Why Technology Stocks Are Falling

Bring on the New Year! 2021 is officially in the books. That means a new slate begins. It’s time to look forward.

But in 2022, markets are spooking investors. Many are wondering why technology stocks are falling.

Today I’ll answer that question, but more importantly I’ll tell you how to benefit and where my focus will be going forward. But let me start by rolling back the tape for moment. As an investor it’s important to understand why the market does what it does.

Stocks move like waves in the ocean, pushed around by buyers and sellers. If you can get a handle on that, making sense of the market is a lot easier.

If you recall, literally one year ago, the stock market picture was very different from now. All stocks were rallying. Demand was epically high. Good stocks, bad stocks, SPACs…you name it, they all rallied hard. The good times kept rolling. The fun seemed to never end. Many felt that investing was easy!

Back then our data was extremely overbought. So extreme that we issued an early warning system. Weeks later markets fell and we haven’t been overbought since.

Today though, we are far from overbought conditions. Fear is high as investors are faced with rising inflation and the high likelihood of interest rate hikes. Growth stocks have been obliterated. That’s why technology stocks are falling.

But that’s the bear case. Today I bring good news! Believe it or not, pullbacks in great stocks are incredible long-term opportunities. When everyone is rushing for the exits, the wise thing to do is look for diamonds in the rough. Believe me, there are plenty right now!

Today we’ll do 2 things. First, we’ll cover some awesome data. We are going to get a handle on what’s going on with Technology stocks.

Then I’ll show you where to hunt for the best opportunities.

Let’s do this.

Big Money Index Shows More Rotations Under the Surface

Waves in the ocean can make you seasick. Waves of money in the stock market can too.

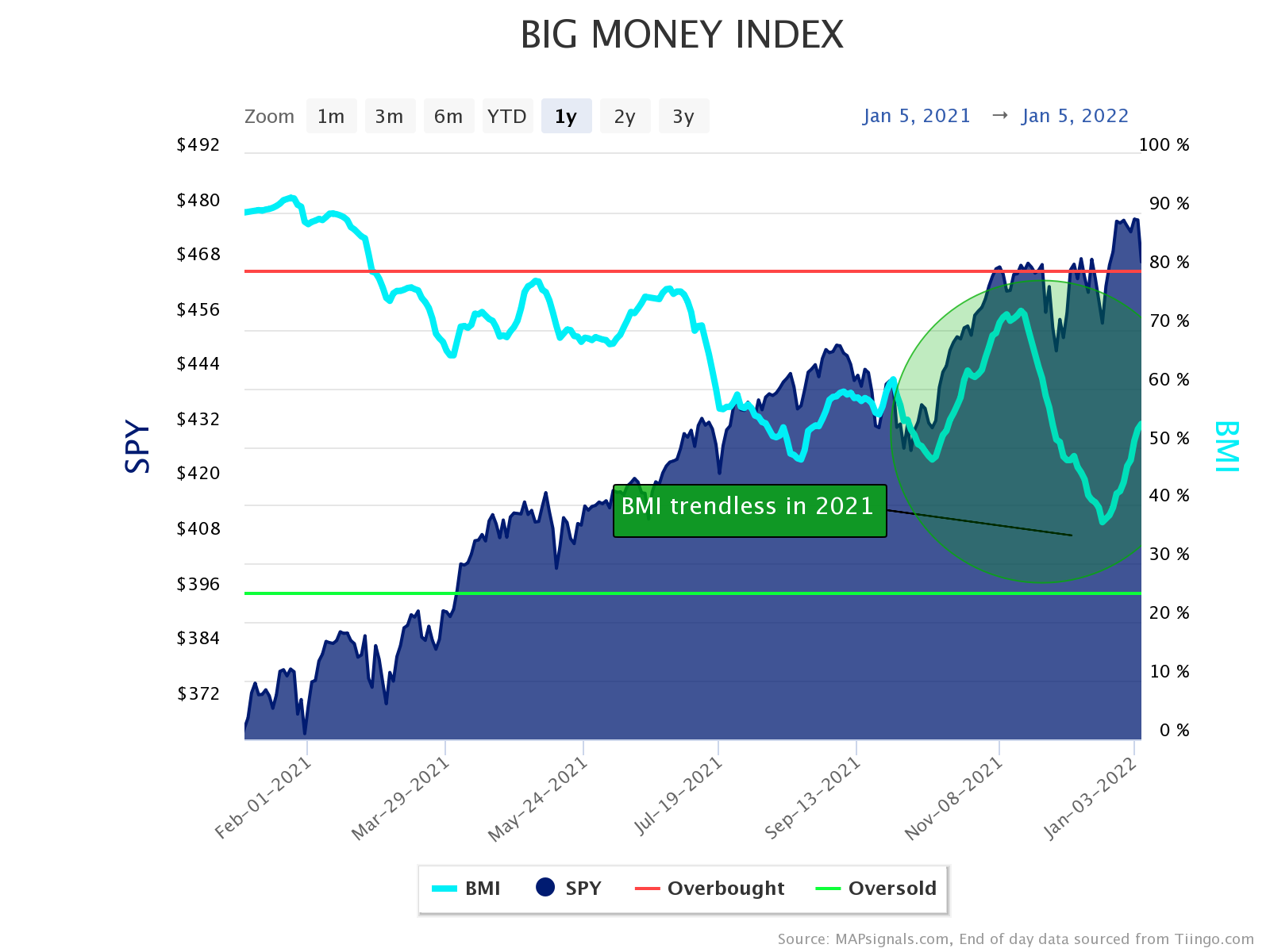

The Big Money Index has been trendless for the better part of a year. This indicator is our 30,000 foot view of the market. When it ramps, stocks rip. When it dips, stocks drop.

It’s been all over the place for nearly a year as the market faces non-stop rotations:

But notice how the BMI’s latest move is higher. You may ask, how is that possible with Tech stocks getting hit? It’s because the growth/value rotation is in play.

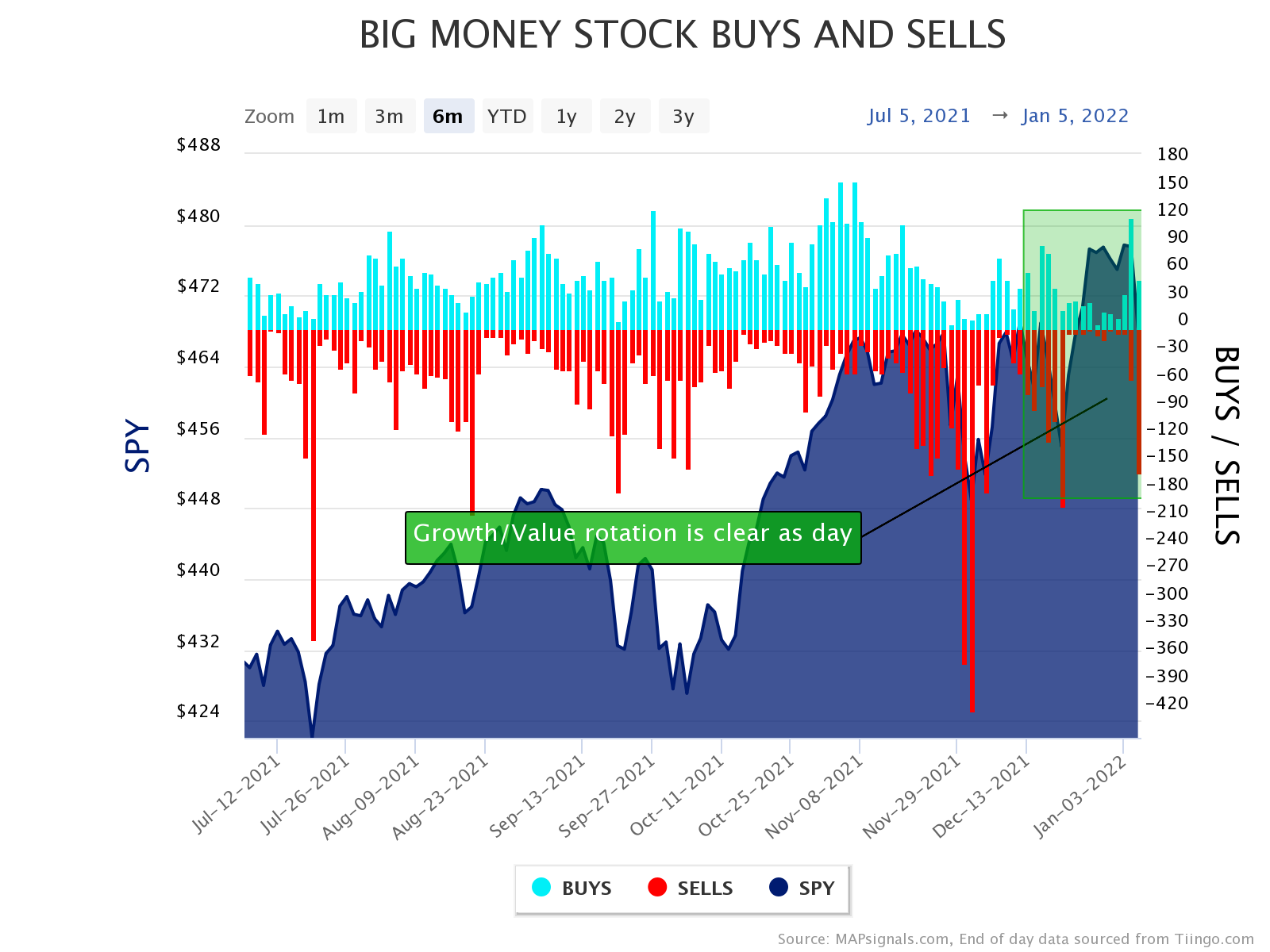

The past few days saw buyers in value groups like Financials & Industrials, but sellers in Technology and growth stocks. If we peel back the BMI and look at the daily activity, you can see the buying and selling going on. Look at yesterday especially:

You should notice a chunky red bar. That’s the selling that growth stocks saw yesterday. That’s why technology stocks are falling.

I love this chart because it alerts me to sell days that are important. We’re working on making this chart the Oversold Stock Indicator (OSI). Because when selling is big enough, it signals a relief rally is near.

The chart isn’t polished yet for production, but you can see roughly how useful it can be.

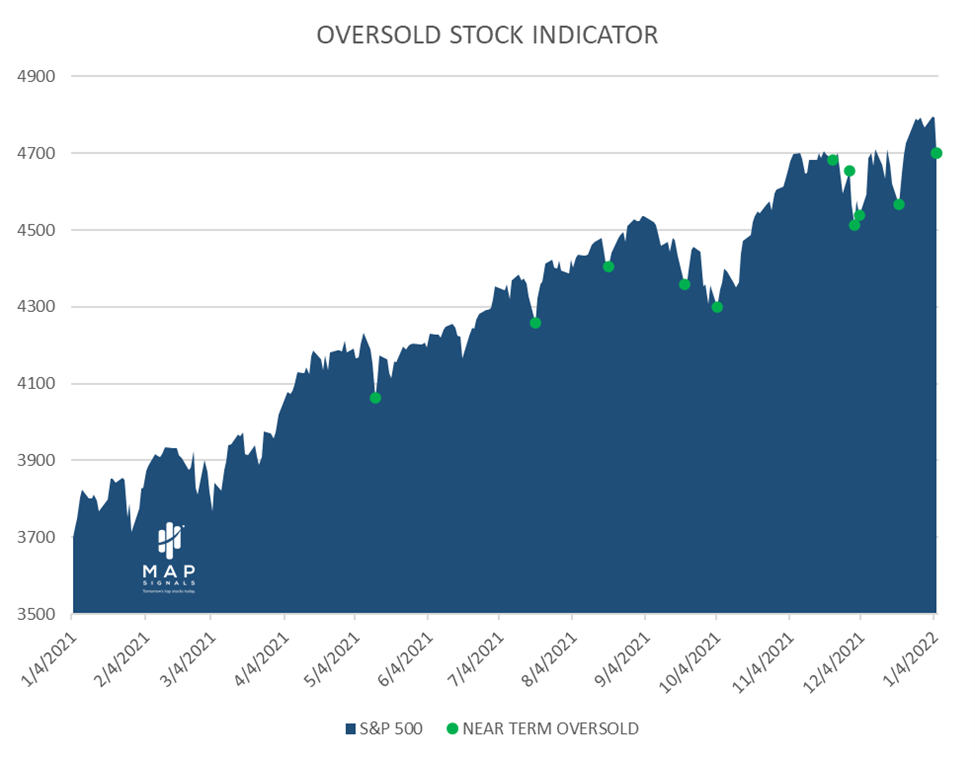

Below triggered an oversold signal…and you can see prior instances in green:

Usually, we see JUICE after big sell days. Wow, stock market data is beautiful! Stay tuned, this chart will be released to members in our portal soon.

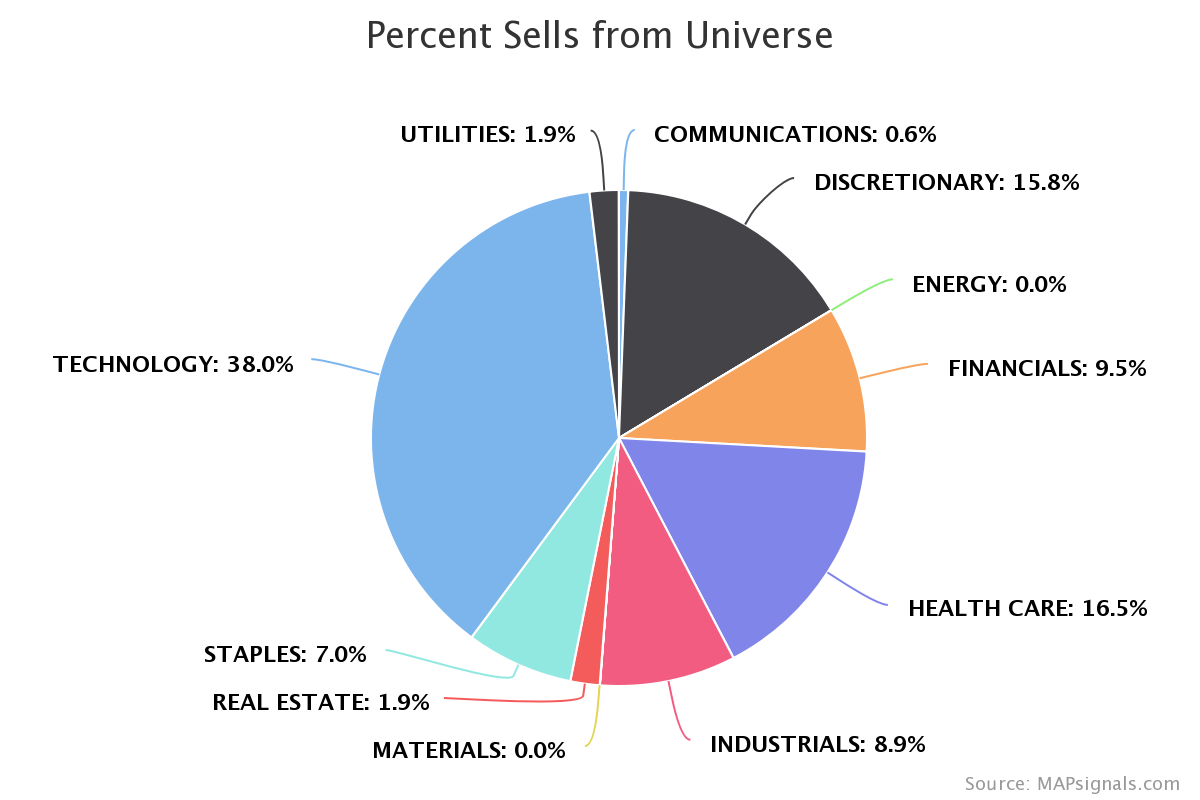

Let’s dig deeper and get a handle on why technology stocks are falling. Here’s a sector breakdown of yesterday’s selloff. Your eyes should see where the pain is:

Yep – 38% of sell signals were concentrated in Technology. That’s heavy duty selling.

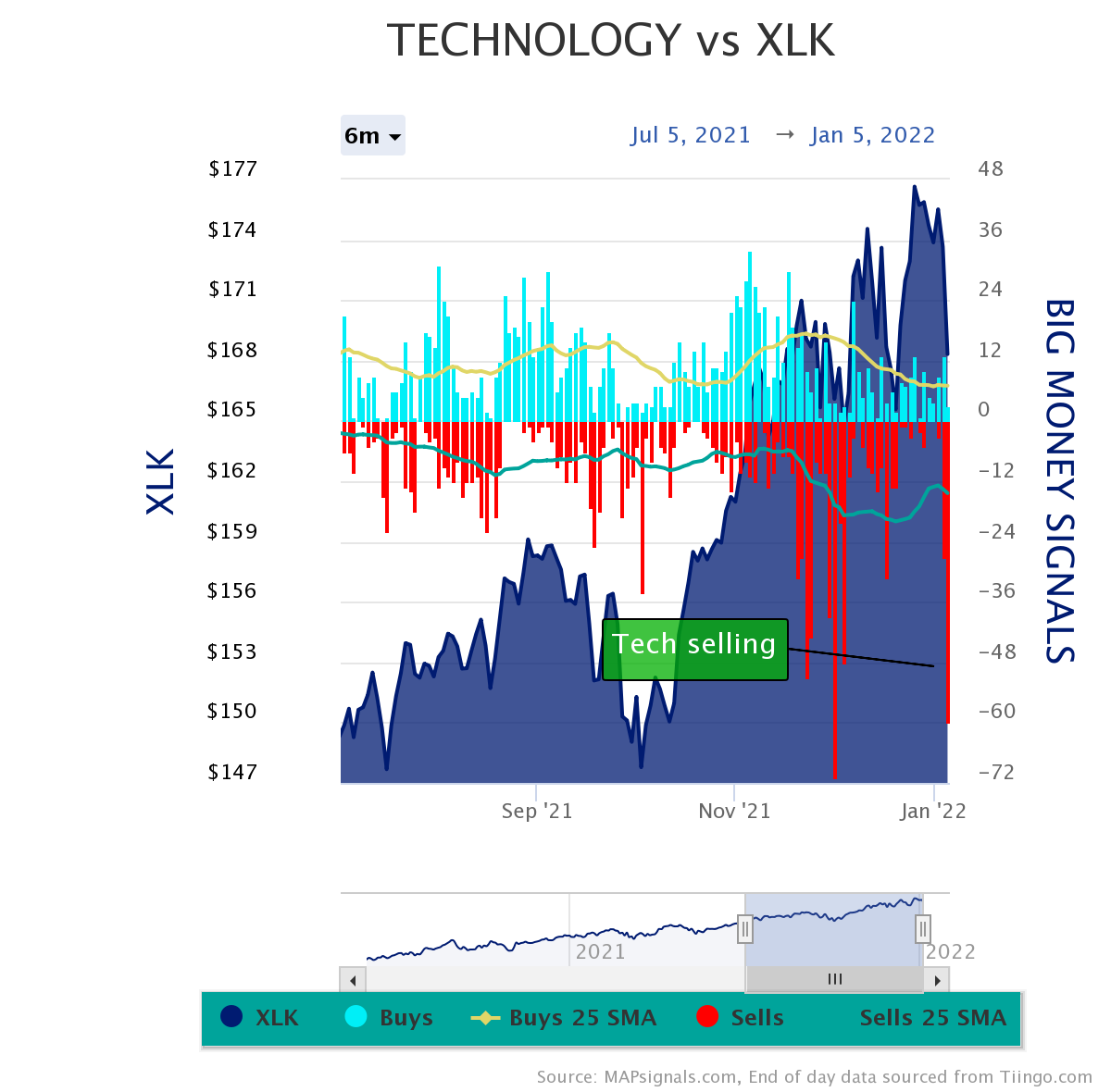

Let’s look at one more chart to hammer this home. Below are the daily buys and sells in the Technology sector. Yesterday’s action was clearly an outsized sell day compared to recent weeks:

In fact, yesterday was the biggest single day of selling in Technology stocks going back to December 1st(the largest red bar in the chart). Because this chart is overlaid against the XLK (Technology Select Sector SPDR Fund), it’s important to note how these big red days tend to line up with sector troughs.

OK…Here’s where my tone changes…

In the coming days and weeks, I expect selling to slow and eventually waves of Big Money will be buying high quality names again. I’ve said to embrace stock market rotations before, and today I’m saying it again.

Now let’s pivot to where the opportunity is found.

Why Technology Stocks Are Falling

I’ve covered why there’s so much pain in the Technology sector. Now, it’s time to understand why this is a big opportunity.

Selling of this magnitude rarely lasts long. We’ve seen countless rotations over the past year and I expect this recent bout of pressure to eventually lift. And when it does, amazing companies will rise like a phoenix from the ashes.

High quality stocks are where I’ll be putting my focus.

Speaking of which, we just released our latest Big Money 20 report for January. These are the top stocks getting the Big Money love in the 2nd half of 2021.

The last basket crushed the market, gaining +16.8% vs the S&P 500’s (SPY) gain of +11.1%:

And the latest basket is full of Technology stocks. If you’re wanting to up your investing game in 2022, give MAPsignals a try.

Let’s wrap this up.

Here’s the bottom line: Investors are asking why technology stocks are falling. Now you know why. It’s because the Big Money is having another growth/value rotation.

I believe the better question to ask is, where’s the opportunity?

Following the data is the answer.

***ALSO, I will be presenting virtually with Wealth365 January 18th at 11AM ET: Finding the Biggest Winning Stocks.

It’s totally free, so click the image below and reserve your spot!

Finally, we just released my latest video: Top Stocks to Invest in for 2022. I had a lot of fun making this one. When the market hands you opportunity, it’s hard to not get excited.

Make sure to like and subscribe to our YouTube channel here!

Also, you can find our other videos here.