2 Tech Stocks Are Screaming Buys Even at All-Time Highs

History teaches lessons.

Guidance from the past often plots the future.

There’s a renaissance taking place in certain growth areas of the market…and the evidence suggests that 2 technology stocks are screaming buys even at all-time highs.

Let’s be honest. It’s been a great run for large-caps in 2024. Non-stop inflows in Tech-behemoths have kept major indices climbing week after week.

Long-term investors should be happy as clams in this tape. I know I am!

While my data-driven forecast for a healthy market pullback has yet to take hold, there’s a much larger bullish phenomenon firing for select growth stocks.

High-quality companies, AKA: outliers, are finally beginning to pay dividends. And when you study history, you’ll learn that new dividend initiations on incredible stocks equate to outstanding long-term returns.

Today we’re going to size up the current Big Money landscape and zero-in on why markets keep rallying. Then we’ll isolate 2 all-star stocks surging…and why they’re set to defy gravity in the coming years.

If you enjoy eye-popping evidence-rich studies, sit back, and enjoy the ride.

Unrelenting Large-Cap Inflows Keep Markets Climbing

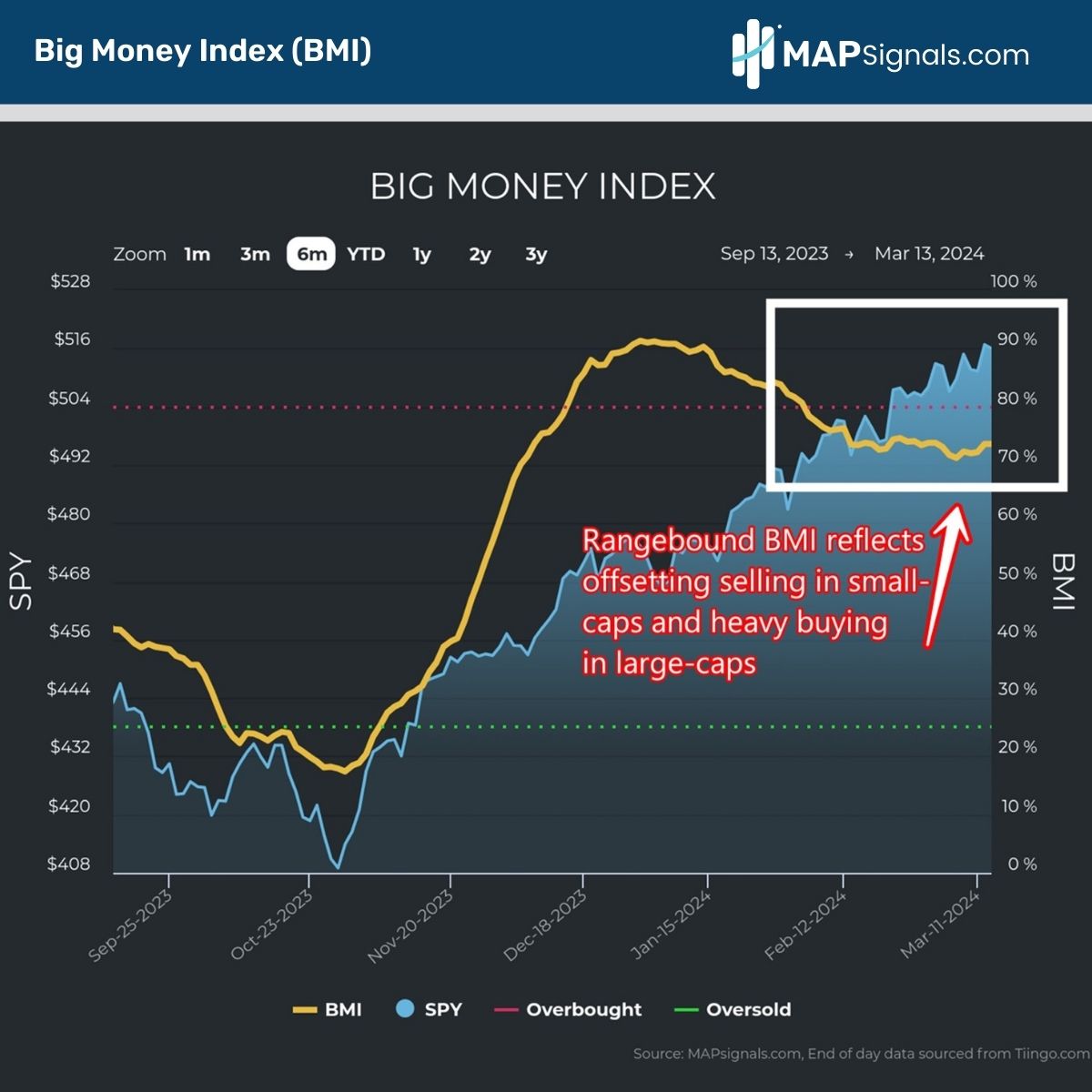

The money-flow picture is striking. The Big Money Index (BMI) has been range-bound for weeks.

Since breaking below overbought territory in February, the overall trend of capital has been flatlining. For a month, the BMI has been coiled around the low 70s region while the S&P 500 (SPY ETF) has steadily risen:

At first glance you may be inclined to believe the BMI is broken, it isn’t. Diving below the surface reveals the true picture.

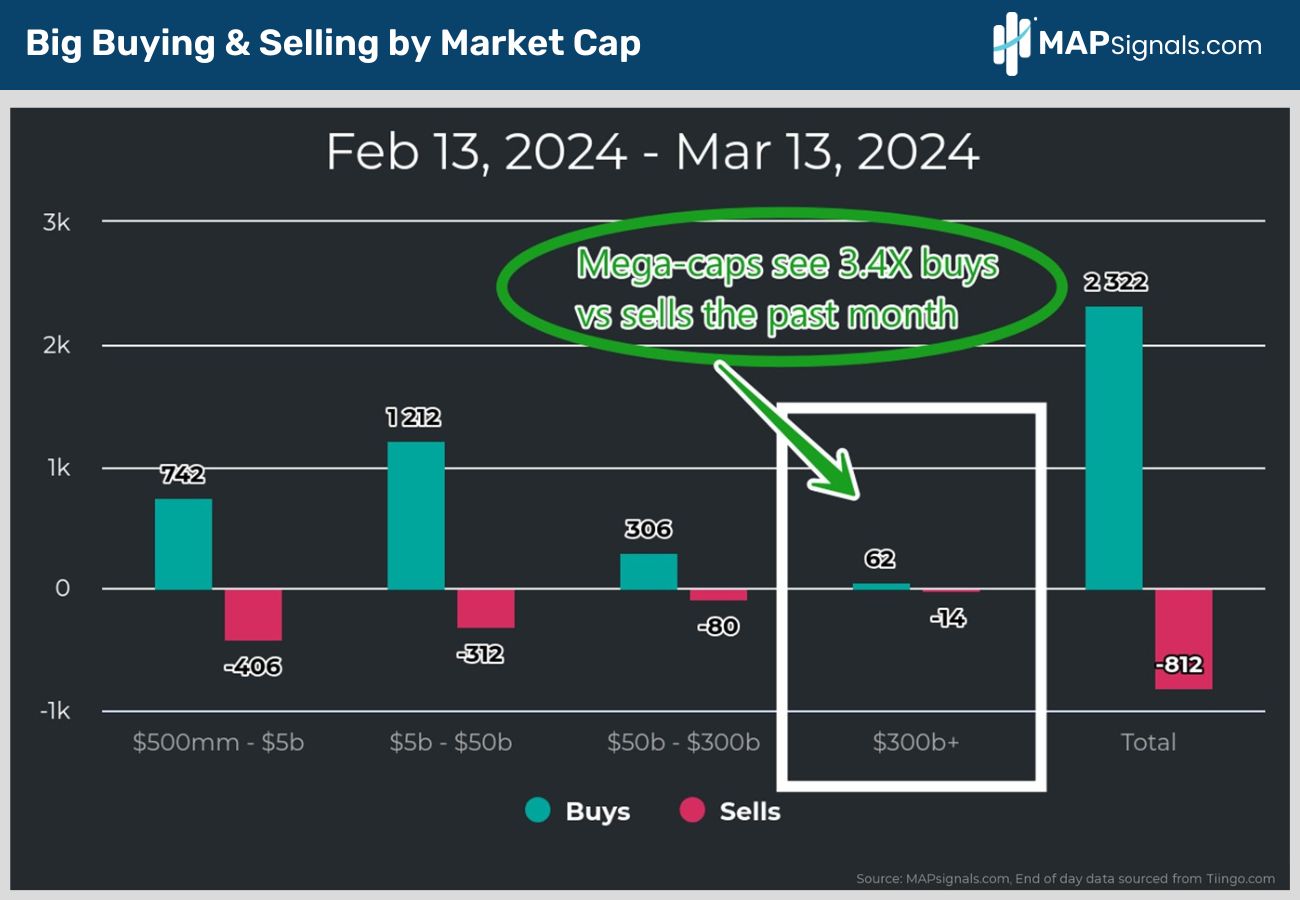

Large-cap enthusiasm is keeping market-cap weighted indices surging. The below image details this beautifully.

Over the past month, there have been 62 mega-cap stocks bought compared to only 14 sold. That’s a 3.4:1 inflow to outflow ratio.

Contrast that to a more even money flow picture for small-caps where 742 stocks were accumulated and 406 were sold.

Whenever capital is pouring into the largest stocks on earth, major indexes have nowhere to go but UP:

And when you understand the earnings picture, it begins to make sense.

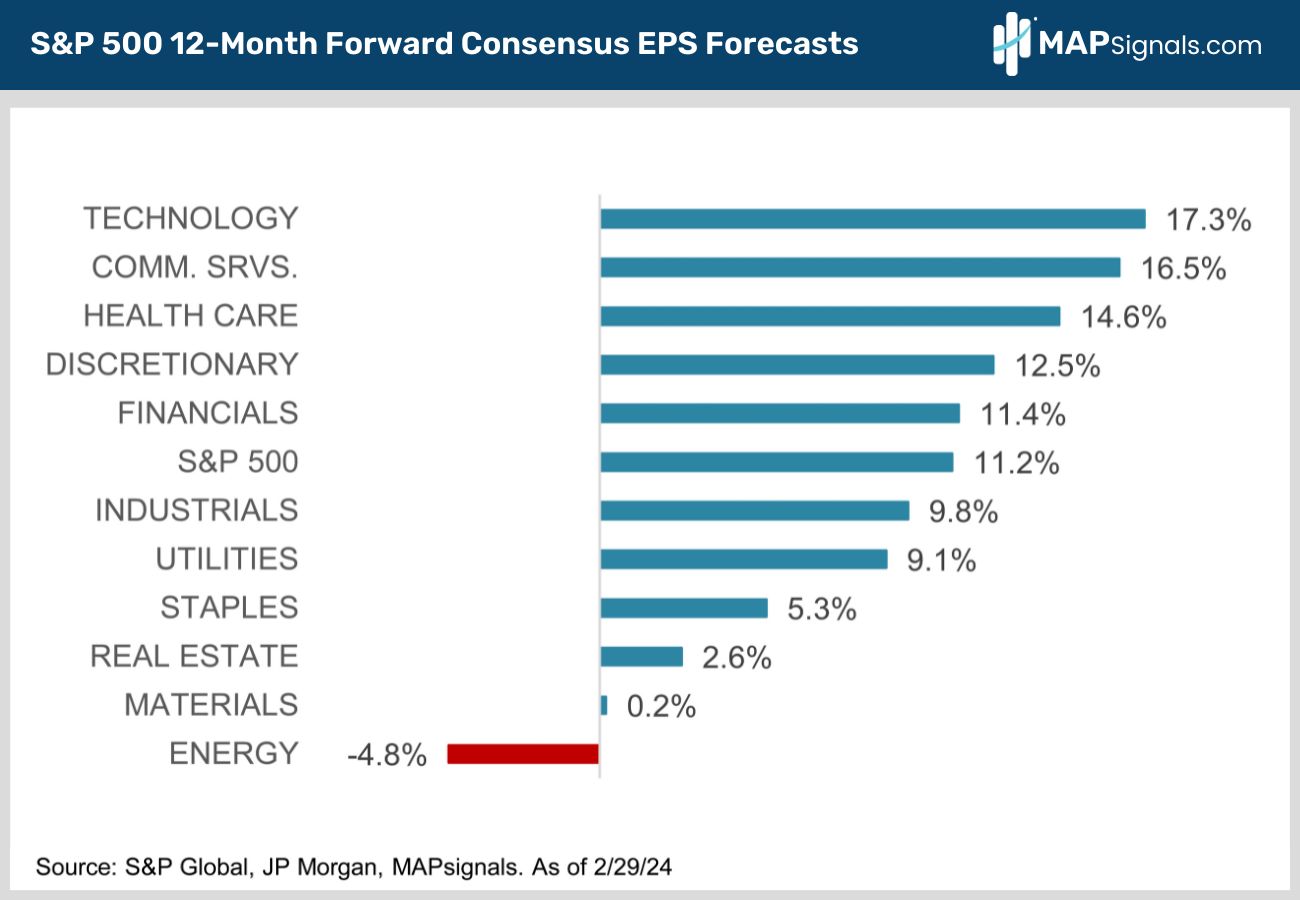

Technology stocks, partly fueled by an A.I. frenzy, have seen the greatest magnitude of inflows lately.

As shared earlier this week by Alec Young, the 12-month forward consensus EPS forecast for Technology stocks towers above all others at +17.3%.

Capital follows earnings:

It isn’t just inflows and earnings that signal big gains ahead. Brand new dividend initiations are also part of the story.

2 Tech Stocks Are Screaming Buys Even at All-Time Highs

When a company initiates a dividend, it signals a lot of faith by the management team. Making the decision to share a piece of a company’s profits indicates the forward picture is healthy.

Two all-star companies, Salesforce.com (CRM) and Meta Platforms (META) both recently initiated quarterly dividends of $.40 and $.50 per share respectively. (Disclosure: I own CRM personally)

Now, a company graduating into an income play could have you dozing off, thinking their best days are behind them…but you’d be incredibly wrong.

As I’ll show you, these 2 technology stocks are screaming buys even at all-time highs.

To prove it, let’s review history.

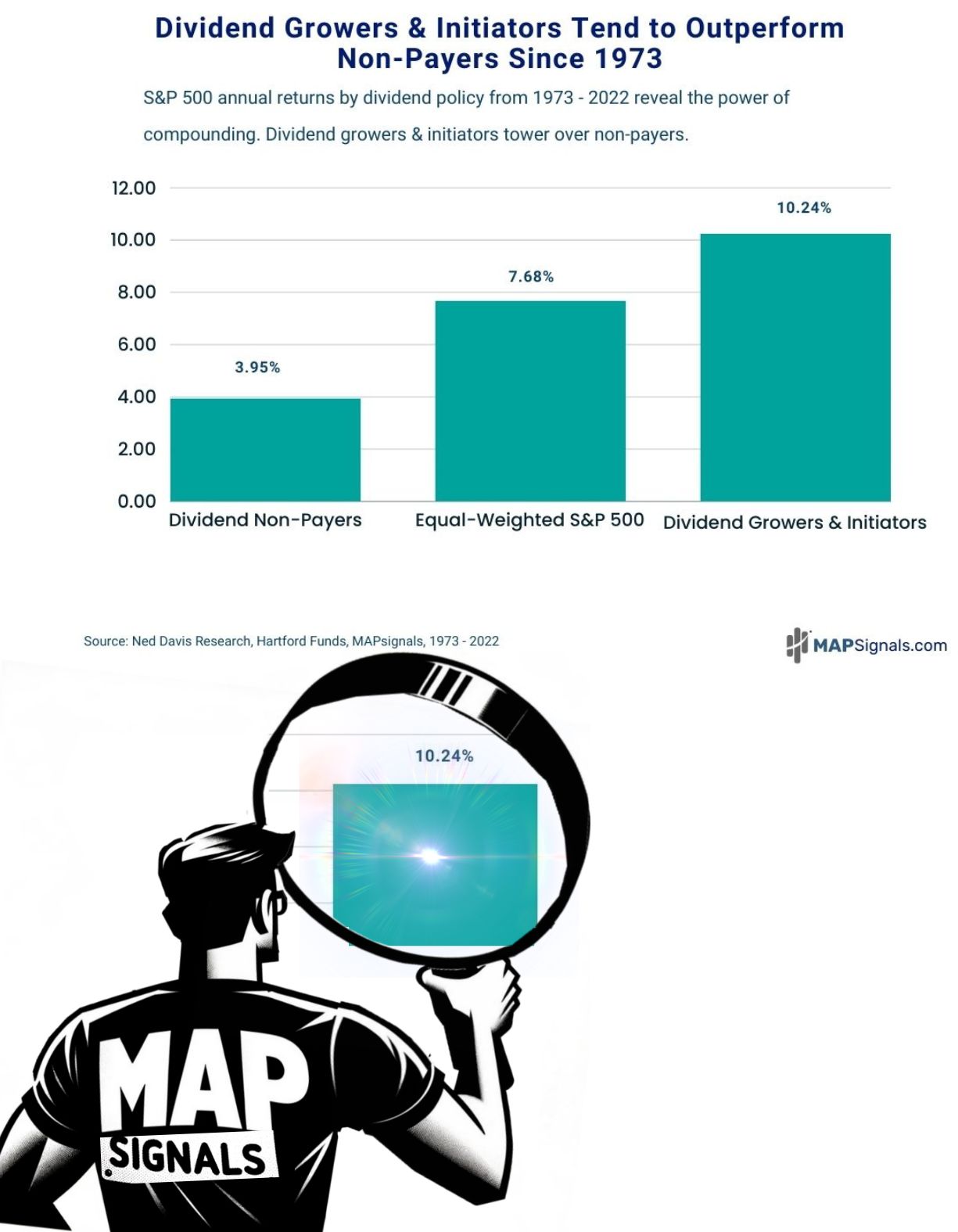

Since 1973, companies that initiate and grow their dividend, handsomely outperform non-payers:

Our friend Marty McMap zeros in at what’s important. Annual gains of +10.24% from dividend growers and initiators are strikingly higher than +3.95% for those that don’t. This study alone should have you jumping for joy at the prospect of owning META and CRM over the coming year.

Though I believe there’s potentially an even bigger runway for these outlier stocks for years to come.

Here’s why.

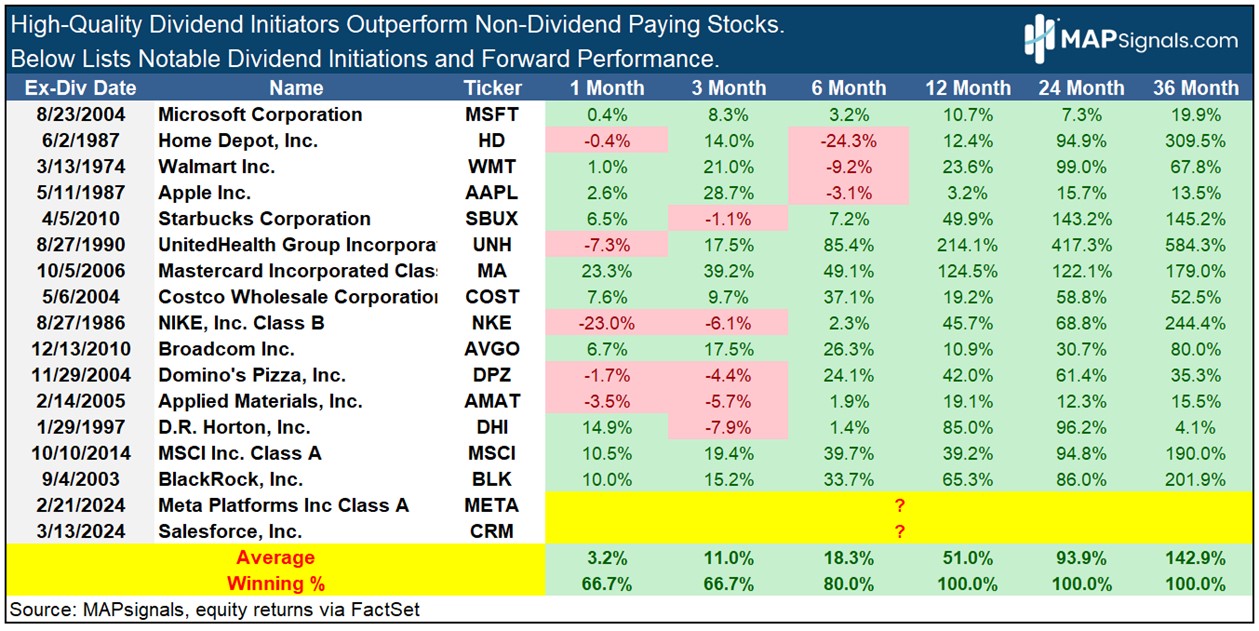

I went back and studied 15 notable dividend initiations from some of the biggest names ever. To be fair, this list has some bias to it.

To cull together this list, I made the assumption that at the time of their first dividend announcement, it was reasonable to assume the companies would be in business 10 years later…exactly how I feel about Salesforce and Meta today.

High-quality companies that initiate dividends sport some of the best returns you’ll find.

Companies on this list include Microsoft, Home Depot, Walmart, Apple, Starbucks and more. Keep in mind this list covers initial dividends from the ‘70s, ‘80s, ‘90s, and 2000s.

A year after these firms paid their first dividend:

- A year later they gained an average of +51%

- 2-years later they nearly doubled at with a +93.9% rally

- 3-years after, the stocks saw mind-numbing returns of +142.9%!

(Disclosure: I personally own MSFT, HD, WMT, SBUX, COST, NKE, & CRM)

Folks, dividends are important. BUT, outlier stocks paying dividends are some of the most bullish signals you’ll find.

Couple that with our most important power signal, our Top 20 report… and it’s like you’re holding aces at the Hold’em poker table.

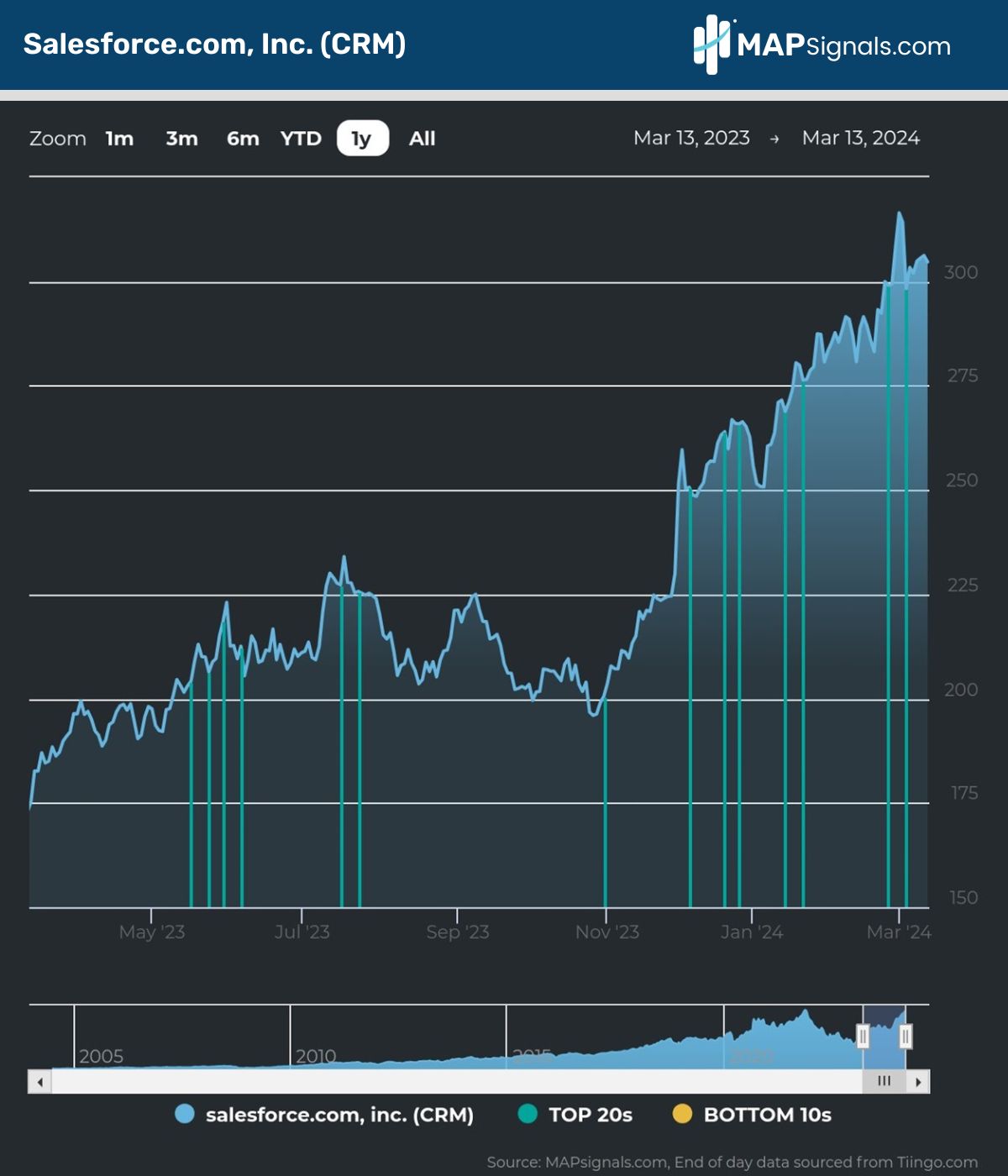

Salesforce has appeared on this rare list 14 times the past year:

And META has seen a juicy 9 signals:

When you study the evidence…these 2 technology stocks are screaming buys at all-time highs.

Let’s wrap up.

Here’s the bottom line: Consistent inflows in technology behemoths keep indices climbing higher and higher.

2 notable companies benefiting from this tidal wave of capital are Meta and Salesforce…tickers we know very well in our research. All year they’ve been profiled as top stocks numerous times.

Couple that with recent dividend initiations, and you’re staring at huge potential gains in the years to come.

Sometimes, waiting for a pullback is warranted for the market as a whole. But don’t lose sight of the bigger opportunity.

When you zero in on the best stocks in the world, morphing into income plays…you’re hunting for big-game returns.

That’s the holy grail of investing.

And this is why having a market map is so important…helping you cut through the noise in any environment.

If you’re a serious investor or a Registered Investment Advisor (RIA) looking for cutting edge stock-picking research, get started with a MAP PRO subscription.

You’ll be able to sift through our proprietary data and find tomorrow’s leading stocks…TODAY.