4 Smart Reasons to Buy Energy Stocks Now

Boomtown isn’t just in growth stocks anymore.

The data is shifting.

Here are 4 smart reasons to buy energy stocks now.

The Fed effectively greenlighted stocks at yesterday’s meeting. With 3 rate cuts estimated for 2024 in the dot plots, Wall Street and policy is in lockstep.

Markets like to be on the same page.

This is great news for many pockets of the market outside of the red-hot Tech space. A soft landing effectively promotes all sectors, which indicates a broadening of the rally.

I personally have been waiting for indications that our data is ready to turn higher…I believe it’s finally here.

Down and out small-caps are primed for upside. Beginning last week, our sectors shifted in rather dramatic fashion as large investors began betting in non-growth areas of the market…like oil and gas stocks.

Today we’re going to make the data-driven case to add Energy stocks to your portfolio.

Strap on the hardhat and let’s drill down.

4 Smart Reasons to Buy Energy Stocks Now

Our overall bullish stance coming into 2024 hasn’t changed one bit. Sure, there’s been some bobbing and weaving for indices along the way, but stock picking has been incredible.

Calls for a broadening of the rally are taking hold in a great way. There is new leadership appearing.

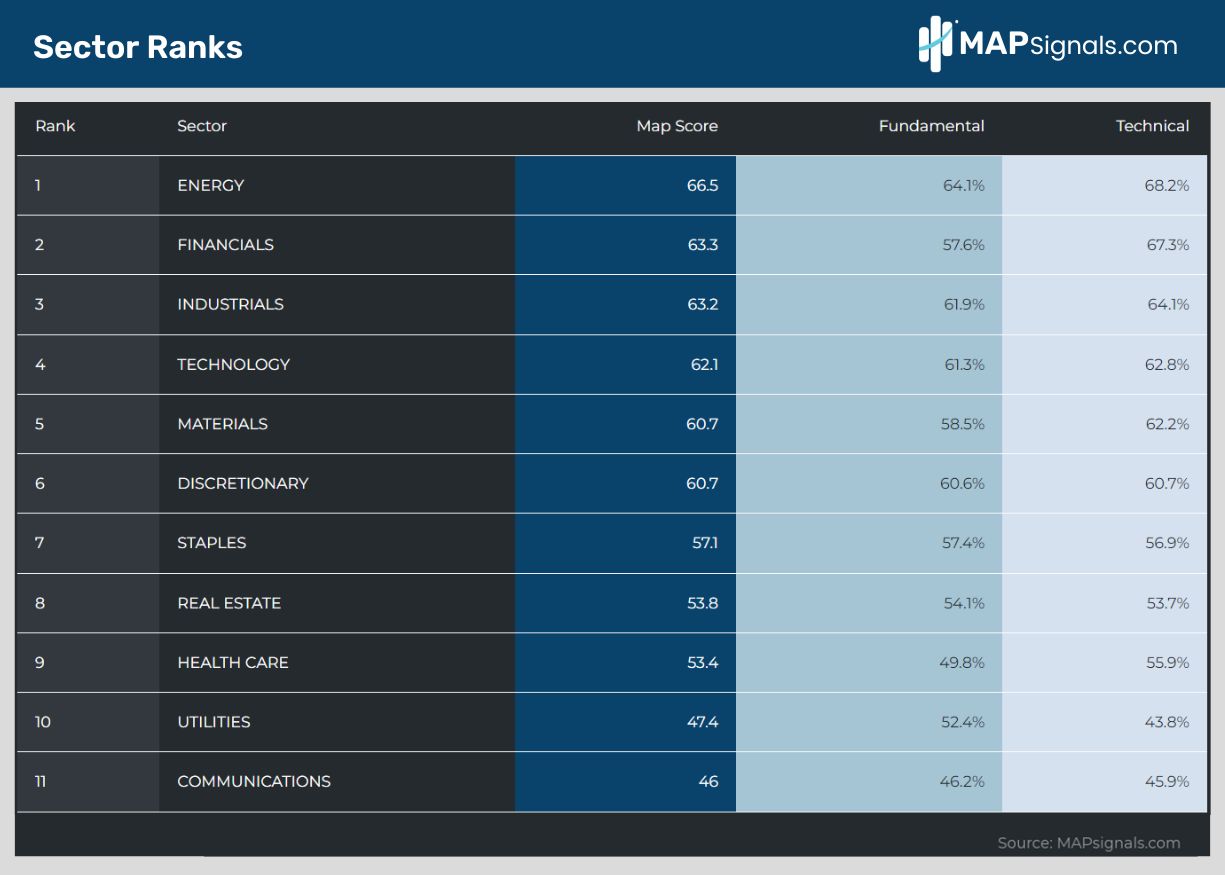

Reason number 1 to own Energy stocks is purely based on it now being the top sector by ranking in our data.

What’s even more striking is that Technology, which gets all the media attention, fell to 4th place:

Before you go and sell your Technology stocks, just consider what this graphic means. It’s taking an average weighting of all stocks in each sector and plotting the score.

On a relative basis, Energy, Financials, and Industrials have shot up in rank. Those 3 areas show more broadening under the surface than Technology does currently.

This is great news for value-minded investors.

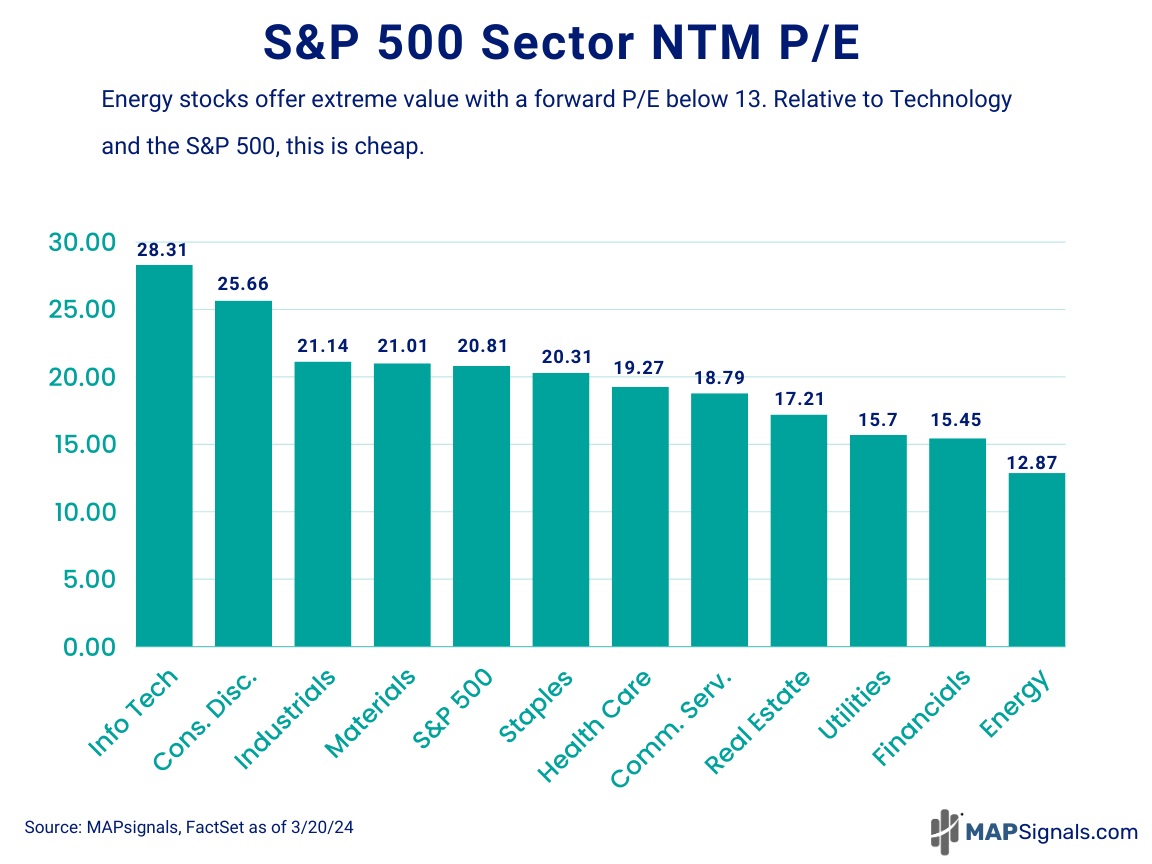

Which brings us to the number 2 reason to buy Energy stocks now: they are outright cheap. Below reveals this beautifully.

As of 3/20/24, the S&P 500 clocked in at a rich next-twelve-month P/E ratio of 20.81. When you contrast this to the Energy patch’s P/E of 12.87, value suddenly appears:

Even more remarkable is Energy’s valuation relative to Technology stocks, with the Info Tech sector valued at 28.31Xs forward earnings.

Believing all stocks are wildly expensive right now is wrong. Energy and Financials both sport depressed relative prices.

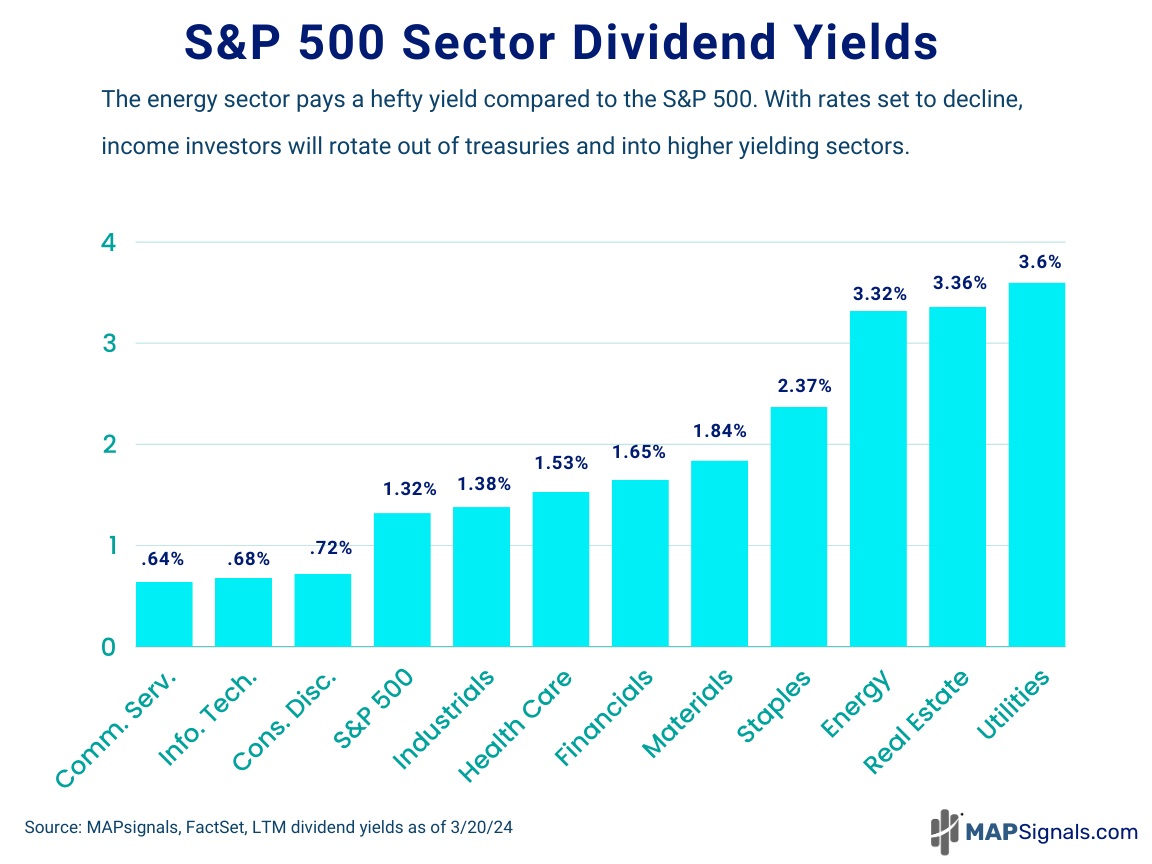

But we can’t stop here…possibly the most important reason that Energy stocks deserve a hard look is the fact that they pay you handsomely to own them.

If you recall, history proves that over 40% of the market’s long-run returns are due to dividends. Investing without them is foolish.

Reason number 3 to scoop up Oil & Gas names is their attractive dividend yield. Currently, Energy stocks offer a payout of 3.32%. That’s 150% higher than the S&P 500’s yield of 1.32%.

Given that interest rates are heading lower soon, the crowd that’s been hiding in money-markets are going to be looking for income replacements.

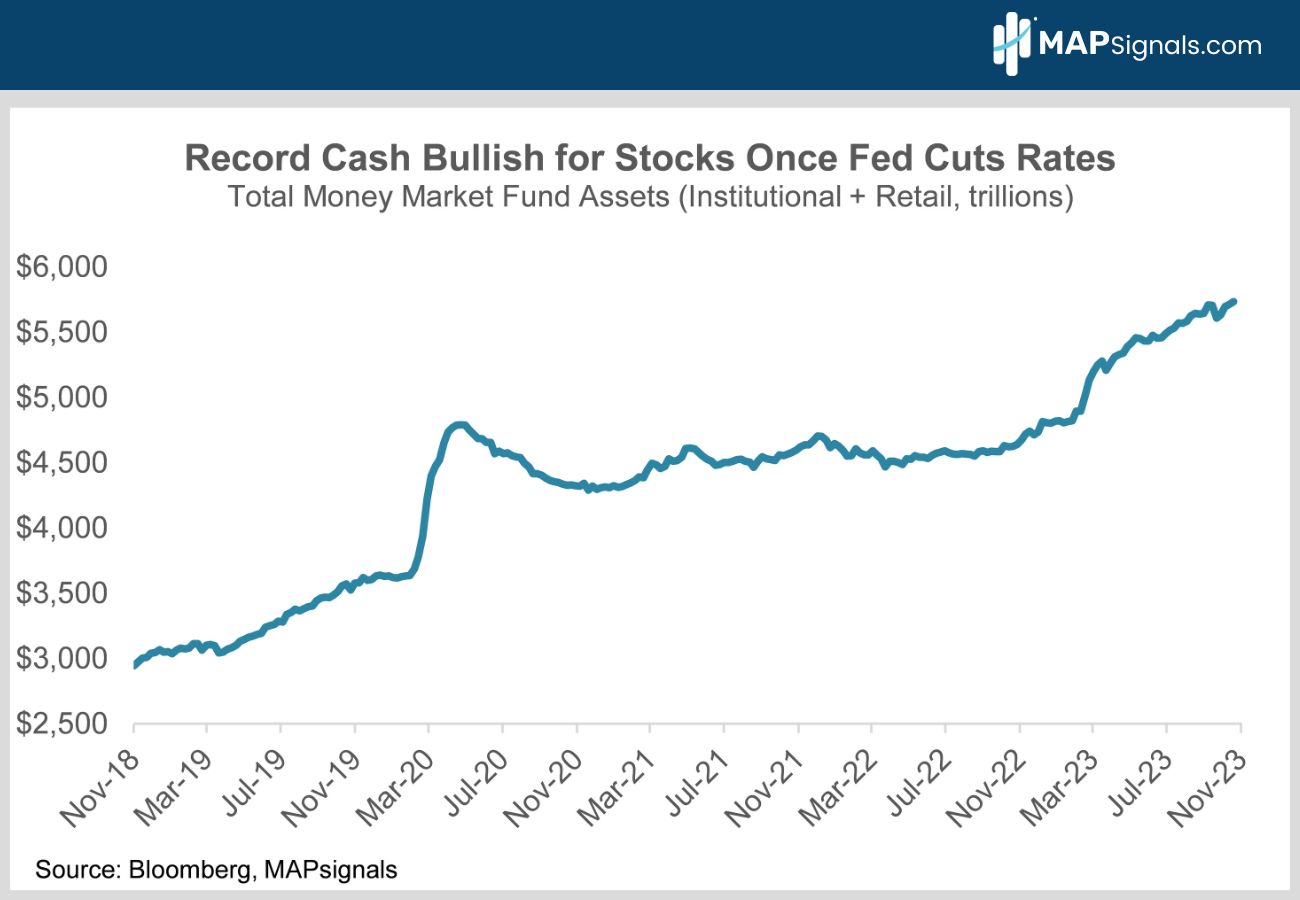

This brings us to the number 4 reason to consider energy names: Cash is going to become less attractive as interest rates decline.

Yield thirsty investors will eventually 2nd guess their reasoning to keep their devotion to money market funds.

It doesn’t take a genius to know that dividend stocks offer a solid alternative for income needs. Investors will likely refuel portfolios with attractive energy companies.

Let’s review what a crowded trade looks like with a chart of $6T+ in money market accounts:

It’s all coming into focus. New leadership in Energy makes a lot of sense tactically and from a macro perspective.

And this new dynamic has reshaped our Top 20 report this week. Energy and Industrial names represent 55% of this stock list.

If you’re looking for new names to consider given this brand-new shift, we’ve got you covered.

Let’s wrap up.

Here’s the bottom line: The crowd is dazzled with growth stocks. That’s fine, but don’t count out a soft-ball setup happening in the Energy sector.

Select oil & gas names are top ranked, lowly valued, and offer rich yields. Even more important is the fact that trillions of dollars in money markets will be hunting for new income sources…

This represents a fat opportunity if you know where to hunt.

That’s why a market map is so useful!

Now’s a perfect time to jump on a new trend.

Follow the money!

If you’re a serious investor, or a Registered Investment Advisor (RIA) ready to take your portfolio research to the next level, get started with a MAP PRO subscription today.