When the Tide Goes Out of Stocks

It’s amazing how timely seasonality strikes.

Just when the crowd felt the coast was clear, a pullback ensued.

When the tide goes out of stocks, they fall.

They should just shut the markets down in August and September and reopen in October. Those powerful words were uttered by a portfolio manager friend of mine years ago. He’s right.

Equities run the gauntlet in August – September. Low liquidity environments breed heightened volatility. That’s why I said to prepare for a Summertime pullback late last month. A red-hot overbought market married with seasonal headwinds was the perfect setup for a healthy dip.

The tide of buying is receding quickly. Our data signals more downside ahead. Being prepared is paramount.

Today we’ll dive into the Big Money waters. We’ll cover the single reason stocks are falling hard. Then we’ll explore a game plan for jumping back into equities.

They say a rising tide lifts all boats.

As an investor, you don’t want to get stranded when the tide goes out.

When the Tide Goes Out of Stocks

Data has a way of explaining the stock market in simple terms. While media pundits chatter about rising rates, weak China data, and more as the reason for market weakness, the truth of the matter is simpler. It all boils down to money flows.

Below reveals a real-time view of institutional participation. The Big Money Index (BMI) reached the warning zone of 80% on Friday July 28th. I’ve circled why that’s a critical level to pay attention to.

Over the past year, that crescendo of buying is extreme and rarely lasts. Stocks fall shortly after:

The BMI is under immense pressure. It’s set to fall further in the coming days and weeks.

Folks, don’t be alarmed. August is kicking off as it usually does, lower. Month-to-date the S&P 500 has fallen 4%. Since 1990, the index falls an average of .6%.

Summertime is the perfect moment for institutions to let off the gas and book some profits. Looking at the daily flows, that’s exactly what’s taking place.

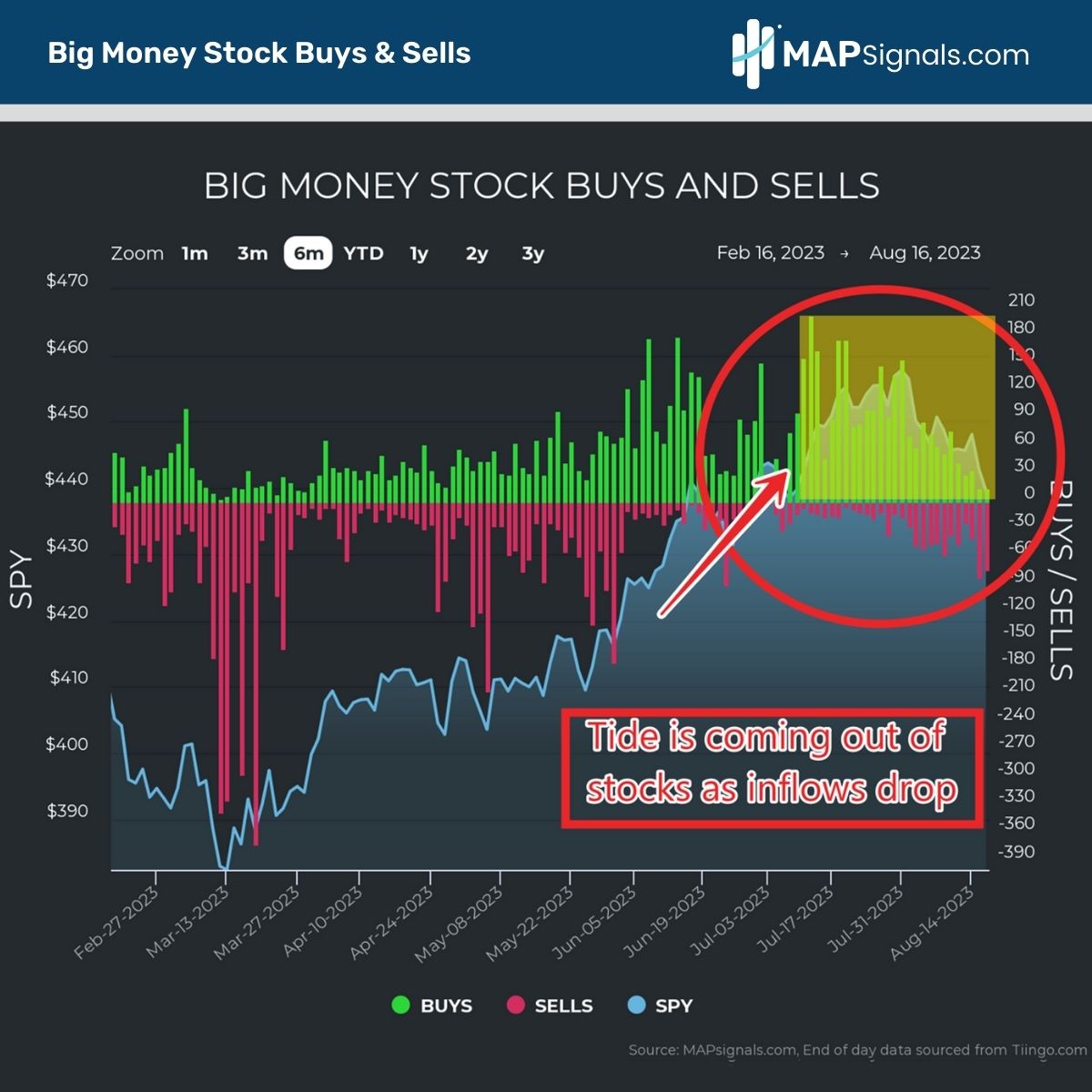

When the tide goes out of stocks, markets fall:

Circled above notice 2 things: First, buying has slowed dramatically. Second, selling is increasing. This relationship is in constant motion.

This is why it’s important to understand market mechanics. When you’ve sat at an institutional trading desk for years, you learn to respect Big Money positioning.

What I’ve witnessed is simple. Big institutions shift well in advance of market-moving headlines. The outflows spotted above came just days ahead of the spike in yields that’s being touted as the latest reason stocks are plunging.

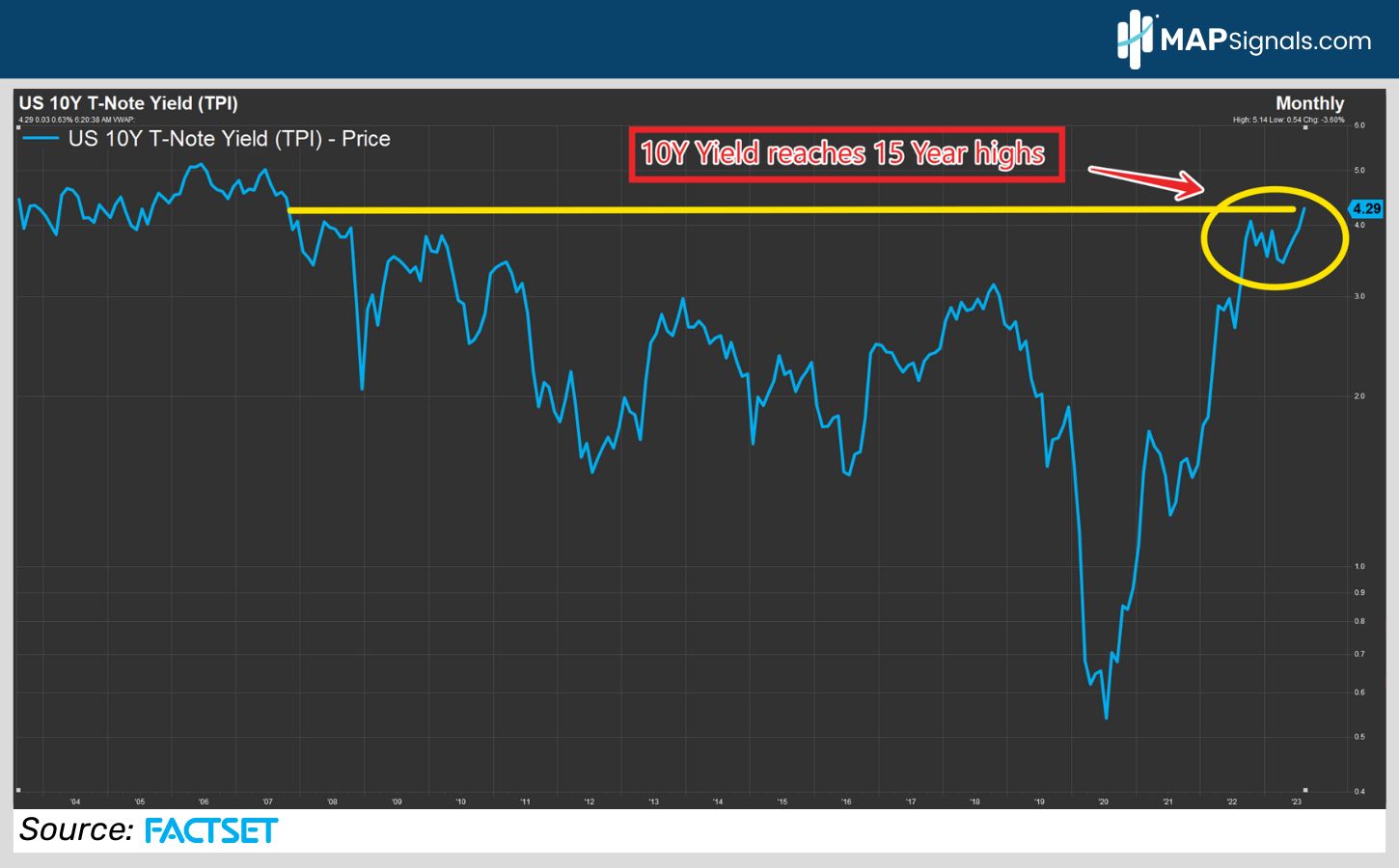

The 10Y yield broke out to 15-year highs this morning, sitting near 4.30%:

Without question, rising rates can act like gravity on stocks. Investors know this after sitting through 2022’s downdraft.

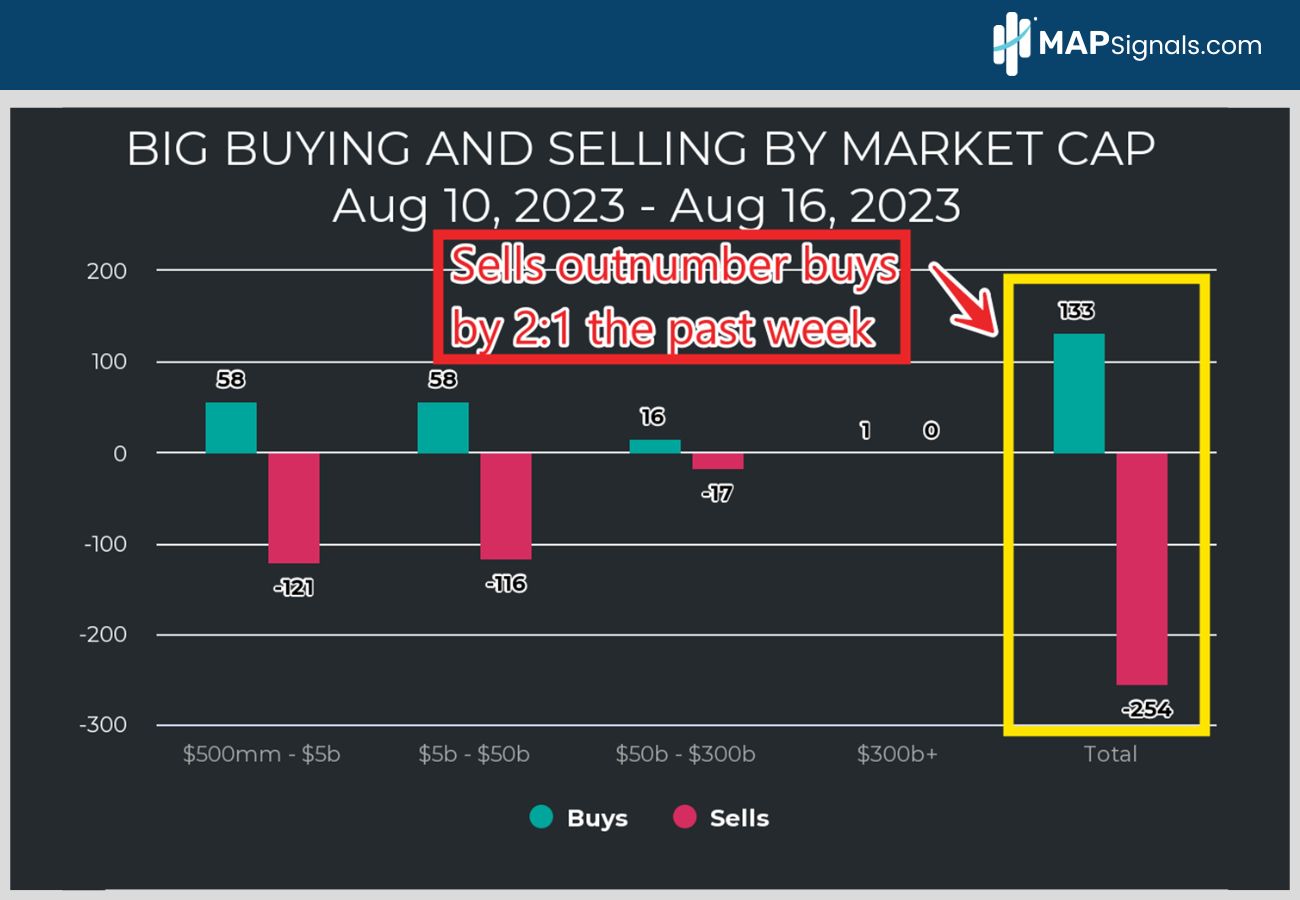

Many see this as the primary reason the market tide is shifting. However, reviewing buy and sell activity the past week tells you all you need to know. Sellers outnumber buyers by a ratio of 2:1, check it out:

This is why the BMI is nose-diving. So, what’s an investor to do? Run and hide? NO!

Keep it simple. Just follow the Big Money Index. Right now, it’s under pressure indicating a much-needed pullback is underway. Eventually the waves will shift back in favor of the bulls, turning the BMI tide…that’s when it’ll be go time for stocks.

Members of MAPsignals know that we’ve been very vocal about summertime pullbacks for many weeks. We’ve surfed these waters before.

Let’s wrap up.

Here’s the bottom line: Stocks are under pressure. Low-liquidity summers are perfect environments for summer shenanigans. When the tide goes out of stocks, they fall hard and fast.

A few short weeks ago we prepared you for the coming pullback. It’s here. Our Big Money Index is heading south, indicating institutions are racing to higher ground.

Now isn’t the time to panic. Instead, take a deep breath and start building your buy list. Top-ranking companies under pressure will be the first ones to bounce hard and fast once markets stabilize. That’ll come when the crowd least expects it.

Warren Buffett said it best, “Only when the tide goes out do you discover who’s been swimming naked.”

Don’t get beached.

Get a MAP!

If you manage money or are serious about investing, let MAPsignals data-based approach help your portfolio ride these uncertain waves. Get started with a PRO subscription today!