Rare Capitulation Signals Big Gains Ahead

Stocks were sold with abandon.

Be thankful.

Rare capitulation signals big gains ahead.

Volatile markets are never fun. Yesterday’s Fed presser sent shockwaves across equity markets.

Nothing was spared. Correlation approached 1. The S&P Small Cap 600 fell 4%. The S&P Mid Cap 400 fell 3.84%. The mighty large cap S&P 500 collapsed 2.95%.

That’s forced selling for you!

While pundits will argue the merry-go-round path of interest rates in 2025, I believe there’s a stronger signal to heed.

Yesterday’s meltdown has a positive data-driven message. Start picking away at high-quality businesses on sale.

Now let’s review the proof.

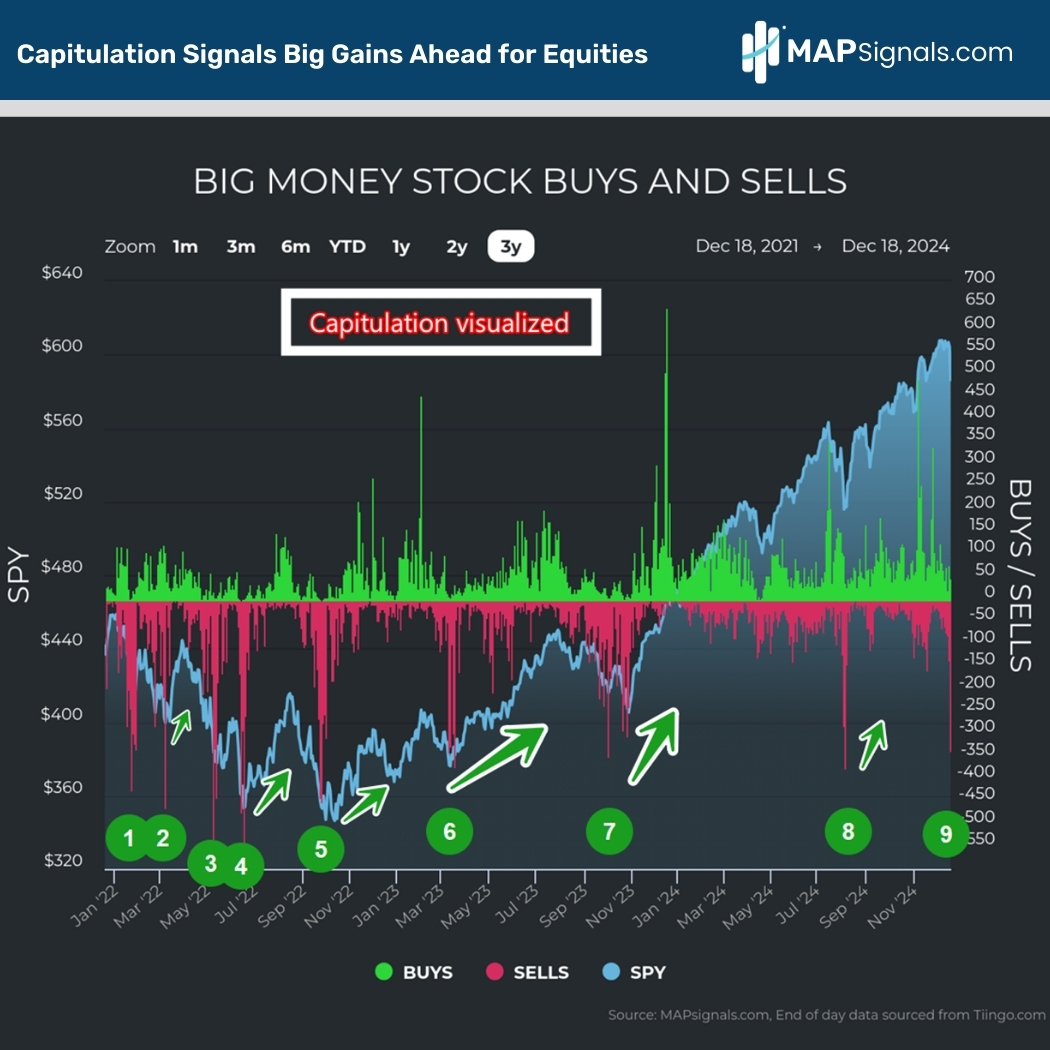

Rare Capitulation Signals Big Gains Ahead for Equities

Forced selling events happen. It’s part of trading.

Knowing how to respond is mission critical.

Let’s rewind the tape to August when we last saw similar forced selling. You can review the message as it echoes today’s setup.

Yesterday’s drawdown amounted to a 3.2% buy day. Or more importantly, 96.8% of our signals were for sale.

11 stocks were accumulated and 334 stocks were liquidated. You can visualize this below and review prior similar capitulation events:

Rarely do we see widespread weakness. And as you can tell from the above chart, rarely does it last forever.

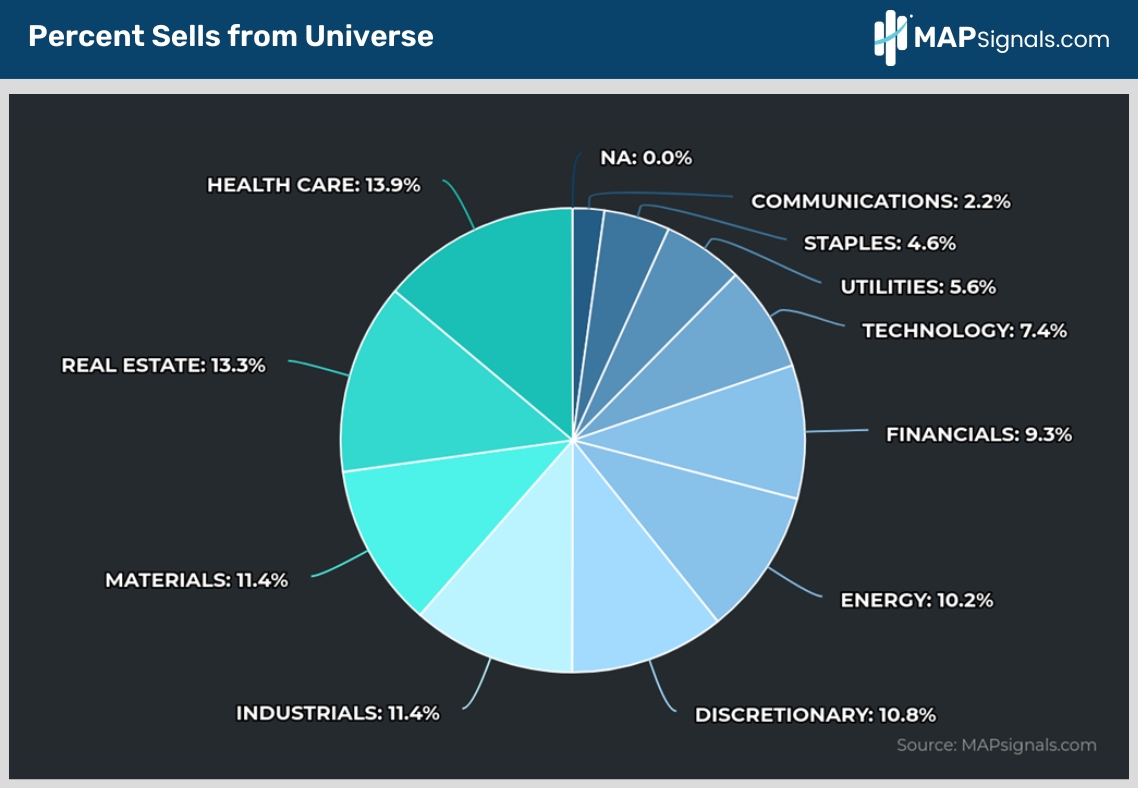

Breaking down the red by sector shows how all groups felt the pain.

Every single sector felt the wave of money exiting portfolios. Below is a pie graph notating all sell signals broken down by sector:

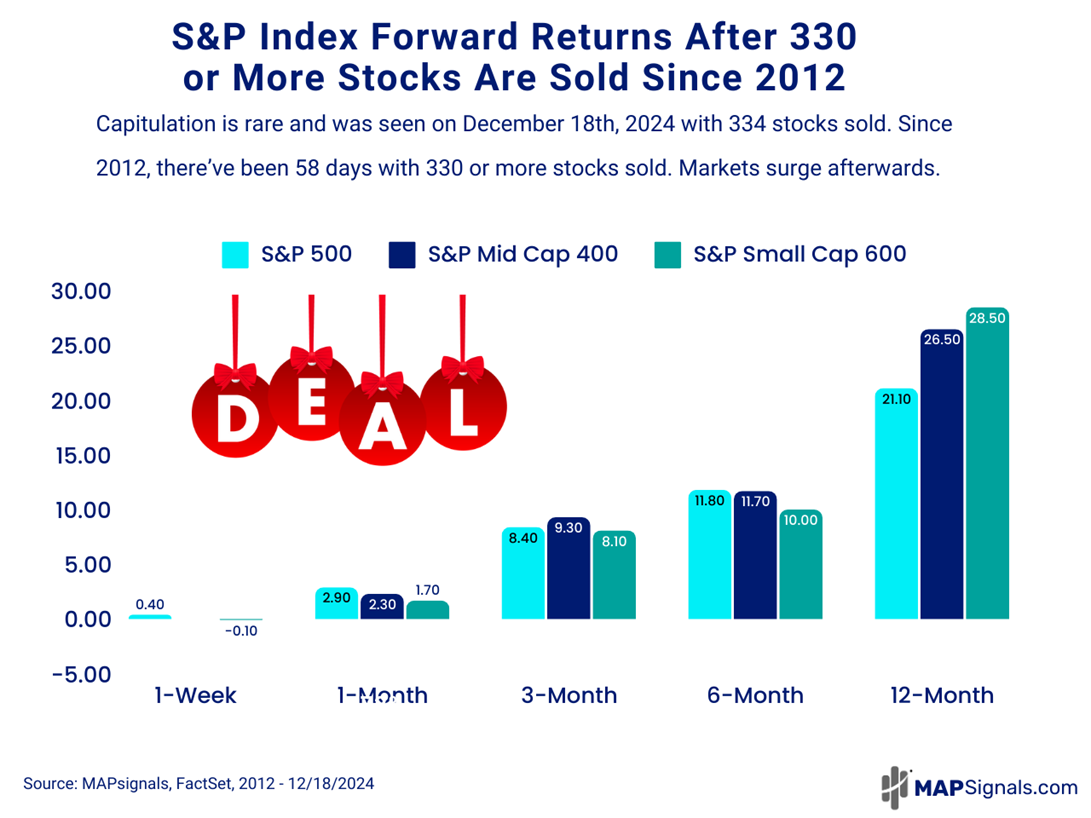

If you’re feeling down and out right now, don’t. Right now, is a wonderful time to be adding to stocks.

Here’s why I can confidently say that.

Back to 2012, we’ve had 58 discrete days when 330 stocks or more were liquidated. What comes next is a powerful market-beating rally in small, mid and large caps.

When 330+ stocks are sold:

- 3- months later sees the S&P 500, 400, and 600 all jump at least 8%

- 12-months later, large caps jump 21%, mid-caps soar 26%, and small-caps zoom 28%

Now’s not the time for holiday fear. Instead, embrace holiday cheer:

And with a backdrop like this you can bet that single stocks will dramatically outperform. This aligns with our 2025 market outlook suggesting investors look outside the S&P 500 to unlock big gains.

All-star companies in the financial, discretionary, industrial, and technology spaces have been massively outperforming.

Rare capitulation signals big gains ahead.

You just need a map to spot them!

Later today, we’ll be releasing a MAP PRO update taking today’s study a step further by sector and isolating outlier stocks.

Once the dust settles, you can bet institutions will plow back into companies with the best forward outlook and tailwinds.

Can you invest without a map? Maybe.

I just can’t recommend it!

If you are an RIA, money manager, or are serious about investing, get started with a MAP PRO subscription as we head into 2025.