Holding Aces

In heads-up Hold’em, pocket aces have an 81% chance to win the hand.

Can you still lose with pocket aces? Yes.

Right now our data is showing positive signs.

There are good bets, bad bets, winning bets, and losing bets. Making good bets is how you win big over the long-run.

Signs point to pocket aces for Mapsignals – ie, a good bet.

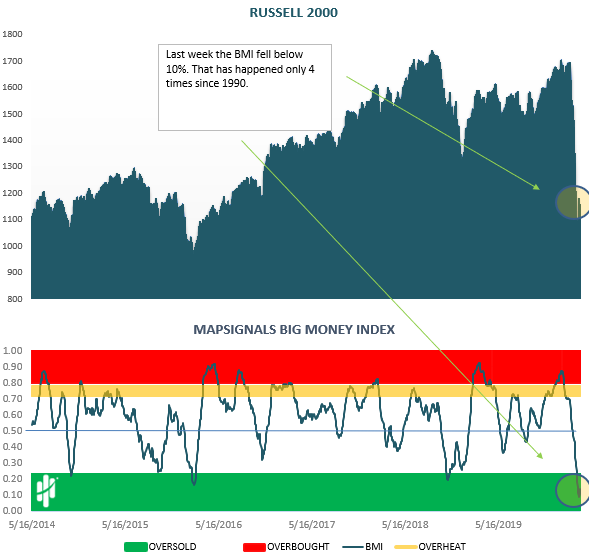

Extreme Oversold Periods Like Now

It’s super rare to see this much selling.

Have a look at our Big Money Index. It tracks big money moving in and out of stocks.

If it’s heading lower, big selling is happening. If it’s heading up, big buyers are showing up.

Last week clocked a 9% reading…that folks, is incredibly rare.

It’s so rare in fact, it’s only happened 4 times since 1990!

Each instance occurred in a bear market, like now.

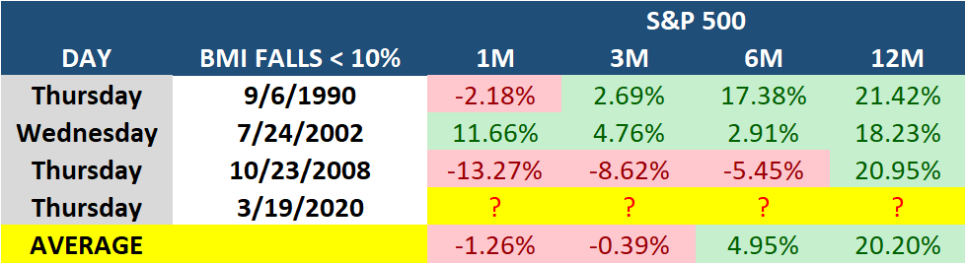

Below are the 4 times, since 1990, when our Big Money Index fell below 10%.

All prior periods were very dark times for the market.

Many of you remember the Global Financial Crisis – that’s the last time we saw this kind of selling.

But, take a look at the 12 month forward returns – that’s juice…ie, good bet.

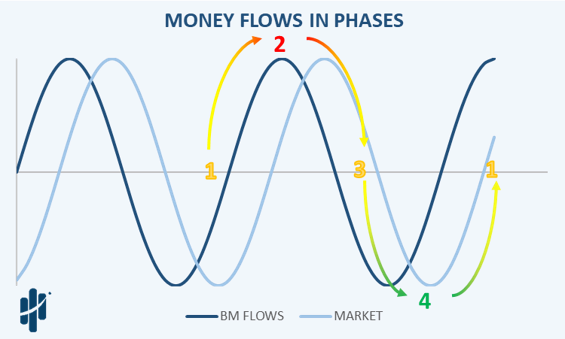

The Phases Of Big Money

The Big Money flows in waves.

There are 4 phases we see consistently:

- Huge buying and very little selling – (think FOMO)

- Buying slows and selling picks up – (usually near a peak)

- Buying slows further and selling begins to take over – (a pullback has begun)

- Buying is gone, and sellers are in control – (think bear markets and scary headlines)

Have a look:

We are in phase 4. These are the times to shop for great companies on sale…ie, good bet.

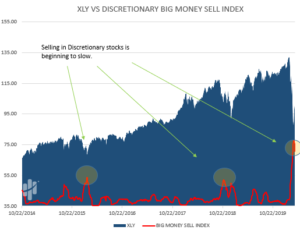

Big Selling In Stocks Is Slowing

Every day we look under the hood of the market.

We measure big money moving in and out of thousands of stocks.

To get a pulse on the market, we group the buys and sells by sector.

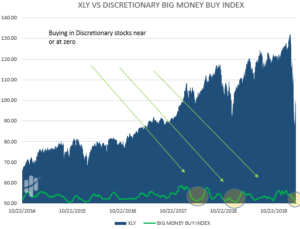

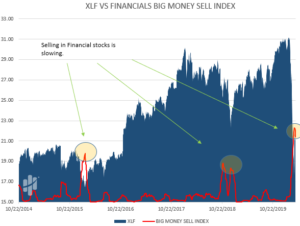

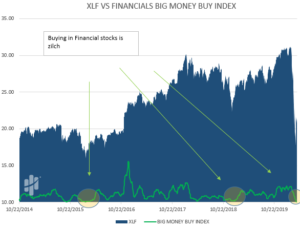

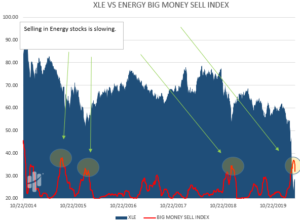

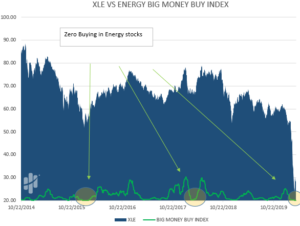

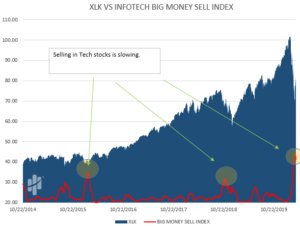

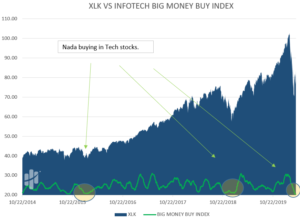

If the red line is increasing, selling is increasing. If the green line is increasing, buying is increasing.

Look at how selling is slowing and buying is near zero. Click the images to zoom in.

Here’s discretionary:

Now, financials:

Energy:

Technology:

Bottom line: it’s a scary world out there. Headlines are horrible.

However, if we take a step back and look at things through the lens of data, we see pocket aces.

It’s not about winning every hand, it’s about making good bets.

If you bet when the odds are in your favor, long-term you will win.