Investors Are Plowing Into ETFs

Animal spirits are back. You can feel the bullish breeze in the air.

The sentiment shift is notable: Investors are plowing into ETFs.

Yesterday’s inflation reading sent cheers throughout the trading community. The June CPI report stunned the crowd as prices rose only 3%, plunging from 9.1% only 12 months earlier.

That’s wonderful news! We all should welcome price relief.

While these headlines offer positive developments, keep in mind that institutional buying has been signaling this inflation death-spiral for the better part of a year.

Just yesterday, we saw a hefty appetite for ETFs as the retail crowd rushed in. What does that mean for stocks going forward? Today’s study will give us clues.

Let’s first plow through the data.

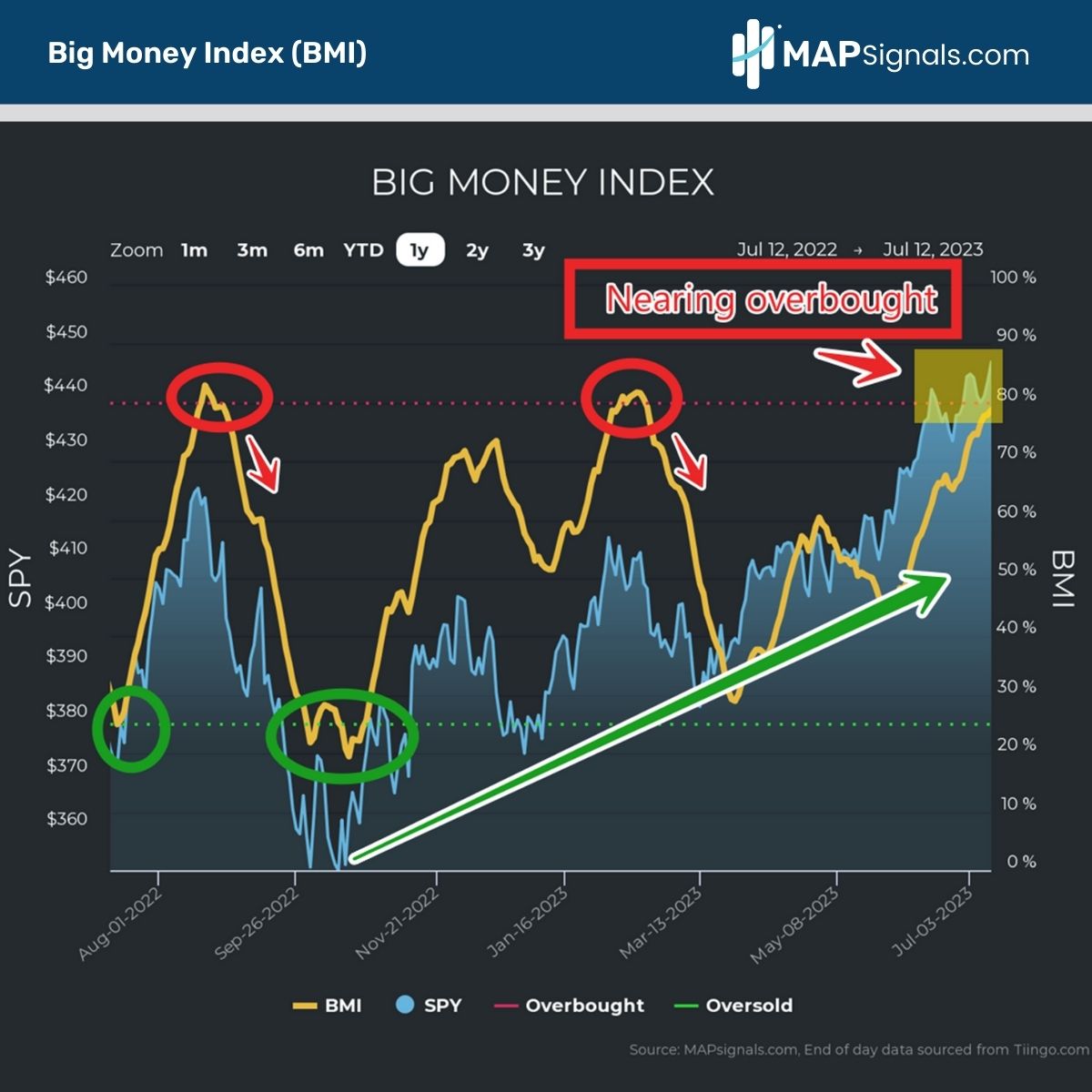

Big Money Index Marches Higher

They say the trend is your friend. I say, the trend of institutional support is your friend. Our trusty Big Money Index (BMI) has signaled inflows since October.

Volumes precede price. The BMI is the market’s North Star. It offers real-time positioning on Big Money appetite. We are nearing the red zone:

A reading of 79% is kissing the red line (80%+). Last week, I gave an overbought stock market playbook. In it, I showed how stocks tend to stay in the warning area for an average of 4 weeks.

That means, enjoy the ride. Only when the BMI begins to fall, should we worry that trouble’s brewing. That would indicate that buy pressure is fading.

In the chart above, I’ve circled the last 2 overbought periods. Notice that when the BMI nosedives, that’s your signal to take profits.

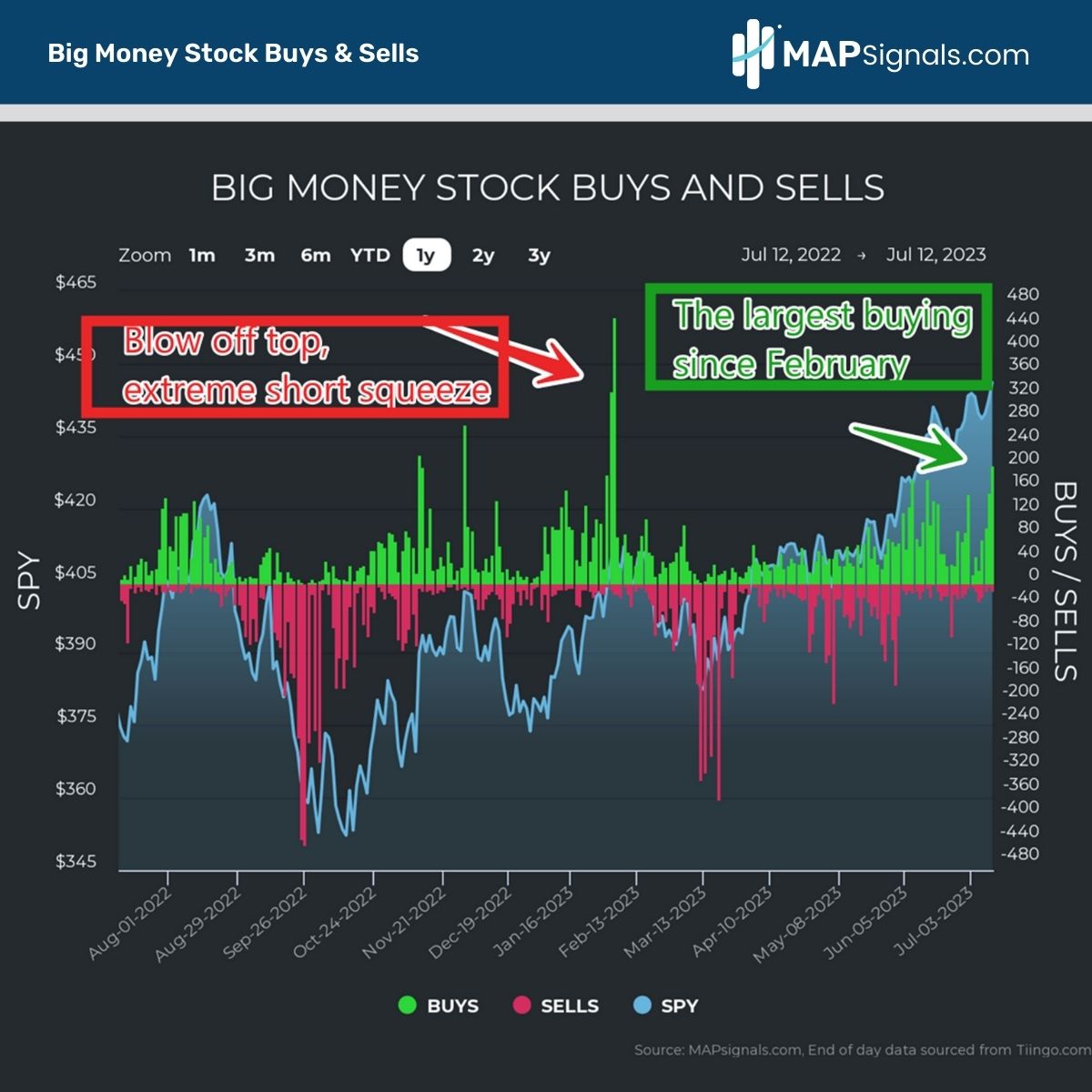

We aren’t hopping off the bull train just yet. However, our data is signaling the first signs of exuberance since February. Equities are getting scooped up at a break-neck pace.

Please note yesterday’s buying was no-where near the magnitude of February’s buying spree. Today’s environment is much more constructive:

Folks, this is what a bull market looks like! Holding great stocks into a tidal wave of inflows is how you win.

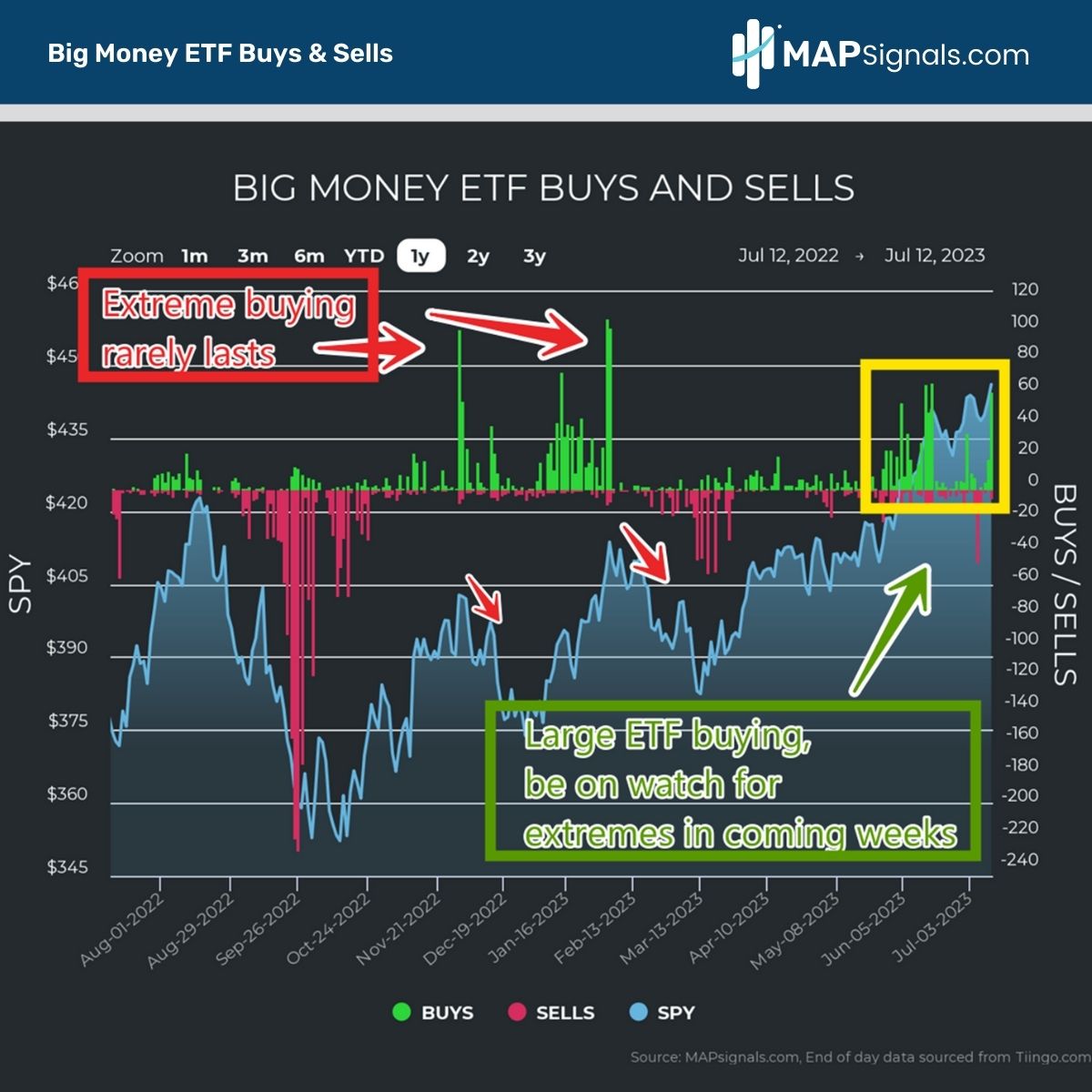

Investors Are Plowing Into ETFs

It’s not just stocks that are pressing higher. ETFs are under heavy accumulation too. Below reveals 61 ETFs were bought yesterday. It’s across the board participation: REITs, growth, Energy, Technology and more.

No doubt, investors are plowing into ETFs:

Now, in a bear market this would be a massive warning signal. Today’s environment has many equity tailwinds supporting further price appreciation: rates have likely peaked, down trending inflation, plenty of companies are issuing positive earnings guidance, etc.

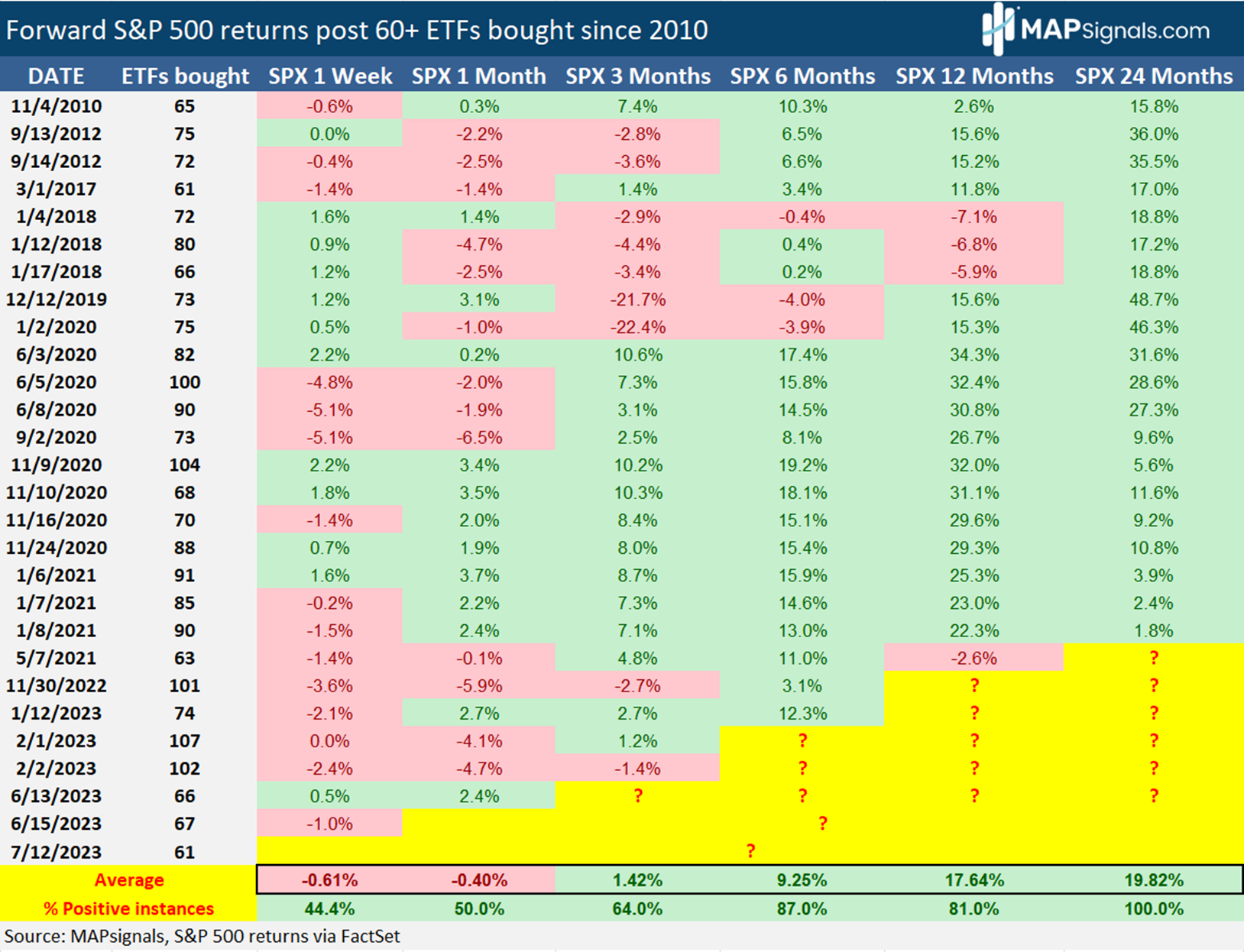

Even with the positive undertones, it’s still imperative to search for clues in history. I went back and looked at prior instances when at least 60 ETFs were bought. Since 2010, we’ve had 27 discrete instances prior to yesterday.

Check this out. A week post this level of buying shows the S&P 500 down .61% and 1-month out falling .4%:

This data echoes last week’s message that stocks tend to sputter a month after being overbought.

The bigger message here is what happens 6, 12, and 24 months out: Stocks are up monstrously! A year after this level of ETF buying sees stocks up nearly 18%. Hang on for 2 years and it’s nearly 20%.

So, what’s the story here? Investors are plowing into ETFs. Near-term this tends to preface a cool-off period. That’s when you want to be adding to equities. Use any healthy pullback to grab stocks beating and raising guidance.

Those are the leaders of tomorrow, where MAPsignals shines.

Let’s wrap up.

Here’s the bottom line: Markets are elevated. Stocks are surging, exciting the crowd. Investors are plowing into ETFs, approaching extreme levels.

History points to a healthy pullback ahead for stocks. I’m sure many would welcome it!

While this can appear as a negative for the market, it’s not. 6-months out and longer shows big gains for stocks.

Given all the tailwinds mentioned, this bull market is far from over.

The North Star guided sailors in uncertain waters.

Investors should do the same with the stock market. Don’t sail blindly, follow the Big Money!

Lastly, if you’re a professional money manager or are serious about investing, let MAPsignals unique data take your game to the next level. Don’t fly blind, use a MAP!