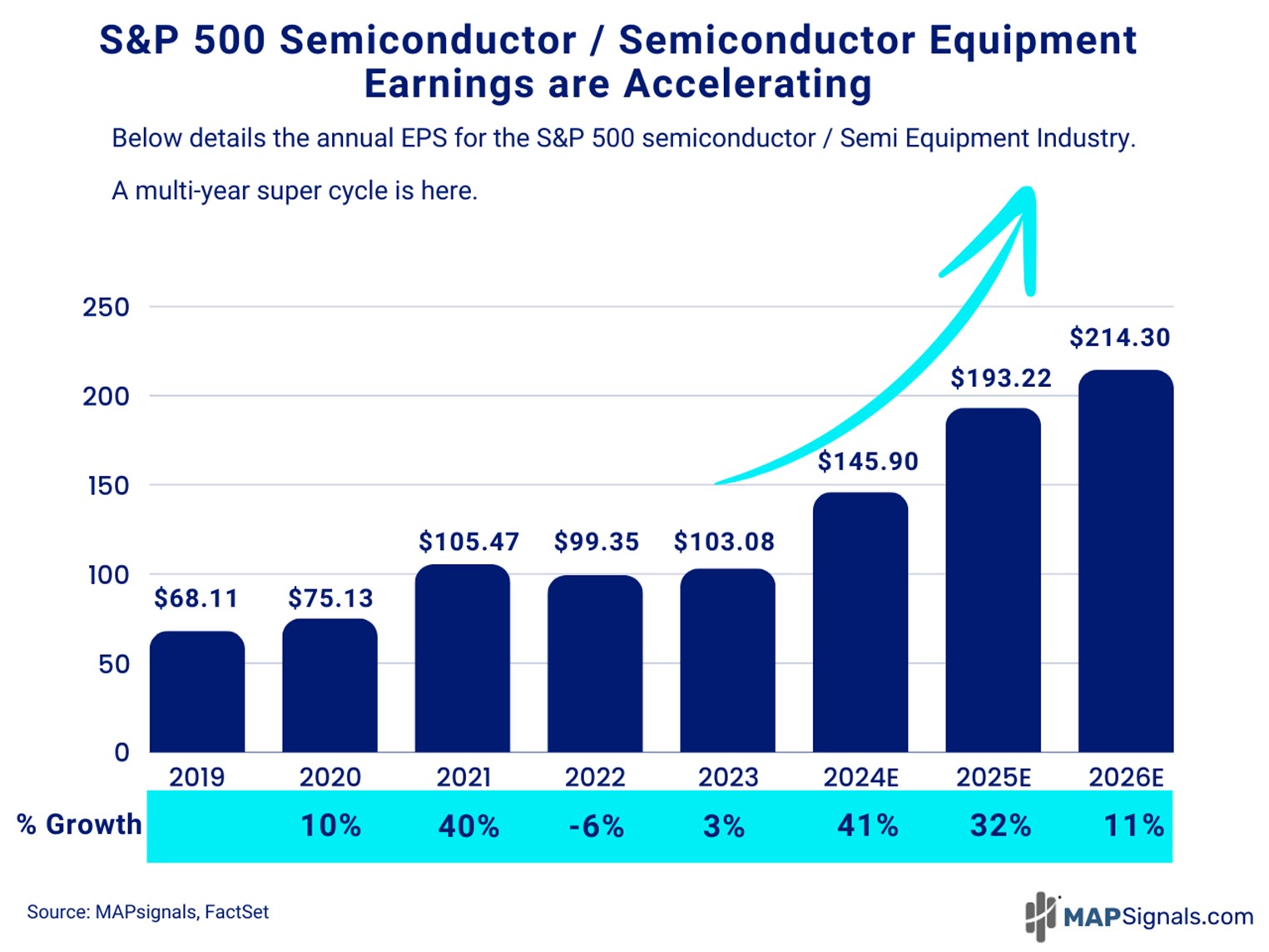

Reason number 1 to keep owning semiconductors comes down to accelerating earnings. Stocks follow earnings…it’s that simple.

Not only has EPS been climbing lately, it’s set to boom in the coming years.

Below shows this beautifully. From 2019 to 2023, annual EPS for the S&P 500 Semiconductor / Semiconductor Equipment Industry has risen from $68.11 earnings per share to $103.08.

That’s a 51% increase.

But it gets better…a lot better. Estimates for 2024 are pointing to $145.90 in EPS, representing a 41% surge in earnings.

That’s followed by +32% EPS growth in 2025 and +11% growth in 2026:

Want to make money in stocks? Focus on earnings growth. Let’s keep going.

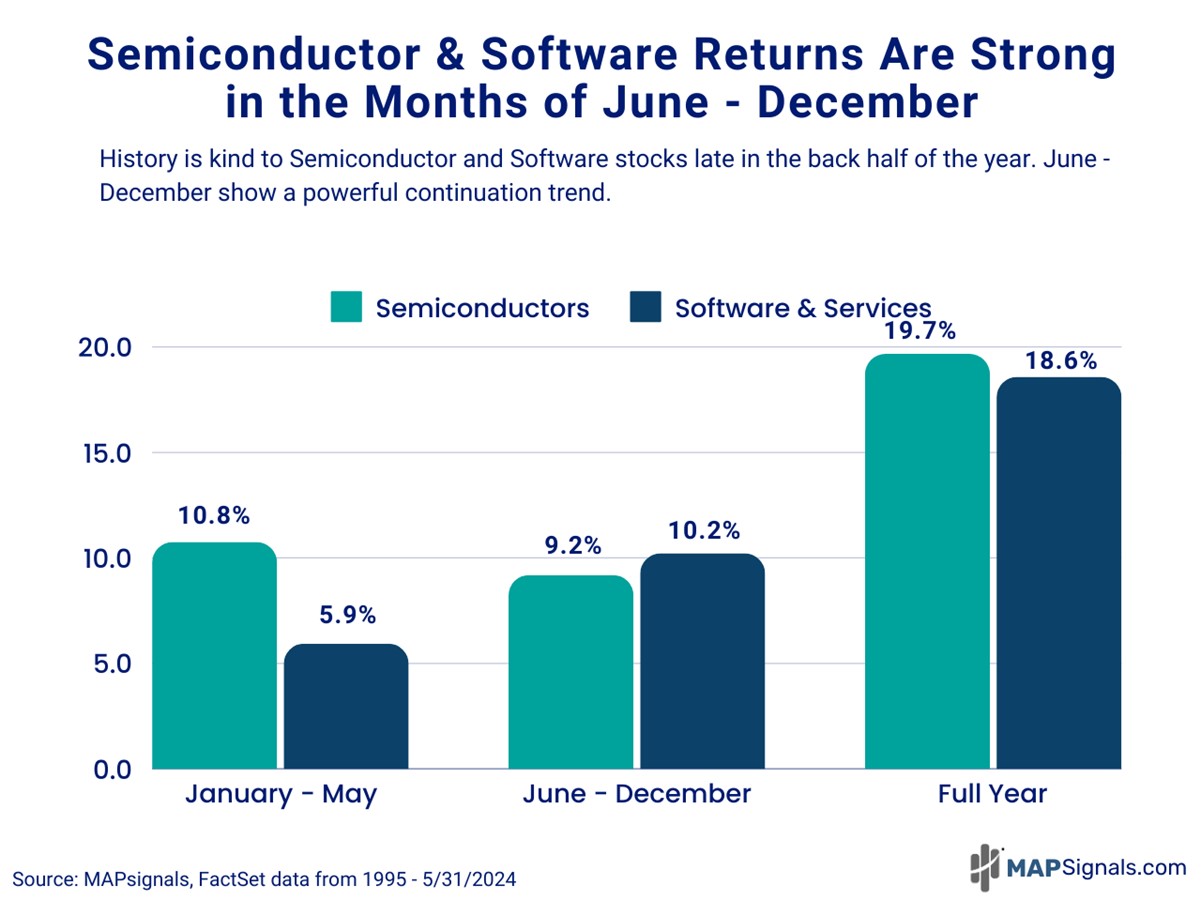

Reason number 2 to buy semiconductors comes down to history. Jumping off the bull-wagon this summer could sound enticing.

However, history suggests that could be a mistake.

June typically kicks off an illustrious bullish continuation trend through the end of the year. Since 1995, the Semiconductor group has gained an average of 9.2% in the final 7 months of the year.

Given my message last week to buy Technology stocks after rare capitulation, I’ve included the S&P 500 Software & Services June – December double-digit historical returns as well:

The earnings picture is bright. Check.

The technical picture is beaming. Check.

Now what’s left to drive home this opportunity is the money flow picture. Nothing gets me more excited than showcasing outlier stocks under healthy constant institutional support.

Reason number 3 to keep buying all-star semiconductors is due to strong recurring inflows from the institutional community.

This is where MAPsignals’ unique lens into supply and demand unlocks tomorrow’s winning stocks.

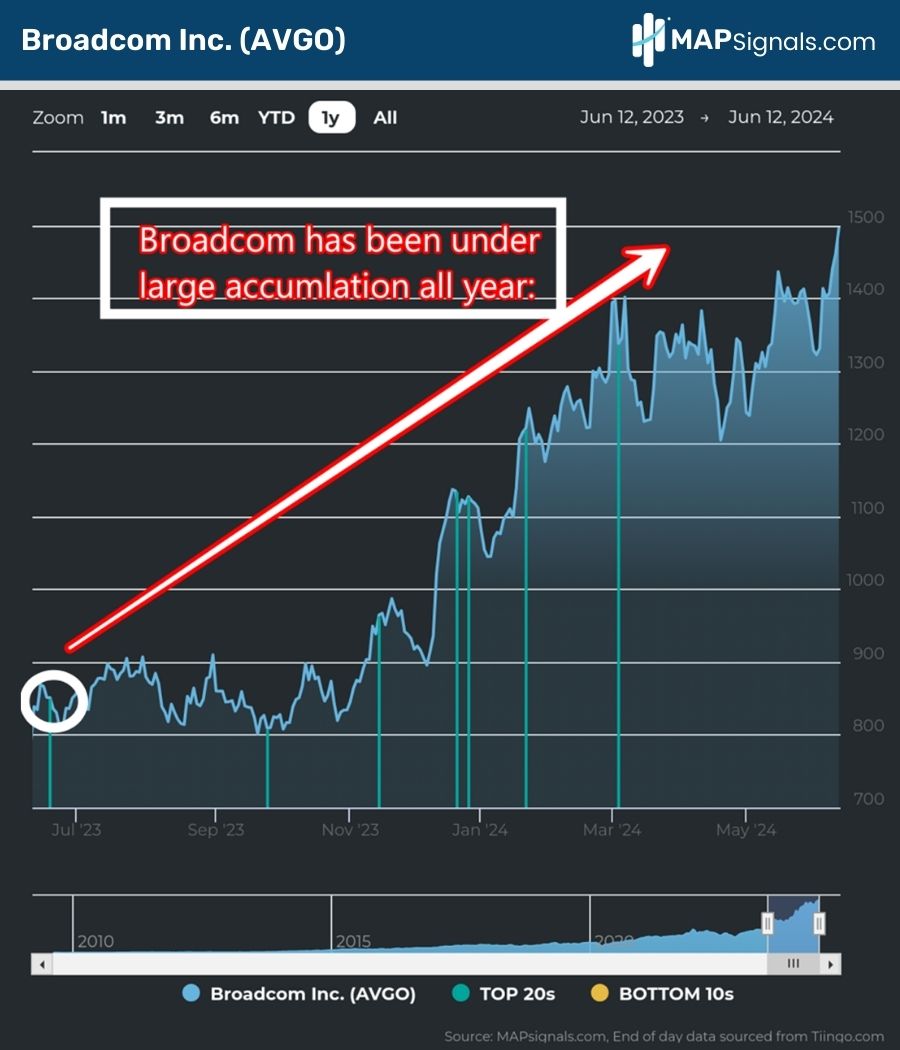

Given Broadcom’s explosive earnings report last night, let’s take a look at the stock’s money flow picture the past year.

If you think the trend of owning this powerful player is a new concept…think again. This name has been all over our rare Top 20 list.

The first of 7 Top 20 instances came on June 20th, 2023. Since then, the stock has steadily climbed 75%, helped by strong inflows along the way:

That’s a beautiful chart if you ask me!

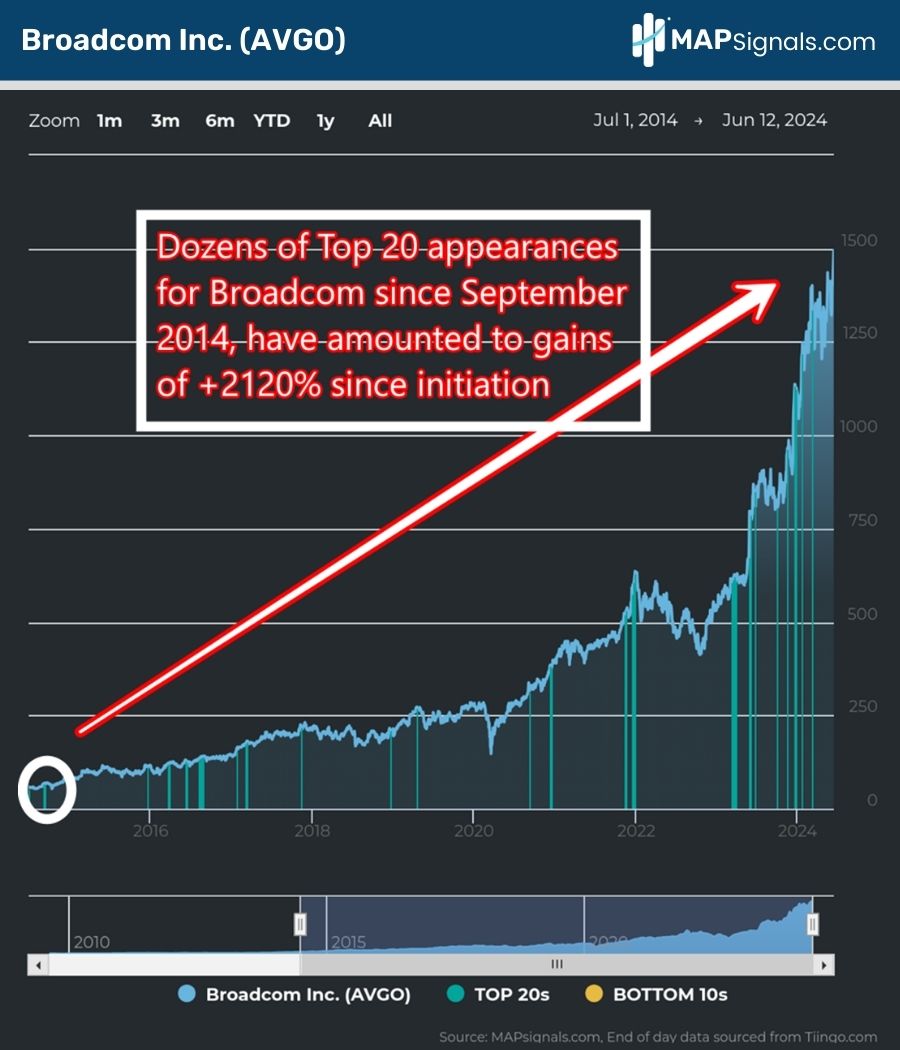

But when you zoom out, it gets even clearer. Since 2014 (when we started our business), AVGO has been one of the most bought names in our research.

In other words, the institutional demand for this incredible company has made it a mainstay in our research.

Here you can see when the company came on our radar at a price of $68.28 on September 8, 2014. That’s a performance of +2120% since the first buy signal:

That repeated blue signal is the stairway to heaven. All outliers we’ve found have charts that look like this.

Outstanding semiconductors are poised to keep climbing simply due to the ultimate power law in markets: Relentless demand for the stock.

That’s what we witnessed handling institutional order flow on Wall Street trading desks many years ago…it’s never been truer than today.

Position for further upside in the semiconductor industry due to the super cycle that’s already here for A.I. and the latest upgrade cycle coming for Apple products.

Let MAPsignals help you spot the names big investors are betting on…hand over fist.

Here’s the bottom line: Technology stocks need to be part of any growth investor’s portfolio. The 3 easy reasons to buy semiconductors hand over fist come down to the bright earnings picture for the industry, technical tailwinds, and of course relentless demand for their shares.

That’s a powerful cocktail to kickstart any portfolio.

There’s a whole host of names getting the Wall Street blessing…many not in the media headlines. Let MAPsignals bring those potential opportunities to you.

If you wait for the media GO-SIGNAL to flash, you’ll miss a lot of the early move. Money flows drive prices…and portfolios!

Use a MAP to see the money movements in real-time.

If you’re serious about finding outlier stocks, or are a Registered Investment Advisor (RIA) or money manager, now’s a great time to add our cutting edge research to your process. Get started with MAP PRO subscription and get our weekly Top 20 report in your inbox each week.

Can you invest without a MAP? Maybe…but I can’t recommend it!

Lastly, join me in our upcoming free webinar next month in partnership with Wealth365, discussing how now is shaping up to be one of the best small-cap opportunities.

You won’t want to miss it.

Have a great week!