2 Key Signals Forecast Strong Gains for NASDAQ Stocks

Investing doesn’t have to be complicated.

Simply own great companies…especially technology names.

2 key signals forecast strong gains for NASDAQ stocks.

Let’s be honest, clouds of uncertainty are everywhere you look. We’re facing:

- A looming election

- Global wars

- Record Federal debts

The list goes on and on. Sounds complicated, right?

It doesn’t have to be. Focus where institutions are placing their bets and odds are you’ll grow your wealth… and ideally worry less.

At MAPsignals, our money-flow indicators have signaled healthy appetite for stocks for months. That’s kept our unpopular bullish message in play.

Today’s write-up offers 2 evidence-rich studies pointing to healthy gains ahead for the NASDAQ. The lagging group is getting an upgrade today.

If you’re like me and are hunting for positives in a sea of uncertainty, we’ve got you covered.

But first, let’s size up the money-flow landscape.

Big Money Index (BMI) Remains in an Uptrend

Working on Wall Street taught me to respect the flow of money. Handling countless equity orders for institutions revealed the ultimate power law in markets: supply and demand.

If demand outstrips supply, stocks have nowhere to go but up.

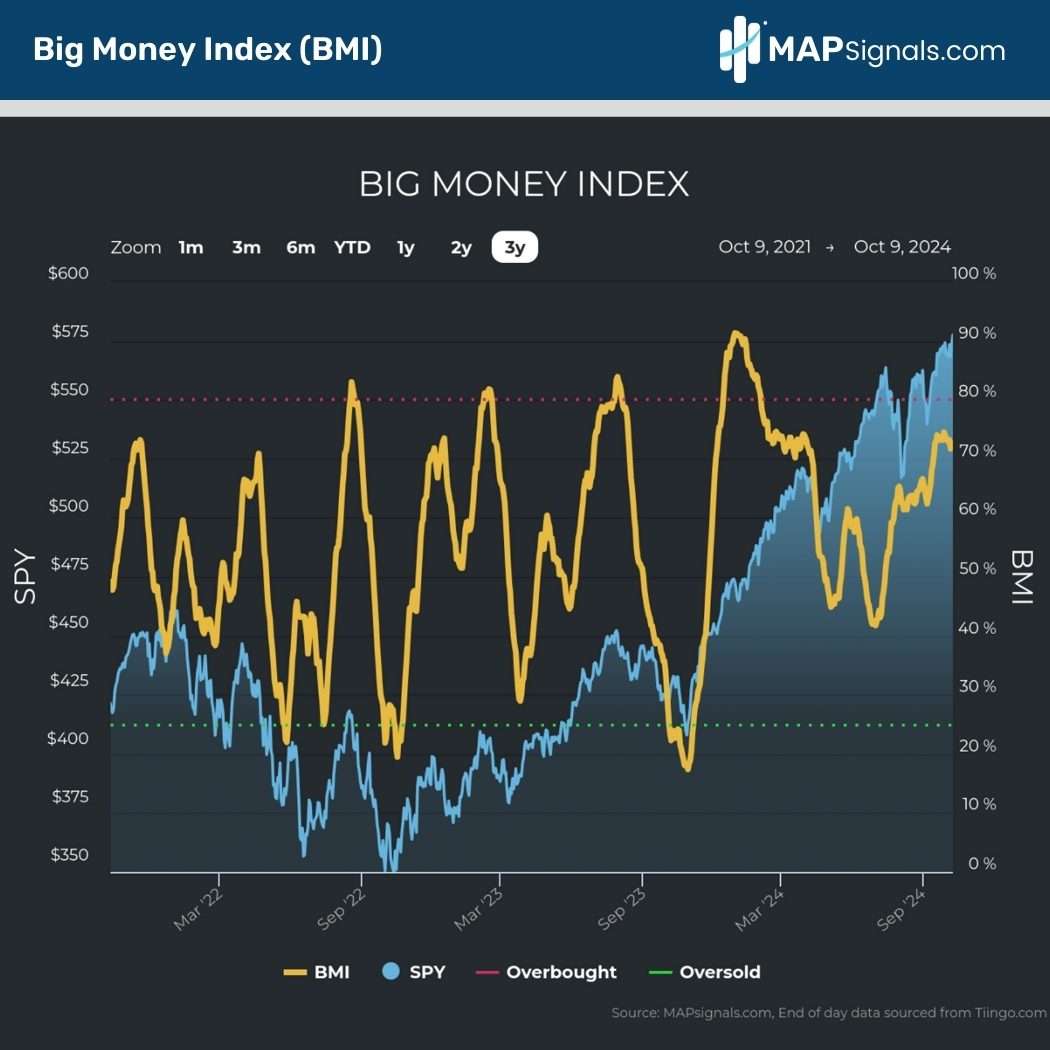

Our Big Money Index (BMI), which gauges unusual buy and sell pressure on thousands of stocks, has been steadily rising.

On a 3-year basis, you can see how it tends to lead markets when we reach extreme readings (overbought red line and oversold green line).

Currently, we’ve been cruising along in the mid-70s:

This is healthy action. However, we all know that stocks haven’t been climbing in a straight line. We’ve had a number of selloffs along the way.

This is where we find our first signal study on the NASDAQ.

2 Key Signals Forecast Strong Gains for NASDAQ Stocks

Respecting the trend is paramount.

However, there are explicit capitulation signals to understand as well. These are some of the most powerful signals you’ll find anywhere.

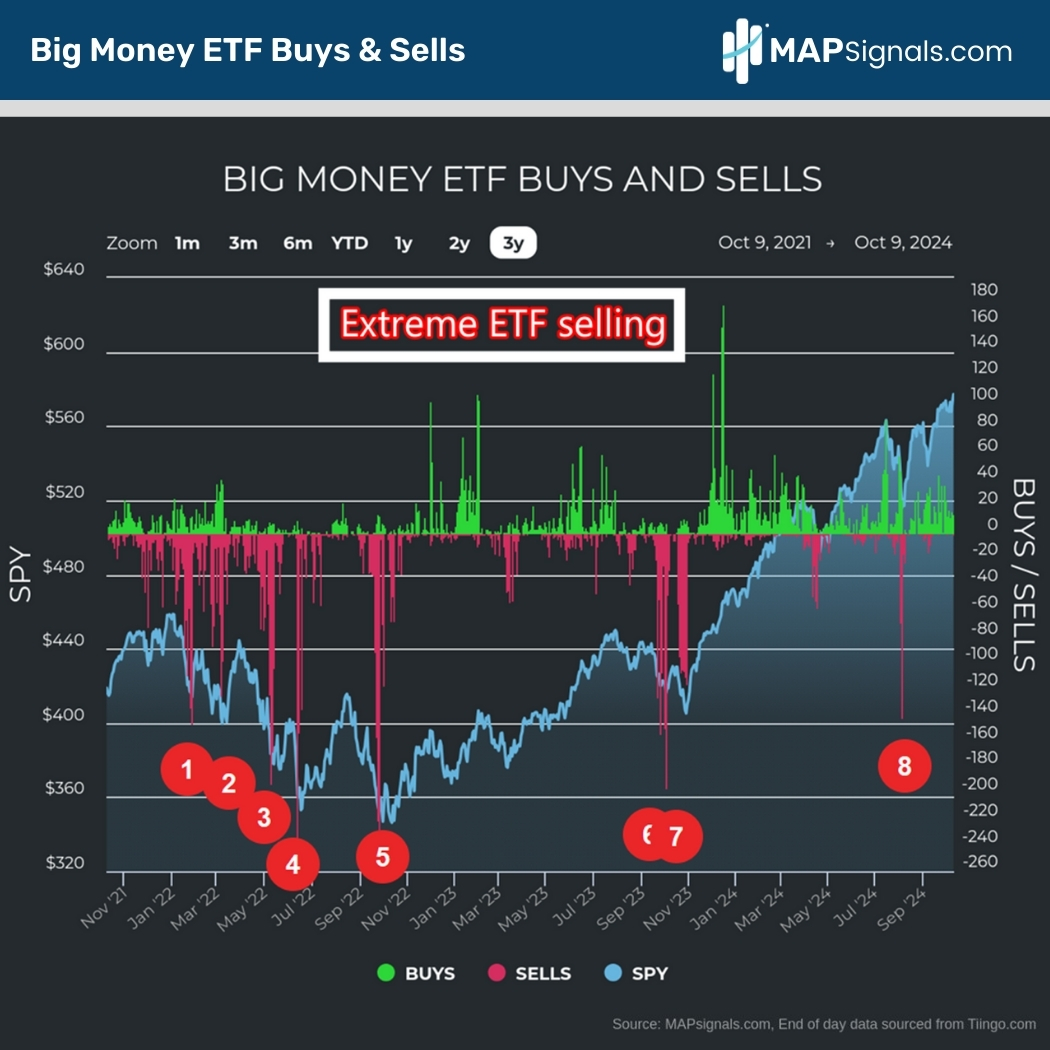

The last notable selloff was in early August when the VIX exploded to over 38. We were front and center with our subscribers telling them to buy the dip.

One of the reasons was due to ETF liquidations. When investors dump ETFs, it often signals a near-term bottom is in play.

On August 5th, we logged 142 ETFs sold. This is one of the largest outflow days in recent years:

Now you may think this is old information. But you’d be wrong. These force-selling events act like a reset for markets. They often create a mega-uptrend for months and years later.

Here’s why this level of selling is bullish for the NASDAQ.

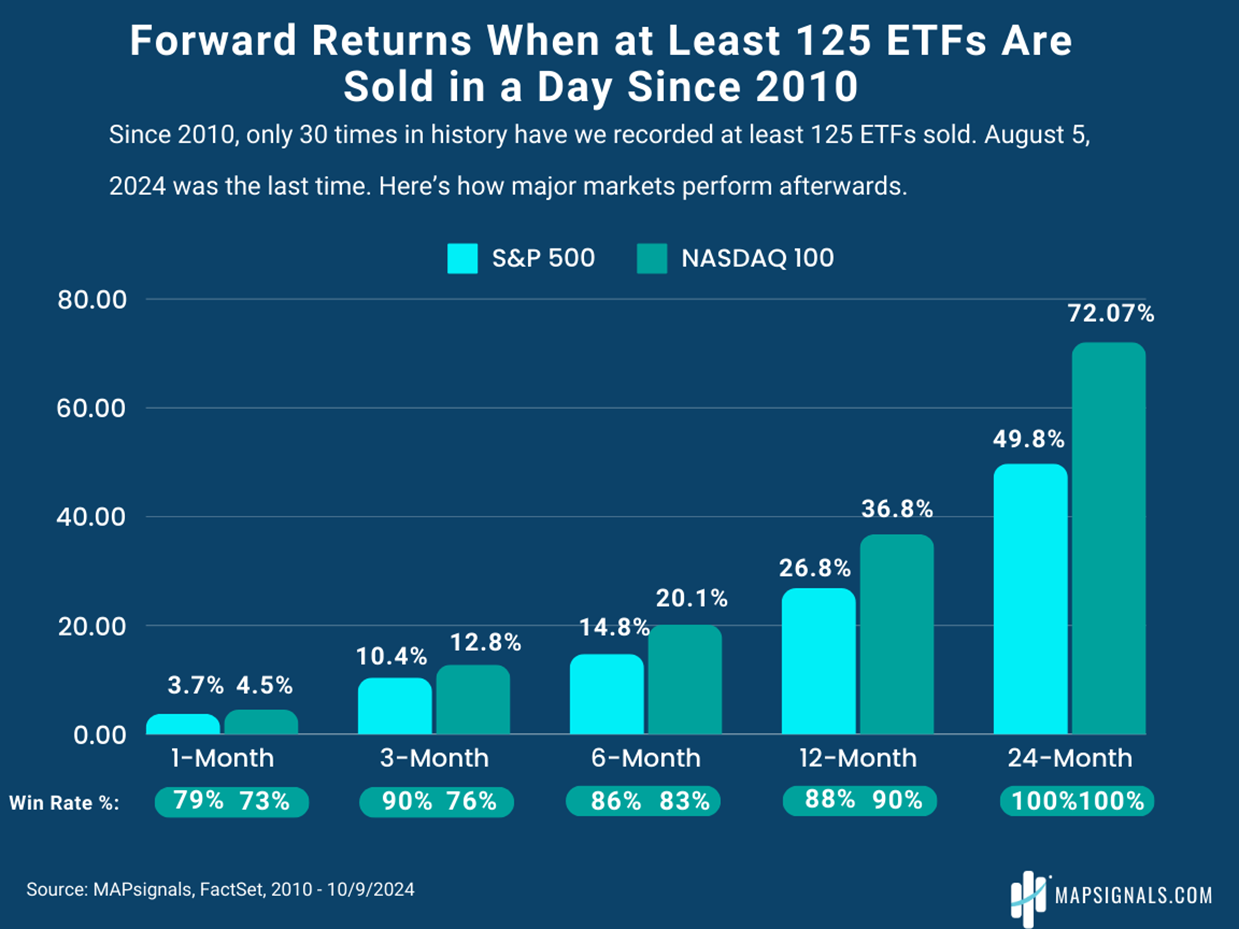

In our August liquidation piece, we highlighted the forward returns for both the S&P 500 and NASDAQ 100 post 125 or more ETFs sold since 2010.

I’ve updated the returns through yesterday. Whenever 125 or more ETFs are sold:

- 3-months later the NASDAQ jumps 12.8%

- 12-months later the NASDAQ rips 36.8%

- 24-months later the NASDAQ zooms 72.07%

For those keeping score, since August 5th’s plunge, the NASDAQ has gained 13.4% in just over 2-months…we believe we are in the early innings of this signal.

And if this doesn’t get you excited, I’ve got another reason to own Tech stocks now.

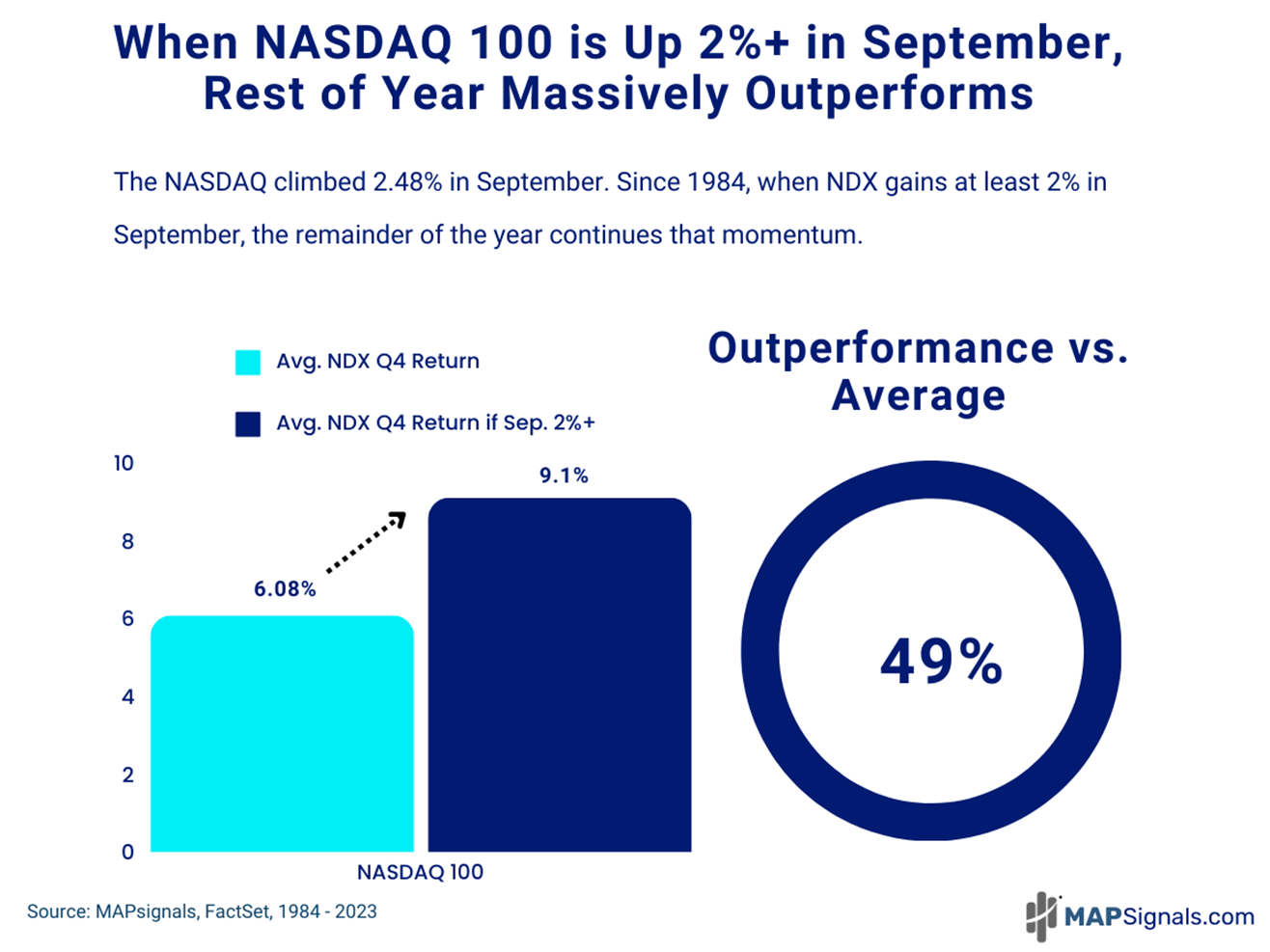

It comes down to momentum. The month of September clocked a gain of 2.48% for the tech-heavy NASDAQ 100. This was the best September performance since 2013.

Turns out, strong Septembers are bullish omens for Q4.

Since 1984, the average gain for the NASDAQ in the months of October – December is a juicy 6.08%.

Not bad.

BUT whenever September gains at least 2%, the following 4th quarter climbs to 9.1%! Don’t fade strong September momentum:

Putting all this together, we’ve got a cocktail for solid gains into year-end. Use any potential October surprise weakness as a buying opportunity.

That’s how we stay ahead of the game at MAPsignals…follow the money into the best stocks.

Here’s the bottom line: Tech stocks have languished recently. But they’re ripe to climb soon.

We’re in the midst of an ETF liquidation oversold signal that lasts for months and years. Couple that with the evidence that big Septembers tend to see outsized outperformance in Q4…you’ve got a powerful backdrop to own growth stocks.

And the best news is MAPsignals finds the explosive high-quality opportunities loved by institutions.

Don’t follow the never-ending negative headlines.

Follow a map.

Right now, the NASDAQ is the destination.

If you’re a professional money manager, RIA, or are a serious investor, get started with a MAP PRO subscription today.

It’s a great way to navigate uncertainty!