How To Find Outlier Stocks

Stocks go up. Stocks go down.

But outlier stocks go way up. Here’s how to find outlier stocks.

Have you ever noticed that a handful of stocks seemingly head higher year after year? You know, the Apples (AAPL) and Amazons (AMZN) of the world.

That’s what we witnessed years ago sitting on Wall Street trading desks. Like clockwork, a small percentage of stocks kept running year after year. And these weren’t junky stocks built on hype. No, these were incredible businesses with amazing products and services.

We recall watching companies routinely blow out numbers, only to juice higher. We wanted to own those kinds of stocks.

Then something happened to help us on that journey. We began to pay attention to how the Big Money players invested. We saw with our own eyes, how they’d constantly invest in the same kinds of companies…the great ones.

When you see it firsthand, it changes your perspective. It changed us. Handling big stock orders gave insights into how the big boys and girls traded. Fast forward a few years and MAPsignals was created.

The foundation of what we do is grounded in that unique experience. Our data seeks out unusual trading in stocks.

But we don’t stop there. Years of analyzing the best stocks taught us to focus on companies growing their revenues and earnings. Why? Because that’s how to find outlier stocks.

When we marry Big Money trading together with great fundamentals, magic happens. Our data laser-focuses in on a few companies.

This is important because right now markets are jostling day by day. On the surface it looks like stocks aren’t going anywhere. But our data tells a different story.

It shows mega buying in high-quality small-caps. That’s been our message for weeks, and why we said to buy growth stocks now.

Many of these stocks are likely going to be the next crop of outliers. More on that in a bit. Let’s now check in on some market data.

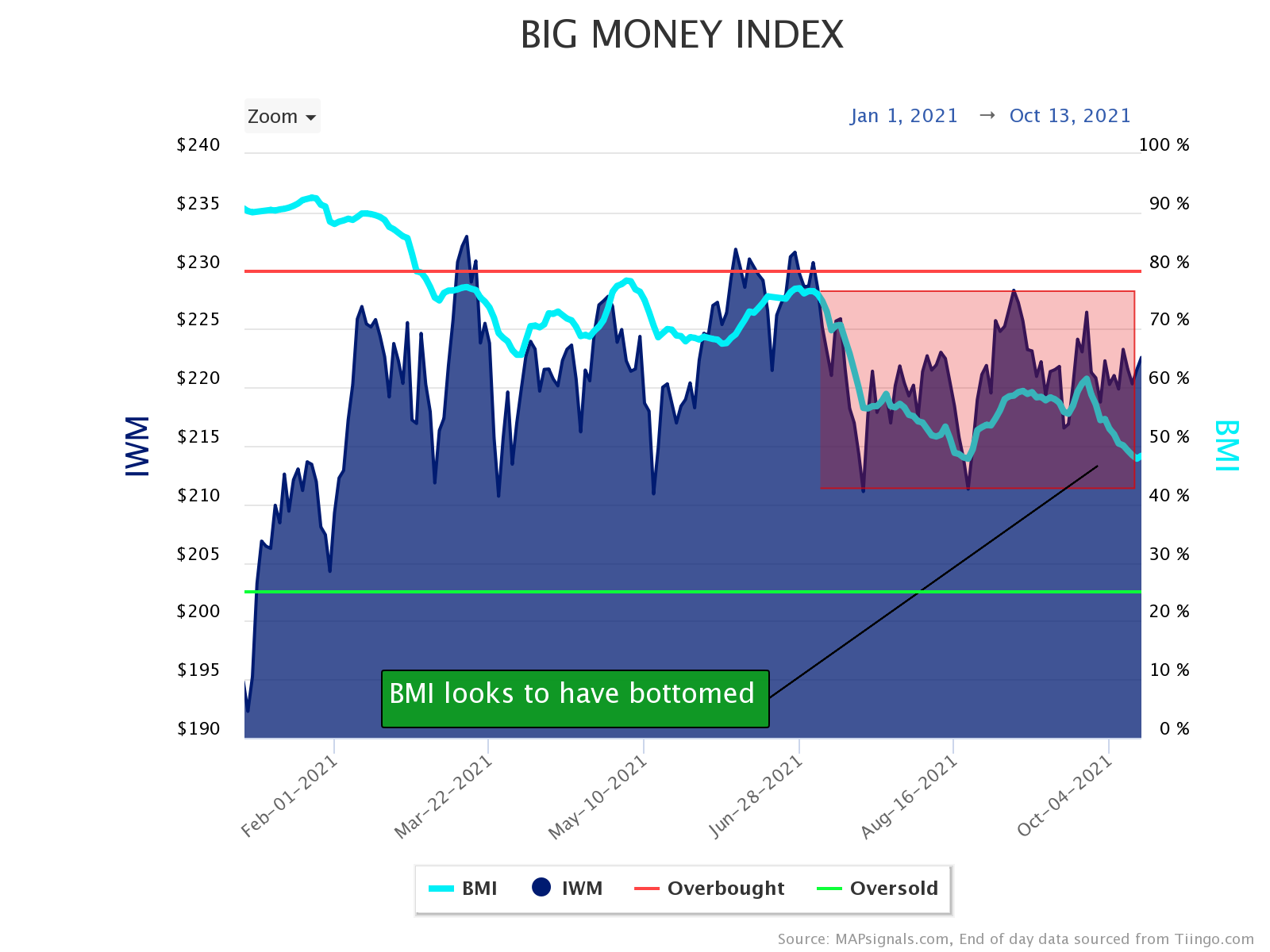

Big Money Index is Ready To Soar

It’s been chop city for stocks. One look at the Big Money Index will tell you that.

Below I’ve outlined the trendless nature of the BMI the last few months. In fact, it reached its August low yesterday.

That’s the negative news. The more important message is that this morning showed a very bullish signal: High-quality small-cap stocks are getting bought. That’s incredibly bullish for markets:

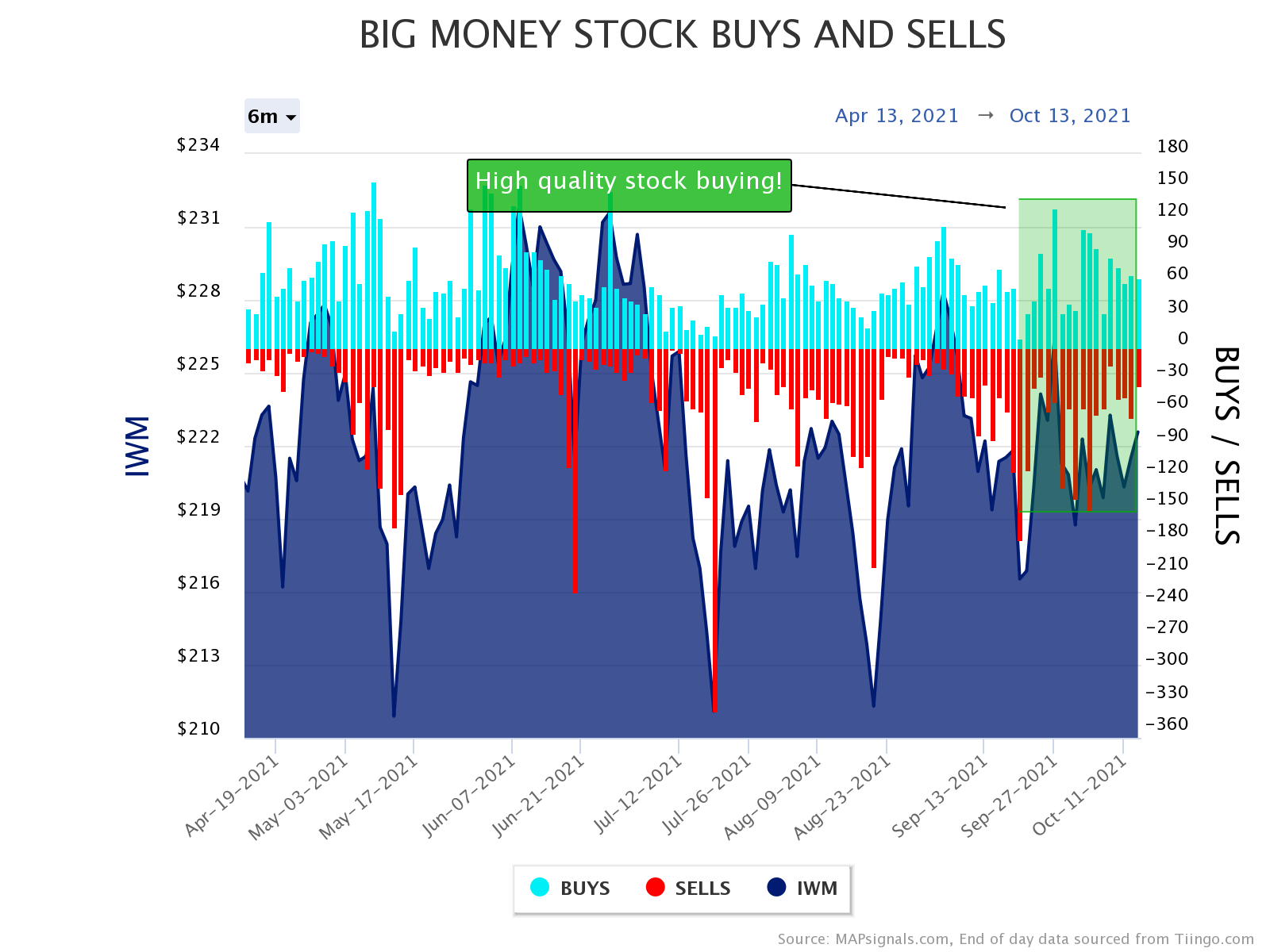

And going a step deeper, we can see the daily action supports this narrative. Selling in stocks is slowing. Buying in stocks is growing. Remember, these are the signals that make up the BMI.

Look how the red bars (sellers) have been getting shorter. That tells us that supply is being met with demand. And when that happens…JUICE flows into stocks!

But the quality of stocks getting bought is what’s important. We believe many of the stocks getting scooped up right now are future outliers.

So now let’s shift our focus there. Nothing gets us more excited than sharing how to find outlier stocks.

How To Find Outlier Stocks

Outlier stocks are the ones that make massive gains. Usually, they are the companies with awesome products, leadership, and growth.

That’s where we spend our entire focus. So, each week we profile the Top 20 stocks getting bought by the Big Money. All-star stocks are found on this list.

And what we’ve found is the best stocks keep getting bought week after week, month after month, and year after year. To highlight these Big Money favorites, we created our popular MAP 50 report, which comes out monthly on the 15th.

This report showcases the 50 stocks getting the most Big Money love over the past 6 months. Why do we do that? Because outlier stocks tend to keep getting bought…

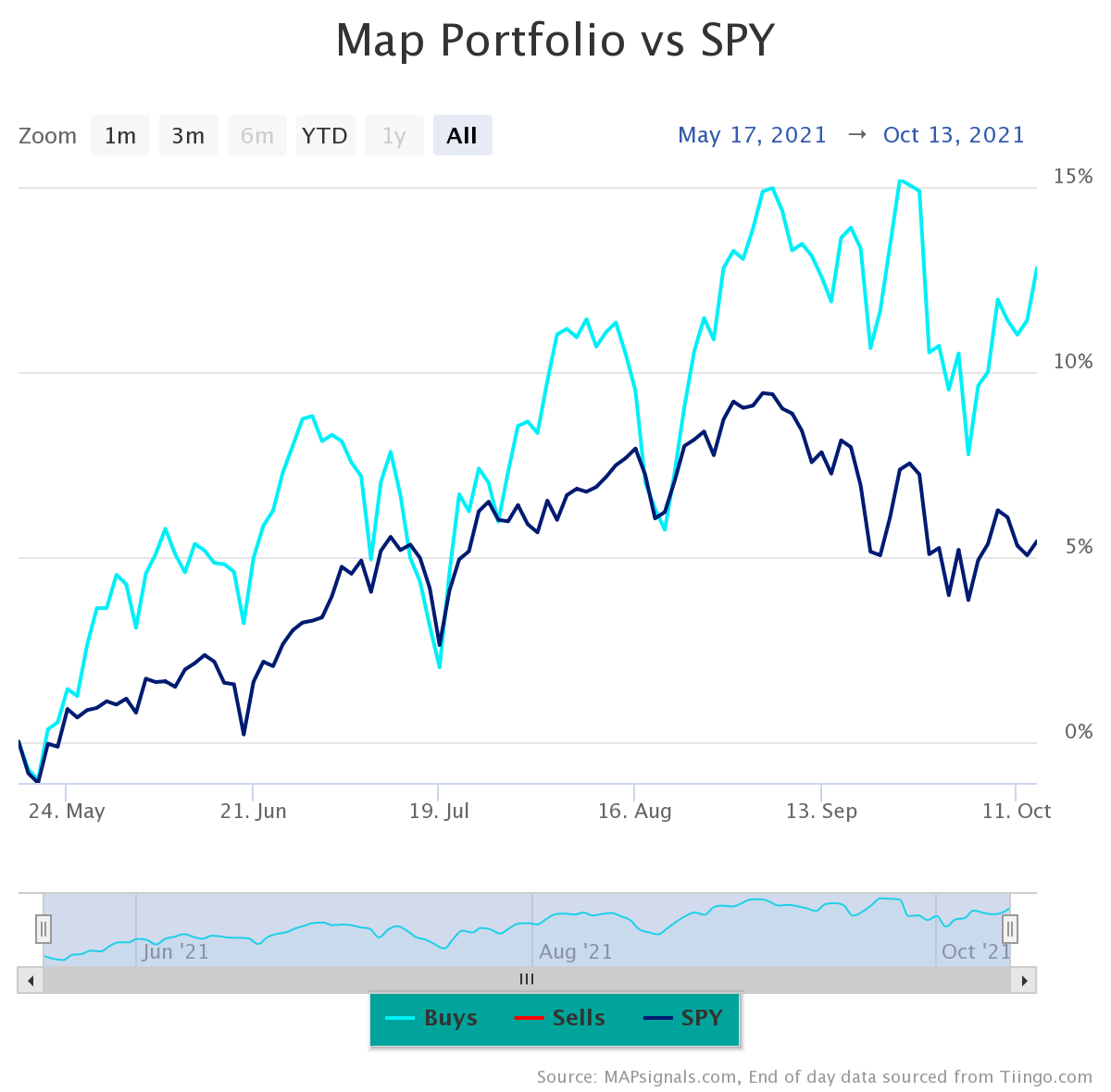

Let me show you what I mean. Below is the performance of our May MAP 50 report held through yesterday:

Those 50 stocks more than doubled the S&P 500 (SPY ETF), with the MAP portfolio gaining 12.82% vs a strong SPY return of +5.42%.

That’s awesome performance, but there’s more!

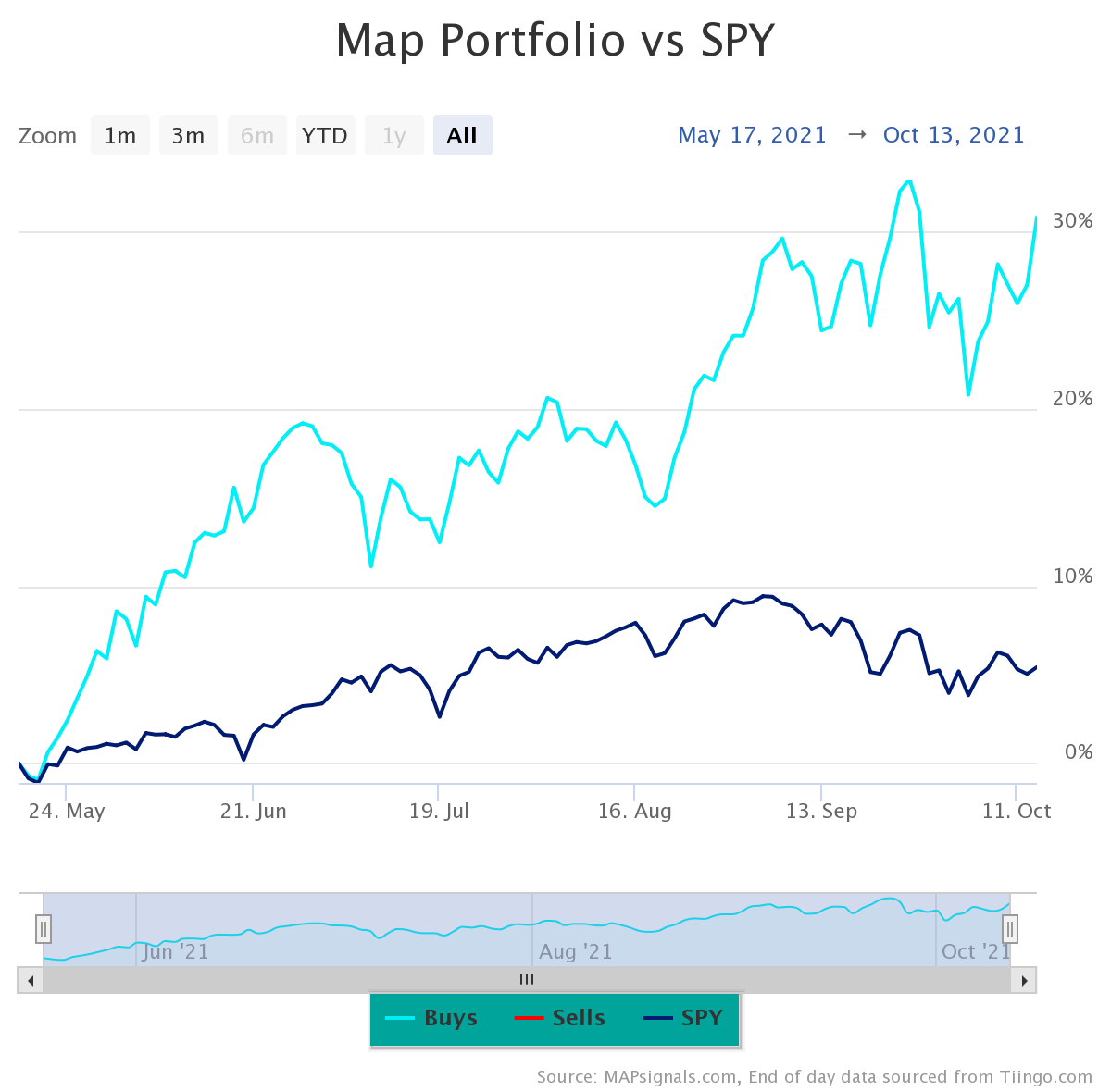

Below is the performance of the top 10 stocks from the same report (removing the bottom 40):

Now, that’s major outperformance. Those 10 stocks gained an average of +30.84% vs. SPY’s +5.42%. That’s the power of outlier stocks.

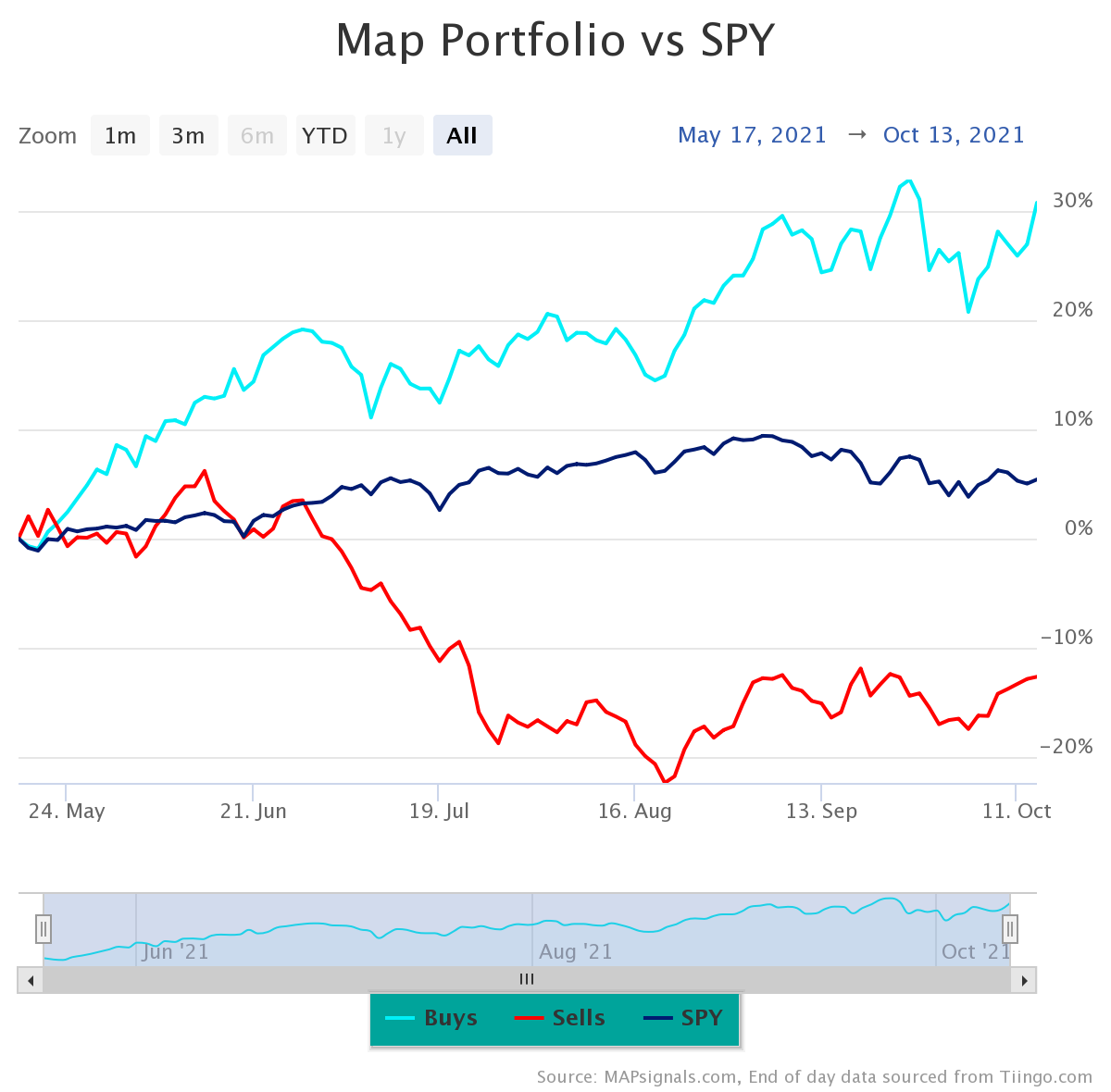

And the Big Money process doesn’t just focus on what’s getting bought. Remember, we track selling too. Looking at the same time frame as above, I’ve included the performance of the 10 stocks getting sold the most.

Have a look:

The red line is showing the performance of our worst ranked stocks. They fell an average of 12.70%.

That folks, is the power of Big Money.

Following the Big Money reveals trends. So, if you ask us how to find outlier stocks…we’ll simply say, “Follow the Big Money, baby!”

And based on the recent buying happening, signs are pointing to more upside. If you’re looking to get access to tomorrow’s MAP 50 report, get started here.

Here’s the bottom line: It only takes a few outlier stocks to transform a portfolio. The latest Big Money data is signaling that high-quality stocks are getting bought. We believe the next crop of outliers is in our data right now.

Follow the juice!

***And as a bonus, check out our latest video: How Big Investors Trade Stocks. In it, Luke and Jason chat about their Wall Street experiences that led them to create MAPsignals.

Make sure to like and subscribe to our YouTube channel!