Best Way to Invest Globally

2022’s stock market is off to a rough start.

US stocks aren’t the only ones on sale. Here is the best way to invest globally.

Fans of MAPsignals know we like to stress-test conventional wisdom. That’s because outsmarting the crowd can mean big money to be made. Let me show you how that applies to global investing.

Experts have long recommended owning a diversified portfolio. That’s nothing new, we’ve heard it a million times. Combining assets that can zig when others zag should lead to a smoother ride. And my best way to invest globally, is a great way to diversify.

It’s not uncommon for Americans to think little beyond our borders, but it’s a big world out there! In fact, US stocks only represent 61% of global stock market value. That’s why most U.S. investors own some international stocks in their retirement mix. The problem is almost nearly all that money is stuck in foreign large cap stocks.

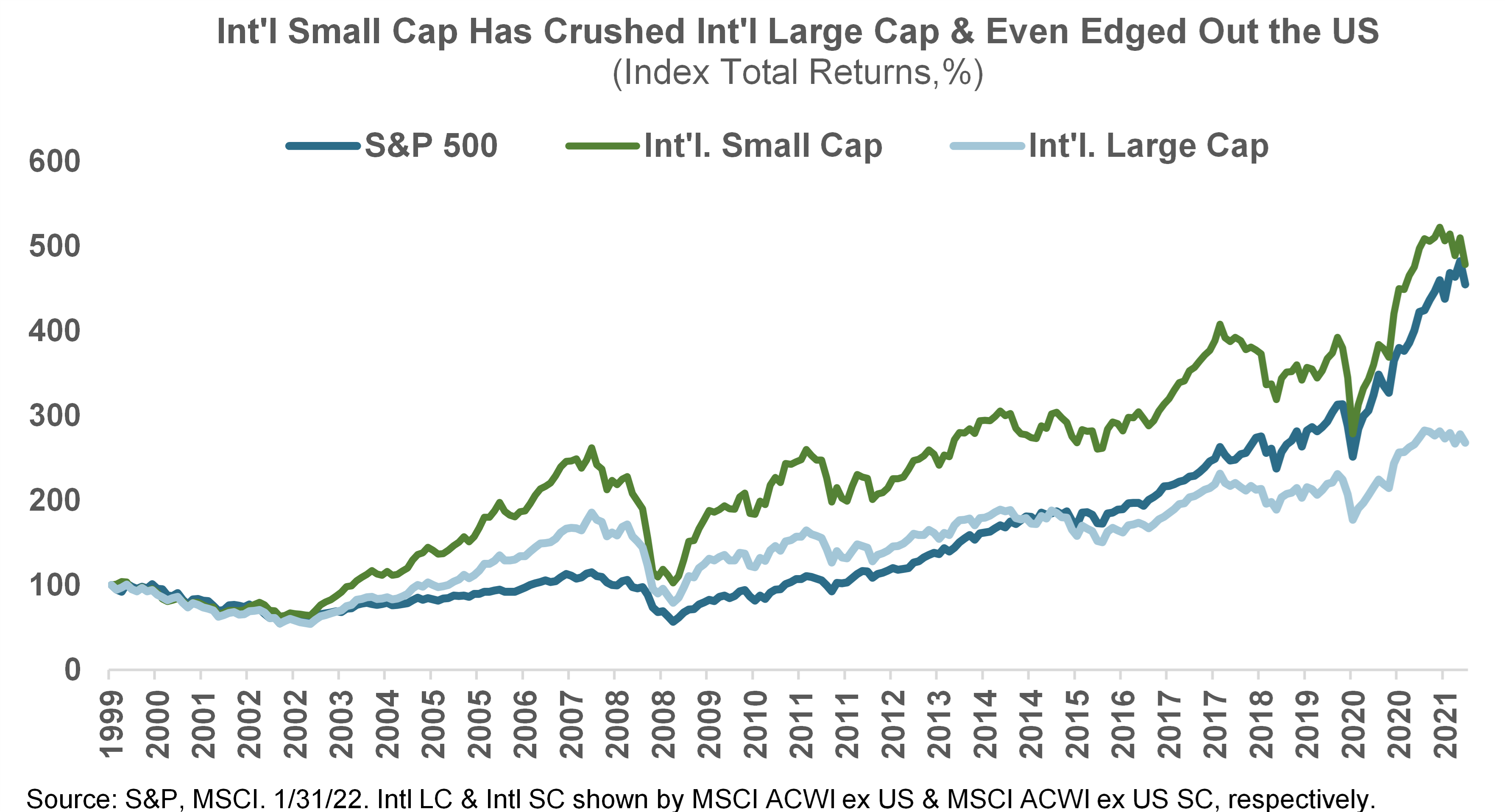

Corporate 401K plans and major brokerage platforms steer investors into large cap foreign funds because they’re perceived as less risky. That’s understandable but costly, leading to missed opportunity. Since 1999, overseas small cap stocks are up five-fold (chart), almost doubling foreign large cap returns and even edging out the S&P 500!

Even more amazing is that smaller foreign stocks’ upside has come without wild swings. That’s right- they’ve been less volatile than the Russell 2000, the leading US small cap index.

Everybody loves a bargain and now foreign small caps fit the bill. They’re cheap; trading at only 14.6X 2022 consensus earnings forecasts. In other words, that’s 30% cheaper than the large-cap heavy S&P 500: double the 15% long-term average.

The icing on the cake is a juicy 3% dividend yield. When inflation is high, dividends help maintain your purchasing power. But they also pad returns in what are often more volatile, lower return environments. Consider this: in the 1970s, dividends comprised 78% of the S&P 500’s returns!

Any way you slice it, international small caps deserve a serious look. They could be the best way to invest globally.

Best Way to Invest Globally

ETFs that track leading international benchmarks from MSCI and FTSE Russell are very popular. They make it easy to go global. They offer great world exposure, including everything outside the US from developed markets like Europe and Japan, to emerging markets like China and India.

Country concentration is weighted according to the size of each market. That means you needn’t worry about how much money to allocate to which country. And ETFs come in both large cap and small cap flavors. This plug and play flexibility makes it easy to target any slice of the global stock market pie.

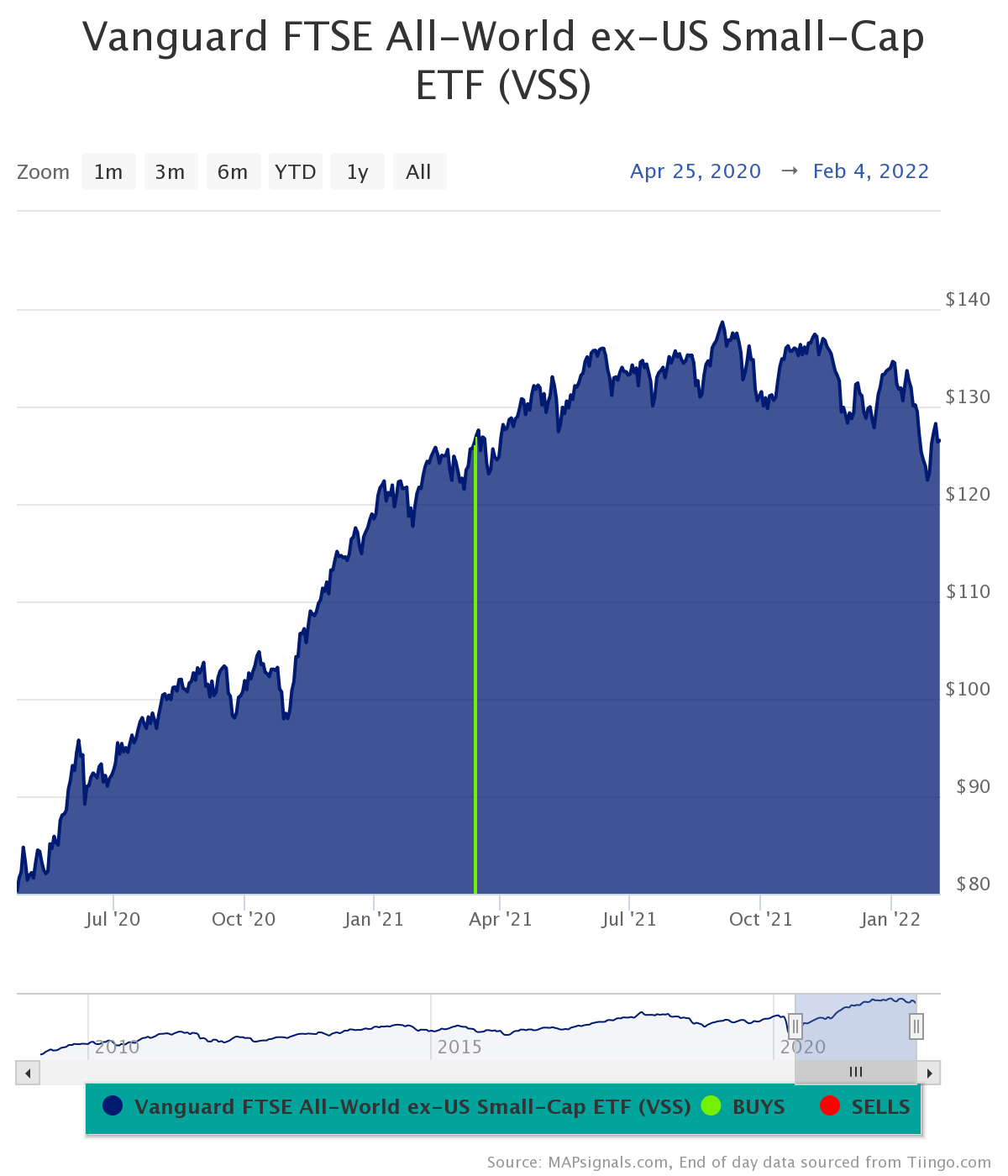

Vanguard’s VSS is the leading international small cap ETF with $10B in assets.

VSS a one stop shop including all foreign developed and emerging markets. The best part? It’s rock bottom expense ratio of 0.08% is the cheapest in the category.

And below you can see the fund has gotten one lone buy signal the past 20 months:

Remember though, it’s not either-or. You needn’t replace all foreign large cap exposure with international small caps. You can own both.

The point is the data says to put small caps on your radar.

Here’s the bottom line: As I see it, the best way to invest globally right now is to have international small cap exposure. I see this as a smart bet for RIAs and those looking to broaden their reach outside of the US.

I say: let the crowd keep gobbling up global large caps! Crowded trades rarely generate consistent long-term alpha (returns above a benchmark).

Stick to the road less travelled by adding international small caps to your retirement mix – they’re a better way to go global!

Trade well,

-Alec

***And if you missed our latest video: Best Stocks to Buy Now for February 2022. Jason focuses on top-quality stocks. Eventually the selloff will pass.

Make sure to follow our YouTube channel here so you never miss any of our videos.

Also, you can find our other videos here.