Climate Change Market

If you want to divide a room, take a poll on climate change.

If you want to divide a room, take a poll on “will we retest the lows?”

Wherever you stand on either of these issues shouldn’t matter.

What does matter is that the climate in the market is changing – have a look.

Market Internals Are Improving

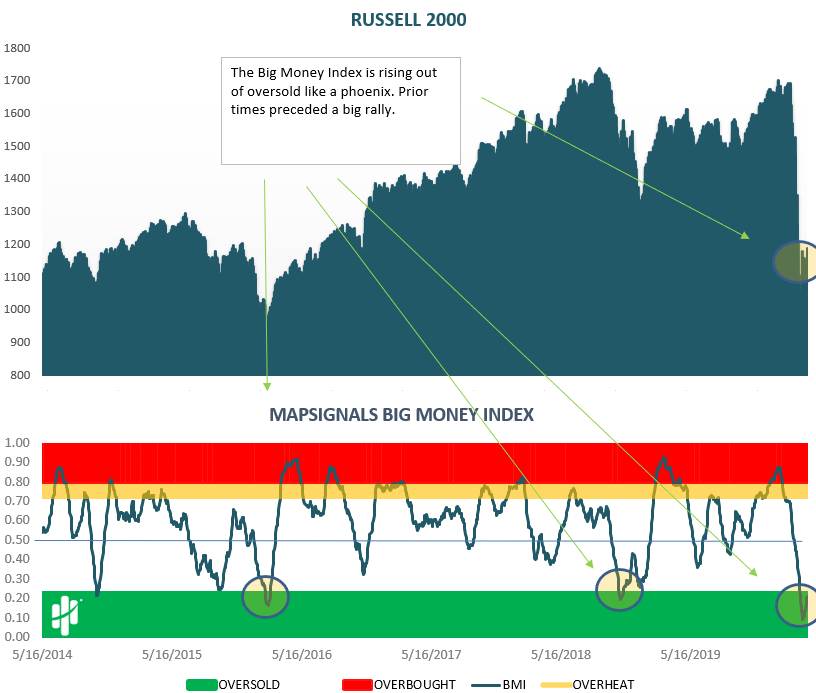

As you know, we follow the big money. We were deeply oversold – which is extremely rare.

Those are times to go fishing for great sales.

But now, the climate is shifting – look how the Big Money Index is rising like a phoenix from the ashes.

We circled prior times when the BMI began to rise out of oversold conditions.

Typically you want to be on the right side of that trend.

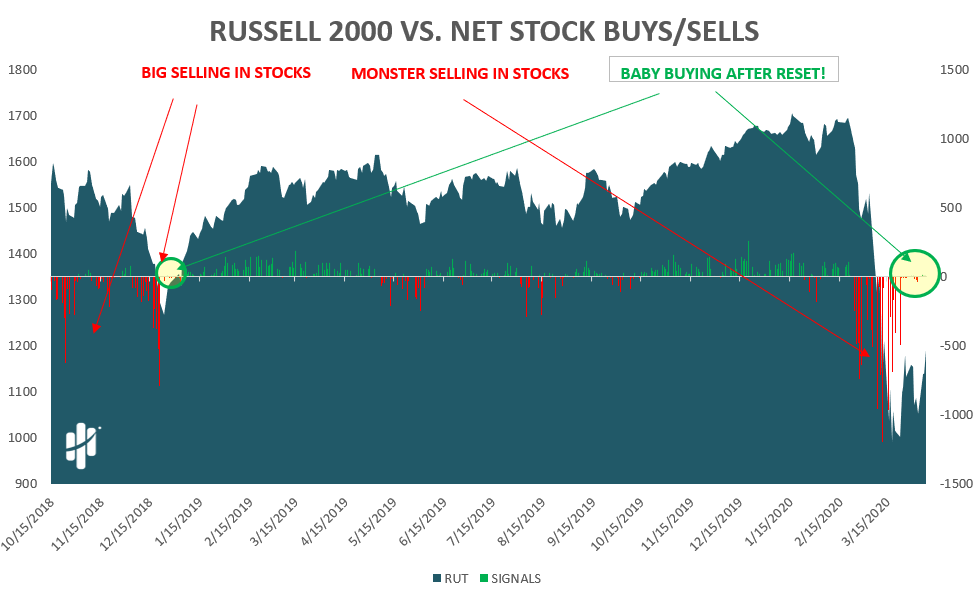

If we zoom in on daily action, you can see a massive climate change.

Monster selling came, then it slowed, and now a few green seedlings are sprouting.

The below chart shows the net buys/sells for the market each day.

Green bars show there were more buyers, red bars mean sellers are in control.

I’ve circled the last time we saw seedlings sprouting after a shock wave of selling.

Here’s a zoom in – you’ll need a magnifying glass!

It’s a Climate Change Market

Some of the best stock scoops were during the free-fall.

When markets reach oversold – monster selling is usually unsustainable.

You tend to have forced sellers in that type of market.

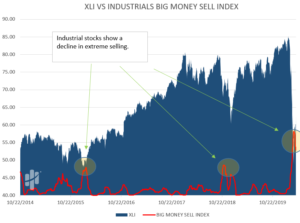

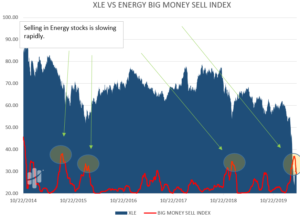

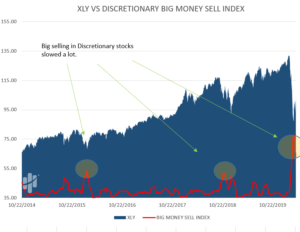

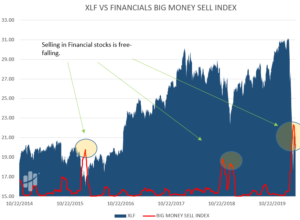

We can see how brutal the selling was by looking at sector selling.

The following charts show a moving average of sell signals by sector.

When the red line is increasing, the rate of selling in stocks is climbing.

When the red line is falling, the rate of selling is evaporating.

Click the images to zoom in:

Bottom line – the market internals have been shifting.

We are presenting the data and have no agenda.

Oftentimes, data can give us clues for when the market is preparing a shift.

We were able to use these clues to give us amazing entry prices on phenomenal stocks.

Hopefully you see what we see – a climate change market.