Feel The Fear

Fear can be paralytic. So, we like to say, you have to “feel the fear and do it anyways.”

When your stocks go against you, don’t be this guy.

We are supposed to be physically fit, right? Doctors recommend regular exercise and a healthy diet. Benefits include a healthier heart, living longer, and less pain.

But another benefit is emotional: Healthier people generally feel happier.

Mental health is recently a focus, too. Vice-versa, a healthy mind leads to a healthier body. But most of us are on our own when it comes to mental health. We use whatever tools our parents gave us, but they too only had what they were given.

Therefore, much of mental strength comes from within.

And so it goes for investing, too. Sometimes fear is high, just like days ago when markets plummeted. Other times it disappears…after stocks start to rally.

For a caveman, fear was mandatory: It kept you alive. But in modern times, fear is more of a goldilocks thing: too little and you’re dangerously daring… too much, you never progress. Just right keeps you in line.

I worked hard to eradicate fear from my life. But it’s hard-wired. And fear of loss can disastrously affect our everyday lives without us even knowing.

Right after New Year’s I introduced something called the “Feels Index.” Remember this chart?

When everyone’s buying- everyone’s happy! And for months now, it’s been all smiles. But, then a nasty rotation came.

Tech stocks felt the pain. Reopen stocks went to the moon. But, it goes against our grain to be a bear for too long…especially in a big bull market.

When some of our favorite stocks pullback 30% or more, we like to get to work…and we have. It feels wrong and scary, but deals are deals. In other words, we like to feel the fear…and do it anyways. We get in there and buy a little here and little there. Why?

Because we fully believe that outlier stocks go up over the long-term – and our 30-year history says it’s true.

We may not yet have the all-clear signal for stocks just yet. But, our signs point to a near-term low being set for growth stocks.

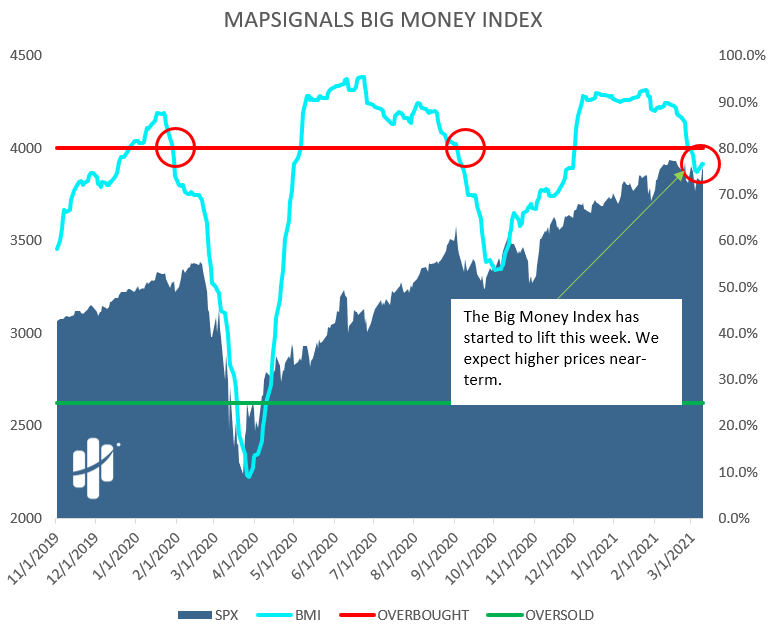

Big Money Index Feel The Fear

The last few weeks have seen lower prices for equities as forecasted by our data. Beloved growth stocks fell precipitously.

While that may cause fear, as a great friend always says “good stocks bounce like fresh tennis balls.” When you check out how the Big Money Index has stabilized and even started to lift, it’s partially because of that bouncing:

The BMI moves much smoother than the market because it’s a 25-day moving average. Markets can be up and down one day to the next. It’s much harder for the BMI to act the same.

That’s why our data says that now the BMI can lift. That’s usually due to increased buying or decreased selling. The latter is what we are seeing in the data. While that may not mean the selloff is done, we do see things are stabilizing.

To us growth investors, it’s our first sign to feel the fear…and do it anyway. At MAPsignals we have been dipping our toes into great stocks. We’ve seen early good signs, but let’s keep looking into the data to find more positives.

Selling In Growth Stocks Slows Significantly

When stocks pullback far enough, reaching a tipping point, selling begets selling. Fear spreads rapidly through the entire system. We saw that on last Thursday the 4th and this Monday the 8th.

But Tuesday and Wednesday of this week was entirely different. Selling slowed and the dip was bought yet again.

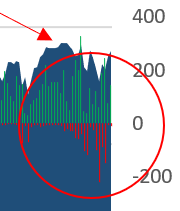

Check this out – below is our Big Money Stock Buys & Sells chart. These are the daily buys (green) and daily sells (red) that make up the BMI. Selling evaporated the last 2 days like a vacuum:

A zoom-in says one thing to me…feel the fear… now, you know the rest of the saying:

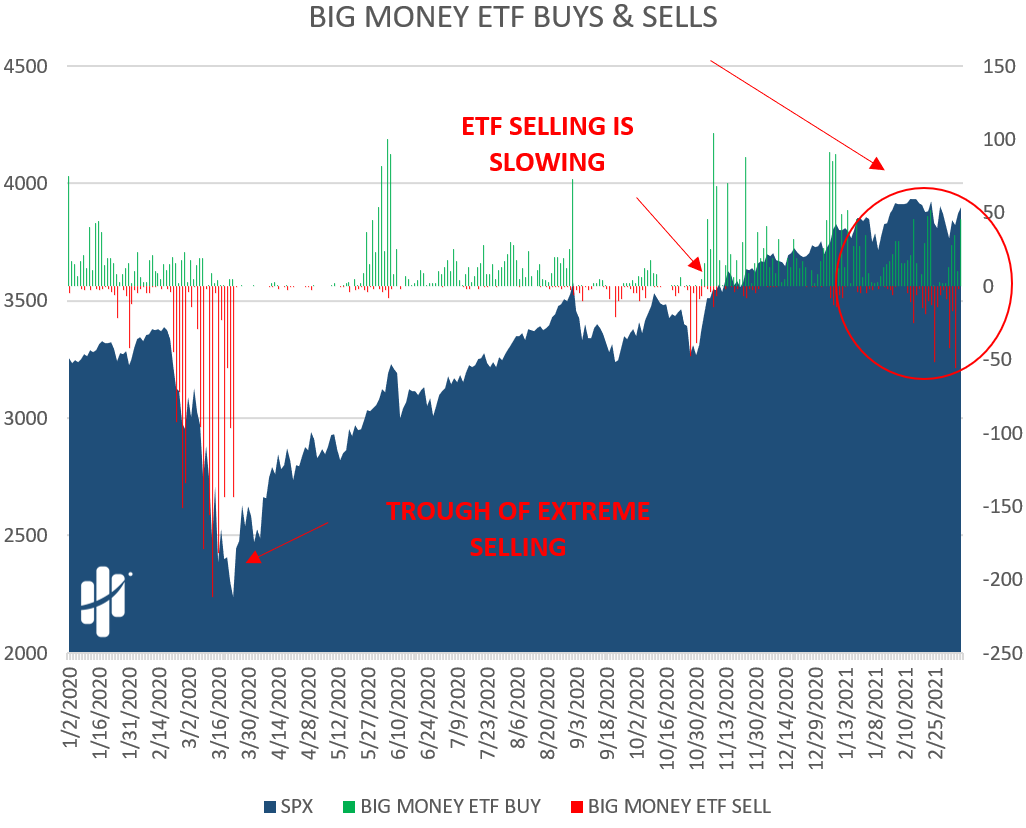

But, that’s not all that we noticed: The same happened with ETFs.

Below is our similar Big Money ETF Buys & Sells chart. Red bars are sellers, green bars are buyers. Both stock and ETF selling has slowed:

These are good signs folks. We’re trying to find a bearish outlook for the last few days, but it’s been difficult. But we aren’t surprised.

We compared this selloff to a level one ankle sprain…our opinion was recovery should be quick and we’d be fully on our feet fast. You can check out our latest podcast here, The Big Money Index Is Falling. What’s It Mean?

Here’s the bottom line: We are in volatile times. Data is flipping around so much that it could make your head spin. That’s a scary feeling because you don’t know what to expect. But, everyone knows that now and then, markets have those feel the fear moments.

We’ve used those feelings to help us time entry points on great stocks. Will we be right in the future? Only time will tell.

But time is on our side: based on what we’ve learned over 30 years of data is this: someone else’s pain usually is an opportunity for our gain.

So, while we wait for further confirmation that growth stocks have indeed bottomed, just know that MAPsignals will find the best juice stocks out there.

***Finally, the tag-team duo, Jason and Luke will be doing a masterclass for the Moneyshow on Tuesday, March 16th – The Best Indicator for Finding Outlier Stocks.

Click the image below to reserve your spot!