Juice Is Loose

At MAPsignals, we live by the numbers. But sometimes data can change its mind. We interpret it and deliver those results.

We seek to surf the data and react to what it’s telling us at that moment. Of course, you can try to anticipate it, but that means sometimes you can get it wrong.

That’s annoying.

But, there’s one way to ensure you win in the long run… follow the juice. Right now, the juice is loose for amazing stocks.

When you hold outlier stocks, over long periods, it really does not matter what the market does. Great stocks continue to be great. In fact, great stocks make investors rich.

Think of it this way, an average person fishing may get a few minnows and one or two decent fish. But a pro fisherman knows where to fish. He will go where the good fish are biting.

Now imagine a pond with only the best fish, or better yet – a barrel… it just doesn’t matter what’s going on in the big sea.

Juice Is Loose: 5 Juice Stocks Prove You Don’t Need To Stress The Markets

The same goes for stocks. Because when you hold core outlier stocks, you don’t need to focus on nailing the tops and bottoms. Of course, that helps for entry and exit, but, in the end, you hold the best through ups and downs.

If you managed a sports team, and you had signed Wayne Gretzky or Michael Jordan as either a rookie or a vet you knew you were getting the best. Who cares if hockey or basketball might be less popular one year over the other?

Eventually those players will shine. The same happens to great stocks. Eventually, the juice is loose.

Focusing on outlier stocks is our way to not stress about timing the market.

But it can be frustrating sometimes, like now, when we get a market where prices just keep rising… aka the juice is loose.

Data says we’re overbought but the market doesn’t care. Instead of stressing over the precise moment it might roll over… focus on the juice.

So now, what we do is find outliers. We find them by following the big money.

When you marry big money signals and incredible companies, you get juice. Again, we may see unforeseen events in the market from time to time, but we’ve learned to always bet on the best.

History tells us we’ll be fine no matter what the market does… just look at the past 20 years: The stock market has been plenty volatile. We’ve seen a Tech bubble, Global financial crisis, and now a pandemic to name only a few rocky points.

Burrito Ruined Day-Trading

Early in my career, I learned most day-traders failed. I found success though because I had the longest hold times in my group. That was my edge… time and patience.

I also began to notice that only a handful of stocks kept going higher and higher no matter what the market threw their way. Day after day I kept seeing the same leaders. That’s when I realized that because awesome stocks were unstoppable, I should just focus there.

Most of my day-trader colleagues would thrive on the in-and-out trades. They’d try to time 5-minute chart reversals and news impacts trying to clip pennies, but I would patiently watch earnings reports and zero in on the best ones.

One day for lunch, our group decided to check out a new burrito joint, Chipotle Mexican Grill, Inc. I fell in love with the food, but more importantly, I fell in love with the business…

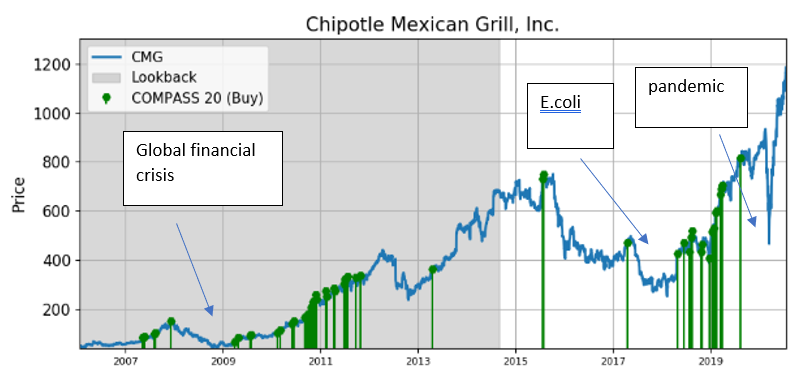

The gray area below is back-tested data prior to when MAPsignals began as a business. The white area is live data. Those green bars are our big money signals.

(Disclosure: MAP or its founders hold long positions in CMG)

Signals started in 2007 below $100. The stock is now roughly 12 times higher. The journey had plenty of peaks and valleys though- nothing goes straight up. The point is – you have to hold if you want the juice.

When you identify the best, it’s not worth the stress of timing tops and bottoms. The results play out over time. Some of the best scoops are when there is a major pullback (we call that deuce). While it may feel like a mistake holding on at the bottom, those are usually rare opportunities.

Let’s keep doing this… because outlier stocks keep going year after year.

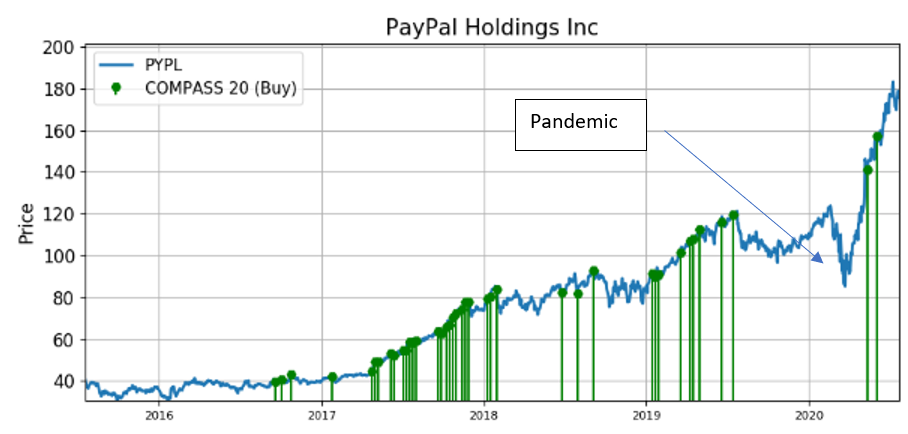

Digital payments is changing the financial landscape. We bet on the leader, PayPal Holdings, Inc.

(Disclosure: MAP or its founders hold a long position in PYPL)

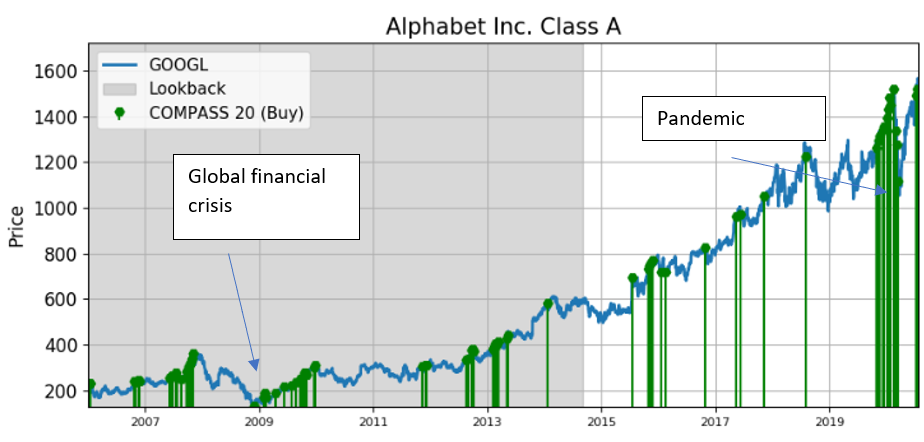

Now, let’s look at search. There is one king, Alphabet, Inc.

(Disclosure: MAP or its founders hold a long position in GOOGL)

All stocks go through pain points. The best come out stronger, because they are the juice.

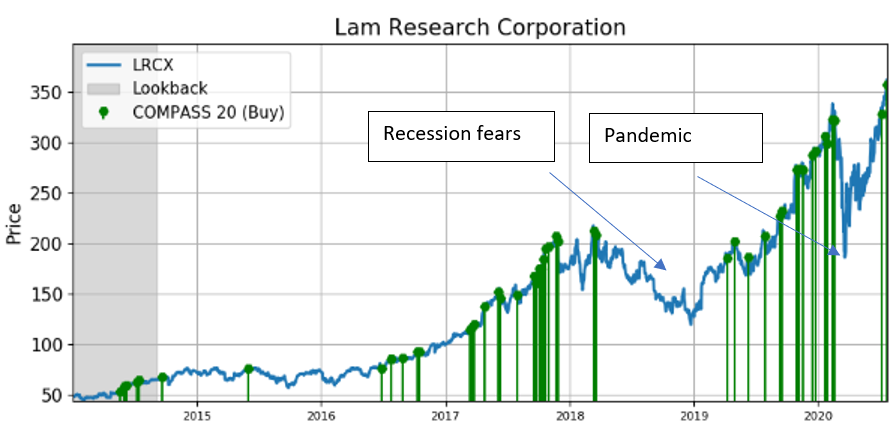

This is getting fun… let’s look at another that we’ve held for years here: Lam Research Corp.

(Disclosure: MAP or its founders hold a long position in LRCX)

It’s all in what you see. When the market is free-falling and pundits are using scare-tactics, that might be the time to pick up great outlier stocks.

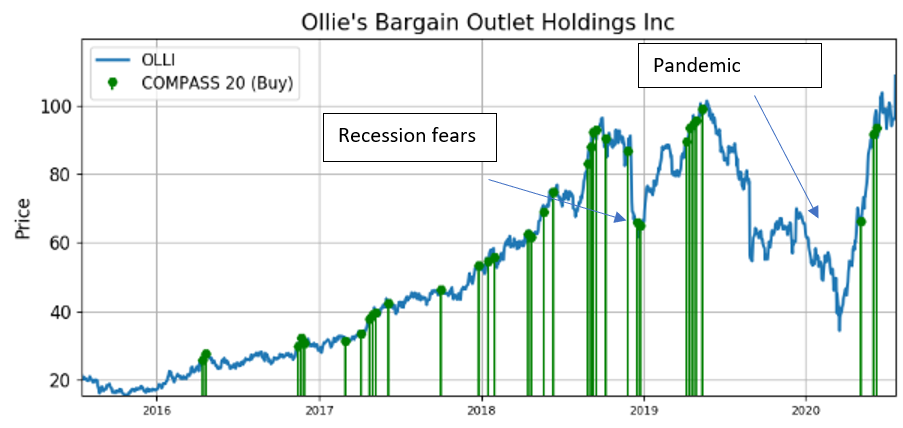

Ok, here’s the last one, a lesser known name: Ollie’s Bargain Outlet Holdings Inc.

(Disclosure: MAP or its founders hold a long position in OLLI)

The green usually leads to more green. Pullbacks can mean opportunity.

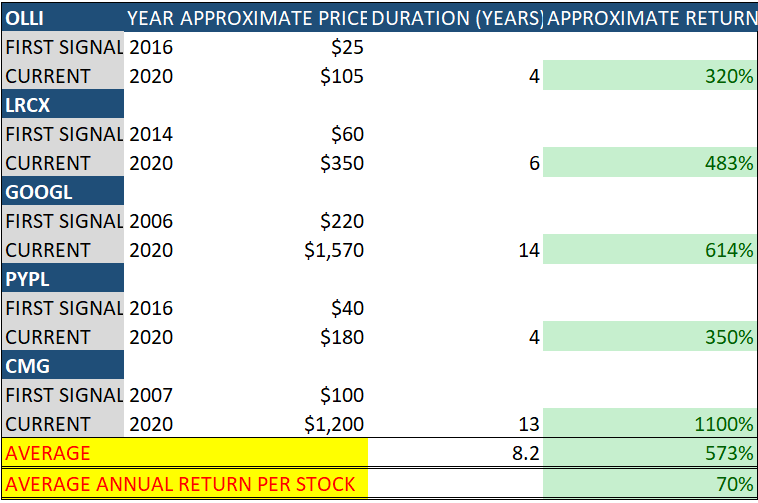

Let’s just summarize here:

The 5 stocks above averaged an approximate +573% return over 8.2 years or approximately +70% per year. Let that sink in…

Now look at it:

Bottom line: you don’t have to always be winning on every investment. A few outliers make all the difference but require patience.

Focus on finding the best… buy the big money leaders.

Once you get a few outliers in your portfolio, you may begin to relax when markets get shaky.

That’s usually when buddies panic and ask you what you’re doing about falling prices.

Maybe you’ll answer, “it doesn’t matter… I’m going fishing for juice.”