Prepare for All-time Highs in 2024

The latest oversold market brought with it a bullish tradition: a face-ripper rally.

Gratefully, MAPsignals relied on evidence for our constructive view.

Given the Thanksgiving week, I’ll keep it short and sweet.

Investors should prepare for all-time highs in 2024.

The latest equity thrust higher has been swift and violent. Given we’re coming out of extremely oversold conditions coupled with the fact that interest rates have peaked, stimulative tailwinds are set to keep money pouring into equities.

It’s time to be cheerful and focused on the bullish undertones in the market.

Let’s talk turkey.

Prepare for All-time Highs in 2024

I’ve got news for the backslidden bears. This rally has a lot further to go.

Not only are earnings turning higher as Alec Young pointed out, but there’s hungry appetite for stocks by institutional investors.

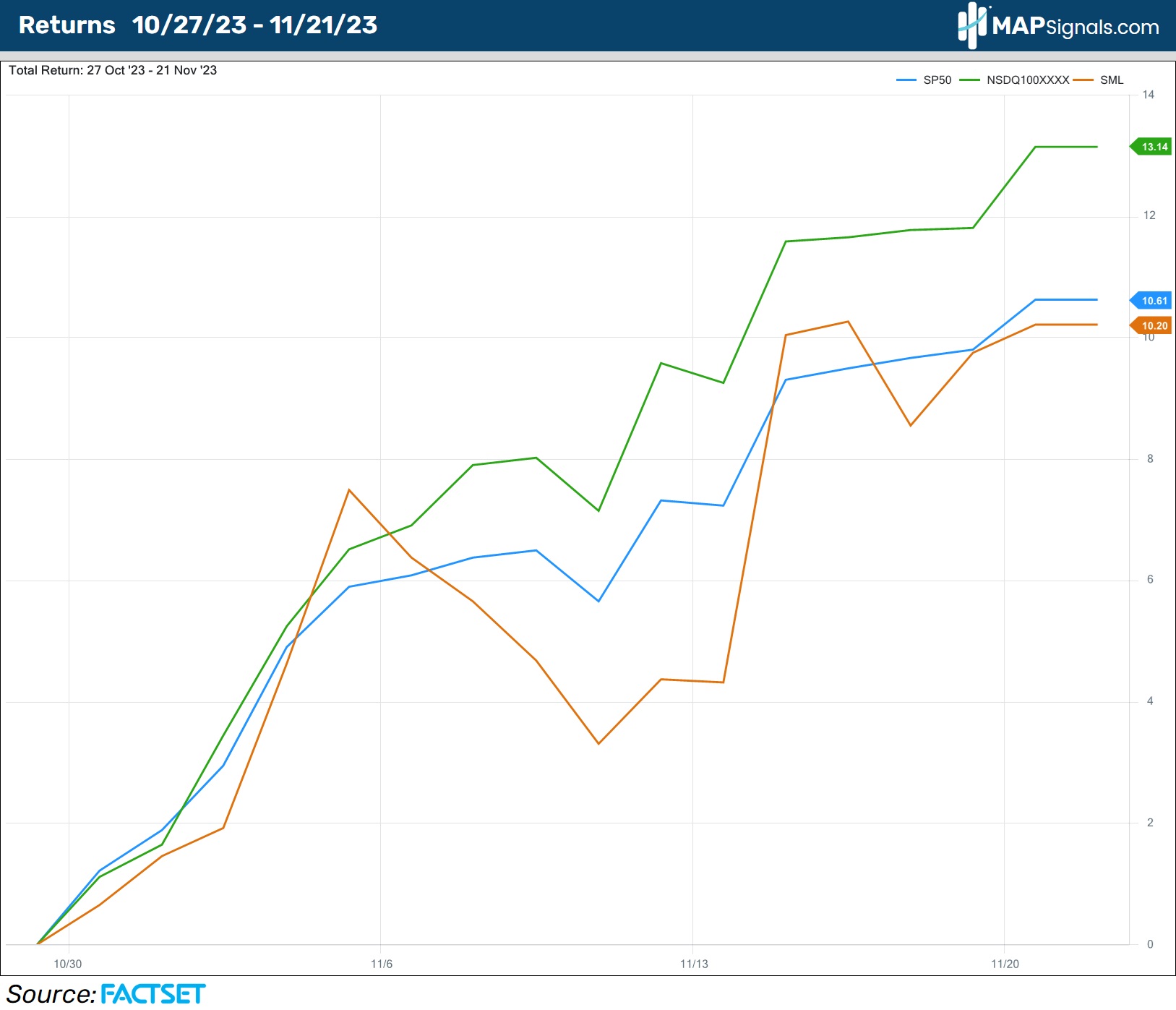

After a blistering oversold selloff, we’re witnessing one of the most violent risk-on environments in years. Since the October 27th low, large- and small-caps are up double digits:

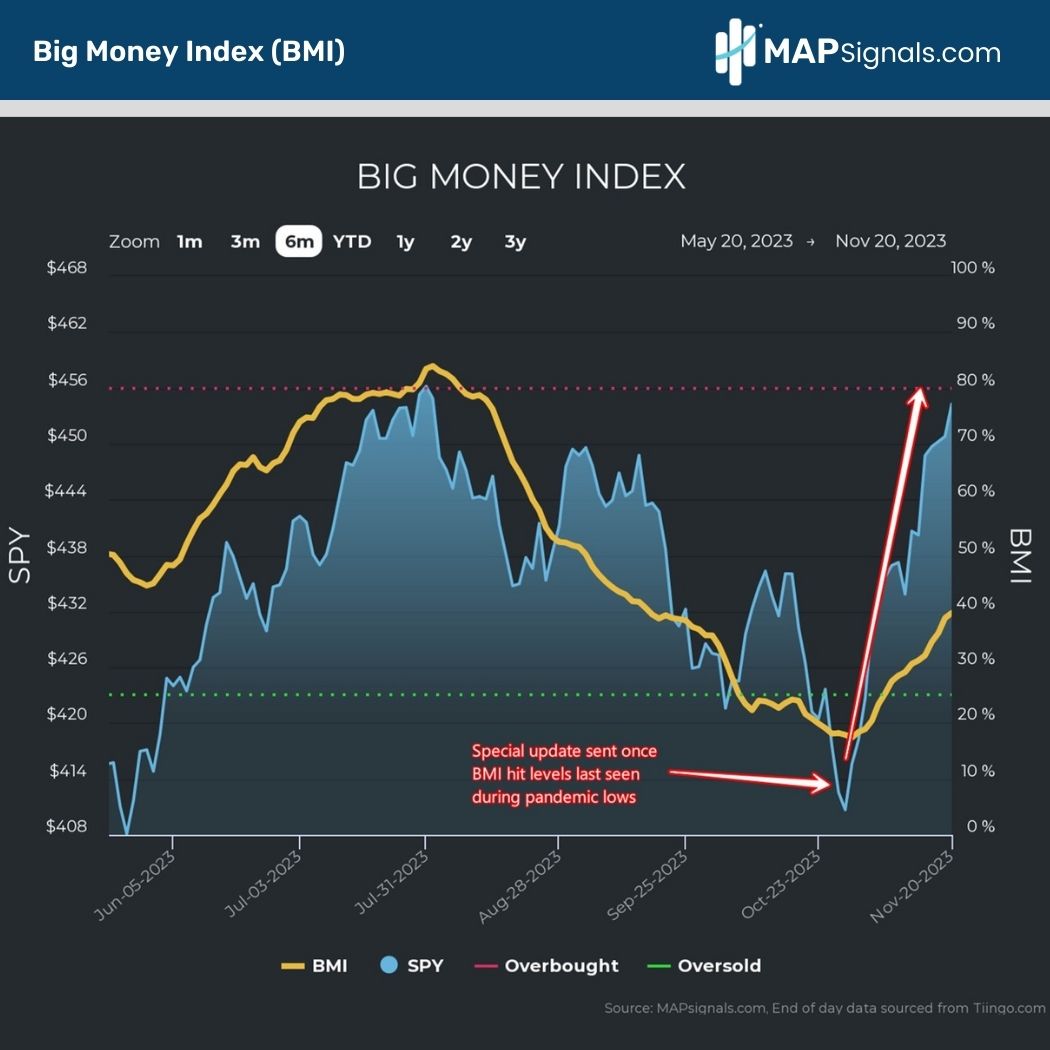

The latest propulsion higher didn’t come as a surprise. Our Big Money Index (BMI) dropped to levels last seen since the pandemic… one of our shallowest readings ever at 17%.

This brought about 2 bold calls from us.

First, small-caps reached extremely cheap valuations signaling a monster rally was coming. Then, we published a non-consensus market volatility update pointing to a swift recovery quickly approaching.

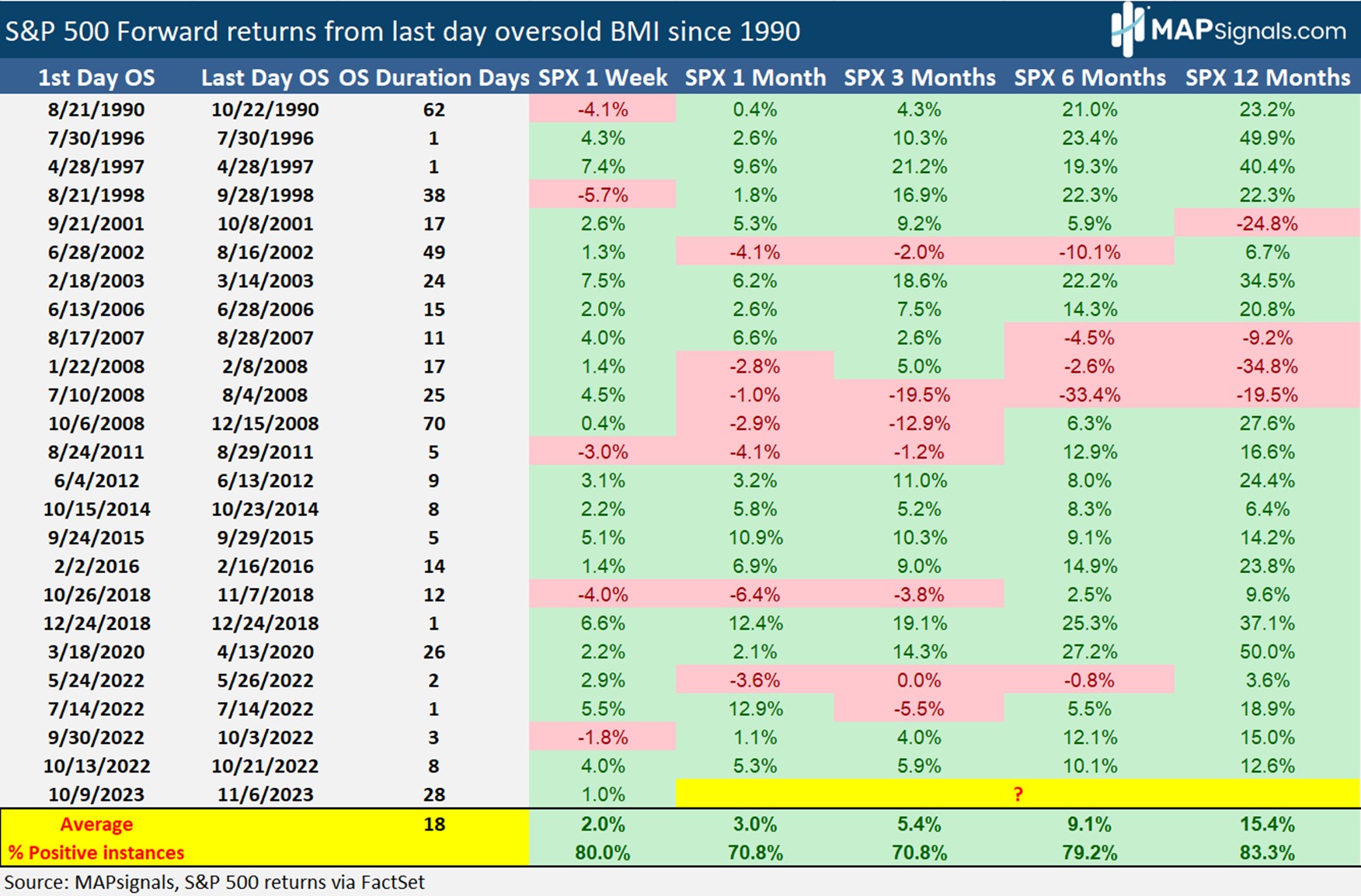

Below shows why you want to be thankful when stocks flash oversold:

Don’t rely on wishbone analysis. Rather, follow signals with a proven track record.

Here are the forward returns for the S&P 500 once the BMI breaks out of oversold territory:

- A month later stocks climb an average of 3%

- 6-months later they surge 9.1%

- 12-months later you’re staring at 15.4% gains

With money gushing back into stocks prepare for all-time highs in 2024. Afterall, the S&P 500 is a basket of stocks, of which many are making 52-week highs.

Where the biggest constituents go, the index follows.

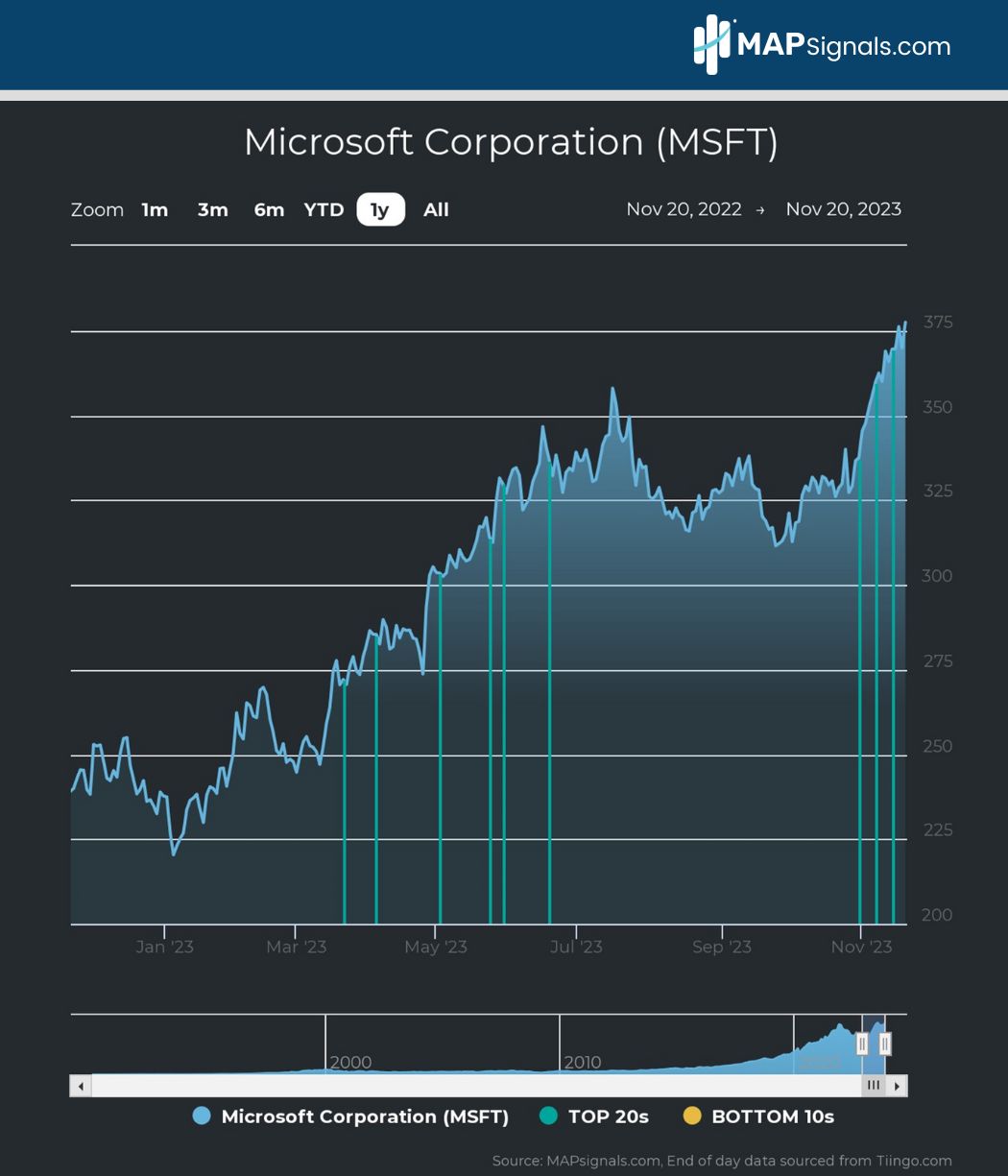

A case in point is Microsoft Corp. (MSFT) which I’ve thankfully been a holder for many years. The latest A.I. circus from the weekend may have you believe the latest resurgence is new.

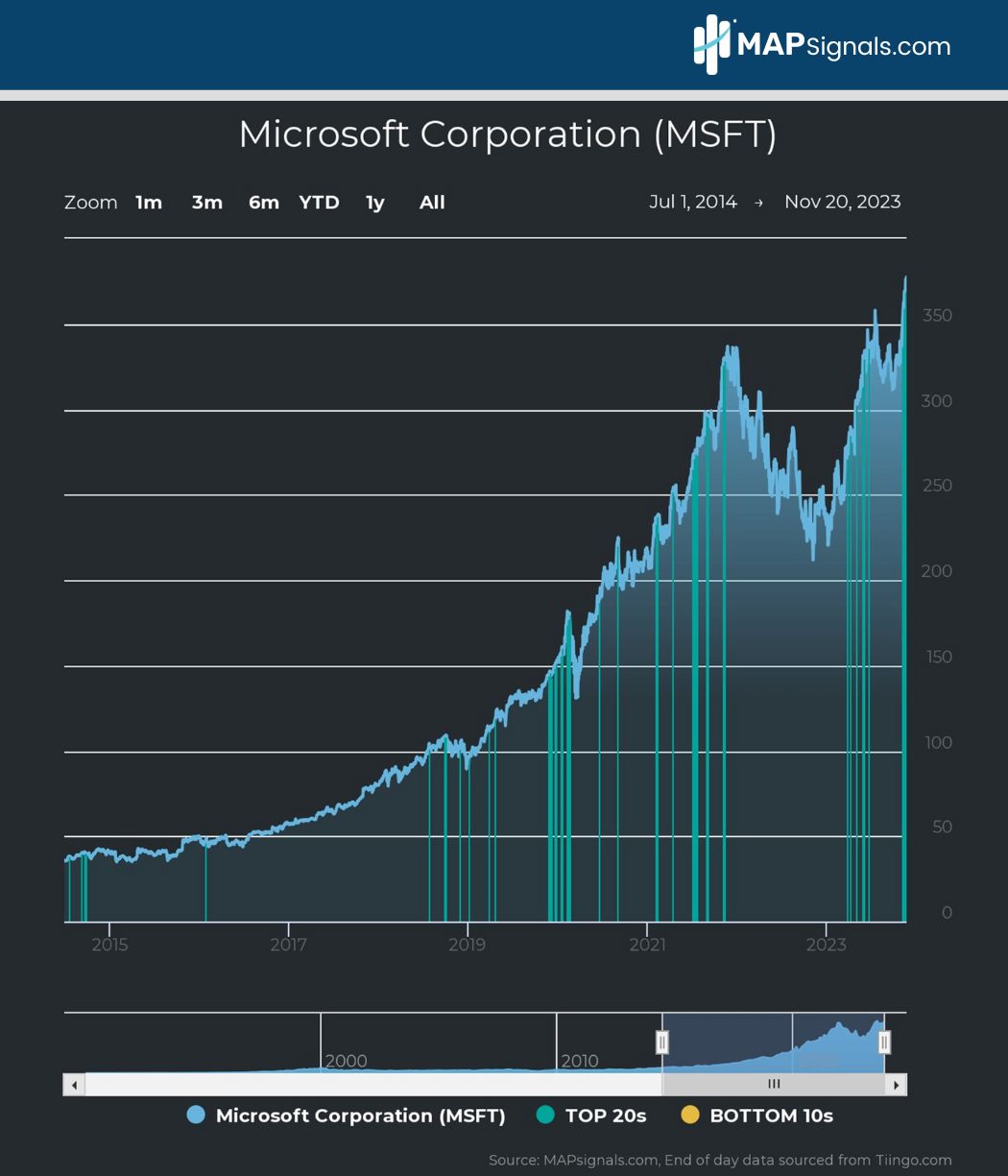

One look at our money flow indicator shows how this rally has been in place ALL YEAR. MSFT has been a recurring magnet for capital on our weekly Top 20 list. Each blue bar highlights when it was a top-ranking name under heavy accumulation:

9 instances the past year is one thing. When you take this study back to 2014 when we birthed this business, this outlier made the report 45 times beginning July 22nd, 2014:

The stairway to heaven from $38.30 to the latest price of $377.44 is a beautiful thing! And it’s not just Microsoft that’s blasting higher. Plenty of high-quality companies with similar tailwinds are racing higher.

As you give thanks this year, prepare for all-time highs in 2024 with a smile.

It’s coming.

Let’s wrap up.

Here’s the bottom line: since the market low on October 27th, small- and large-caps are up double digits. If you’re fading this rally, you may want to think again.

The Big Money Index is blasting higher as demand for stocks reignites. Deeply oversold conditions typically result in +15.4% gains for the S&P 500 a year later.

Keep it simple. Follow the Big Money.

With large-cap stocks like Microsoft leading the charge, prepare for all-time highs in 2024.

As you spend time with your loved ones this Thanksgiving, keep a positive view into next year.

The A.I. wave is real. Focus on the true leaders in the space. Possibly even more important, odds favor interest rate cuts next year. That’ll relieve much needed pressure on equities.

Given this setup don’t be surprised at the portfolio cornucopia that’s coming…

If you’re a professional money manager, RIA, or someone that serious about investing, Get a MAP PRO subscription ahead of holidays.

My hunch is your portfolio will thank you for it!

Happy Thanksgiving everyone!