Macro Uncertainty Favors High Quality Stocks

Stocks have been losing steam lately. Many of you may be wondering what’s changed, and what’s next?

Today, I’ll show you what markets need to get back on track.

Then, I’ll show you how to play it with a leading, low-cost factor ETF that targets the sweet-spot of the market that’s still seeing big money buying.

Macro uncertainty favors high-quality stocks.

Alright, let’s hop to it.

What Happened to the Rally?

The macro-outlook is about as murky as you’ll ever see. Covid did a real number on the global economy that’s still skewing the data. Mixed signals abound. In times like this, it pays to keep things simple.

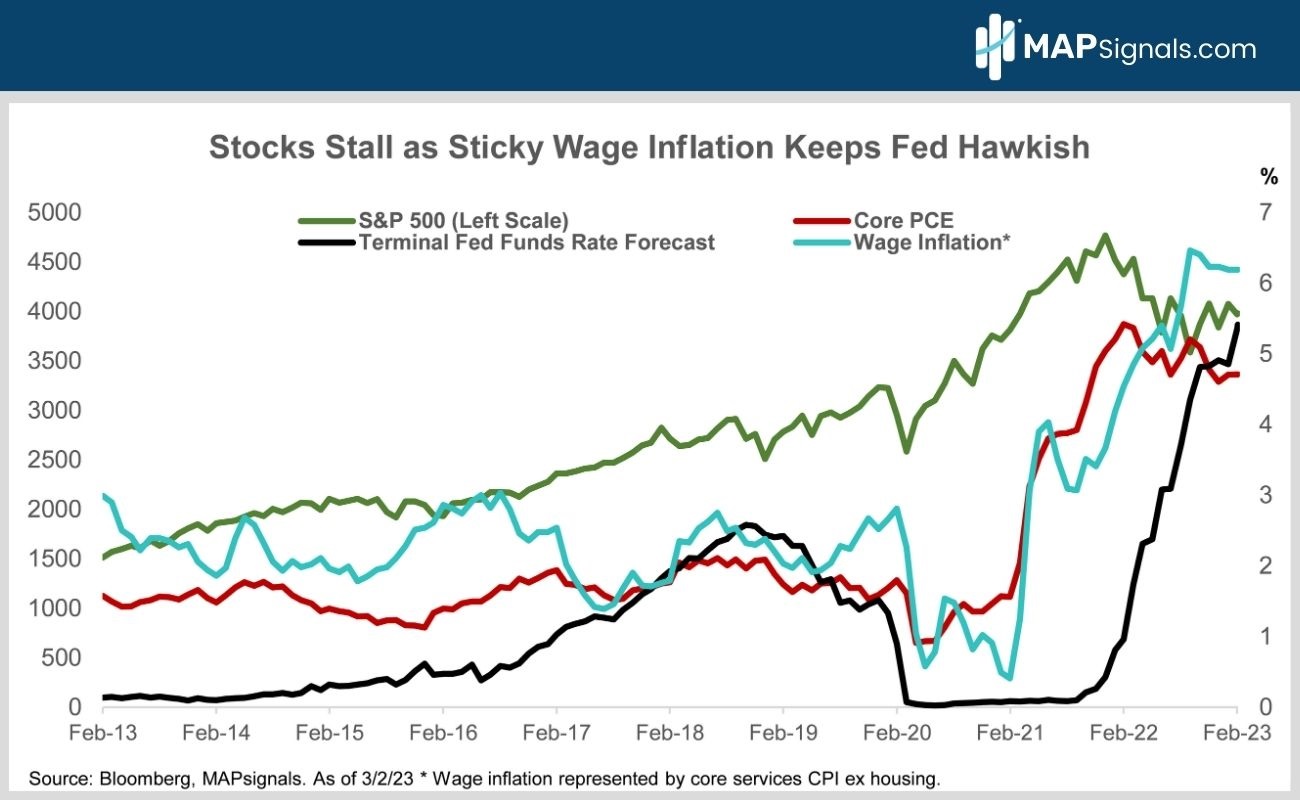

Watch inflation. The Fed’s favored inflation measure, core PCE, has dropped to 4.7% from its 5.4% peak last year. But the strong job market is keeping wage inflation sticky at 6.2%. This has markets betting the Fed will need to raise the Fed funds rate to 5.5% by July and keep it there for a while (chart).

This “higher for longer” interest rate outlook hurts stocks in two ways. First, it reduces economic and earnings visibility. No one knows how much tighter financial conditions will ding the economy and corporate profits. That caps equity upside.

Second, high short-term Treasury yields are siphoning scared money out of the stock market. The 1-year T-bill yields 5.1%.

That’s a nasty double whammy for stocks.

The bottom line is until wage inflation drops more meaningfully, freeing the Fed to finally signal a pause to its rate hiking campaign, the S&P 500 is likely to stay rangebound and choppy.

Everybody loves a rally. But smart money knows you trade the market you have, not the market you want. The reality is sometimes stocks need a breather as investors await better fundamentals.

The below chart highlights how stocks are trapped sticky wage inflation keeps the Fed hawkish:

That’s the bad news. The good news is there are plenty of ways to profit from this volatile, rangebound tape.

Macro Uncertainty Favors High Quality Stocks

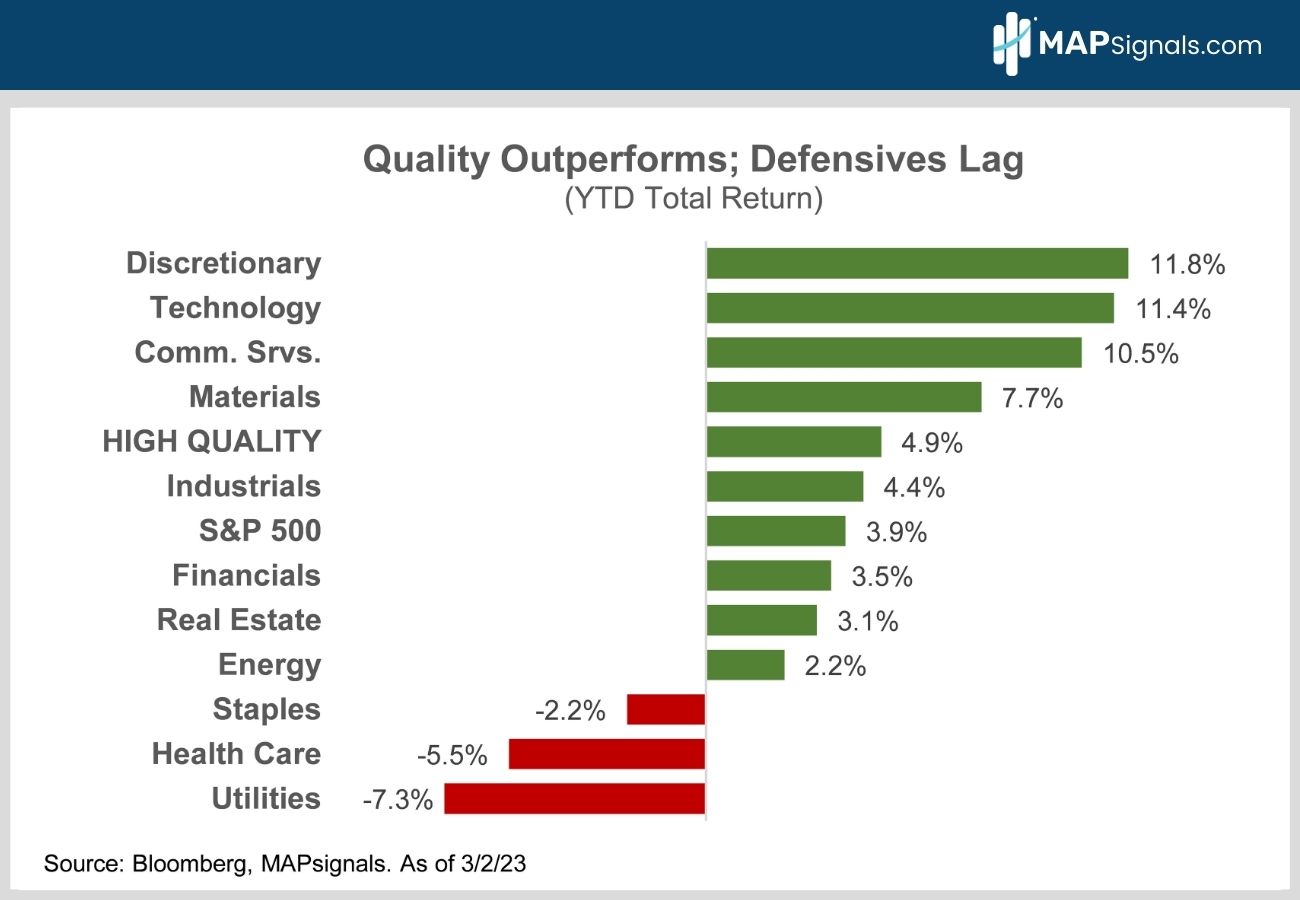

You might think defensive, counter-cyclical sectors like health care, staples and utilities would be outperforming amid the murky macro. But after crushing it in 2022, this well-worn strategy is lagging badly YTD (chart).

Instead, focus on high quality stocks. Quants define high quality stocks as those with the following fundamental attributes:

- High returns on equity

- Stable year-over-year earnings growth

- Low financial leverage (debt)

When you think about it, it’s no surprise that quality stocks are steadily outperforming the S&P 500 YTD (chart).

After all, low debt, stable earnings growth, and high returns on equity make these stocks much less vulnerable to the very macro worries that have investors so worked up right now (higher interest rates, shrinking margins, weakening profit growth etc…).

Notice how discretionary and technology are in the driver’s seat YTD, vs prior value-heavy groups like utilities, health care, and staples:

Even better, unlike more defensive strategies, a sector diversified portfolio of high-quality blue chips offers plenty of upside exposure once the bull market gets back on track as wage inflation eventually cools.

The icing on the cake is that you don’t have to pay up to target the highest quality names. High quality stocks trade at 18X 12-month forward earnings forecasts vs. the S&P 500’s 17.8X. That’s a pretty small premium.

OK great, but is there an ETF for that? You bet.

The iShares MSCI USA Quality Factor ETF (QUAL) is a sector diversified strategy that tracks high quality large and mid-cap stocks. It’s the biggest of its kind with $18B in AUM and sports a category leading, rock-bottom expense ratio of only 0.15%.

QUAL has a healthy MAPsignals’ map score of 59. That’s high enough to show healthy momentum in a tough tape, but nowhere near overbought (think 75-80).

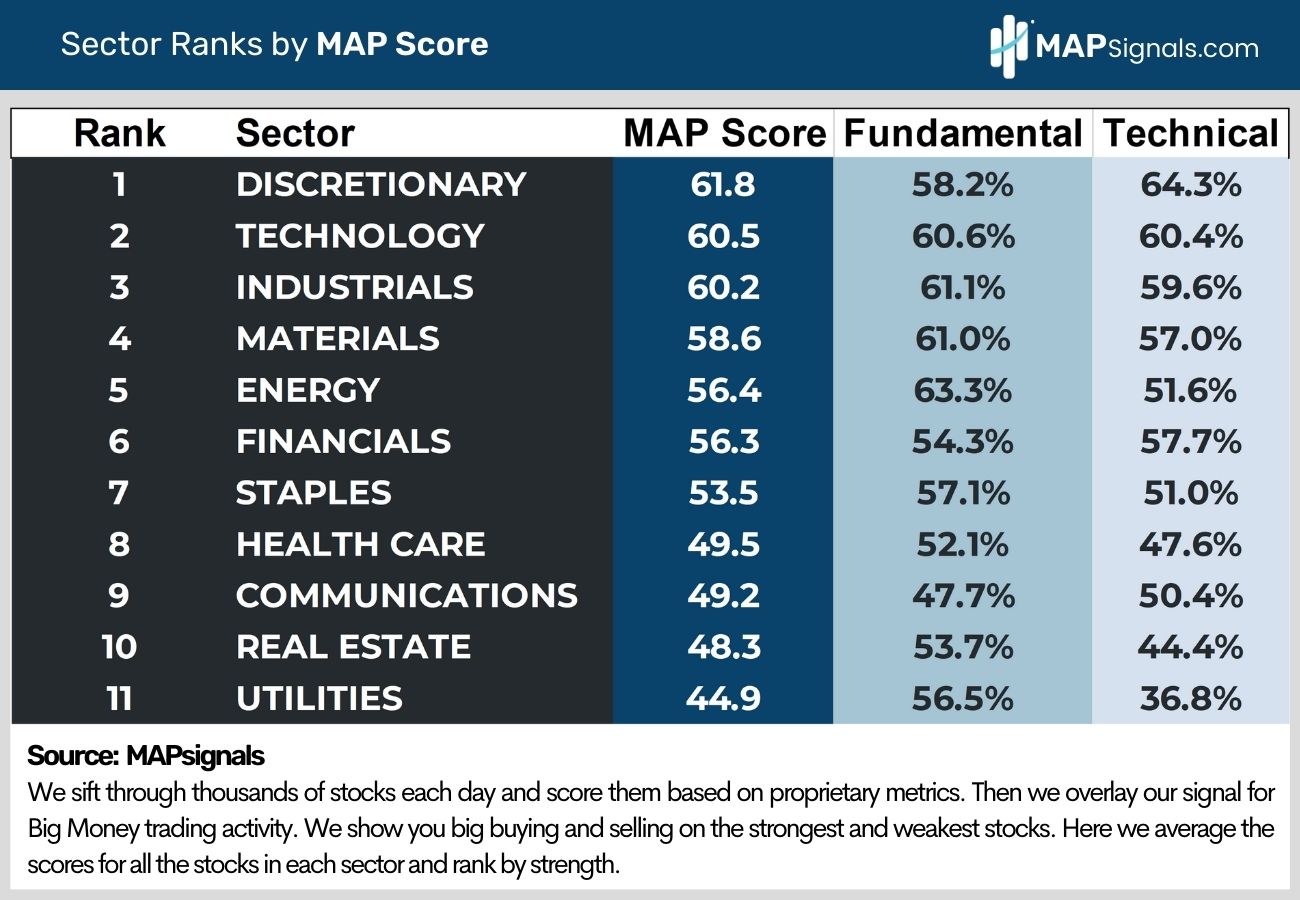

Even better, QUAL has healthy weights in sectors with the highest MAPsignals’ map scores. QUAL has a 28% weighting to technology which has the second highest map score at 61. It also has 11% in consumer discretionary which has the highest map score of 62 and a 9% weight in industrials, the third highest ranked sector with a map score of 60. That’s 48% in our 3 favorite sectors (table).

Wait, it gets better. The top 10 holdings comprise 34% of the portfolio so it’s not too top-heavy. Major holdings just ooze quality – Apple, Microsoft, Nvidia, Meta, Home Depot, United Health, Costco, Johnson & Johnson, Mastercard and Visa. Most of these names have healthy map scores in the 60’s.

Bringing It All Together

The key to outperforming in a tough macro environment is understanding what investors are most worried about and then targeting stocks that are least vulnerable to those concerns.

Sticky wage inflation is pushing up interest rates. That’s siphoning scared money out of stocks amid growing fears of margin erosion and weakening earnings growth.

High quality stocks are outperforming because investors understand that companies with low debt, stable earnings and high returns on equity are best positioned to weather the storm. And unlike most defensive strategies, quality also offers plenty of upside leverage once this bull market gets back on track.

QUAL makes it easy to target high quality, and our ETF ranking process agrees.

To find quality, use a map! Plenty of stocks are rallying right now. Get started with a subscription here.

Invest well,

-Alec