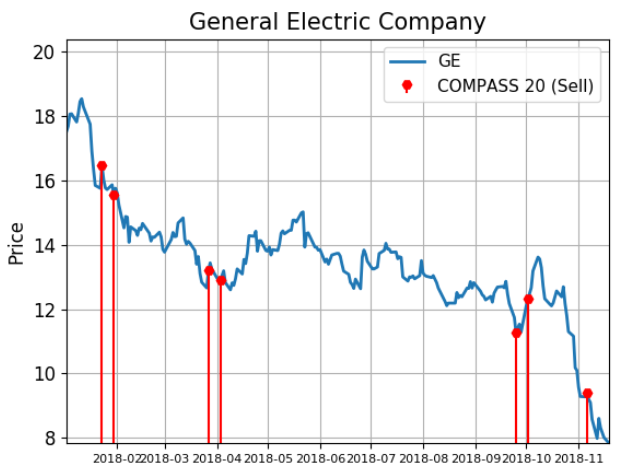

General Electric Shares Flag Red With Unusual Trading Activity

General Electric, Co. (GE) has been under immense pressure this year and this has coincided with large unusual selling activity. This stock has been on our bottom 10 report many times in 2018. Read the article here.