Keep Betting on Elite Financial Stocks in 2024

The mega rotation is only gaining momentum.

As indices bob and weave, one interest rate sensitive area is soaring.

Keep betting on elite financial stocks in 2024.

We’ve had quite a shift in tone the last few weeks. First, we told you there were 4 smart reasons to buy energy stocks.

Then we made the bold claim that unloved small-caps are going to eventually do the unthinkable…make all-time highs.

Well, we’re going to keep the non-consensus research coming. We have a plethora of evidence that financial stocks are set to keep leading in 2024.

While much of the media’s focus is on rate cut predictions and why it can sideline stocks, many are missing the critical facts that financial companies have incredible technical and macro tailwinds this year.

Today, we’re going to showcase why we believe it’s a big mistake to not have a slice of your portfolio pie dedicated to this newfound leadership sector.

If you’re like me and enjoy historical studies, we’ve got you covered in spades.

Keep Betting on Elite Financial Stocks in 2024

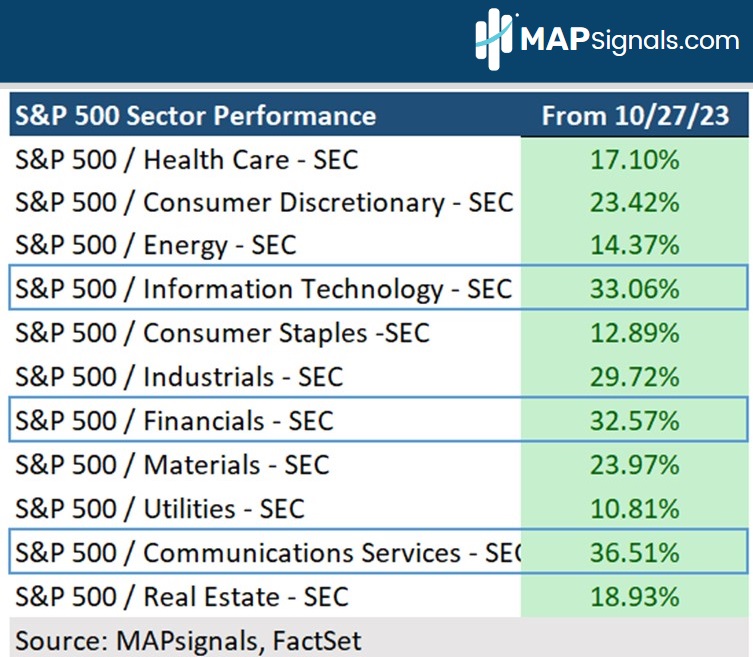

Poll investors on which areas of the market are up the most since the October lows and odds are they’ll quickly say Technology.

That’s actually the right answer. However, Financials are quickly closing that leadership gap. Since the market lows in October, only 3 groups have gained over 30%: Communications Services, Technology, and Financials:

While the Tech and Comm-tech leadership intuitively makes a lot of sense given the A.I. buzz around semiconductors and software names, unbeknownst to many, financial areas have 2 major tailwinds flaring.

The first is a mechanically bullish narrative that we first showcased back in December 2023 when we proclaimed how many financial superstar stocks are primed for massive upside.

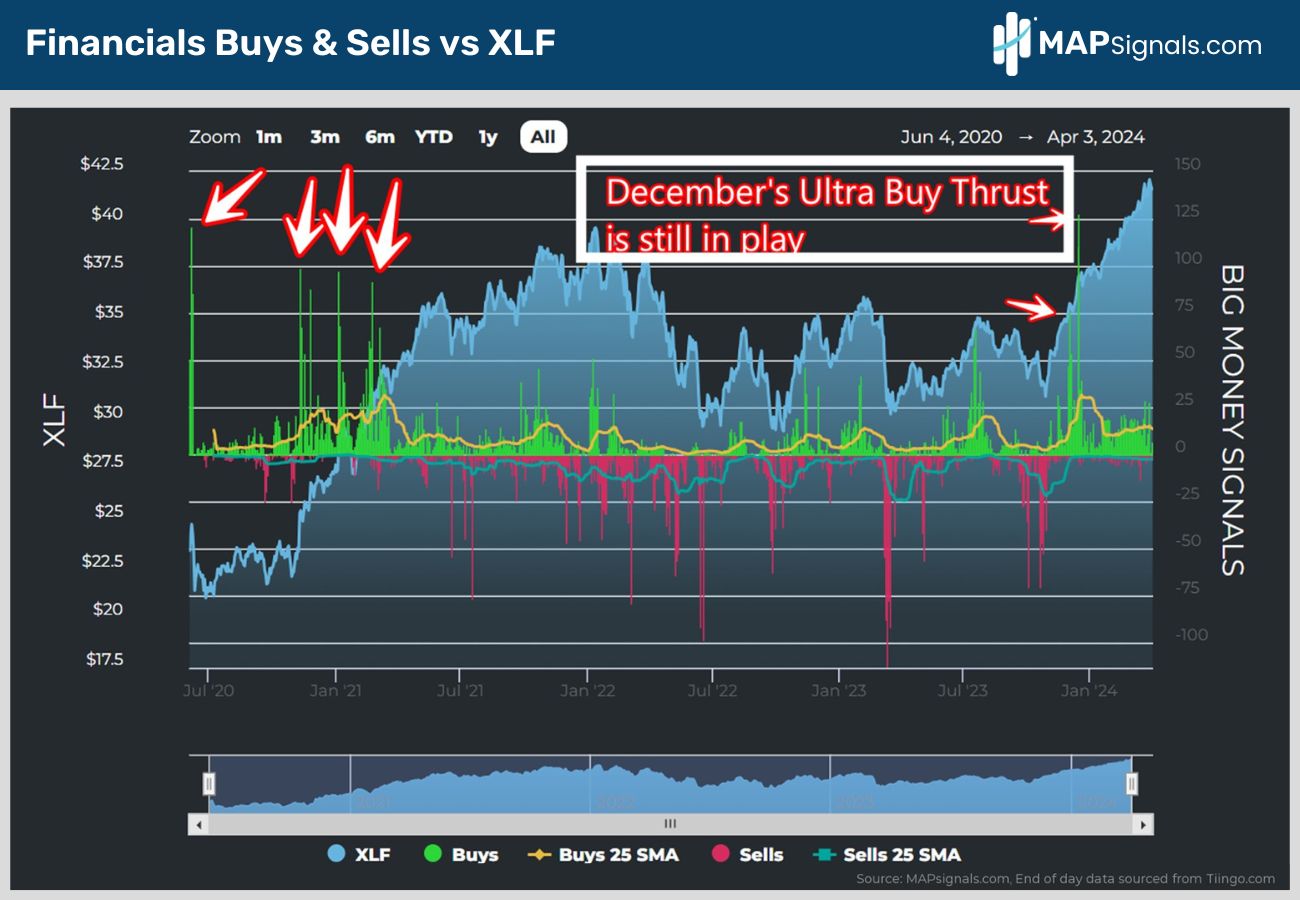

Back then, we notated an incredible event in our data. Over 50% of our Financials Sector universe was bought in a single day. This was exceptionally rare and off the chart:

I’ve made arrows pointing to the events in December and a handful of similar signals a few years back.

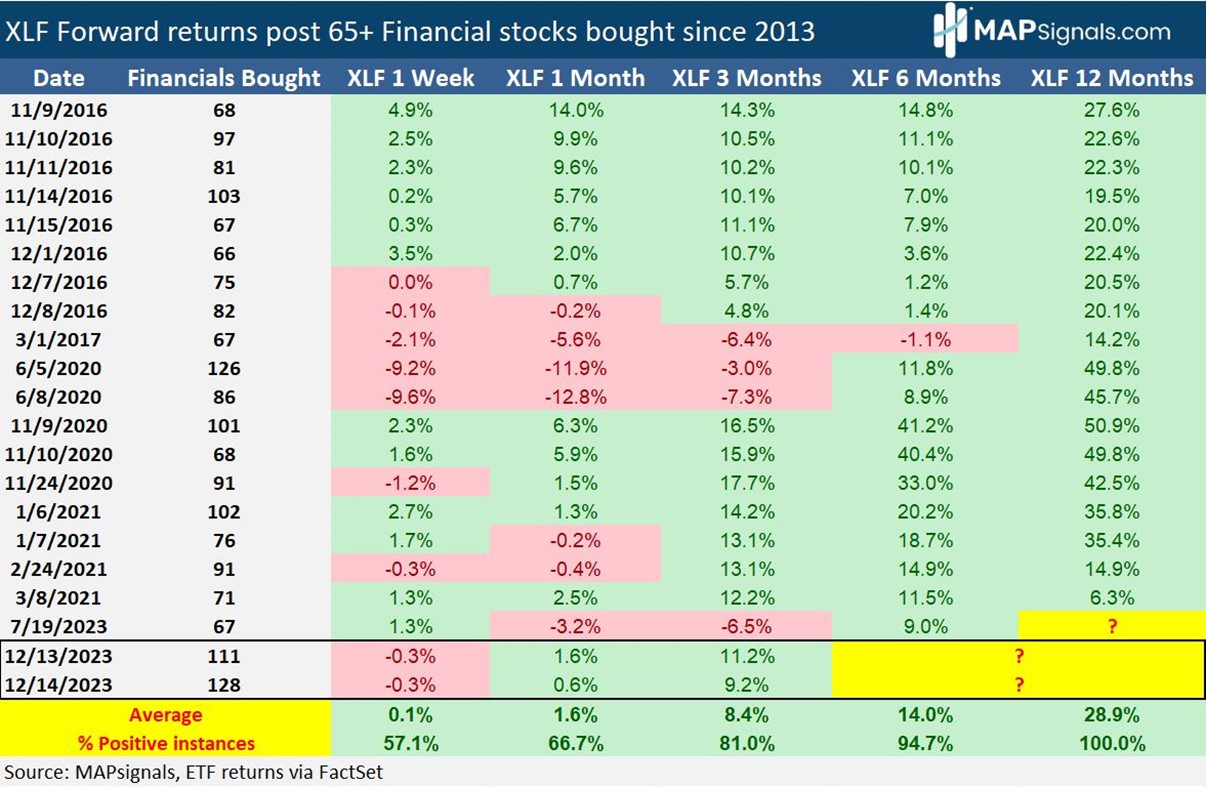

This is important is because we offered a strong historical study that proved that this level of new participation is not only ultra rare, but powerfully bullish months and even a year later.

On December 13th there were 111 financial stocks bought. A day later the record was set with 128 names accumulated.

Folks, as we showcased then, a tsunami of inflows is one of the most bullish signals you can find. We told you to expect big gains in the months ahead…and boy did they come.

3-months after the inflows were detected, the SPDR Financials Select Sector SPDR ETF (XLF) has gained +11.2% from 12/13/23:

The great news is this move is far from over. Keep in mind that a year after this signal, XLF is up nearly 29% with a 100% batting average since 2013.

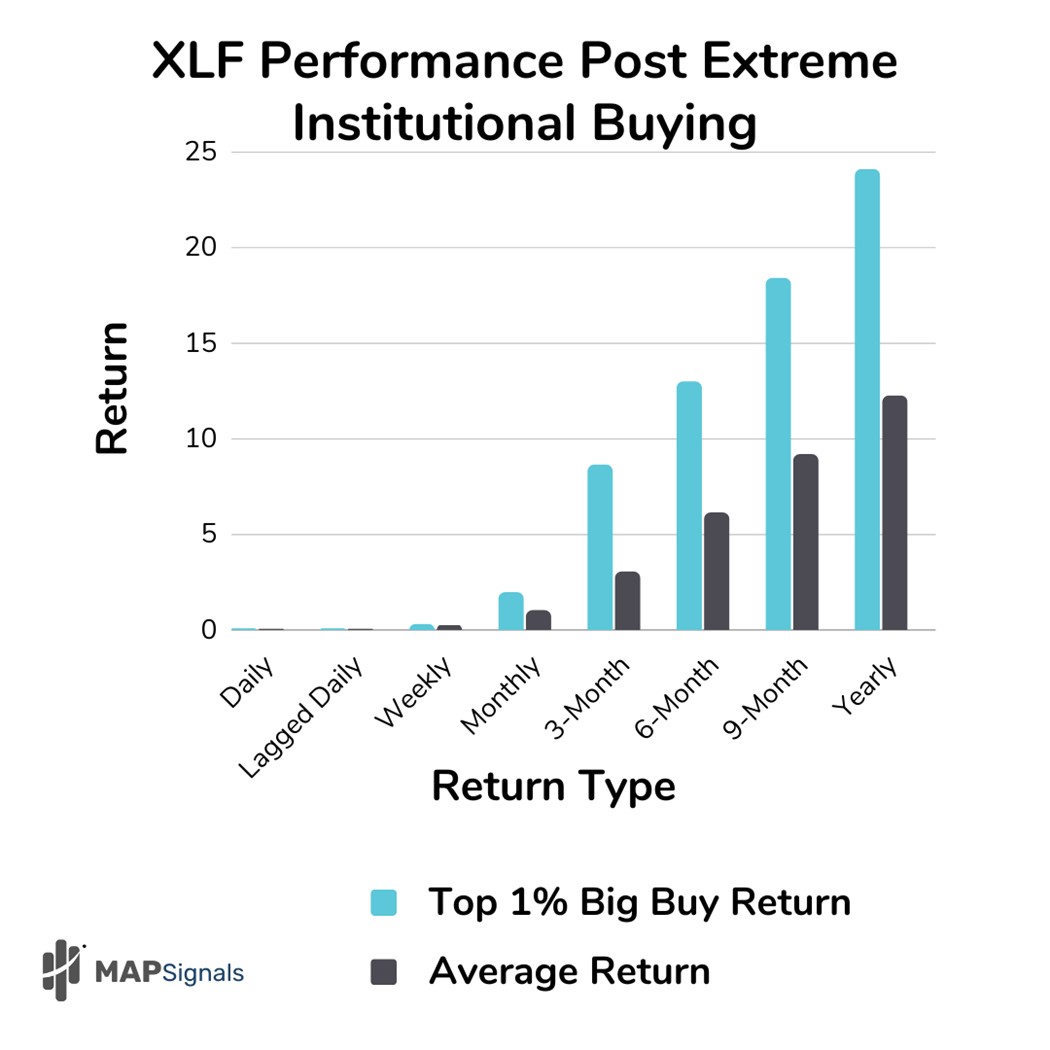

To recap on how powerful this datapoint is, here’s a look at how XLF performs in normal instances vs. the handful of monster buy thrust days.

The blue bars reveal why you should expect nearly double the return when you’re riding inflow waves of this magnitude:

Data is powerful…and profitable.

While we can look back and have confidence going forward, it’s also imperative to measure today. In the last weeks, we detailed how a mammoth-sized reshuffling was occurring in our data.

Brand new leadership has emerged. Said another way, our system is pivoting away from Technology leadership towards real-world groups like Energy, Industrials, and Financials.

Here you can see that from our portal’s sector ranking. Energy is tops by a mile followed by Industrials and Financials:

This is a rebirth that is reshaping our primary business…our weekly Top 20 report. Brand new areas are beaming with major institutional sponsorship.

And when you study the major macro setup, it becomes evident why Financials are a top choice for savvy investors.

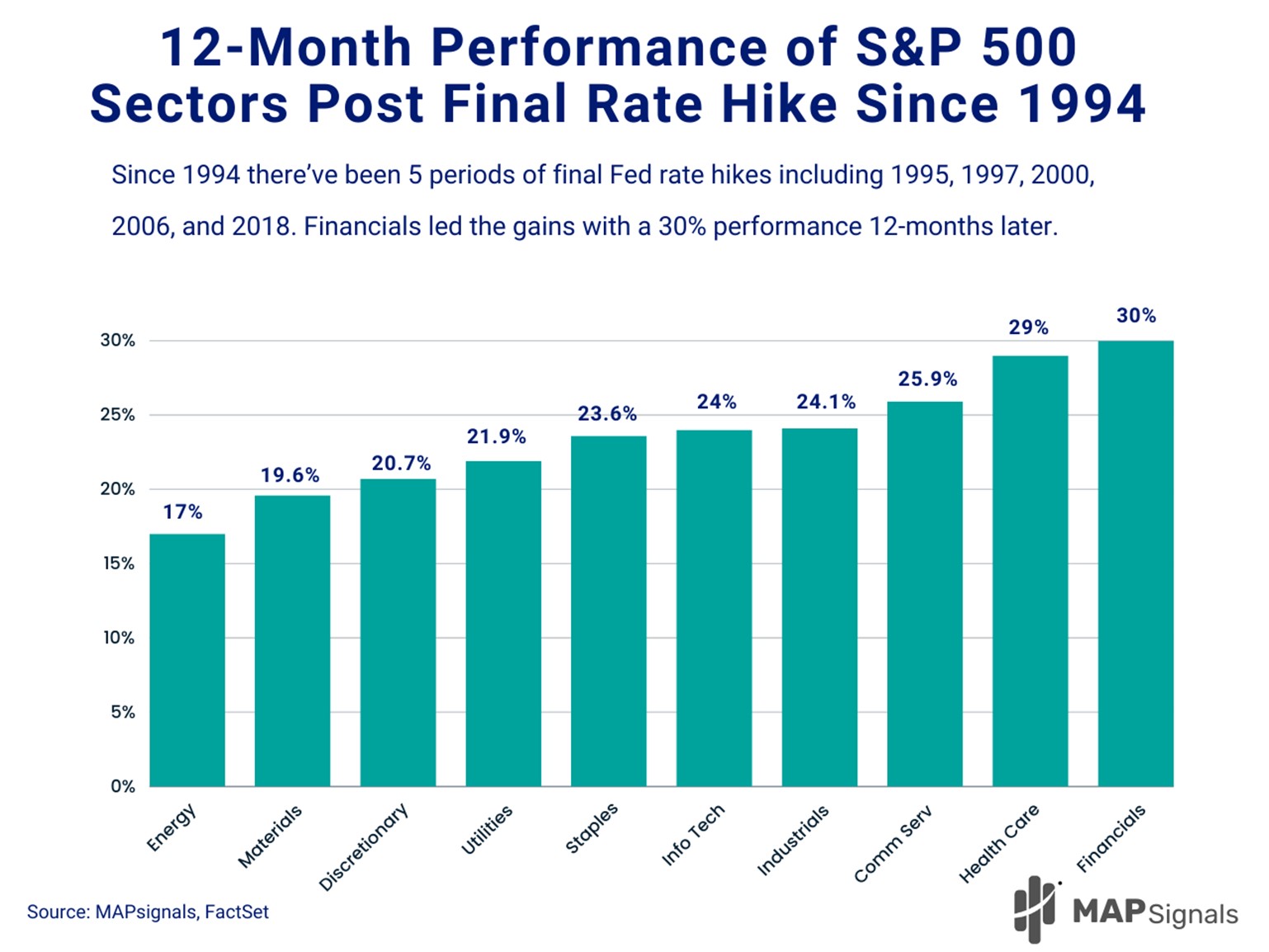

Here’s the 2nd analytical study. Back in December, we provided one of my favorite studies coming into 2024. Whenever the Fed stops hiking interest rates, Financials reign supreme.

Since 1994, post the final Fed interest rate hike, the Financials sector gains 30% on average a year later:

This chart offers a macro greenlight for banks, asset managers, and financial data firms. These are best-of-breed right now.

And it should make intuitive sense. As short-term yields fall, the yield curve steepens. Additionally, capital costs shrink. Both of these lead to more profits.

This is also why big investors are gunning for high-quality financial stocks.

Many of our top ranked stocks in Financials are up double digits since first being profiled in our weekly Sector Top 20 report.

Below is a blurred snapshot from yesterday’s release. You can see that the Top 20 equities are all up handsomely since first being profiled. The RETURN column indicates the performance since the ticker first made the list.

Additionally, I’m showing the non-blurred Bottom 10 that’s also included each week. Keep in mind that for our Financials Sector we group REITs in the mix as well.

Those areas have been hit hard with many of double digits since making the report. It drives home why having a solid process in place can help you navigate leaders and laggards in bifurcated markets:

The data has spoken: Keep betting on elite financial stocks in 2024. The technical, mechanical, and macro setup favors even more green in the months ahead.

There’s plenty of green under the surface.

Let’s wrap up.

Here’s the bottom line: We are banging the gong on financial stocks again. Since the market lows back in October, the group has gained over 30%, nearly in line with Technology performance.

Given the ultra-thrust signal that fired in December that suggests nearly 30% gains a year later for the group…keep betting on elite financial stocks in 2024.

Couple this with the fact that after the final Fed hike is in, Financials gain 30% a year later.

But the evidence doesn’t stop here. Financials have vaulted to a top sector in our data and our leading Top 20 stocks breaking out today are in this arena.

Don’t let new leadership pass you by.

Under the surface is a lot to like…use a map to find to spot the opportunity!

If you’re a serious investor, professional, or Registered Investment Advisor (RIA) looking for market leading research you can’t find anywhere else, get started with a MAP PRO subscription.

Learn the stocks our system loves and get member updates with actionable insights.