Recession Fears Fuel Sector Rotation

Investing is rarely a cakewalk. In times of uncertainty, like now, groups tug and pull.

Our data has been in a downtrend for well over a month, signaling a risk-off tone.

However, new pockets of leadership are emerging. Our data signals a rush to safety as recession fears fuel sector rotation.

If you’ve tuned into any news network lately, I’m sure you’ve seen headlines of economic worries. Sticky inflation and elevated interest rates have consumed the media.

Add to it a recent survey conducted by the National Association of Business Economics reported that nearly 60% of economists expect a recession this year.

Yep, investor fear is elevated.

When worries of recession mount, certain sectors are magnets for capital. We’ll cover those 3 areas today.

Then I’ll zero-in on the bigger message: Selloffs present incredible opportunities to the patient investor. Believe it or not, many of our best performing stocks were found during market turmoil, not when the market was optimistic.

I’ll showcase one example name. Chances are there are a few diamonds in the rough out there today.

Alright let’s hop to the data.

Recession Fears Fuel Sector Rotation

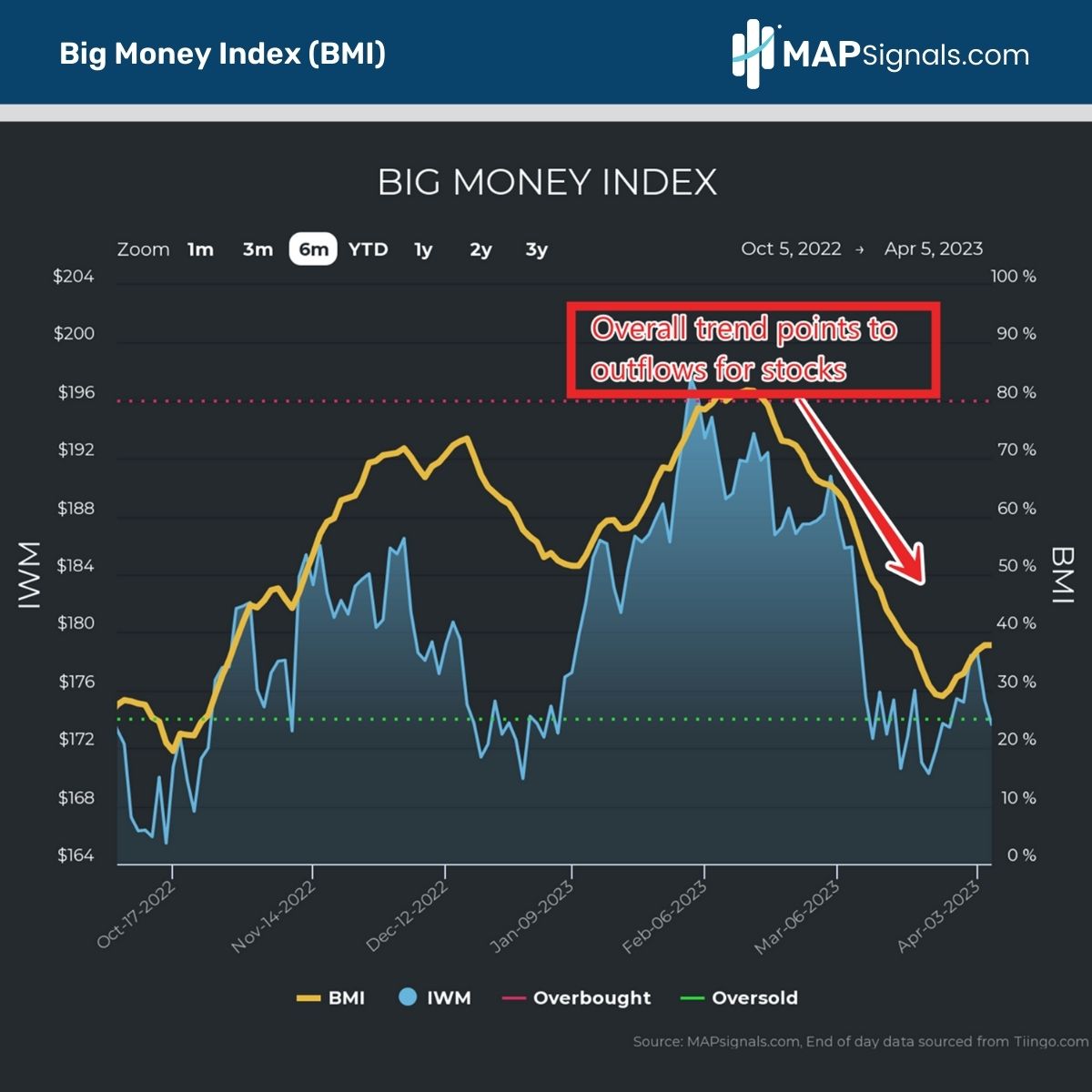

If you’ve followed our flows the past 2 months, you’ll know that breadth has been weak. There’s no better way to view that than the Big Money Index (BMI).

When sellers take control, the index falls hard.

Below I’ve overlaid the BMI with the Russell 2000 (IWM) index as small-caps have been the laggards lately:

The index sits at 37% today, a far plunge from 80+ months ago.

Now notice how the BMI has jumped ever so slightly the past few weeks. That’s simply due to money rushing into a few recession-proof groups.

The first inflow magnet is Utilities. When recession fears flare, investors park money in areas with stable dividend yields and a constant customer base. Afterall, one of the last places consumers will cut back on is the light bill!

Check out the green bar seen yesterday. That’s the most buying noted since January:

Finally, the group is seeing signs of life after a rare capitulation signal (red arrow) seen last month.

Recall in early March, our data made the case that Utilities stocks were a good bet after such a plunge. History painted a bright forward picture. And it was! The Utilities Select Sector SPDR Fund (XLU) is up 7.2% since that call, easily trouncing the S&P 500 (SPY ETF) gains of 2.86%.

Ugly selloffs present opportunity.

Let’s keep going with other areas attracting capital.

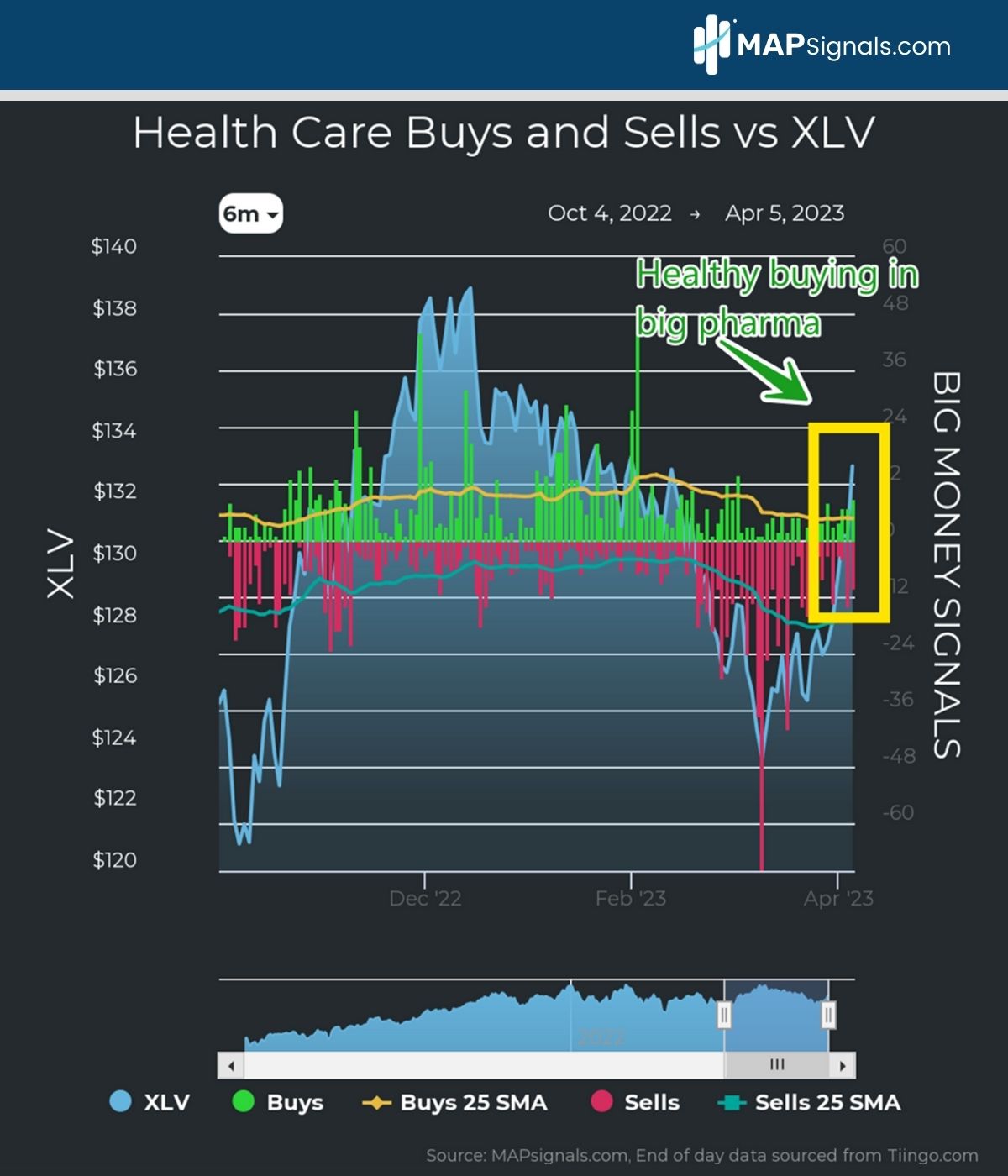

The next group seeing inflows is the Health Care space. Let’s face it, health care needs stay constant no matter the economic situation.

Notice the accumulation signals in the group below:

It may not look like much is going on in the space, but large-cap pharma is seeing a resurgence. Healthy dividend-growth and stable earnings make this group uber attractive when markets get shakey.

Lastly there’s the Staples sector. This group encompasses some of the best well-known businesses over decades. Household products and namebrand goods easily appeal to safety-focused investors.

Not to mention the solid dividends in the group. The Consumer Staples Select Sector SPDR Fund (XLP) currently boasts a meaty yield of 2.45%:

Poor sentiment has traders parked in some of the most steady-eddy areas out there.

Taking it all in, recession fears fuel sector rotation.

But remember, this is only the short-term story for markets. In times of market distress, great companies get dragged down, teeing up attractive buying opportunities.

That’s what we’re all about at MAPsignals. Daily we sift through all the buy and sell noise, and laser focus on superior stocks with top-notch fundamentals.

Believe it or not, tomorrow’s winners are out there! Here’s a great example of finding a diamond in the rough. Back in September of 2014, our data was beginning to soften with the Big Money Index hitting oversold soon after in October.

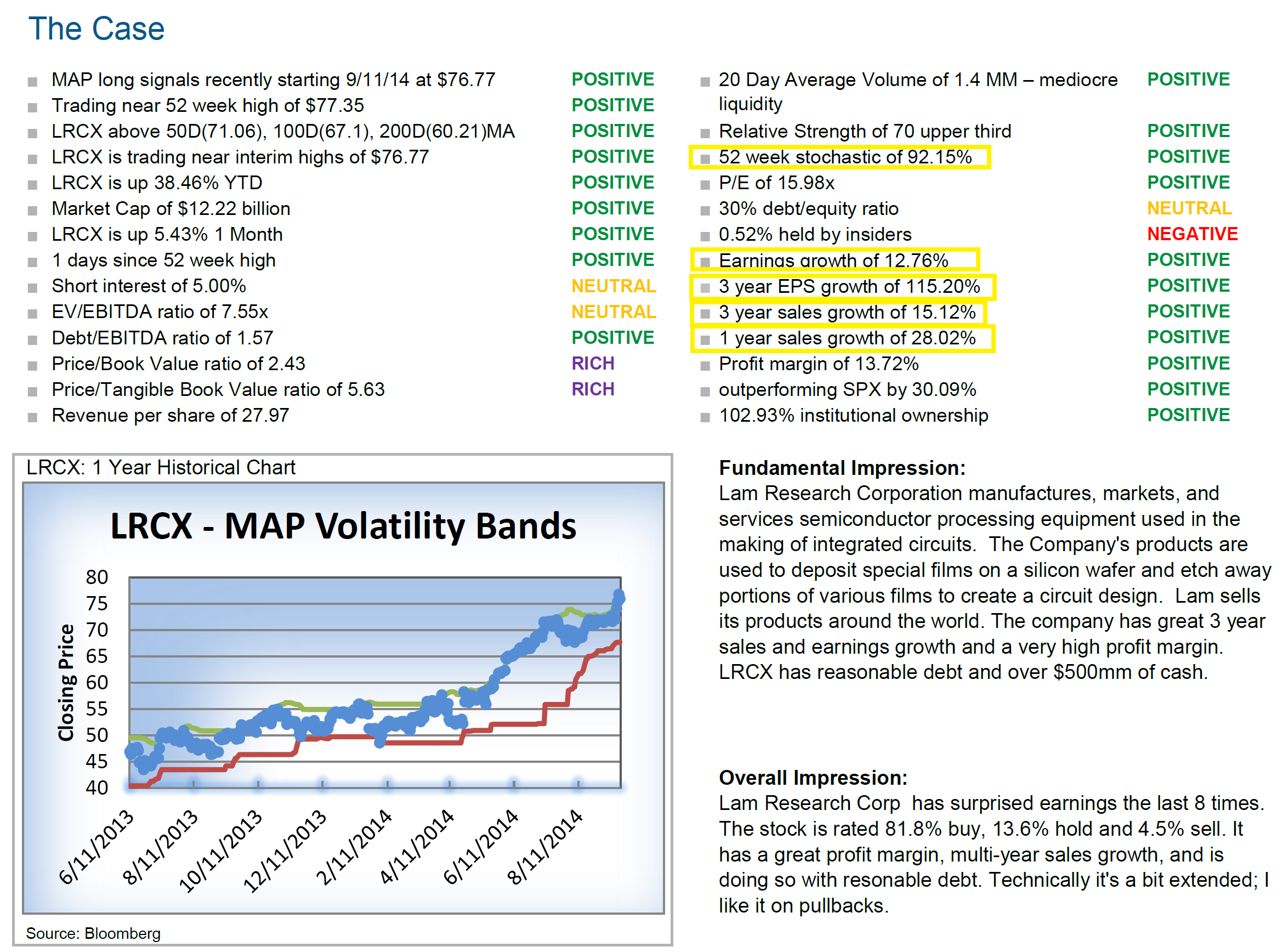

However, there were a few names seeing institutional action and scoring well. One of which was Lam Research (LRCX). The semiconductor firm was under accumulation and sported very strong fundamentals. Here’s a snapshot of the pick from back then.

In yellow is what jumped out at me, strong sales and earnings growth:

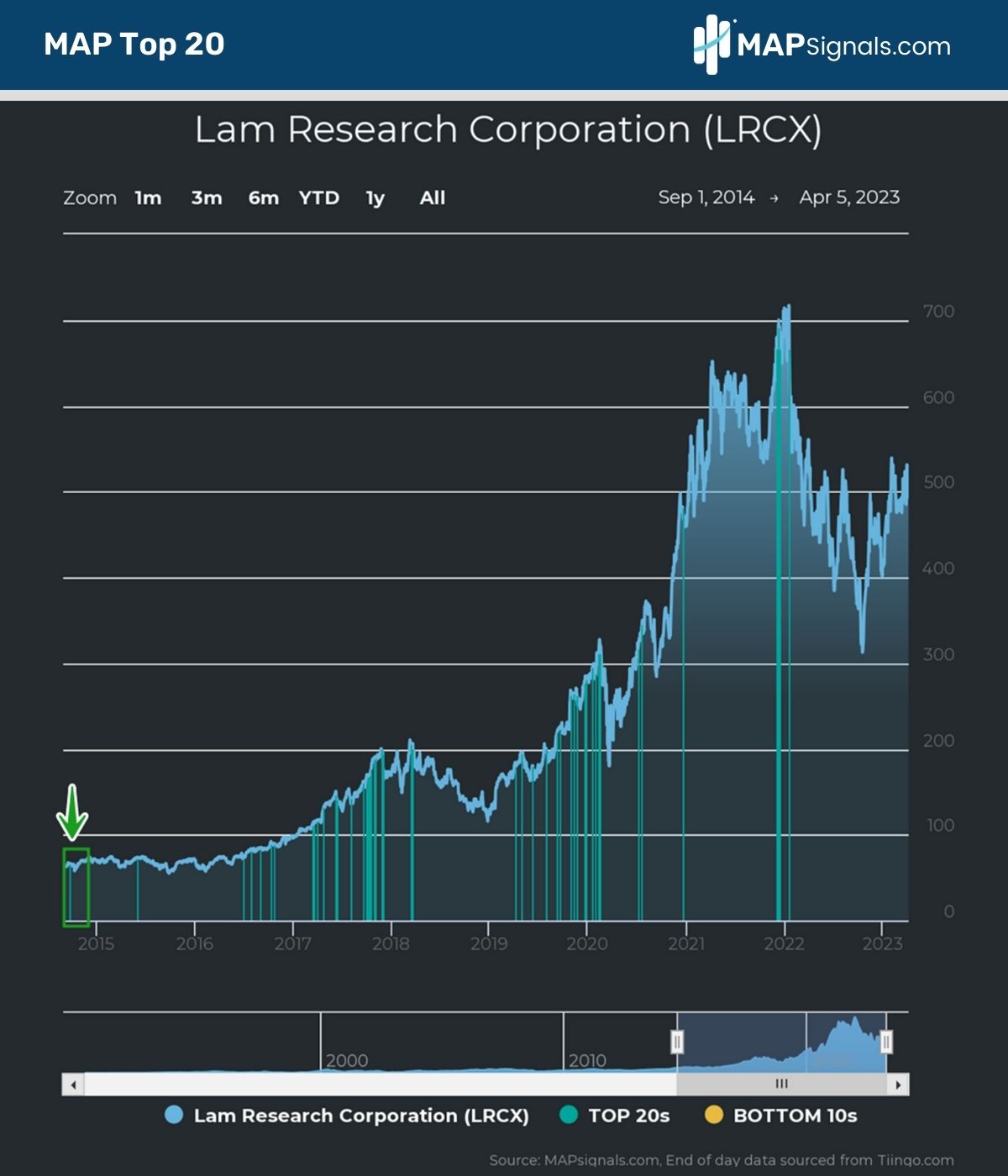

That was the best positioned stock that week. Keep in mind this was a time when sentiment was at its worst. Fast-forward to today, you’ll see where that signal sat on the chart.

Each of those blue signals are days when the stock saw inflows alongside favorable fundamentals. Lam Research kept seeing inflows and growth for years, and as they say – the rest is history.

I bring this up simply because the crowd is fearful right now. But don’t take your eye off the ball. Focus on the opportunity.

There are great companies set to thrive once the backdrop shifts to a bull market. Don’t stop uncovering stones.

Let’s wrap up.

Here’s the bottom line: Recession fears fuel sector rotation. Money is chasing popular defensive groups like Utilities, Healthcare, and Staples. Those areas can offer ballast to a portfolio when times get rocky.

However, that’s only part of the story. Pullbacks offer fantastic entry points to patient investors.

Focus on great businesses with sales and earnings growth. Those will be where the smart investors place their bets.

A map can help you uncover them!

Get started with a MAPsignals subscription today and tune out the noise.

Have a great holiday everyone.

Disclosure: I hold long positions in LRCX in personal and managed accounts.