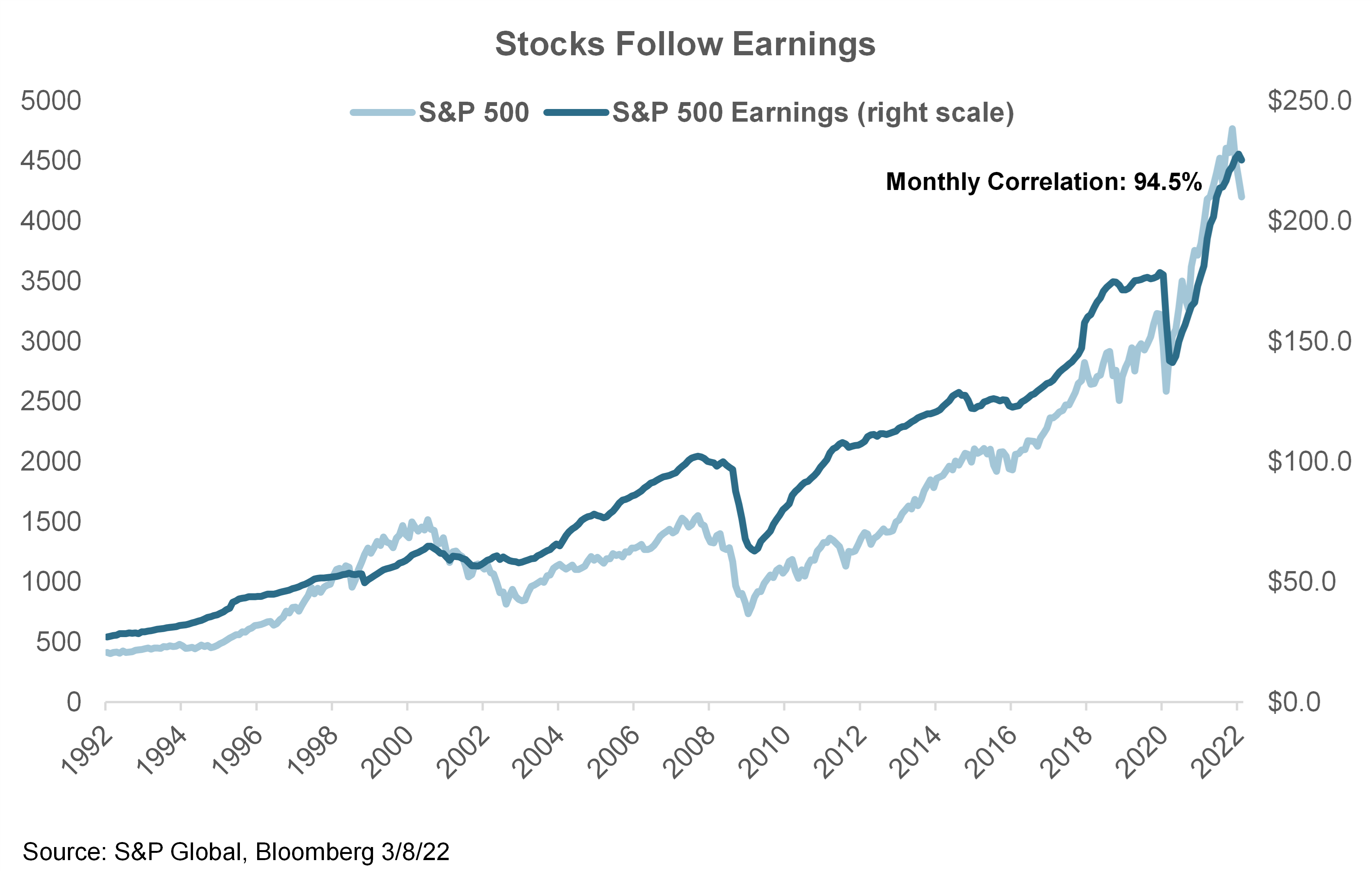

Stocks Follow Earnings

It’s no secret stocks follow earnings and interest rates. We know inflation is pushing interest rates up, making stocks more volatile. That makes having a realistic take on earnings more important than ever.

To kick things off, I’ll show the long-term relationship between stocks and profits. Then I’ll highlight key macro risks to Wall Street’s earnings forecasts and the sectors poised to outperform. Lastly, I’ll use MAPsignals data to show you how to play it with stocks and ETFs.

For starters, when you buy a stock, you’re really buying a share of a company’s profits. So, naturally you’d expect stocks to track earnings. But get this: the relationship is even tighter than you might think.

Since 1992, the S&P 500 Index and S&P 500 earnings have moved virtually in lockstep, posting a 94.5% correlation! It’s clear that stocks follow earnings.

History shows why profits are so important but let’s keep going and look at the macro picture.

Stocks Follow Earnings

Earnings have been on a tear. In fact, S&P 500 profits grew a sizzling 47% in 2021. That’s a hard act to follow. As such, Wall Street only forecasts 6% 2022 S&P 500 EPS growth.

Warren Buffett famously said: “Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future.” Wise words indeed. Consider that: since 1990, on average, actual S&P 500 earnings growth has been 6% weaker than the consensus forecast in January.

Here are my top macro risks to 2022 earnings:

- The war in Ukraine is worsening inflation by pushing up commodity prices. It also raises the risk of a recession in Europe and big slowdowns elsewhere as higher costs slow growth.

- Sticky inflation could cause the Fed to tighten much more than expected, triggering a recession.

- The time-tested, US Treasury yield curve is down to 0.25%, signaling increasing recession risk.

- S&P 500 profits have suffered an average 25% peak to trough decline during recessions. That implies 2022 S&P 500 EPS of only $175 vs. the current $225 Wall Street consensus.

With such a dismal outlook, you may be wondering, “how do I play it?” Today I’ll show you.

It rarely pays to get defensive because most of the time, you’ll just watch the parade go by. Recessions however are the exception. They spark bear markets by hammering earnings. Since 1929, the median S&P 500 bear market drop was 33% and took 25 months to fully recover from.

That means bear markets are worth sidestepping.

A US recession isn’t a slam dunk, but the risk is certainly growing. Commodity sectors like energy and materials should continue to outperform. They’re the only groups where earnings are being revised sharply higher thanks to soaring commodity prices. They also pay big dividends and are under-owned by institutional investors.

If the economy does downshift, utilities should also keep doing well. Utilities have consistently beaten the S&P 500 during recessions and bear markets because their profits are less sensitive to economic weakness.

Plus, US utilities don’t have any foreign exposure, insulating them if the Ukraine war triggers a European recession. Meanwhile, other defensive sectors like staples and health care both have significant European sales.

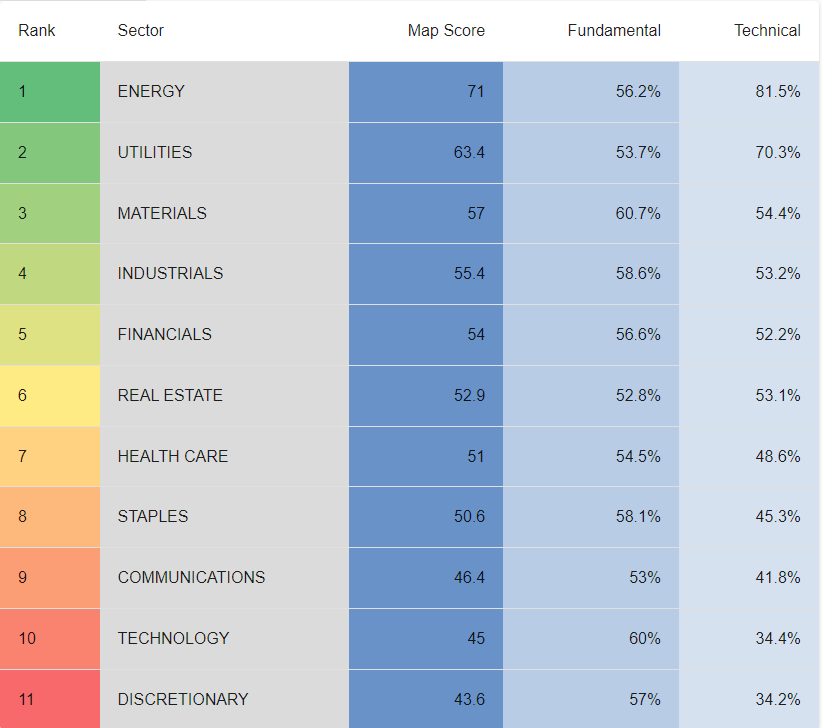

Interestingly enough, big money investors agree. We can actually see that in MAPsignals’ sector raking process! The energy, utilities and materials sectors currently have the highest map-scores at 73, 63 and 56, respectively.

The sector’s weaker fundamentals are due to trailing fundamentals. Therefore, the strength of their scores comes from technical strength. In other words: big buying!

Now let’s look at the Spider Sector ETF for each sector along with a top MAPsignals pick that’s seeing strong buying from the big boys.

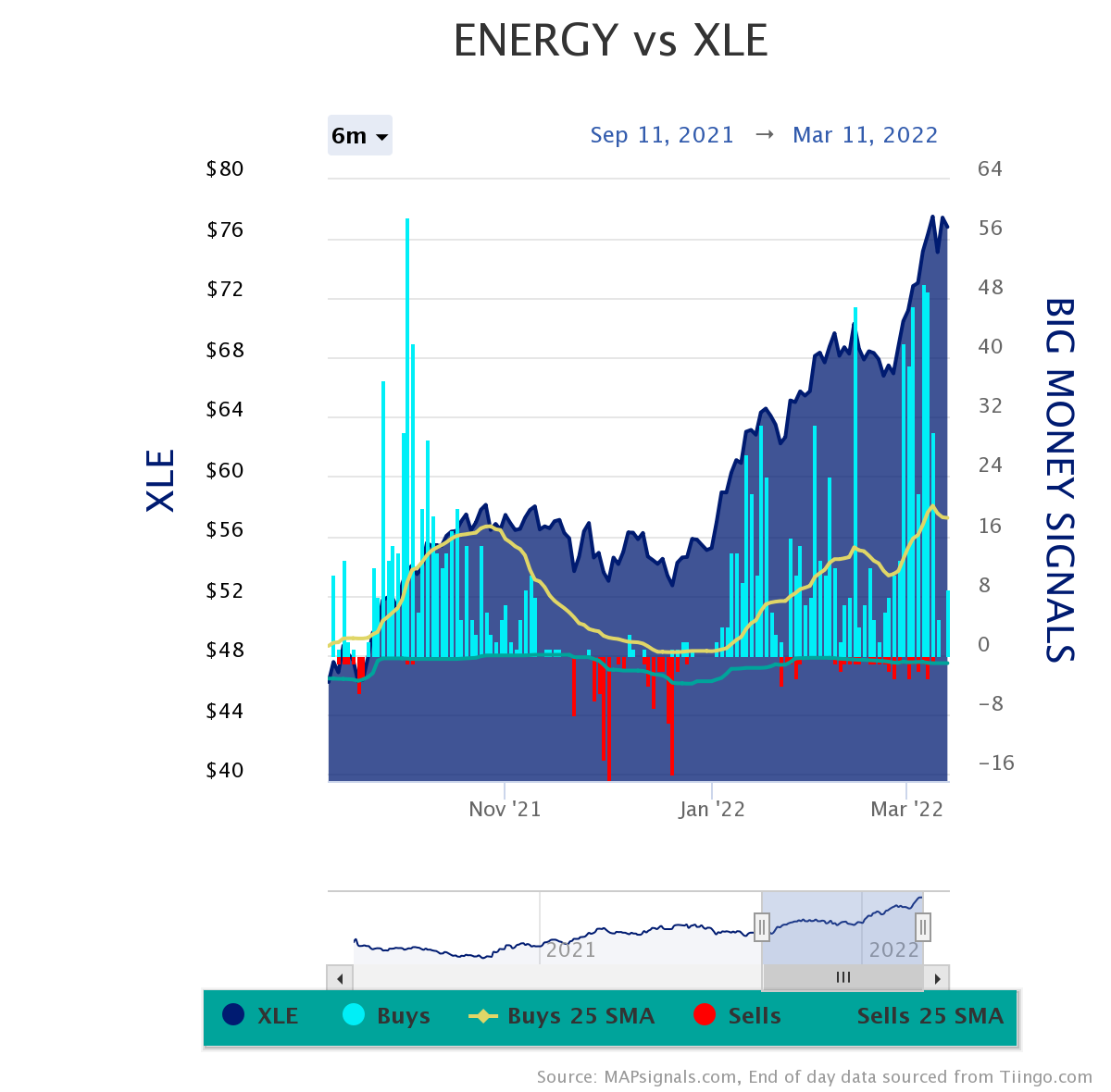

Energy is going from strength to more strength. It has the strongest momentum in the market by far. The big blue bars denote accumulation with unusual volume:

When a sector’s been leading for a while, sometimes it pays to beat the bushes for under the radar opportunities. Coterra Energy (CTRA) fits the bill and it’s seeing heavy buying lately.

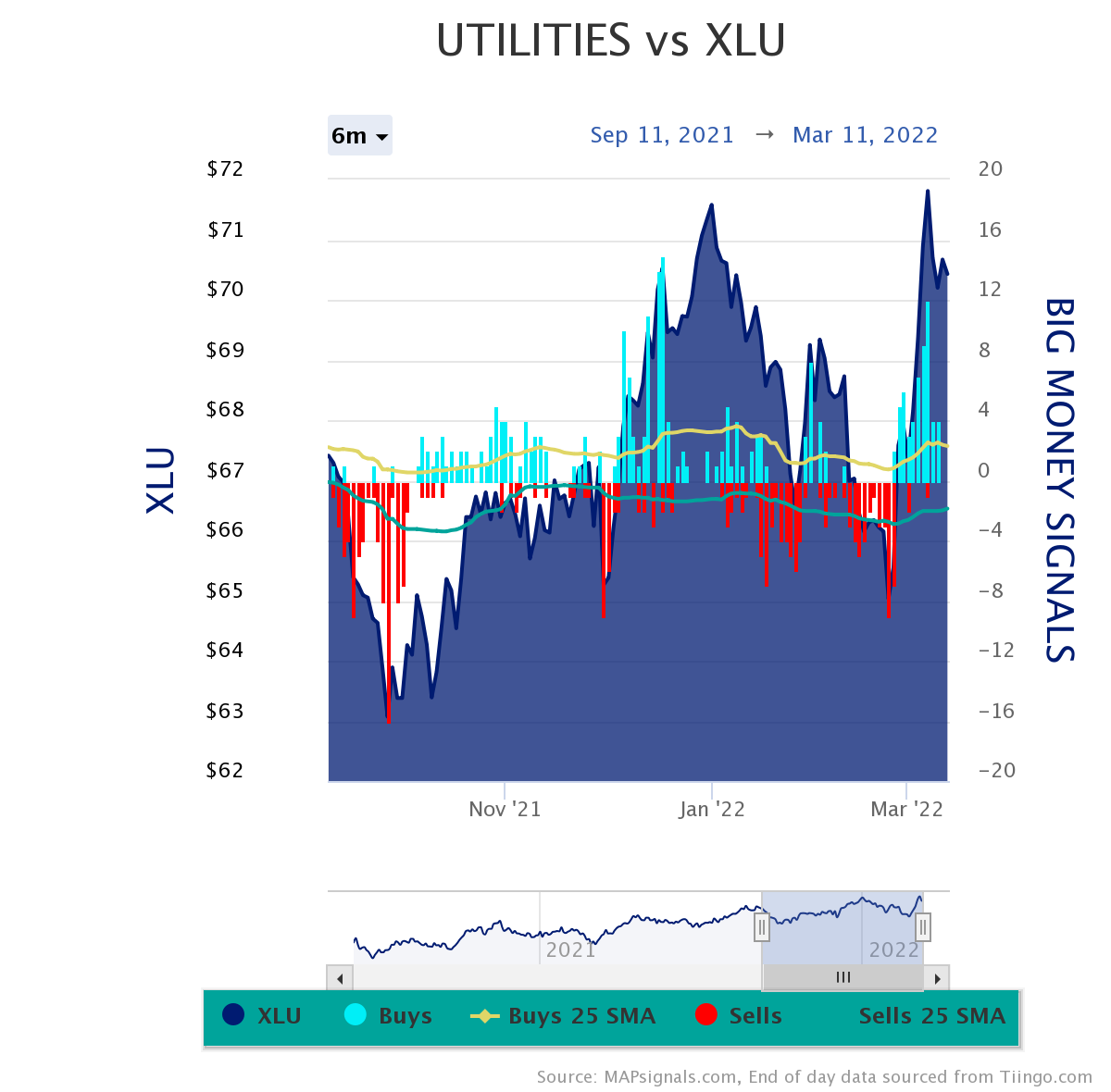

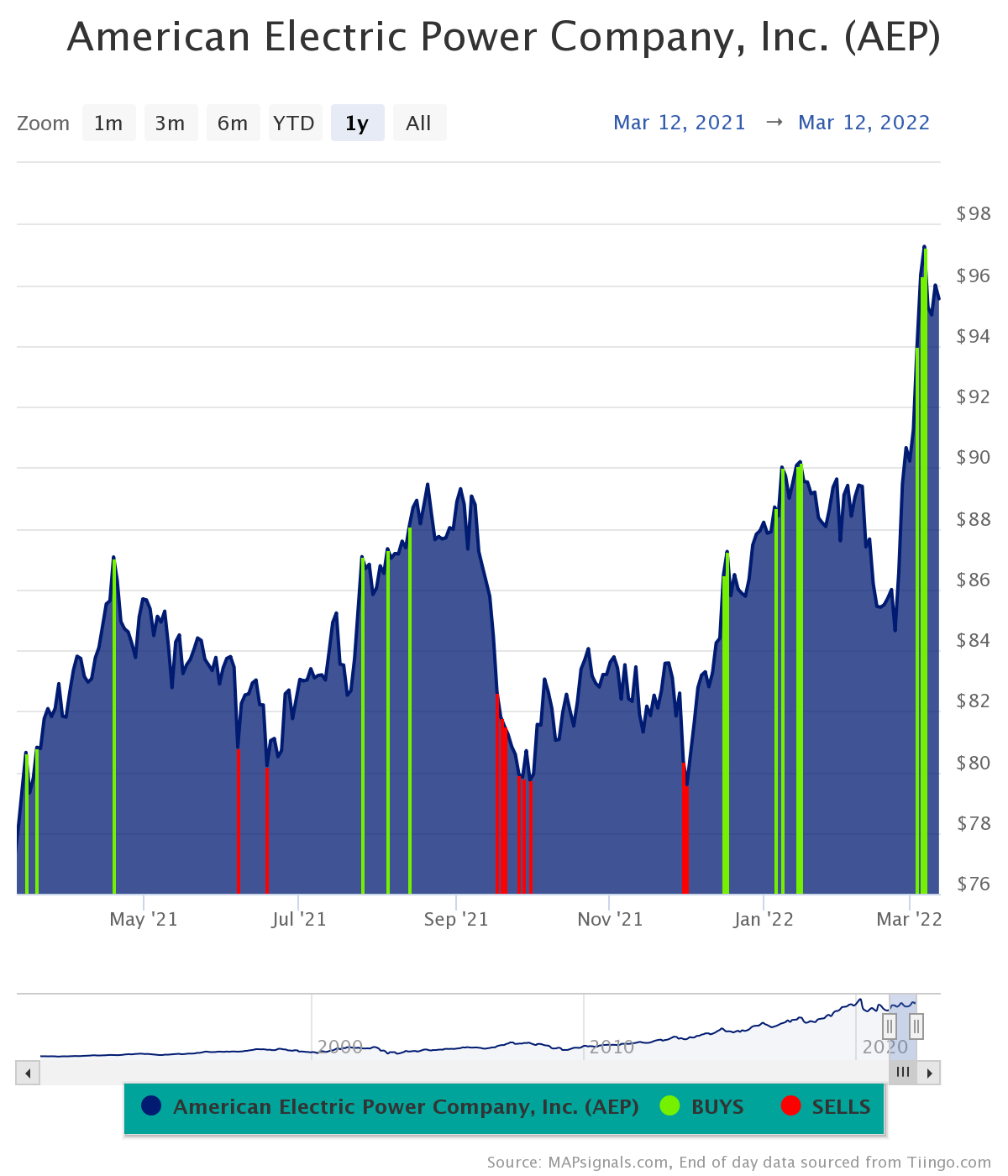

Now check out how utilities have recently come on strongly. Again: the bonus here is that this sector is made in the USA. That means, no European exposure. Look at the big blue buying lifting it higher!

So, let’s look at a top name in those bullish signals. American Electric Power Co. (AEP) is a top utility pick seeing accelerating buying. And it sports a juicy 3.2% dividend yield.

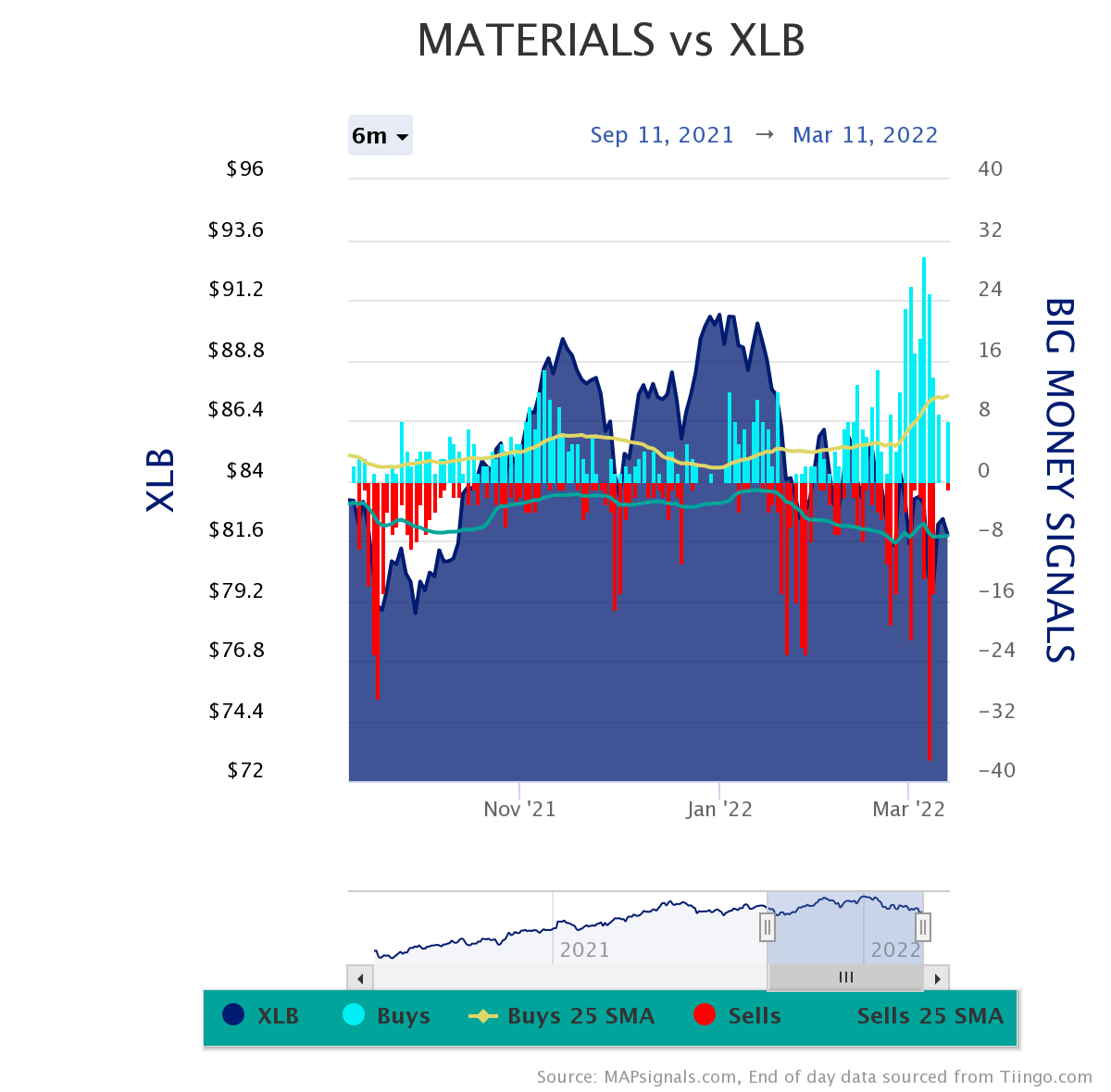

Finally, the materials sector is seeing increasingly big buying as commodity prices ramp up. Russia doesn’t just export oil and gas, it’s also a huge seller of wheat, gold, nickel, and palladium, among others.

Prices are surging as the war in Ukraine threatens to keep Russian supplies off the world market indefinitely.

Have a look at the leading materials sector ETF, XLB, it’s also seeing increasing buying.

Inside of those blue bars are stocks. Check out this leading stock, Archer-Daniels-Midland (ADM):

ADM is a blue-chip agricultural play that is benefiting in this macro landscape.

Bringing It All Together

Wall Street’s 2022 profit forecasts look too rosy. My view is they likely won’t meet estimates. Wall Street still forecasts 6% EPS growth this year. I doubt it.

The war in Ukraine will potentially make it harder for the Fed to cool inflation amid record commodity prices. More Fed rate hikes would risk pushing the economy into recession. Meanwhile, the war will dent European demand for American goods and services.

The flattening Treasury yield curve signals recession risks are growing. Corporate earnings have fallen an average of 25% during recessions.

No one has a crystal ball. But the risks of a recession and a bear market are rising fast. Focus on stocks whose profits are most insulated from the macro minefield. The big money is showing us the way through energy, utilities, and materials.

And with earnings likely rising in these sectors, it pays to remember: Stocks follow earnings.

If you’re looking for data to help you navigate these uncertain times, consider a MAPsignals subscription.

Trade well,

-Alec

***Finally, check out Luke’s latest market insights in our latest Weekly Stock Market Update.

Make sure to follow our YouTube channel here so you never miss any of our videos.

Also, you can find our other videos here.