Falling In Love And Outlier Stocks

When I started out investing, I fell in love with the idea of being a market god.

Outlier stocks hadn’t yet crossed my mind.

Years later I read this great book, “More Money Than God” by Sebastian Mallaby. In it he profiled my heroes. The hedge fund titans who were MAUs or Masters of the Universe.

These guys were untouchably successful- and I wanted every bit of it.

I was smitten with an image of who I wanted to be.

So, as I embarked on my journey to become one, I thought trading stocks needed to be complicated. I assumed, the more charts and indicators, the better.

I had lots of screens, lots of flashing lights, and TV squawking in my ear. I was on the phone. I was ADD to the max.

I was like the young teen chasing every girl I could find…

I dreamed of buying the bottom and selling the top over and over again…

That’s how you win in the stock market right? Trade a bunch of stocks with many small profits!!!!

The answer may be yes for some, but for me it turns out it was “no.”

My answer to success came over years of discovery. It wasn’t a lightning bolt moment where everything changed, it was more like life… a slow evolution of learning and improvement.

But now you get to benefit from me paying my dues for years.

You see, the secret to becoming a market god is insanely simple. You have to fall in love. The answer is three little words:

Hold outlier stocks.

Hold Outlier Stocks

It took me a ton of trial and error to learn this one simple concept. I had to make some spectacular blunders along the way.

Those mistakes were awfully painful. But I wouldn’t change a thing because they were life altering.

Back to when I started out, I joined a Manhattan day-trading shop in 2006. I talked a bit about it last week. It was awesome.

40 of us were paid to trade stocks all day. It was a dream opportunity for a small-town boy like me.

This got me exposed to technology. Stock market software allowed algorithms to be programmed. I could code whatever parameters in stocks that I wanted.

After much screening, I discovered growth stocks. And within those, I was able to laser in on the best.

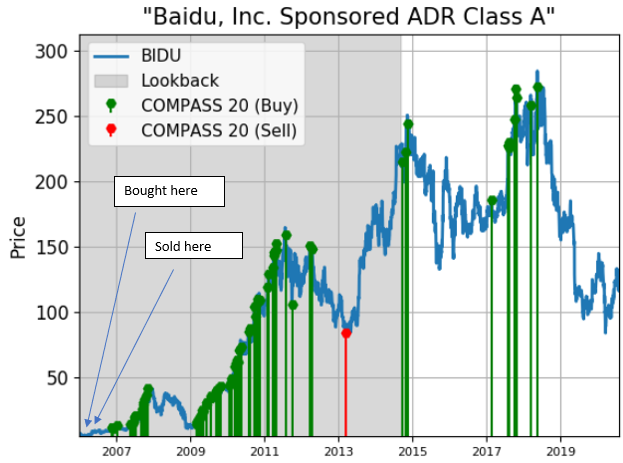

One of the best ones at the time was Baidu, Inc. (BIDU).

I’ll never forget the trade:

I bought BIDU around $90 and sold it for roughly $100. I made a quick $10 bucks per share and I thought I was a market god.

But, over the course of months and years, I watched the stock continue to rise.

That frustration of missing out on the huge gain made it clear: I didn’t want to trade in and out. Making a quick 11% was a waste of time, and more importantly money. I didn’t want the crumbs: I wanted to make life changing money.

Eventually BIDU split 10 for 1. If I had only held those 100 shares of BIDU, today we’d be talking about a monster winner: that trade cost me over $100,000 in profits.

I realized- I was no god. I felt like a fool leaving all that money on the table.

The market god made me learn through pain… the experience told me to “hold outlier stocks.”

Don’t get me wrong – I am truly grateful for that mistake, because what came after was juice.

Big Money Investors Find Outlier Stocks

Less than a year after joining the day-trading shop, I met my business partner. He hired me as a trader on his derivatives desk. Together we saw firsthand how big money investors find outlier stocks. We traded billions of dollars worth of stocks – sometimes even in a day.

My passion was finding juice stocks: the ones that beat all others. His passion was mechanizing a system to accomplish this and removing emotion.

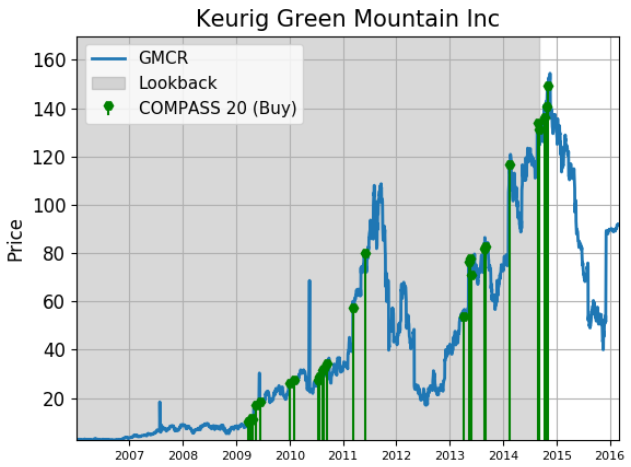

Eventually, the next fat pitch came. It reminded me of BIDU from years earlier, but this time it was Green Mountain Coffee Roasters, Inc. (GMCR).

They invented those coffee pods so popular today. They created a category and consumers couldn’t get enough of them. Every earnings announcement they made seemed to be a huge beat and a raise of guidance.

Eventually they were taken over.

This time, I didn’t take the 11% clip. I held. And I was rewarded handsomely: this stock alone doubled my portfolio in a year.

The lesson for me was time consuming, but numbingly simple. I’ll boil it down for you here:

Stocks are like falling in love, when you find “the one” you don’t let it slip away. You grab on to them.

The key though is the same: don’t let them slip away for a quick thrill.

The market will do what it does. It goes up and it goes down. Outlier stocks ride with the market, but eventually reveal themselves as bigtime winners.

I learned day trading focuses on the small stuff, when the big stuff happens right under our noses.

I chased plenty of girls in my youth. None of them had the impact and life-changing effect of marrying my wife. We share our lives and just had our third child earlier this week.

Outlier stocks are like falling in love. All we have to do is find the right ones, grab them, and hold on to them and never let them go.

Only with outlier stocks, you get to fall in love again and again and again…