Bullish Case to Own Real Estate Stocks into Yearend

If you’re only focused on Tech stocks right now, you’re missing out.

A massive rotation that began months ago is in full force.

Interest rates are falling.

And that makes a bullish case to own real estate stocks into yearend.

One of my favorite write-ups this year signaled a monster reversion trade was coming. If you recall, the crowd was ultra-focused on a handful of stocks, while the rest of the market underperformed by a wide margin.

Fast-forward to today and many left-for-dead sectors are playing catch-up… especially Real Estate stocks.

REITs, known for their juicy yields and low-growth profile, can often be overlooked by investors. In fact, the sector is the only negative performing group on a 3-year basis.

I believe Real Estate fortunes are set to improve.

Today, we’ll size up the REIT landscape through our Big Money lens. Then we’ll laser-in on one historical study suggesting the group will ramp into the end of the year.

Bullish Case to Own Real Estate Stocks into Yearend

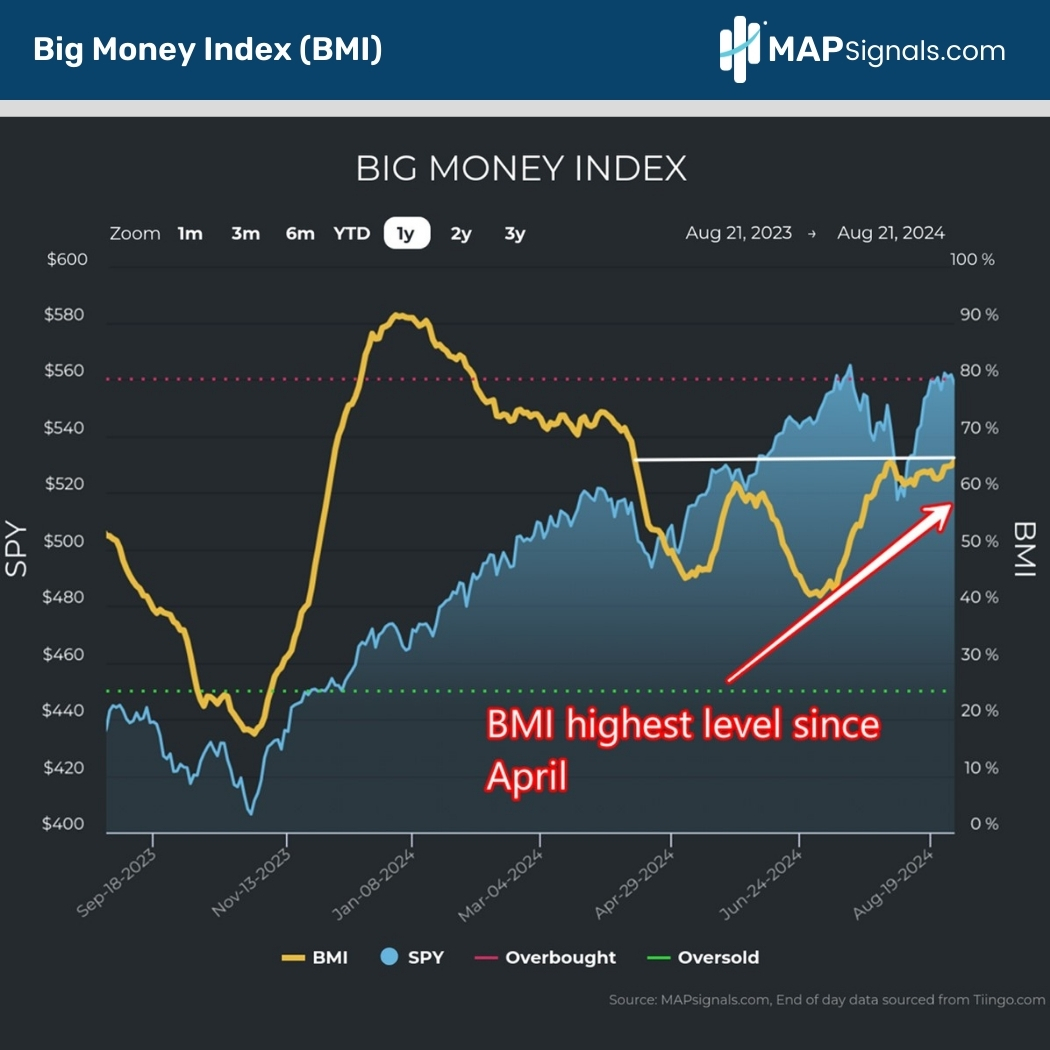

The rotation trade is only accelerating. One look at our Big Money Index (BMI) reveals a startling truth: Money is being put to work.

With a 65.6% reading, the BMI is at a 4-month high:

A rising BMI can only mean that more stocks are under accumulation compared to those getting sold. It may surprise you to learn that Real Estate stocks are a major contributor to the rise in the BMI.

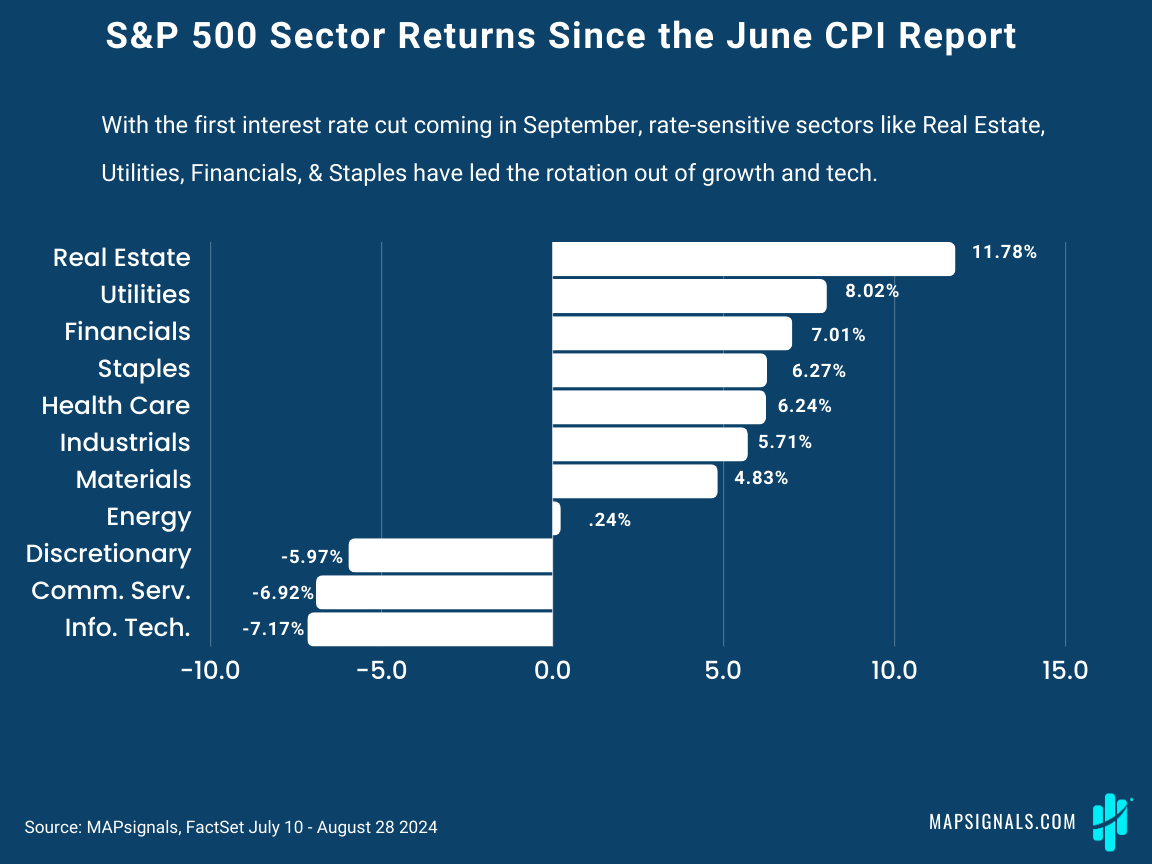

Since the June CPI report that came out on July 11th, greenlighting the Fed to begin cutting interest rates in September, high-yielding sectors have put in a stunning performance.

From July 10th, the S&P 500 Real Estate sector has jumped an incredible 11.78%. Utilities, Financials, and Consumer Staples sectors each have gained 8.02%, 7.01%, and 6.27% respectively.

Likely more eye-popping is the fact that Information Technology and Communication Services have each fallen 7.17% and 6.92% over the same period.

The rotation into high-yielding sectors is very much still in play:

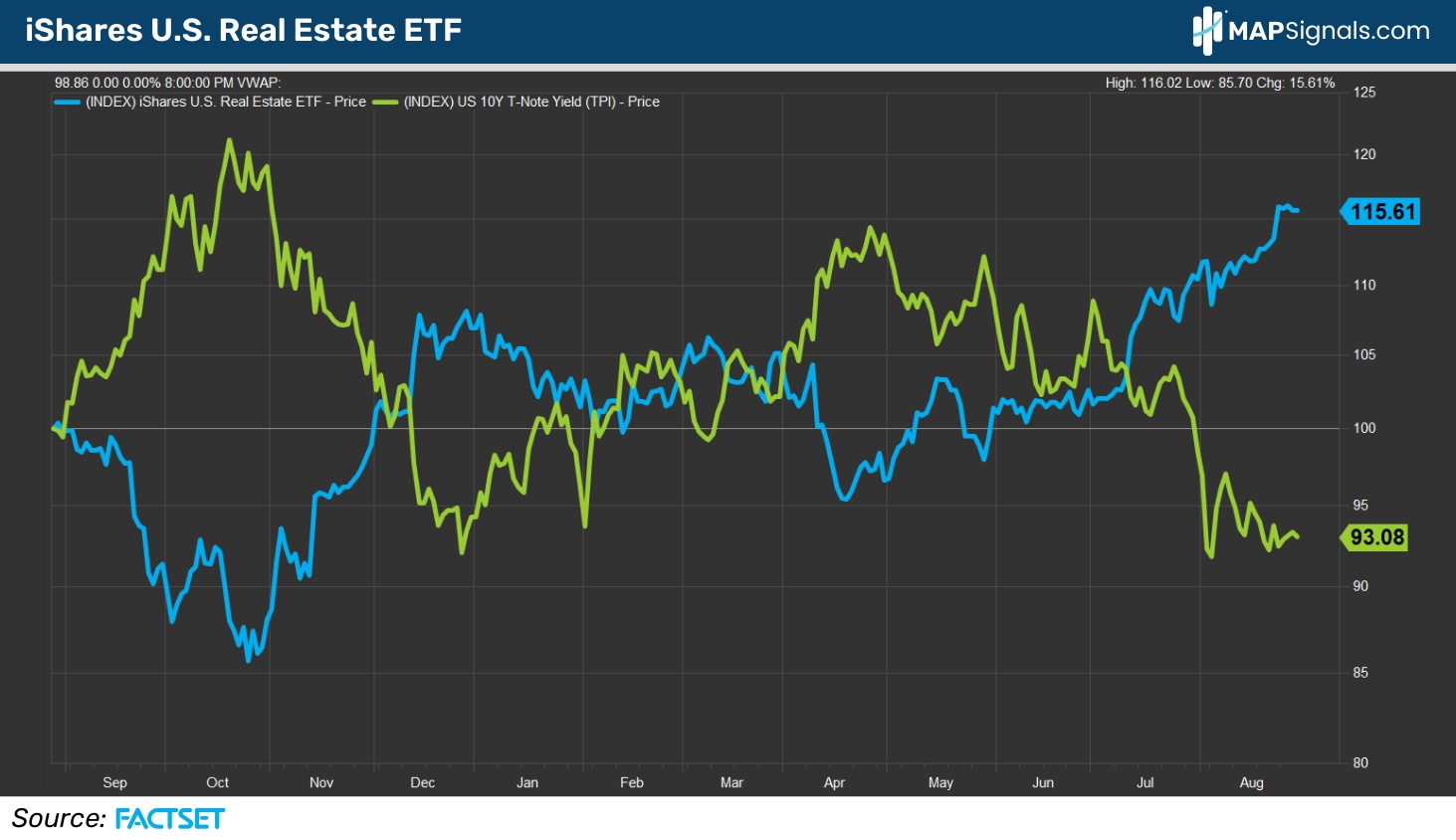

Why Real Estate stocks in particular are surging comes down to 1 major macro tailwind: falling interest rates.

Since July 1st the US 10Y yield has fallen from 4.48% to 3.83%.

As you can see below, there’s a negative correlation between real estate stocks and treasury yields. The following 1-year chart plots the relative performance of the iShares Real Estate ETF (IYR) to the US 10Y yield.

When rates zig, REITs zag:

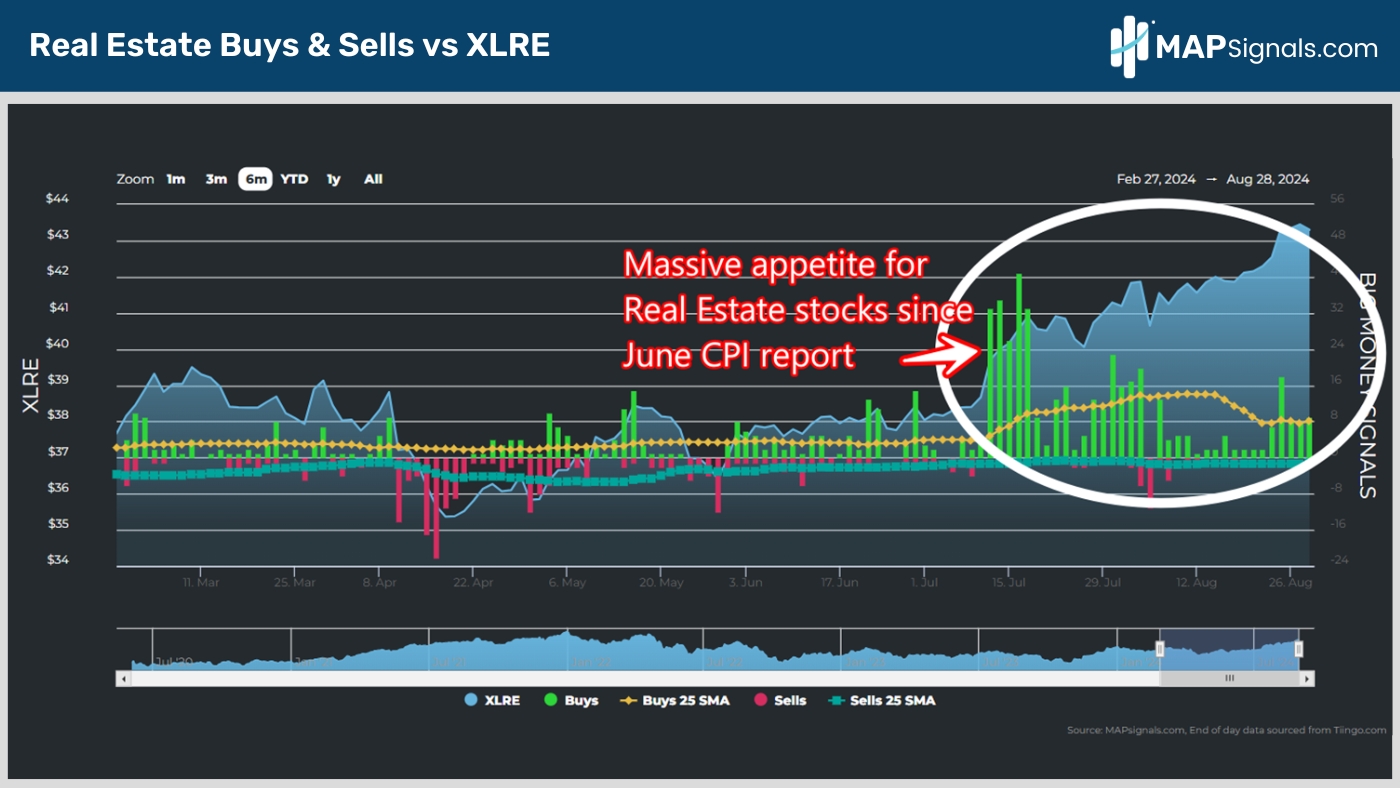

One glance at the Real Estate money-flow picture shows how strong the buying has been in the sector.

Since the June CPI report effectively murdered the runaway-inflation narrative, high-yielding REITs have been an easy bet for yield-hungry investors.

When rates are set to fall, real estate stocks become more attractive.

Plotting the Real Estate buys and sells by sector, the level of institutional sponsorship is off the chart:

And here’s why I’m making the bullish case to own real estate stocks into yearend.

I went back and studied high-momentum periods for the real estate sector and what I found supports even more gains in the months ahead.

Check this out. Year-to-date, the iShares Real Estate ETF (IYR) has gained 9.25%.

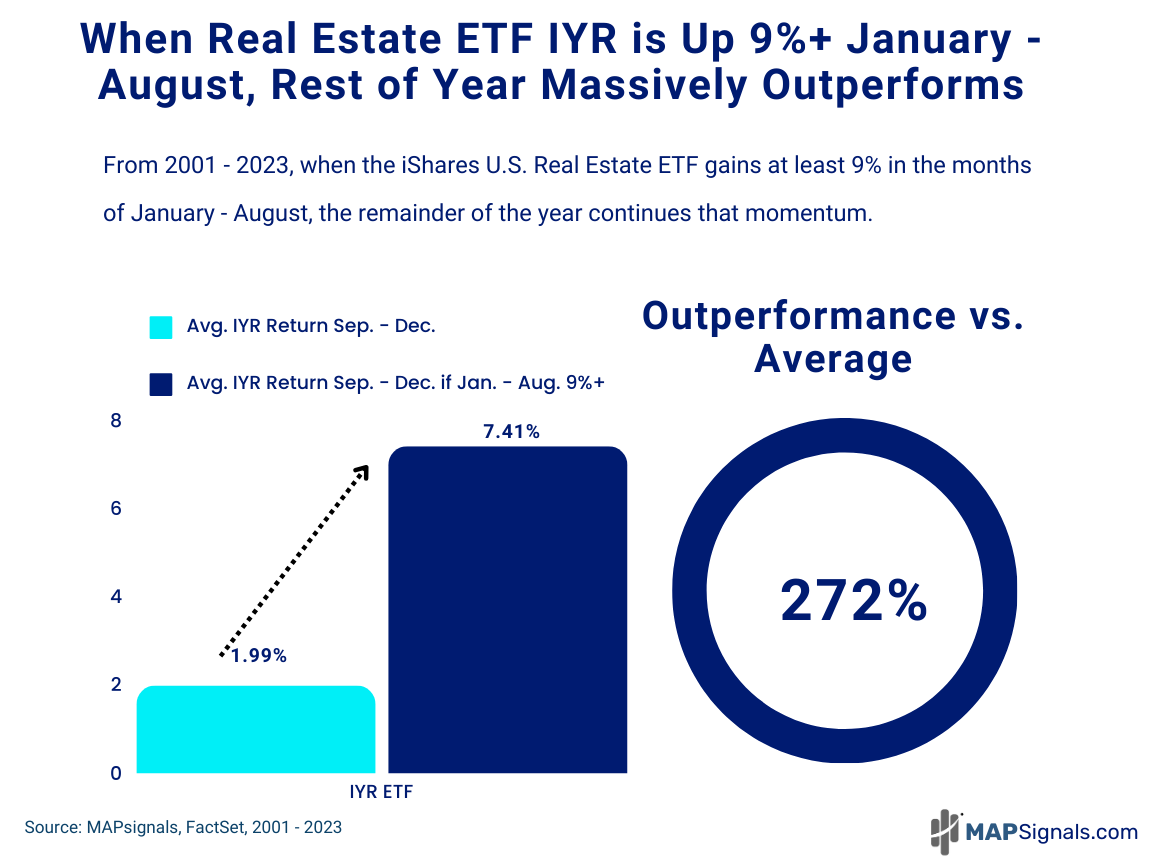

Back to 2001, the average return for the iShares Real Estate ETF (IYR) in the months of September – December is a measly 1.99%.

However, when IYR gains at least 9% in the months of January – August, the remaining 4 months of the year see market beating average returns of 7.41%.

For those keeping score, that’s a whopping 272% outperformance vs. the typical return:

To be fair, we still have 2 more days of returns before 2024 closes out August. Regardless of how the month ends, I see this unloved area as a great bet even into next year.

Most are unaware of the rebirth happening in REITs…this is where MAPsignals shines.

All of those inflows above are discrete equities flying higher day after day. If history is any guide, REITs will be on the sector leaderboard in 2025.

This is where being armed with a money-flow MAP comes in handy.

Don’t focus on the popular trades…find the profitable trades.

Let’s wrap up.

Here’s the bottom line: Real Estate stocks are outperforming Tech stocks by nearly 20% since July 10th. As rates fall, high-yielding REITs become incredibly attractive.

Our trusty Big Money Index (BMI) is making new multi-month highs… and a lot of that juicy lift is due to the renaissance in REITs.

There’s a whole world of market-beating stocks outside of the popular Mag 7.

You just need a map to see them!

If you’re a serious investor, Registered Investment Advisor or money manager, now’s a great time to take advantage of the massive rotation.

With a MAP PRO subscription, you’ll be able to spot our top ranked REITs every single week in our all-star Top 20 report.

Don’t wait for the media to blow the bullhorn on Real Estate stocks…by then it’ll be too late.

Money Flow > News Flow

Have a great week!