Focus on Leading Sectors

If you sense this bear market’s getting long in the tooth, you’re right.

The 2022 downdraft has now lasted longer than the average. The good news is pullbacks eventually end and produce greener pastures. So how can investors play offense during tough times?

Focus on leading sectors.

Let’s discuss recent action in markets. It’s been a wild couple of months for investors. Since October, the S&P 500 has staged a respectable rally of ~5%. This comes after an unsettling September drop of 9.2%.

That action is in-line with history. Down Septembers and up Octobers & Novembers are what you can expect in midterm election years.

In fact, we’ve been quite vocal on these seasonal patterns.

Throw in yesterday’s confusing message from the Fed, and many investors are wondering if this playbook is still alive and well. A more dovish FOMC statement followed by a pro-hawkish undertone from Chair Powell took the market by surprise.

But history is on the bull’s side going into year-end. The best offense is betting on leading groups. And MAPsignals helps you find them.

Focus on Leading Sectors

How can you find the top sectors in the market? We use data to uncover them.

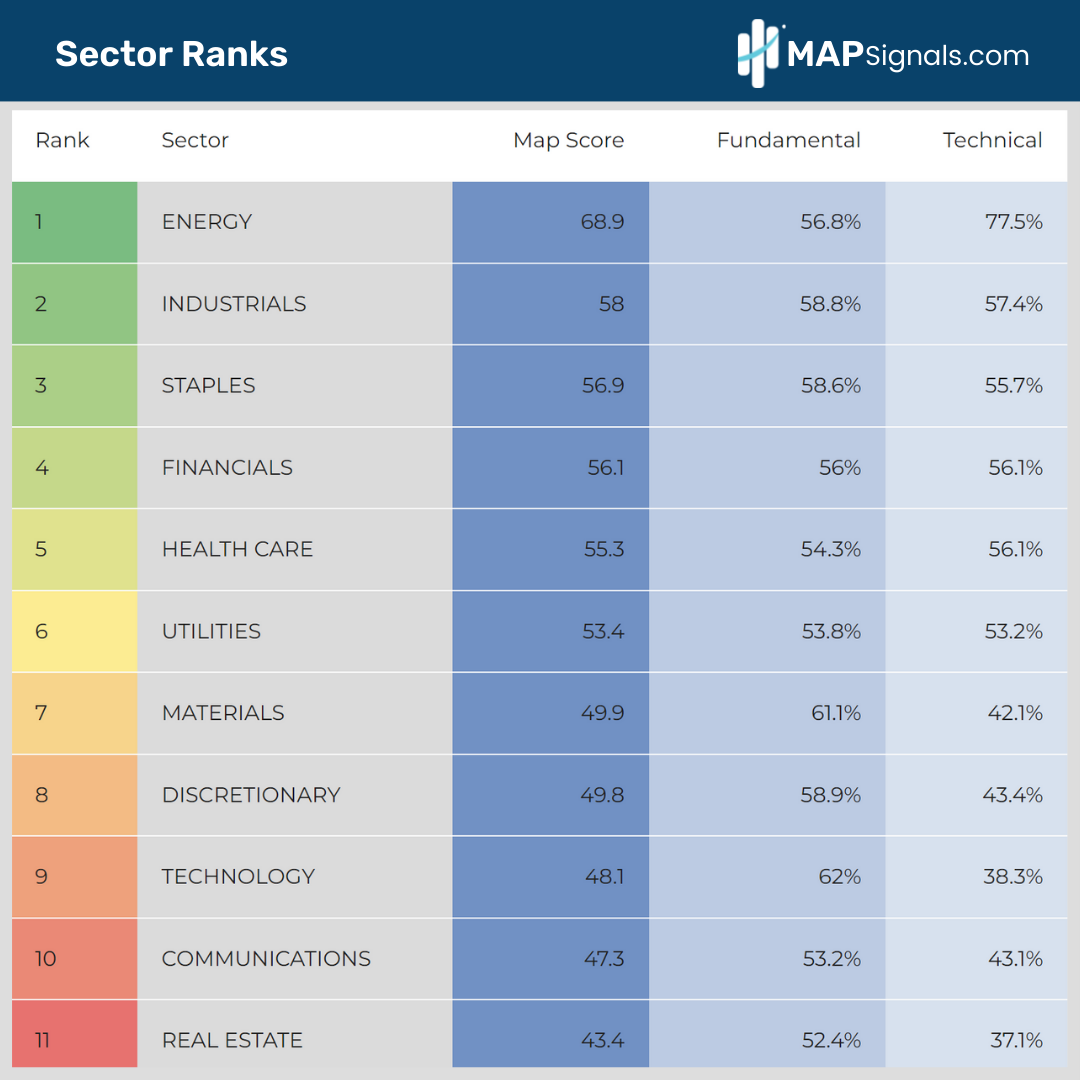

Each morning our models rank all sectors by score. The MAP score is a blended average of scores for each group, made up of fundamental and technical factors.

Here’s this morning’s snapshot. Energy, Industrials, Staples, Financials, and Health Care rise to the top:

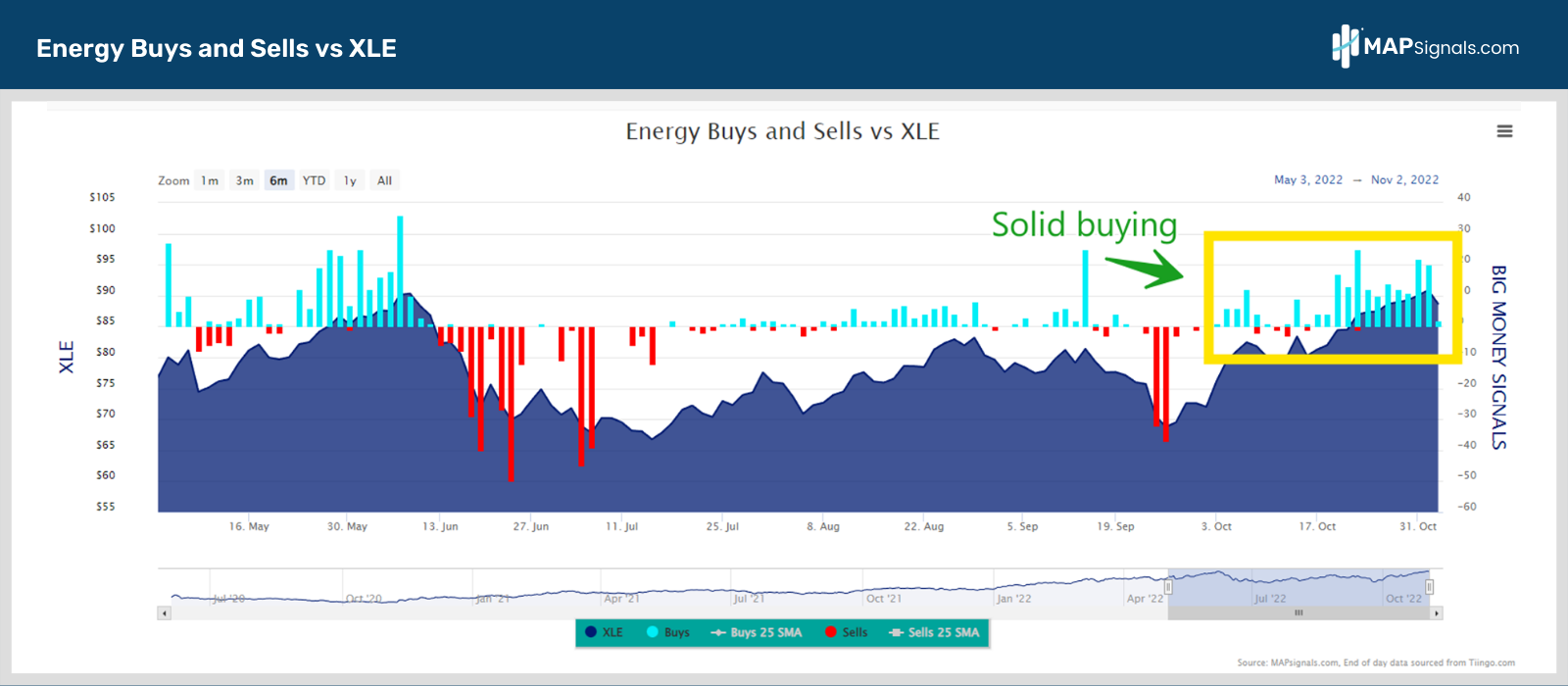

Under the surface of these scores are Big Money movements. Let’s begin with Energy. The group has clearly been in the driver’s seat all year with elevated commodity prices. That’s led to big profits for the group, making it the top sector this earnings season.

It has healthy buying as you can see:

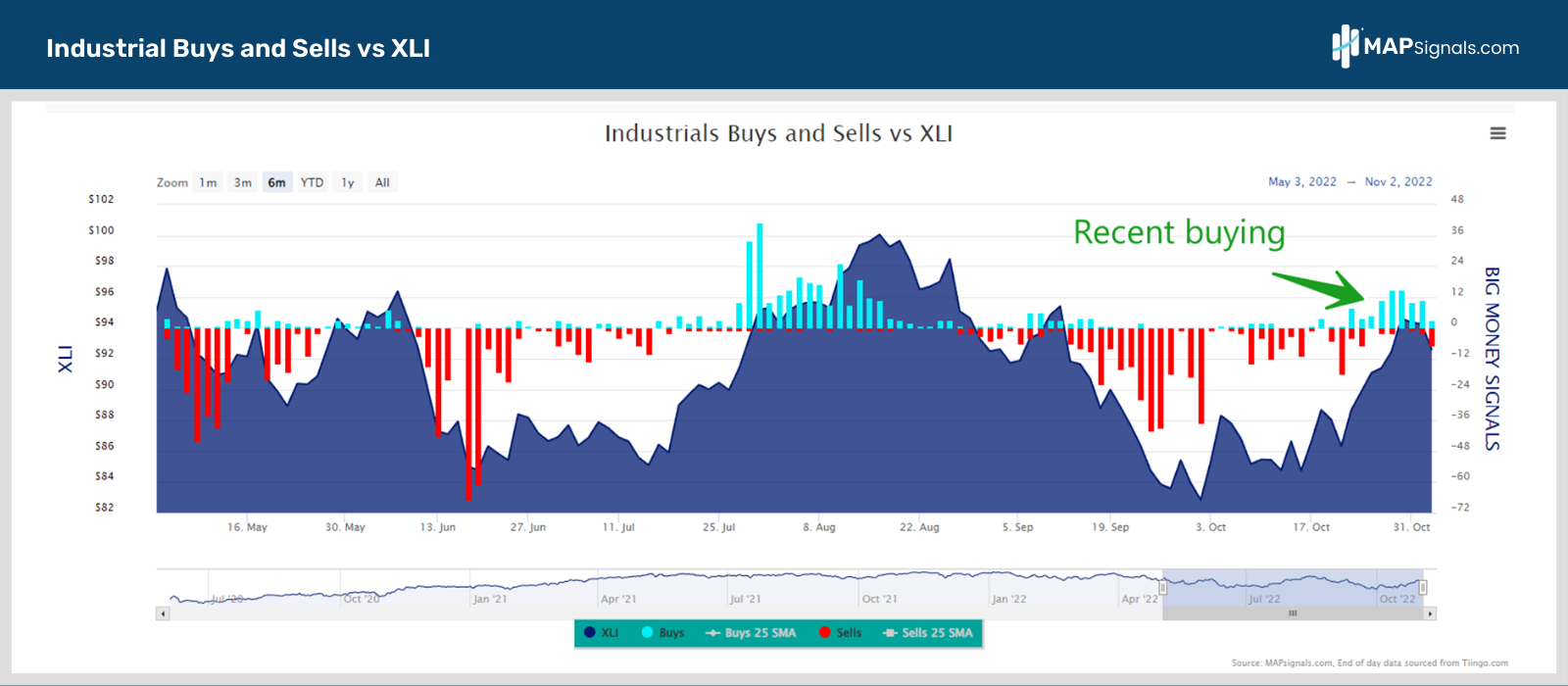

Next is industrials. While the buying is less dramatic, it’s been in 2nd place recently. Defense and agriculture/machinery names have led the inflows:

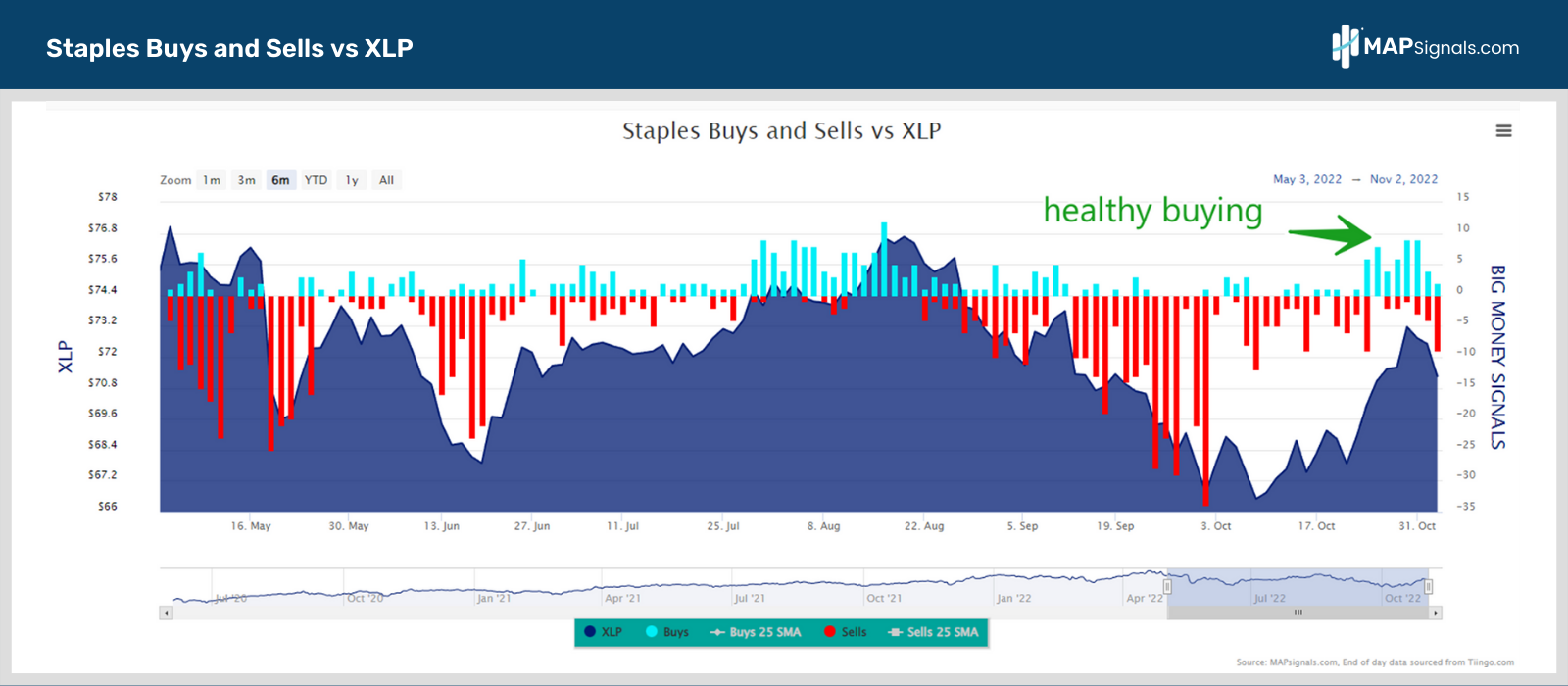

Then there’s staples. Large well-known brands with pricing power have attracted capital. Some of these stocks have been big winners this earnings season:

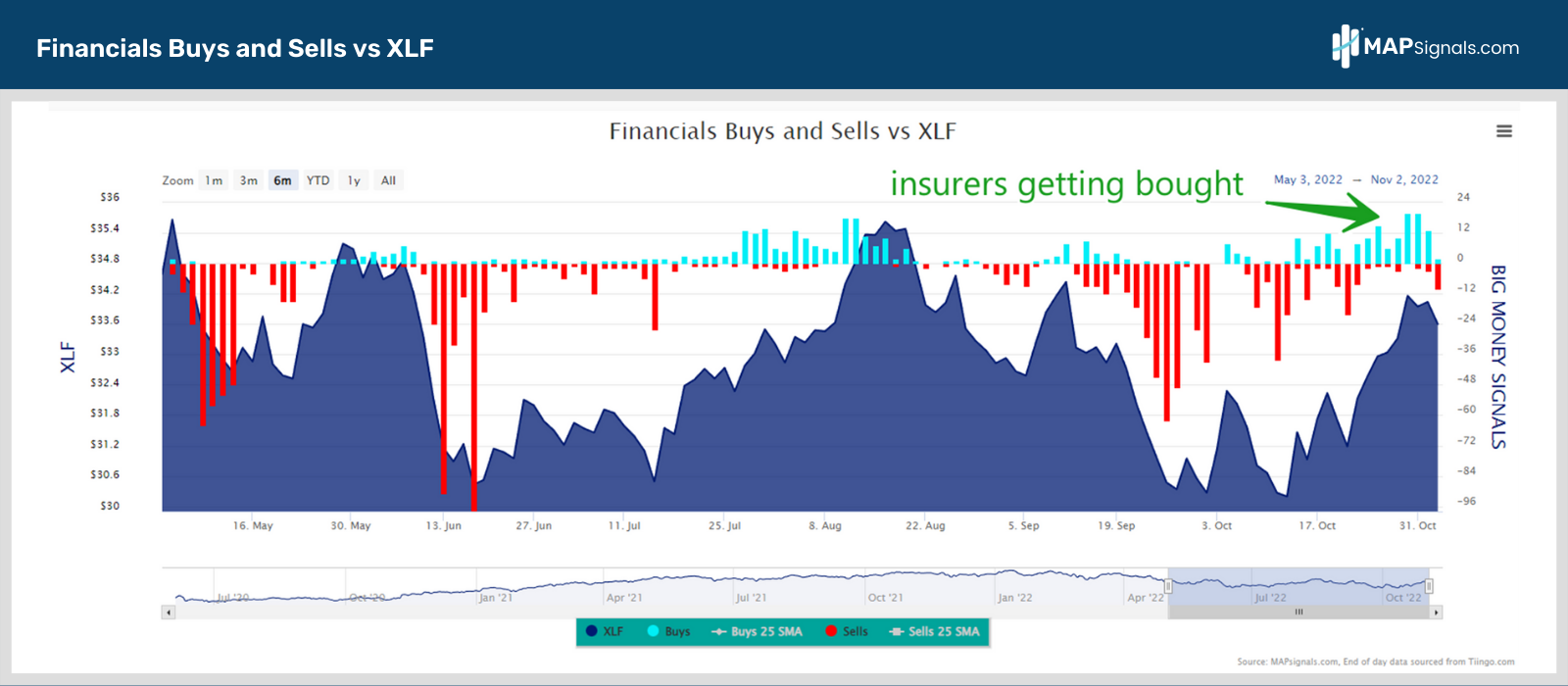

Financials have risen in the ranks, too. With many wealth managers and insurers benefiting from rising interest rates, many of our top stocks are in this group:

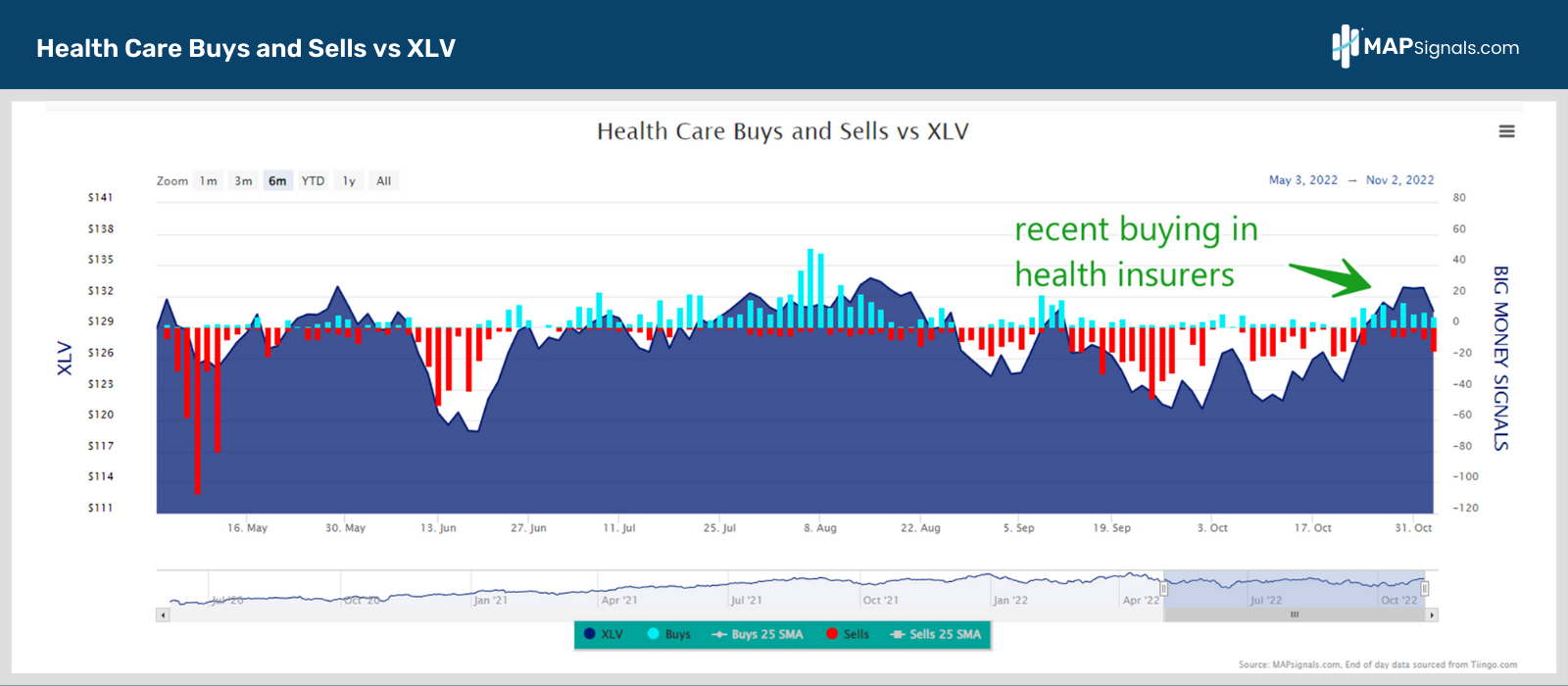

Lastly, there’s Healthcare. It’s one of the most defensive groups out there. Consumers tend to spend on their health no matter how the economy is faring. Health insurers have been big magnets for capital all year:

These 5 areas are the top areas by score and capital inflows according to our data. In a longer-than average bear market, our message is simple: focus on leading sectors.

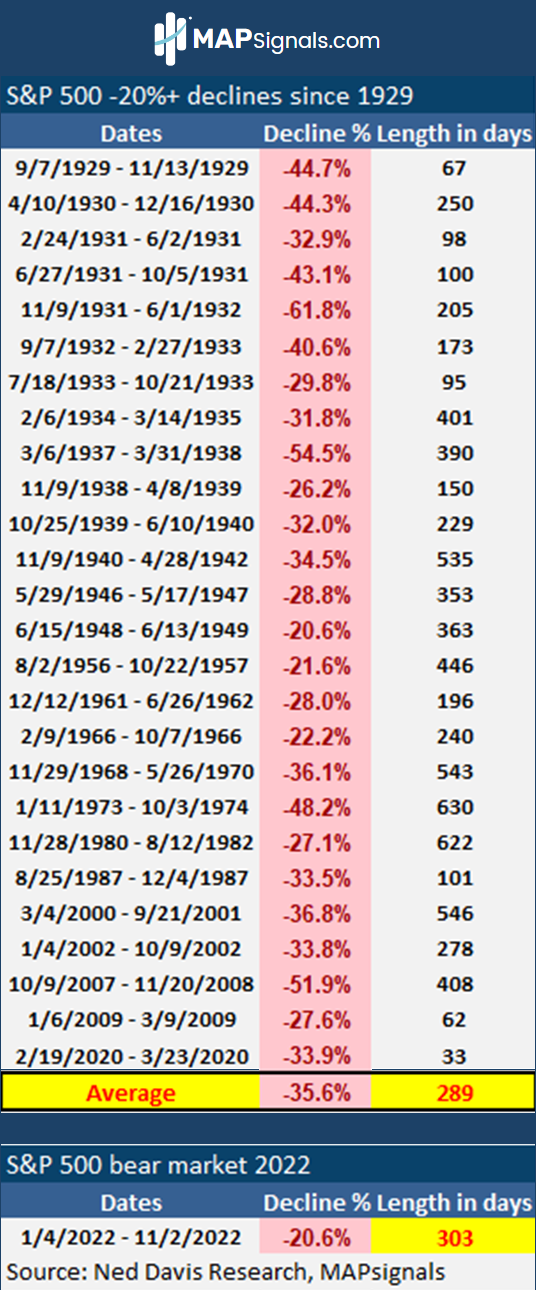

And to wrap up, here’s a snapshot of prior bear markets going back to 1929. The average drawdown is -35.6% compared to 2022’s pullback from highs of -20.6%.

Additionally, the average bear market lasts 289 days. We’re now at 303:

Looking above, today’s bear is the longest we’ve dealt with since 2008. That’s no fun. BUT it’s important to realize better days lie ahead. The market always recovers eventually.

Until the macro climate clears, focus on sector leaders.

Here’s the bottom line: Markets have been under pressure for 10 months. We’ve now eclipsed the average bear market in terms of length.

By focusing on leading sectors like Energy, Industrials, Staples, Financials, and Health Care your portfolio can better handle volatility. There are plenty of leading stocks out there… many at highs.

Data can help you find them!

And you can get started with a MAPsignals subscription and follow our Big Money data every day. All of these charts and more are from our auto-generated portal.