Be Kind, Please Rewind Market

Back in the ’90s, Blockbuster was magical.

Hunting for the best movie was the game.

But there was one rule, “be kind, please rewind.”

This market confuses many. Here at Mapsignals, though – our data helped us win.

We were focused and looked back to get a picture of what might come.

Winning in markets is all about being calm and rewinding.

The Big Money Index Is Running Hot

After a huge reset in the market, we tend to see a wicked rip.

Oversold markets reprice very quickly.

What we are seeing now is very similar to prior oversold periods.

As you can see, in terms of Mapsignals data – the current market action is expected after being oversold.

This is why rewinding is critical.

Using feelings and emotions, for us, has never worked.

So, is this bounce in stocks because of FOMO buyers?

Let’s dive deeper.

Why Markets Are Ripping

We don’t know everything, but we do know our data.

The 2 things causing this reset are:

- Selling in stocks went from huge to zero

- Buying in stocks has increased from zero to small

This is very typical of deep selloffs.

Said another way, sellers have to get out of the way before buyers take the lead.

This is supply and demand 101.

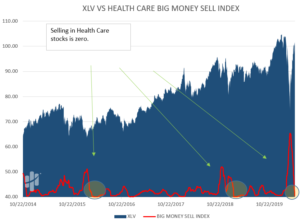

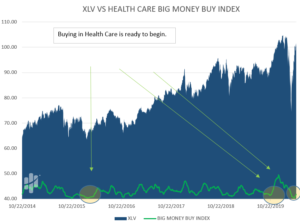

Let’s look visually at selling going to zero and buying lifting from zero.

Below are sector charts tracking the rate of selling (red line) and rate of buying (green line).

If the green line is going up, buyers are showing up.

If the red line is going down, sellers are drying up.

We’ve discussed these themes before.

When the sea changes, you gotta ride the wave.

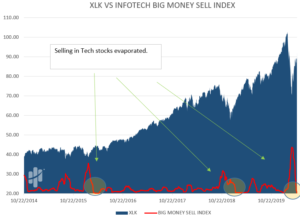

Now, you’ll see the same pattern with Technology:

Bottom line – buyers are small, but gaining.

This rip is not because of massive buyers – it’s because sellers evaporated.

There is more risk of going overbought than retesting lows.

Market Gyrations Are Part of the Game

Market headlines will make your head spin.

What seems bearish one day, is bullish the next.

The flow of money gives insights irrespective of headlines and emotions.

Some say that we did well during this pandemic.

If that’s true, it’s because we were able to rewind.

I’ll leave you with a video we posted in late January, How We Win.

At the 5 minute mark, we chat about how we use the Big Money Index.

We had a lot of fun making this video.

Be kind, please rewind.