Dropping The Hammer

Sometimes situations require walking on eggshells.

Other times require dropping the hammer.Today we’ll be dropping the hammer. But first, let’s talk about market head-fakes. The stormy clouds started parting on Friday and we sent an impromptu member update, stating that the buyers are back…video style.

The markets have done some incredible things lately. Signs pointed to an pullback that didn’t really happen. Our cash was ready to go to work, but it’ll have to wait a bit longer.

The data predicted a drop. Sellers showed up. Things looked to be right on schedule. But then there was an intervention. The powers that be didn’t want a market puke.

You see, when retail brokerages like Robinhood & Interactive Brokers decided to halt buying in certain meme stocks, it changed things. Wall Street was able to de-risk their awful short bets in orderly fashion. What set up to be a deeper pullback…didn’t work out that way.

MAPsignals data showed pain under the surface of the market. So, we prepared our readers. Like weather forecasters eyeing a storm, our job is the same for stocks.

But, markets flip-flopping is part of the game. That’s an automatic sign-up when you become an investor.

Stock market bobs and weaves can distract us from the real story: how great outlier stocks have been performing. The MAPsignals stock picks have demolished the market. Like the Super Bowl, it wasn’t even close.

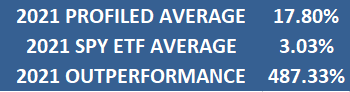

But, before I start dropping the hammer, let’s check out where the Big Money Index sits.

Big Money Index Charges Higher

It’s been a bumpy few weeks in terms of Big Money data. But, now things are starting to settle back into a groove.

The pullback we foresaw did come, although it was very short-lived. Now the Big Money Index is heading higher:

To simplify things, when the BMI rises, stocks should keep gaining. When it falls, stocks are usually soon to follow lower. The first signs of weakness appeared and sounded the warning alarms, but then quickly disappeared…for now.

We are still extremely overbought. Remember: a BMI reading over 80% is overbought. It now stands at 89.8%. Therefore, until there are signs of deterioration in our data, we must continue leaning long.

Now let’s look under the surface.

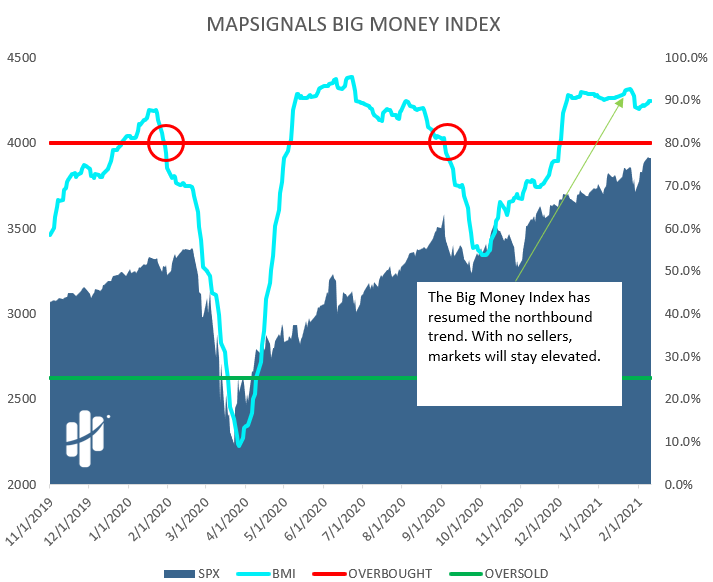

Stock Buying Is Back En Vogue

When the BMI is lifting, it means there must be chunky buyers around. And there are.

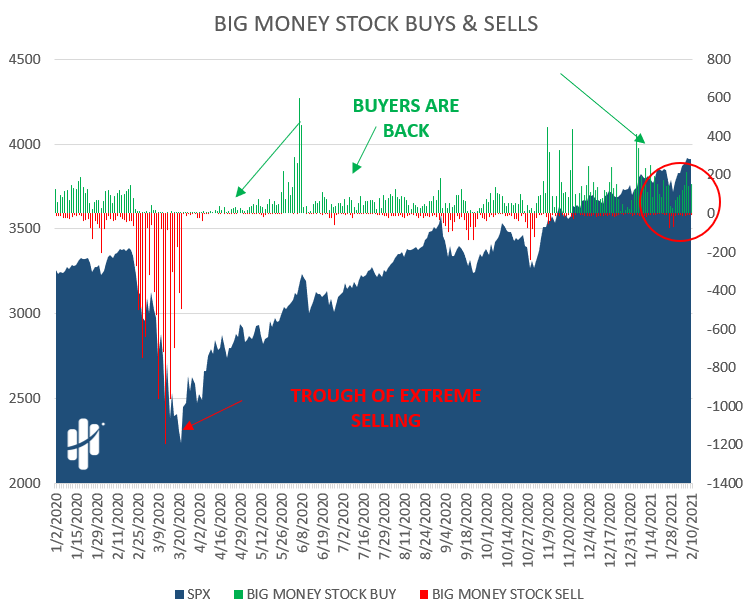

Below are the daily Big Money Stock Buys & Sells. If there are green bars, expect the BMI and stocks to rip. If there are red, expect a dip.

We saw the red. We prepared. But then brokers intervened which stabilized the market. Now, the juice is back. Look at all the recent green:

All of those green bars represent individual stocks blasting off like a rocket. And that’s where MAPsignals shines like no other place.

Outlier Stocks Dropping The Hammer

At MAPsignals, we have a mantra: TAGU – they all go up. Our MAPsignals members know we find explosive stocks. Basically, we’re mapping tomorrow’s winning stocks…today.

So, while market gyrations can cause ulcers, juicy outlier stocks provided the relief in the form of big gains.

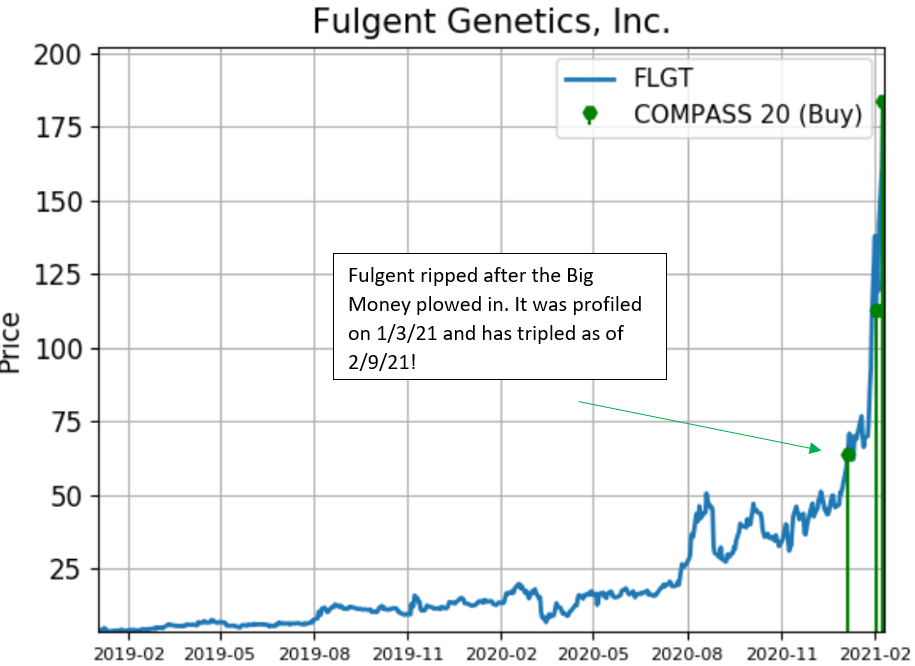

Each week, we highlight 1 stock shaping up for big potential upside. This is part of our Sunday MAP View report. If you wonder how the MAP View stocks fared through the pandemic up until now, I’ll summarize it for you: the market was no match for MAP View outlier stocks.

Below we find the returns for all MAP View stock picks in 2020. We calculated performance as if you had purchased each stock on the date of the report and held until 2/9/2021.

We compare with the SPY ETF. The return was calculated the same way (purchasing weekly). Watch your feet, here comes the hammer.

The MAP View stocks returned +37.87% on average vs. +24.35% for the SPY. And that’s for all of 2020 which includes the COVID-19 pandemic market shock.

But, what about 2021? Drum roll please… (we use hammers for our drums)

That’s right. The average gains for our 2021 MAP View stocks picks is +42.81%! Our first pick of the year FLGT- it tripled since January 3rd 2021. So, while the media focused on meme stocks like GME, AMC, and BB… Big Money was focused elsewhere – and MAPsignals knew where.

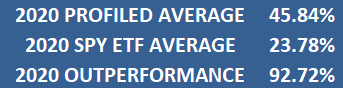

But let me hammer home another point: our Top 20 report has been rocking too.

Each week we list our Top 20 Big Money stocks. We also profile 2 of them. We do that for folks that want handpicked stocks so they don’t have to work too hard. Most people don’t have time to sift through twenty stocks a week. This helps with that.

Similar to the study above, here’s the performance for the 2 profiled stocks each week in 2020. We calculated the performance as if you had purchased each stock on the date of the report and held until 2/9/2021.

The SPY ETF return was calculated the same way (purchasing weekly).

That’s right, they nearly doubled the performance of the S&P 500. Now, let’s look at 2021 through 2/2/21.

That’s mega juice, folks.

There are times to be subtle and times to be loud. We just dropped the hammer for a thunderous sound.

Here’s the bottom line: markets can and do change on a dime. Signs that pointed to lower prices suddenly point to higher prices. Eventually that will change, but that’s not the case today.

And as our subscribers know, we let our outliers run. When you catch a powerful bull market, like now – amazing things are possible.

Focusing on the market pivot points is important. But don’t miss the main message: outlier stocks hold the key to outperformance in both up and down markets. No walking on eggshells here: if you need outlier stocks, MAPsignals has what you want.

For more information on how to become a MAPsignals member, click here.