MACRO: Top Sectors to Own this Election Season

Election season is finally here.

The mudslinging and policy curve balls are already ramping up!

With all the noise (and ammo) swirling around, let’s run through our top 2 sectors to own this election season.

On July 8, we published our initial election piece.

We showed you why it’s a mistake to sell stocks ahead of elections. You should aggressively buy into the typical pre-election drawdown we normally see in September and October of election years.

Today we’re digging deeper. We’ll show you history’s two best election cycle sector winners. Not only that, both areas have great fundamentals and are big money favorites right now.

In typical fashion, we’ll offer 3 evidence-rich reasons to overweight our 2 top sector picks heading into November.

Top 2 Sectors to Own this Election Season

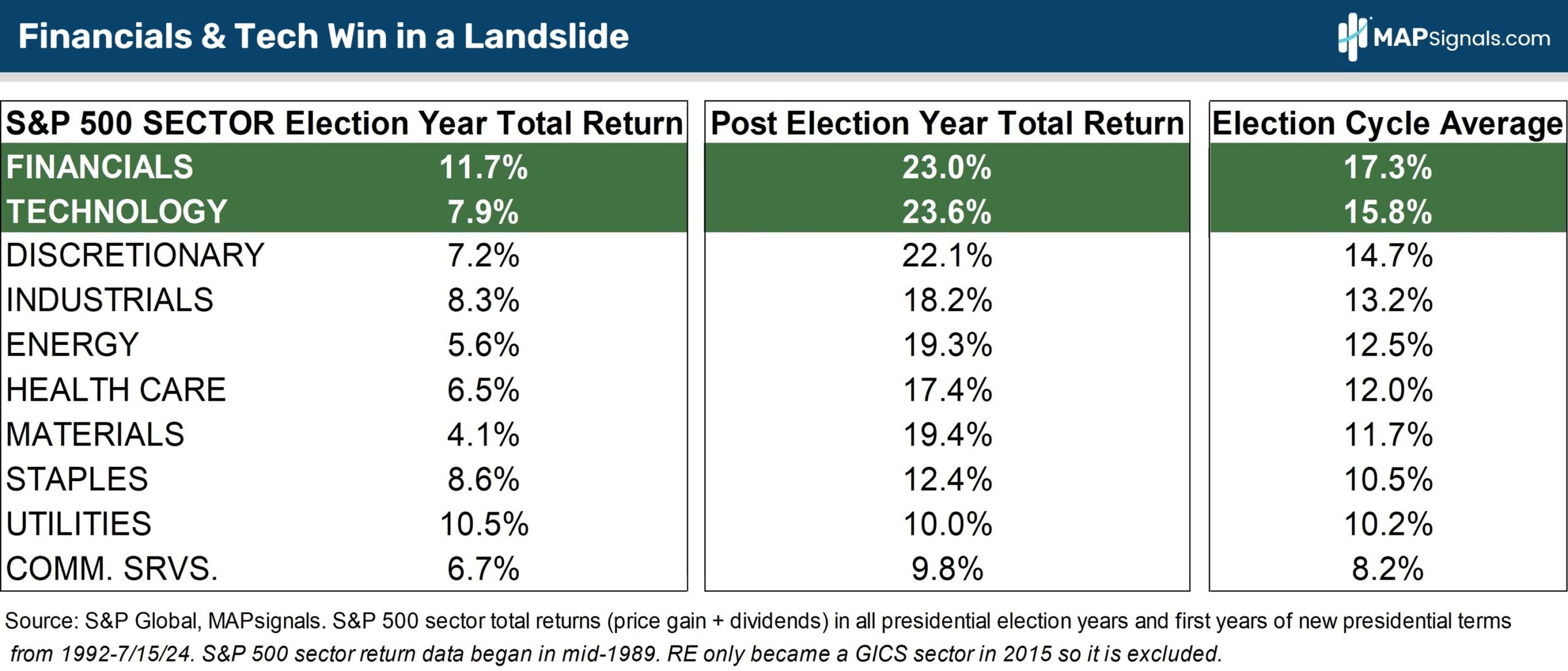

Let’s start by analyzing election cycle sector performance.

With 2024 more than half over, focusing solely on election year performance has limited value.

Instead, we should focus on a two-year span – the presidential election year and the first year of the new presidential term.

When you slice up average historical returns by sector, 2 areas jump out.

Financials lead the pack, averaging 11.7% and 23% total returns in election years and the first year of new presidential terms, respectively. That works out to an election cycle average of 17.3%!

Tech also does great, averaging 7.9% and 23.6% total returns in election years and the first year of the presidential cycle, respectively. That works out to an impressive election cycle average of 15.8%.

That’s upside worth catching. Remember, the S&P 500’s average annual total return since 1926 is only 12.2%.

And in the first year of the presidential cycle, the S&P only averages 10% returns including dividends, making financials’ and tech’s 23% post-election year average returns even more compelling:

Strong election cycle performance isn’t the only reason to like financials and big tech right now.

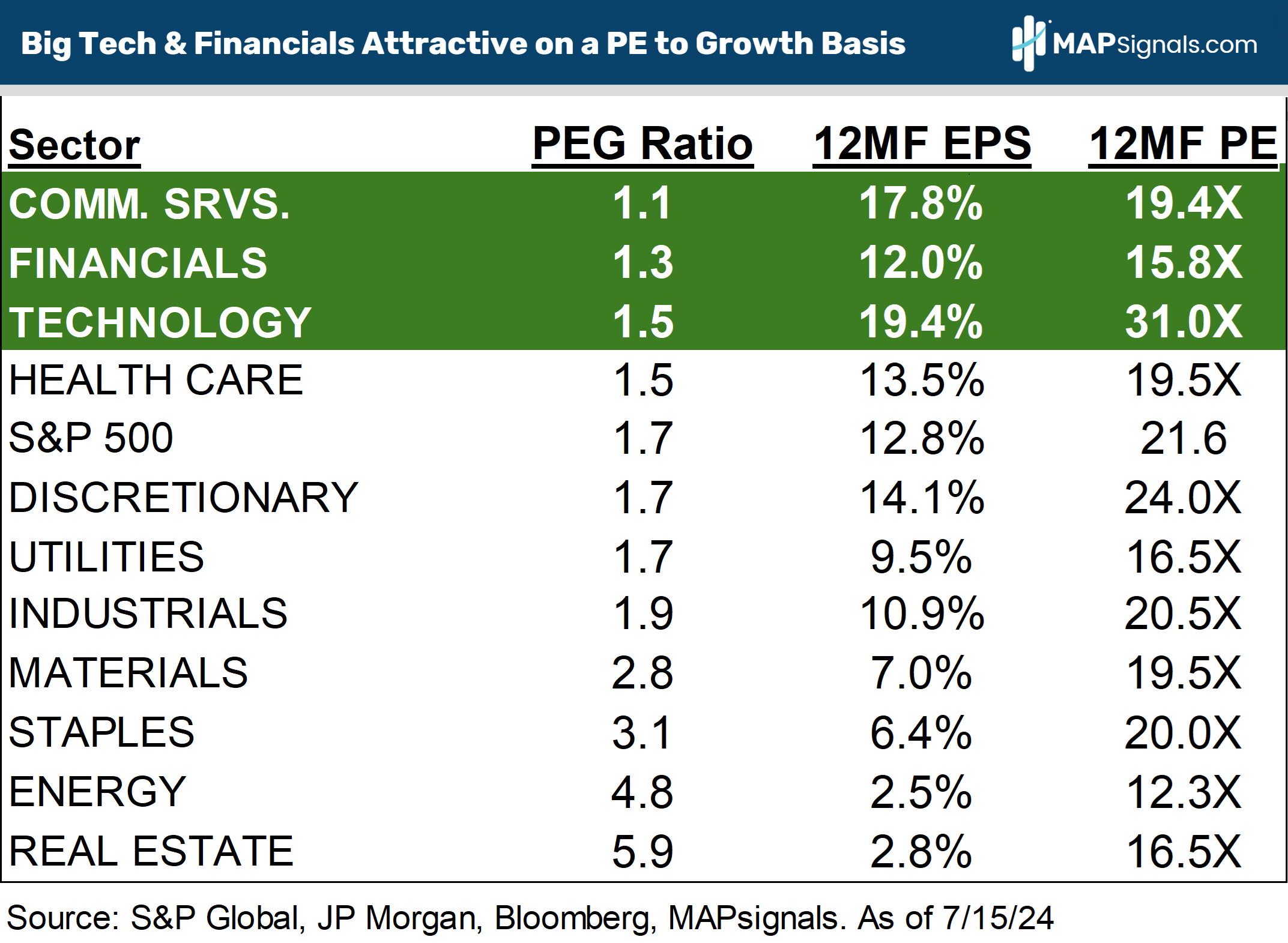

Both boast strong fundamentals with double-digit consensus earnings growth forecast over the coming 12 months (table).

The PE to growth ratio divides a sector’s consensus EPS growth rate into its 12-month forward price/earnings (PE) ratio.

PEG ratios are more useful than PE ratios alone because they adjust a sector’s valuation for its profit growth.

The PEG ratio allows sharp investors to tease out signal from noise when analyzing sector data.

For example, a high PE ratio may be fine if there’s strong earnings growth to support it. The Mag 7 are great examples of this. Their PE ratios are high, but their PEG ratios aren’t because they adjust for tech’s monster EPS growth.

The S&P 500’s PE to growth (PEG) ratio is 1.7 (table). Ratios under 1.5 are very compelling while readings over 2.5 suggest a sector is richly valued relative to its growth, offering limited tactical upside.

The PEG ratios of the financials, technology and communications services (home to Meta, Google & Netflix) sectors are only 1.3, 1.5 and 1.1, respectively (table).

They’re the lowest in the S&P because all 3 sectors’ PEG ratios are depressed by strong profit growth.

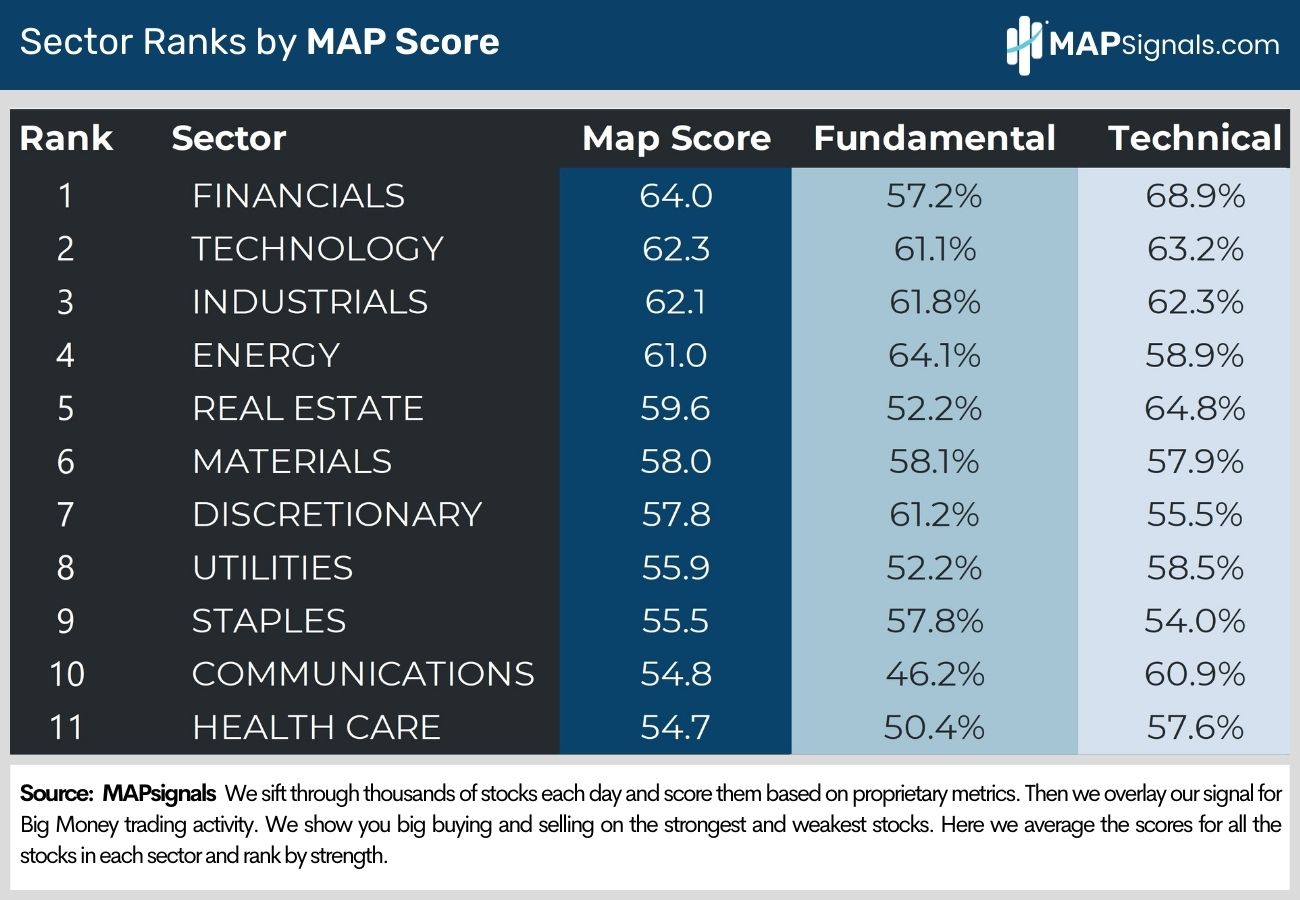

Now that we’ve covered the seasonal and valuation metrics, making Financials and Technology our top picks, let’s make sure these jive with recent action.

Money Flows Signal Healthy Appetite for Financial and Technology Stocks

Earnings, valuations and historical tendencies are important to understand. Couple those with recent institutional sponsorship and you’ve got a powerful recipe for upside.

Financials and big tech are in pole position YTD partly due to healthy inflows. Note how Technology, Communications Services, and Financials are the top performing sectors in the S&P 500 YTD (chart) with 33.4%, 25.9%, & 15.5% gains respectively:

When you compare those to MAPsignals’ sector rankings, you see a similar flavor with Financials and Tech on top:

Let’s dig a little deeper into the latest action in both sectors.

Geopolitical worries have sparked heavy profit taking in big tech recently. Chip stocks have been hit hardest.

Semiconductors are the new oil. Chips power AI. The global chip supply chain runs through the Taiwan Semiconductor Manufacturing Company (TSM).

TSM makes all the leading edge 3 nanometer chips for Nvidia, Apple, AMD, Qualcomm and many others.

Both parties’ election rhetoric potentially threatens access to Taiwan’s chips, albeit in different ways.

Neither Biden’s newly proposed chip export controls nor Trump’s bluster about making Taiwan pay for US protection is likely to be as bad as feared.

This is your chance to buy the world’s best companies on sale. The big money sure will!

Turning to financials, it’s the best performing sector YTD outside of tech. The short-term rotation out of tech is only adding fuel to the fire. Stay overweight.

Let’s wrap up.

Here’s the Bottom Line: The market rally is finally broadening out as disinflation pushes interest rates ever lower in anticipation of a September Fed rate cut.

Meanwhile, the economy continues to hold up well, defying the many skeptics.

This goldilocks scenario is driving a rotation into cyclicals. Financials are leading the charge as tech sees overdue profit taking after its monster run.

Stay overweight financials and look to buy the dip in big tech.

Neither Biden’s new chip export restrictions nor Trump’s Taiwan bluster is likely to be as bad as feared.

Election cycle seasonality, superior fundamentals and big money buying mean this barbell sector strategy should continue to work over the next 12 months.

So, tune out the election noise and buy into the pre-vote volatility, you’ll be glad you did!

There are plenty of new leaders popping up in our data the past week.

If you want to find specific large-, mid-, and small-cap financials and tech names ramping with continual institutional support, get started with a MAPsignals PRO subscription.

It’ll get you access to our portal that updates every morning, showcasing the exact tickers being bought and their scores.

Our prized Top 20 list is full of cyclical market beaters. This is the report that found every outlier stock in our research.

There are plenty of quality tech and financial names to get long as election volatility ramps up.

Use a MAP to find them!

Invest well,

Alec