Earnings Follow Superstar Stocks

Most investors eventually learn that stocks follow earnings.

That’s a fact.

However, when it comes to the best of breed outlier companies, earnings follow superstar stocks.

Weeks ago, I had dinner with one of the largest hedge funds on earth. In our chat, we discussed markets, investor psychology, risk management, and more.

These conversations are always insightful because it isn’t every day you get to pick the brain of a master of the universe. While most of the banter was forgettable, 2 nuggets inspired today’s piece.

I asked him, “If you can boil down your process into 2 sentences, what would you say?”.

His response was so simplistic. “Luke, we focus first on the wave. Second, we identify companies expected to raise earnings expectations in the coming year…before the analyst community catches on.“

This blew me away because what he described was their version of understanding money flows and a laser-like focus on the handful of stocks expected to trounce earnings expectations.

These beautiful concepts, while basic in nature, shape how MAPsignals views the investing landscape: Focus on the waves of money gushing into the best stocks.

Today, I’m going to highlight 2 all-star stocks our research uncovered using this exact playbook. From my years of experience, this is the holy grail of investing.

Earnings Follow Superstar Stocks

Let’s first unpack earnings and why it matters for the overall market.

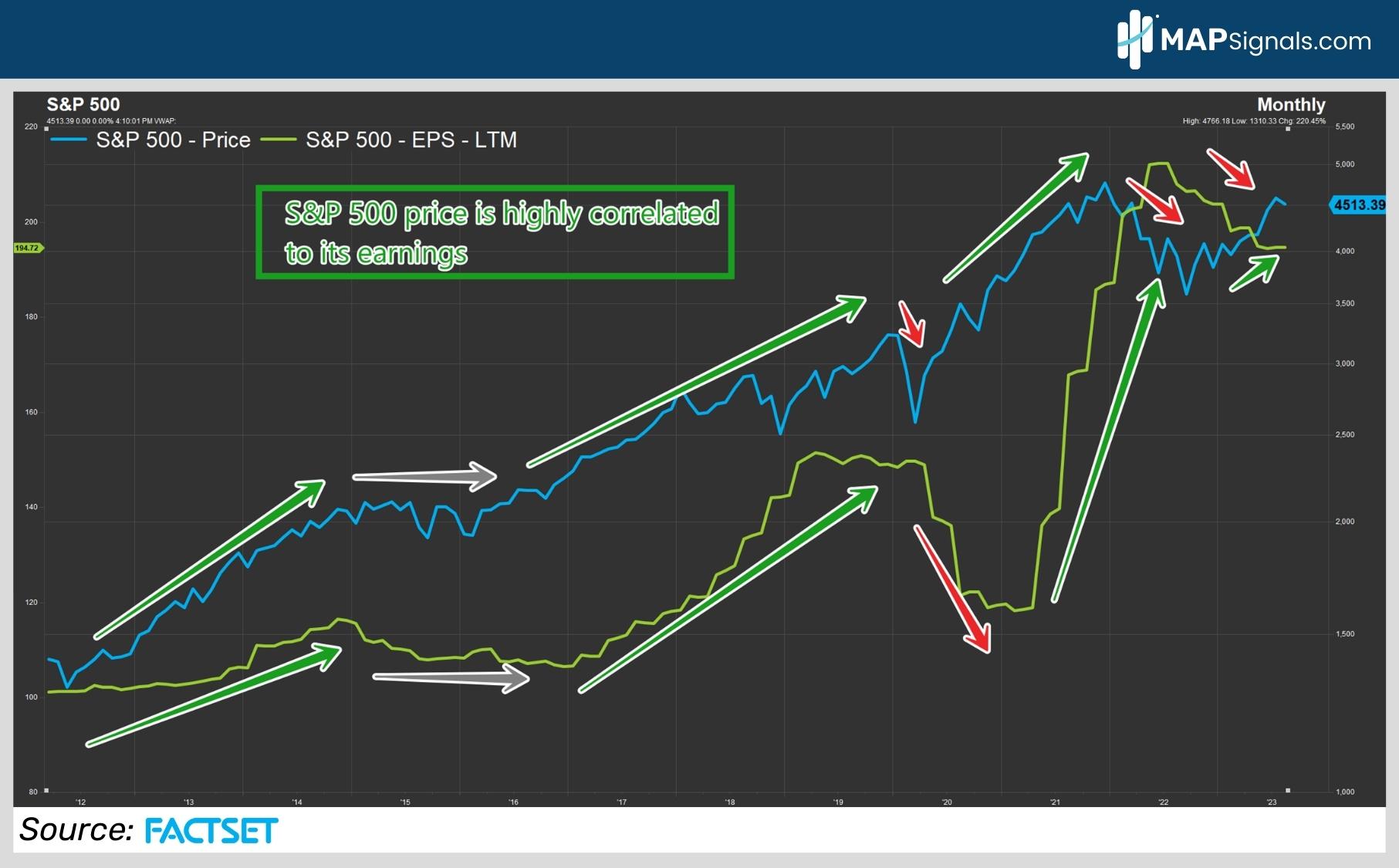

Back in March of 2022, our macro analyst Alec Young beautifully proved how stocks follow earnings. Since 1992, there’s been a monthly correlation of 94.5% between the S&P 500 index price and its earnings.

Below plots the price of the S&P versus its trailing 12-months of EPS since 2012. Without question, the earnings relationship is undeniable. Notice how both move in lockstep:

Having a handle on earnings will give you an edge. But it’s not just earnings that matter. Positioning is equally important. Understanding the wave of money can offer guidance too.

Just last week I prepared you for a summertime pullback.

Rewind to October, I couldn’t have been more bullish on the market. Inflection points are the 2nd piece of what moves markets.

Our Big Money Index (BMI) has been the de facto signal for the market the past year, nailing peaks and troughs. It’s our money wave indicator.

OK now that we see the importance of earnings and money flows at the broad market level, let’s bring this concept home to single stocks. This is where MAPsignals research shines bright.

Recall that my hedge fund friend said to focus on the wave of money and zero in on companies expected to crush earnings.

Here’s where it gets exciting! When it comes to the best stocks in the market, big institutions pounce fast and early, prior to the fundamental surge.

I’ll prove how earnings follow superstar stocks.

Up first is well-known semiconductor player, NVIDIA Corp. (NVDA). It needs no introduction as it’s been one of the most explosive growth stories the past decade. Even recently, many cite their latest earnings blowout as a major reason for the NASDAQ’s blistering rally.

This star-studded stock has been front and center in our research year after year. When people talk about the best stocks on earth, NVDA is always in that discussion.

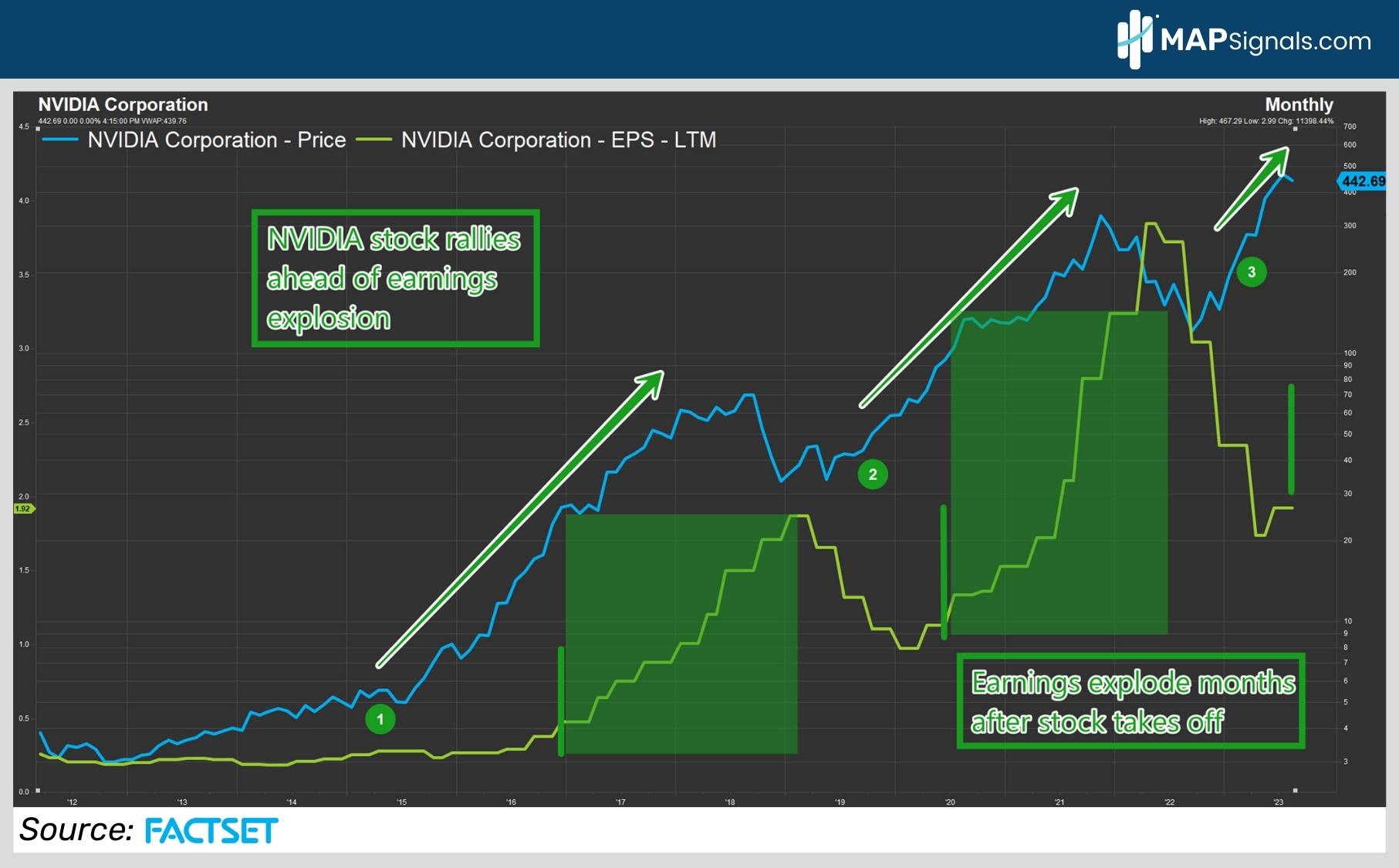

But you may not realize that the stock rallies well ahead of its exploding earnings.

To show you what I mean, here’s NVDA overlaid against its 12-month trailing EPS since 2012. I’ve notated 3 periods when the stock rocketed higher. Shaded in green highlights the important message: earnings accelerate months after the company rallies:

Circled first, NVDA started racing higher in 2015, when trailing earnings were .28 per share. By January 2019, EPS climbed to $1.87.

Observing the 2nd green circle, the stock started juicing in the back-half of 2019 when trailing EPS was near its low of $1.11. By April 2022, EPS more than tripled to $3.85.

This is proof that earnings follow superstar stocks. And it’s exactly what the hedge fund was talking about. Identify the next big earnings growers early.

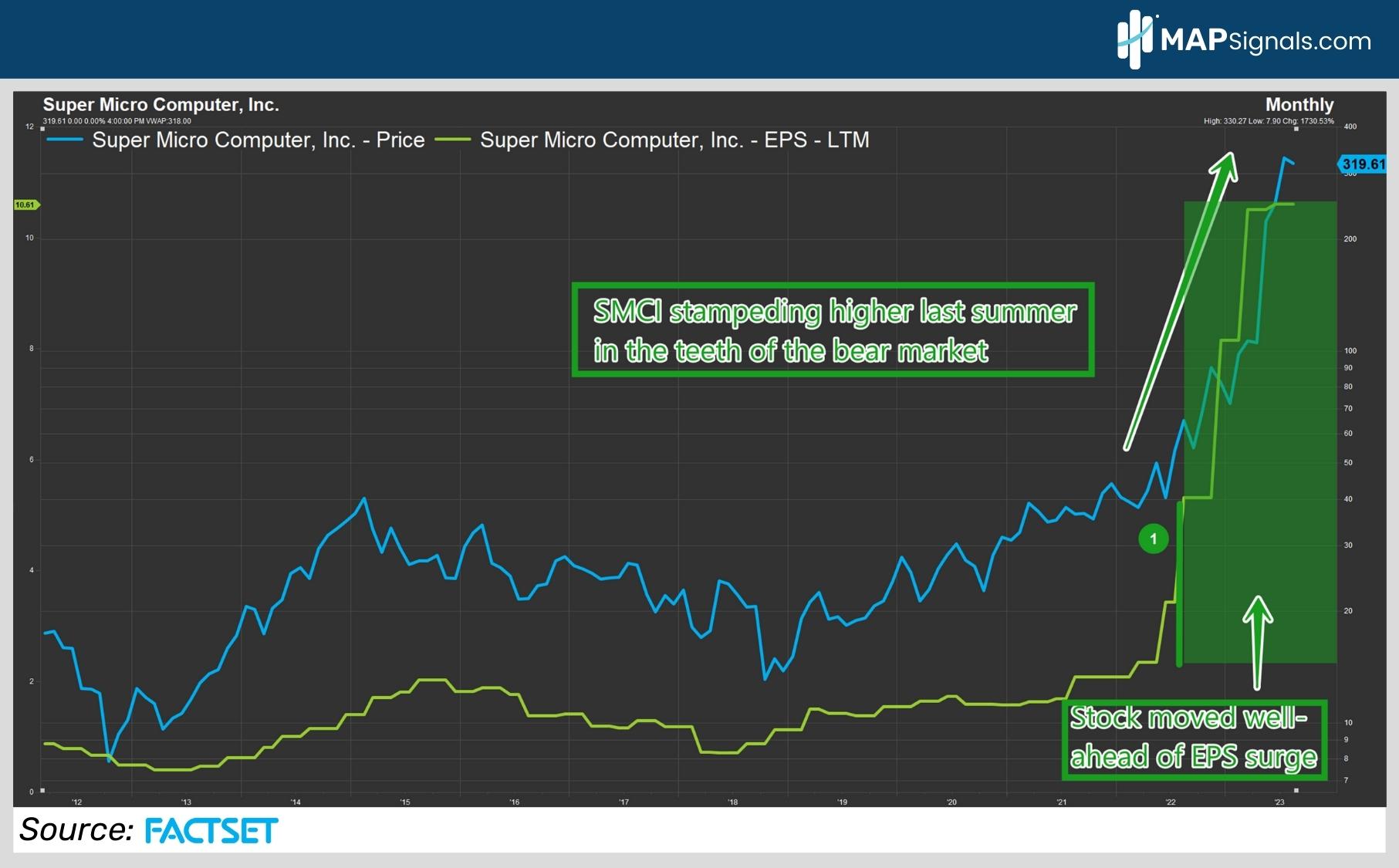

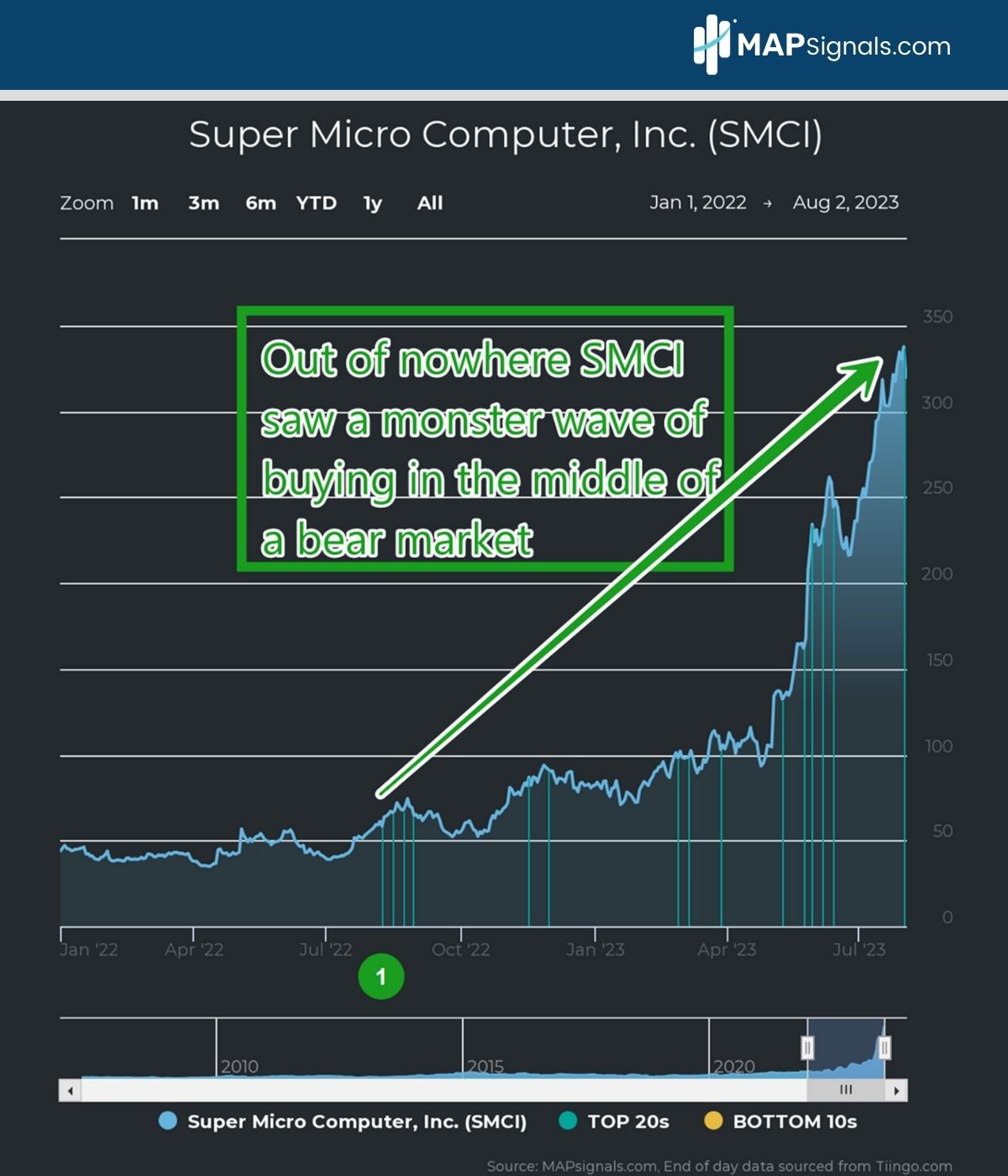

Let’s do another recent example of another monster stock, Super Micro Computer (SMCI). This name has a jaw-dropping, earnings-ripping picture.

Below plots the stock price overlaid against earnings since 2012. Something incredible happened last summer, the stock began to explode higher in the middle of the bear market!

The equity and earnings were range-bound for years. Then in June of 2022, the stock began to quickly climb. At the time, the 12-month trailing EPS sat at $3.44, only to accelerate to $10.61 as of August 2023.

This proves once again how earnings follow superstar stocks.

Now, let’s tie in the wave. Here’s where you’ll want to put your surfing trunks on.

MAPsignals is all about plotting the waves of money in the best stocks. Let’s now view both NVDA and SMCI through the lens of Big Money.

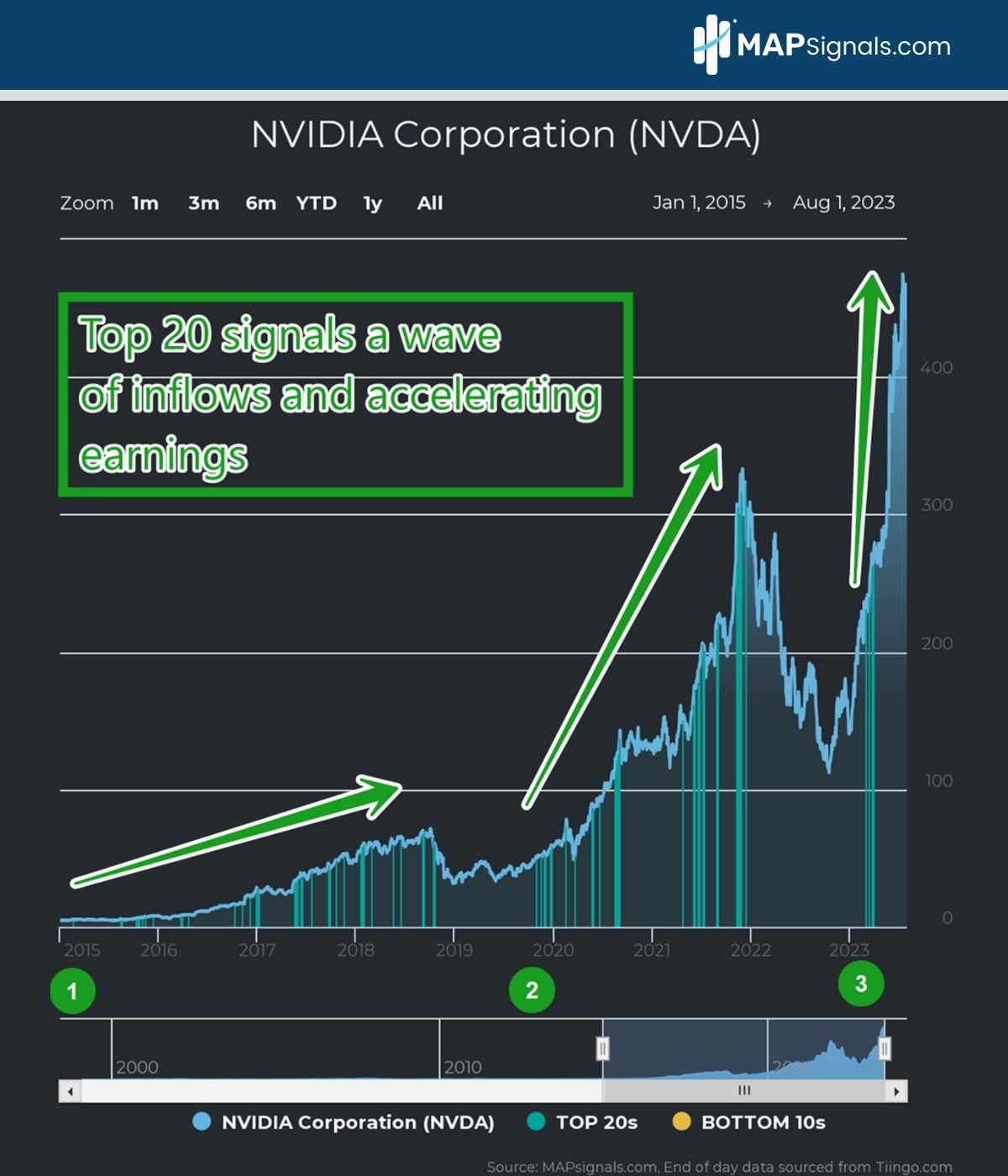

Below plots NVIDIA from 2015 with each time it was profiled on our Top 20 list. This rare signal incapsulates two drivers: heavy accumulation alongside improving fundamentals like earnings growth.

I’ve included the same green circles from earlier. Our software spotted heavy institutional buying igniting the rallies.

In technical analysis, this formation is what I call the stairway to heaven. Few stocks have this profile:

Next, let’s peek at the SMCI institutional footprints. As a reminder, the blue bars indicate a hungry appetite for the stock, including a super strong fundamental outlook.

The Big Money started scooping up the stock last summer as they expected earnings to surge:

Keep in mind this buying began in the middle of the nastiest bear market in recent memory. So, when I proclaimed in August that a new bull market had started, it was based on single name stories.

That’s the power of the wave + surging earnings.

Let’s wrap up.

Here’s the bottom line: No doubt, stocks follow earnings over the long run. However, when it comes to the best of the best, earnings follow superstar stocks.

The brightest investors on earth are well attuned to the biggest trends. Mega outlier NVIDIA surged well-ahead of its earnings ramp. The same occurred with Super Micro Computer.

As Jon Kabat-Zinn said, “You can’t stop the waves, but you can learn to surf.”

If you’re looking for hedge fund quality research, start riding the waves with MAPsignals.