Quiet Chop

Stocks started off October with a bang. Now, it’s quiet chop.

September saw the S&P 500 fall 9.6% peak to trough with a low set September 23rd. This played out precisely how history has suggested based especially on election years since 1992.

Big money sells ahead of uncertain events like presidential elections. Then they tend to buy after election day. But buyers seemed to show up early this year and from the 9/23 low the S&P 500 rallied +9.2% effectively wiping out any destruction saw prior.

But since October 12th, things have quieted down. The data has seemed mixed with no clear buying or selling… just pockets of both in little corners of the market. It’s almost like stocks are tip-toeing into the election.

Sure, we can assign reasons, there always are reasons. Maybe people are focused on tonight’s debate, maybe it’s earnings uncertainty, stimulus, or coronavirus. Whatever the reason is, we’d describe it as quiet chop.

Now that the election is less than 2 weeks away, we see new scandalous headlines dropping daily. Big green market days are followed by red days, seemingly over and over. It’s like the stock market went into a big washing machine with money sloshing around: no clear consensus.

At MAPsignals, we don’t follow the news, we follow the Big Money. So it’s time to dig under the surface, and the signals we see are self-contradicting whispers.

Despite buyers coming in early after our expected big money selling, it looks like uncertainty is back. As we see it, big money chips are being taken off the table. As money managers flatten out risk, stocks are whipping around under the surface. The main indexes may look calm, but volatility is brewing under the surface.

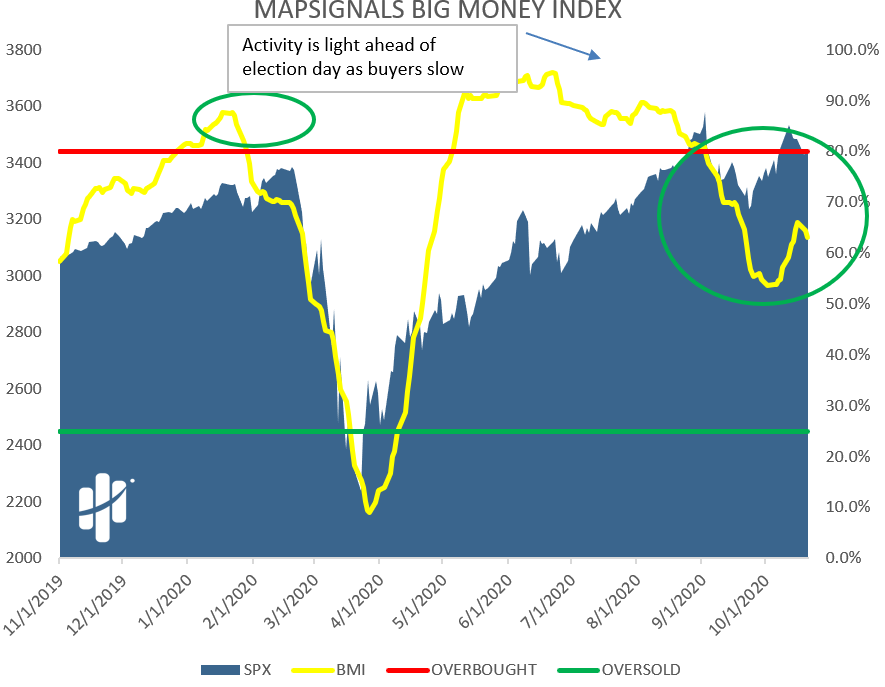

Big Money Index Quiet Chop

In terms of big money action, it’s quiet out there any way you slice it. The big rally kicking off October has ground to a halt as the S&P 500 has fallen -3% since 10/12. Volumes and (logically) signal counts are drying up.

This reinforces our belief that Wall Street money-managers and traders are flattening out their risk. You can see the quiet chop in the BMI:

The precipitous fall from the overbought peak in July has been smooth and steady. The drop accelerated in September as the first round of risk-off took place. Buyers came in- perhaps to cover shorts, perhaps in a bid of over-confidence, but either way optimism surfaced for a few weeks.

Now our data points to near-term uncertainty. More importantly, it fascinatingly once again lines up with the selling in stocks we’ve monitored in our election study going back to 1990.

Now that history is playing out as we thought, what action do we take?

Remember, history suggests that the yellow BMI line tends rise after the election day, indicating an inrushing of big money. While we can’t know for sure until the day has passed, what we can say is this: if you have your eye stocks that may have ran away from you, create a buy list with some price targets in case those sellers do show up again.

With stock signals and volumes drying up, another indicator is reflecting the same…

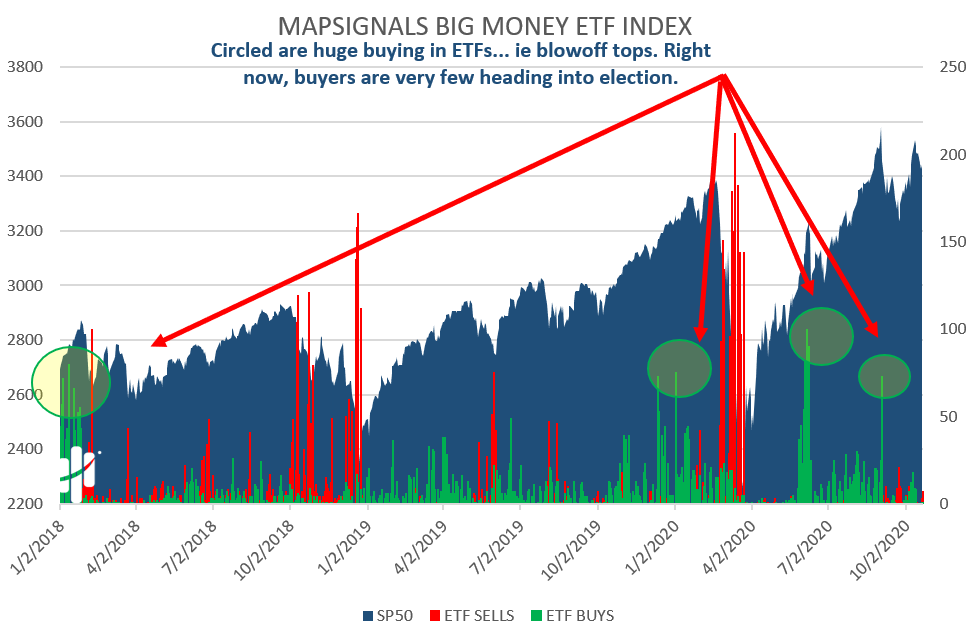

ETF Activity Is Quiet

When stocks are quiet, ETFs usually are too.

Here you can clearly see ETF buyers dried up:

The only real ETF activity we are seeing are ETF bond sellers. Several fixed-income ETFs are breaking down on decent volumes. That is likely just part of the quiet chop as election uncertainty often means a reduction of risk across the board.

Sometimes markets are clearly bulling. Other times they are clearly bearish. But in less convicted times like these we should get our buy lists ready. Should lower prices come, they are good things for long-term investors. Being prepared is key. Opportunity can strike at any moment.

The Bottom line is this – Volatility is here but it’s hiding under the cool exterior of the appearance of muted indexes. We have plenty of reasons to cause reluctance to slap on risk.

Not only are election jitters causing anxiety, but there’s the unknown of a new stimulus package, coronavirus cases are on the rise, and on top of it all- earnings season is here. Earnings is always a tricky time but because we track outlier stocks, most of our companies are doing well.

Big MAP stocks like ALGN might feel like one of the ones that got away as they make new highs. We talked about how to handle frustrating situations like that on our podcast from yesterday. If you missed it check it out.

But the short answer is, new outliers come along all the time. That’s the beauty of the MAPsignals process. With patience, you’ll get the opportunity to own one that won’t get away. It may come in the next few weeks. It may not.

Either way, be prepared because if pre-election uncertainty gives us a chance, we will be shopping for outlier deals.

Above all- remember to vote!