Is Tech’s Rebound For Real

The tech bear market has been brutal. High quality blue chips are down 20% since November while unprofitable, “concept” stocks have been getting clobbered since early 2021.

But lately tech’s starting to get its mojo back. Is tech’s rebound for real?

Is this a durable rally or a dead cat bounce? Today, I’ll show you how to play it.

Is Tech’s Rebound For Real?

To kick things off, I’ll explain the macro factors driving tech’s rebound. Then I’ll use MAPsignals data to show you how to play it with leading tech ETFs and a small cap, outlier that just keeps getting bought.

Tech is an important call to get right – it sets the tone for the whole market. The S&P 500’s overall direction tracks technology because the sector is so big – it’s 26% of the index. That’s double the next two largest sectors combined – financials, and healthcare – both of which weigh in at 13%.

Here’s my take on what’s driving tech’s turnaround:

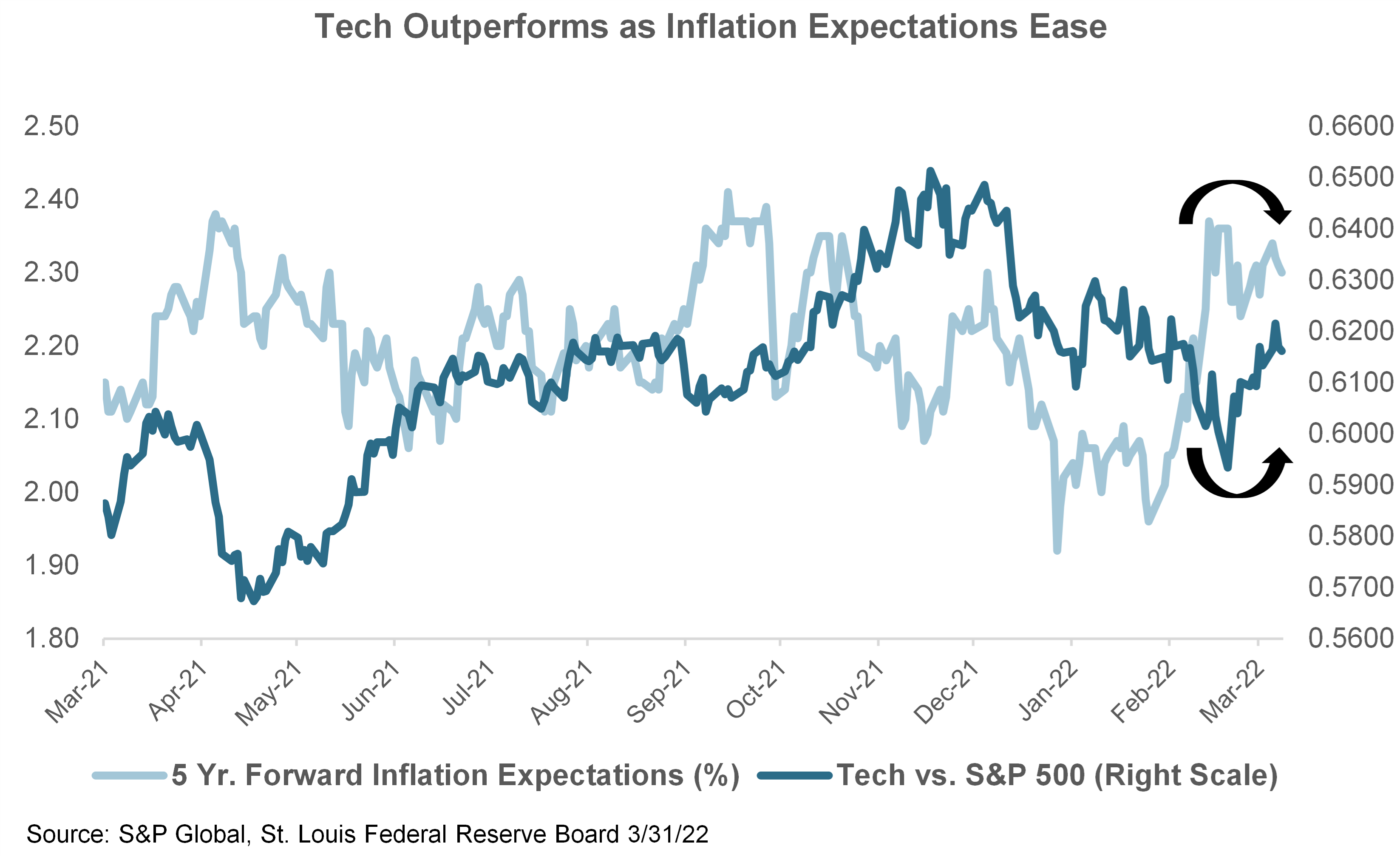

- Less Fed Uncertainty: The Fed’s hawkish pivot at their mid-March meeting ripped the band aid off. Markets are now betting a more hawkish Fed can tame inflation. As future inflation expectations eased tech immediately began outperforming sharply (chart). Fed funds futures price in a 3.25% mid-2023 peak in the fed funds rate. Multiple 50 basis point hikes are now expected.

- When Growth is Scarce, Tech Shines: With recession fears elevated as the Treasury yield curve closes in on inversion, tech’s reliable, all-weather growth is attracting bargain hunters.

- Market Leading Profit Margins: The S&P 500 tech sector’s net profit margin of 23% towers over the S&P 500’s 13%. The spread between the two has never been wider.

- Growth at a Reasonable Price: Despite its much higher margins, tech’s 20% valuation premium over the S&P 500 is in line with the 30-year average. Tech trades at 24.4X ‘22 EPS vs. S&P’s 20X.

- Less Sensitivity to Rising Rates: High quality, mega cap tech stocks are cash rich – they don’t need to borrow money. That leaves them far less vulnerable to rising rates than most companies.

- Easing Commodity Prices: Anything that cools the commodity rally benefits tech by reducing inflation worries. Progress towards a Ukrainian ceasefire would have the biggest near-term impact.

Now, check how the Technology sector ramps when inflation expectations ease:

Lately, Wall Street expects inflation to dampen, sending the Technology group higher. But, now let’s check on the Big Money data.

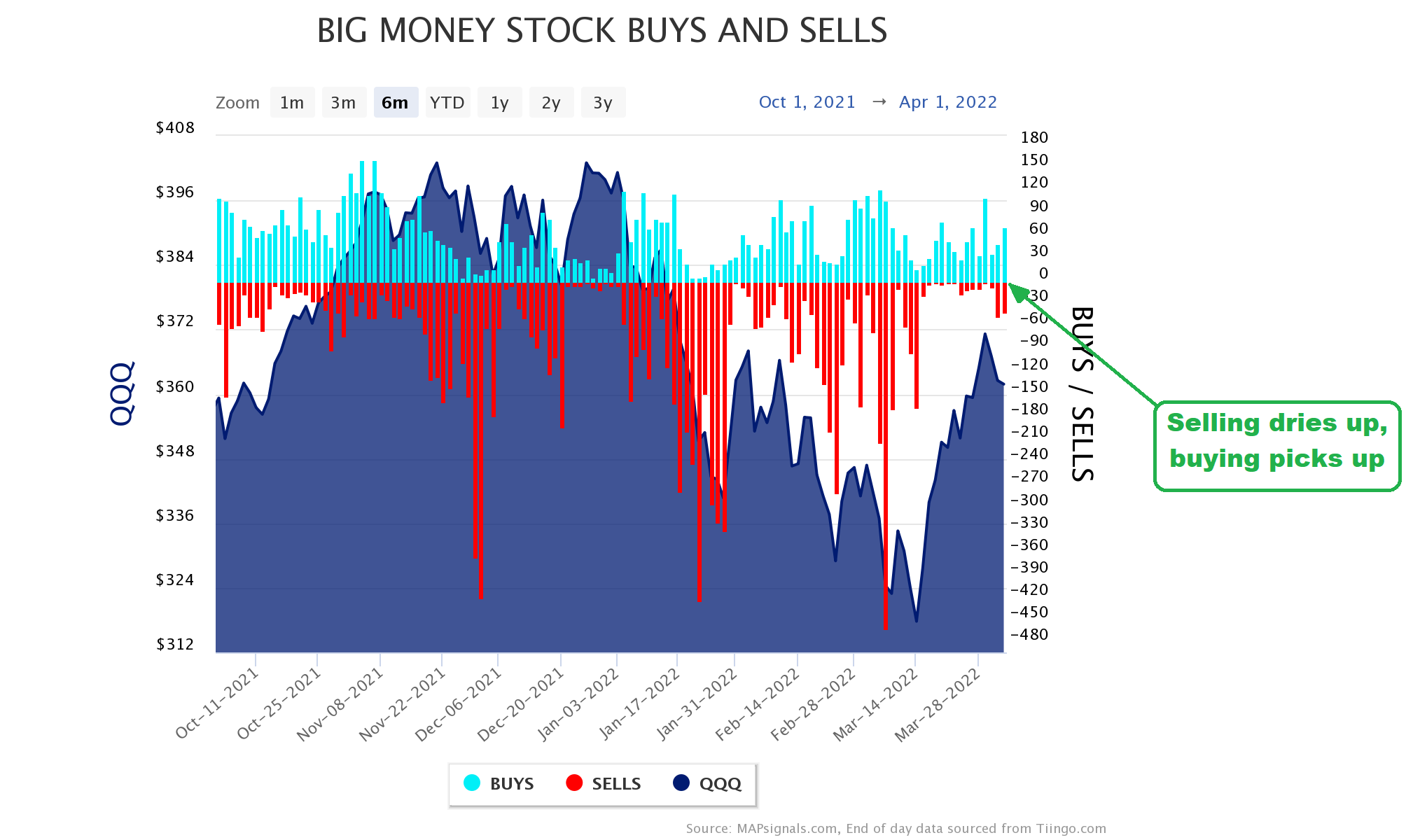

Here’s a look at the 2 biggest tech ETFs: the Nasdaq 100 ETF, QQQ and the S&P 500 Tech sector ETF, XLK. Both ETFs get you lots of exposure to high quality, mega cap tech names like AAPL, MSFT, GOOGL and NVDA, among others.

Below are the daily buys and sells of stocks the past 6 months overlaid on QQQ. Recently, selling has slowed market wide, paving the way for buyers to step in. (Click image to enlarge)

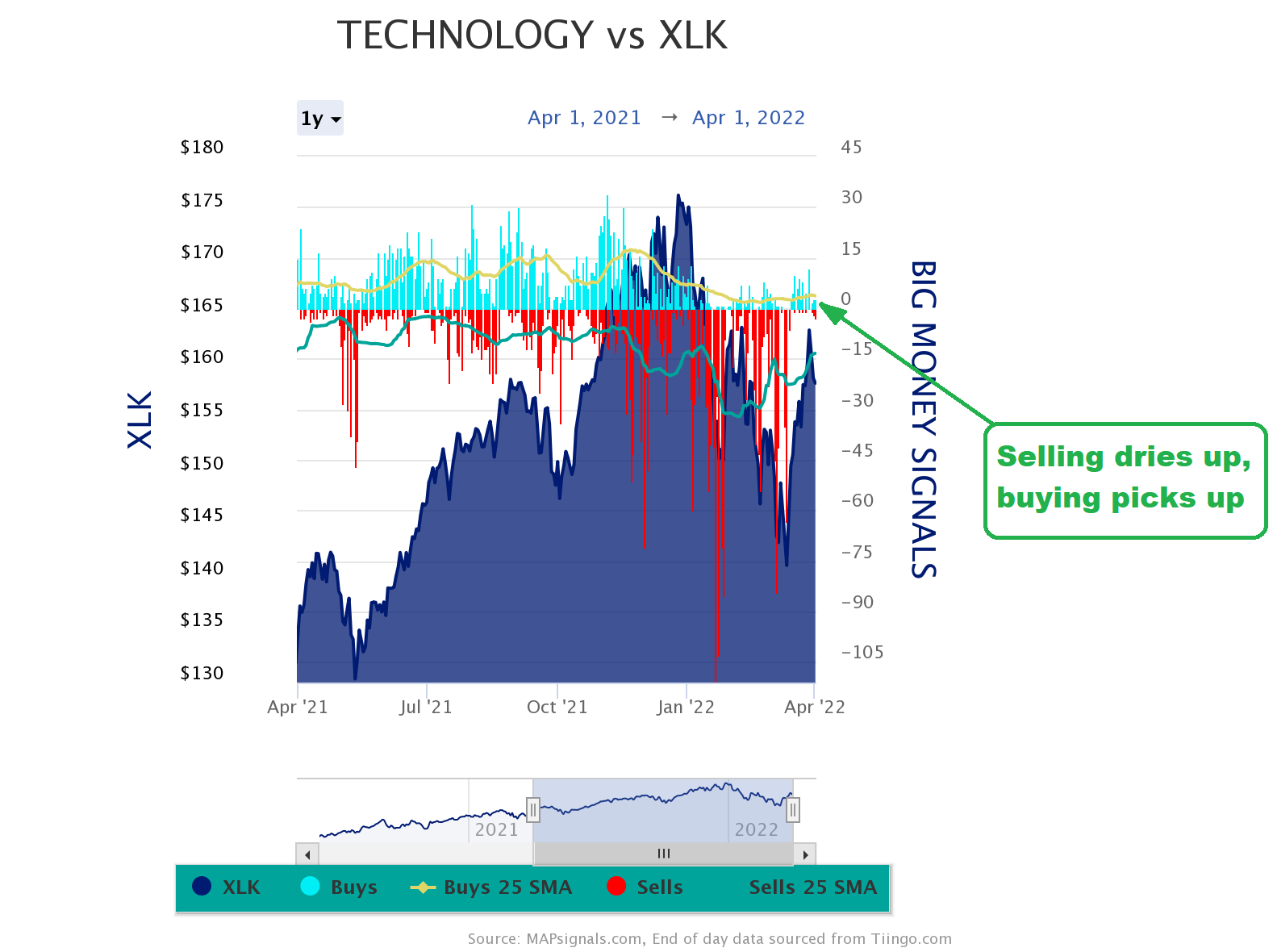

Next, let’s zero in on the Tech sector ETF. Check it out: (Click image to enlarge)

Both charts indicate heavy selling dried up recently as big buying has accelerated.

Now let’s dig deeper. Here’s an under the radar, profitable, small-cap outlier. Rambus (RMBS) is a MAPsignals’ Top 20 chip name seeing big money buying. RMBS has appeared in the Top 20 only twice since 9/6/16, so it’s a newer name. Since its first appearance, it’s up 128%. Lately, it just keeps getting bought.

That’s the Big Money in action.

Bringing It All Together

In the wake of a brutal bear market, opportunity is emerging in high quality, mega cap tech names and smaller outliers seeing consistent, Big Money buying.

The Fed’s more hawkish stance has increased the Street’s confidence it can tame inflation. And with recession fears elevated, tech’s reliable, all-weather growth is attracting bargain hunters, especially given record profit margins and more reasonable valuations. Any positive geopolitical developments and easing commodity prices would just be icing on the cake.

Trade well,

-Alec

Using MAPsignals data helps visualize the Tech opportunity – consider starting a subscription today.

***Tomorrow’s the day! Join Jason, 11AM ET, as he presents The Bear Market Guide to Picking Stocks at the Wealth365 summit. It’s virtual and FREE!