Prepare for a Summertime Pullback

Roll out those lazy, hazy, crazy days of summer. – Sam Cooke

Markets are approaching a seasonally weak time of year. It’s prudent to prepare for a summertime pullback.

WOW, what a difference a year makes. Many have forgotten how just one year ago the crowd wanted nothing to do with stocks. Prophetic sermons of economic collapse echoed from the media pulpit.

Fast forward to today and pundits are praising the rally. It’s a reminder that prices re-adjust investor sentiment.

Lucky for us, we don’t follow the crowd. We follow data and evidence.

Today’s message is simple. Expect equity weakness in the weeks ahead. We’re approaching 2 near-term headwinds: an overbought Big Money Index (BMI) and seasonal weakness.

The bull market isn’t over, it’s just due for a pause.

Let’s now review the evidence and take stock of the summertime market climate.

Prepare for a Summertime Pullback

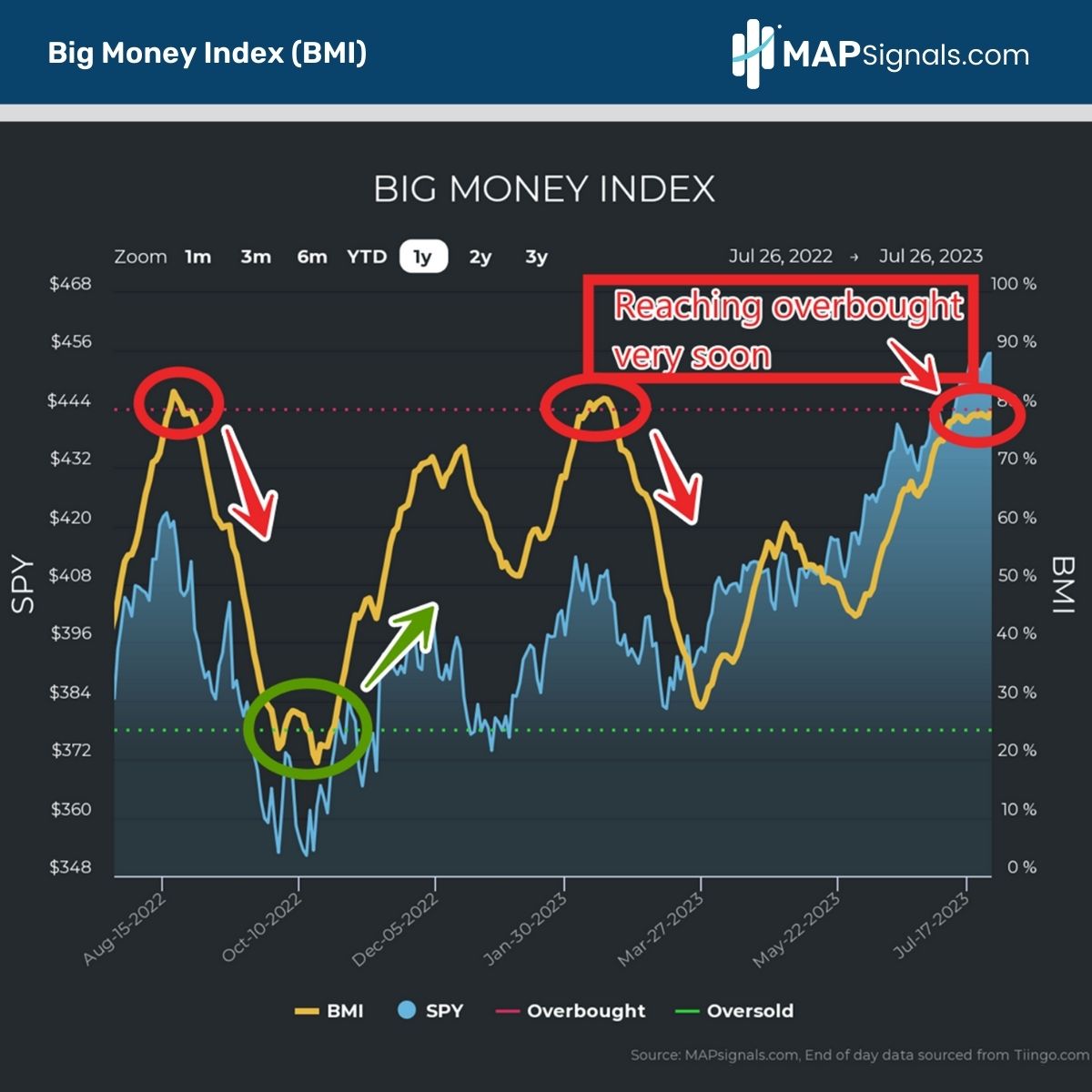

Three weeks ago, I laid out an overbought stock market playbook. In it, I noted how we’d reach the red zone in a couple of weeks. We’re now moments away from piercing the 80% threshold:

The far-right red circle shows how the BMI is ready to ramp into overbought territory. Now, at first glance this could cause concern, but remember that overbought readings aren’t a market death nail.

Going back to 2009, the forward 1-month return of the S&P 500 is a modest +.2% once we breach the red zone. Basically, stocks take a breather from the break-neck pace of inflows.

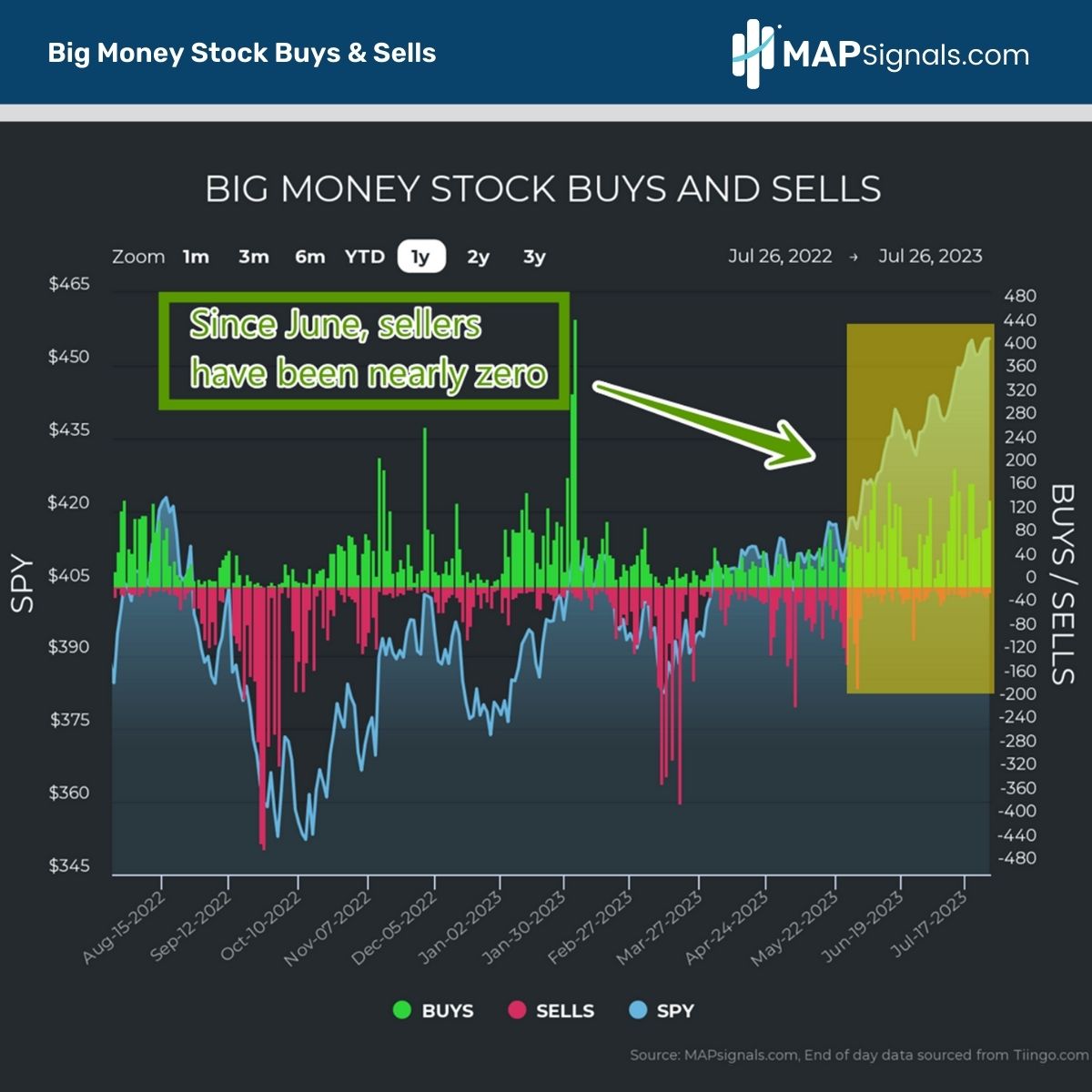

Diving below the surface we see the main reason for hitting the caution area: a lack of sellers. In early June, our data showed that a mega rotation was upon us, small-caps were under heavy accumulation.

They say the proof is in the pudding. Since that non-consensus call, breadth has improved mightily.

Below you’ll see how that’s the main reason our market barometer has steadily climbed. When selling drops, stocks pop:

That’s what a bull market looks like through the lens of data. In a noble effort, prolific bears keep falling on the sword.

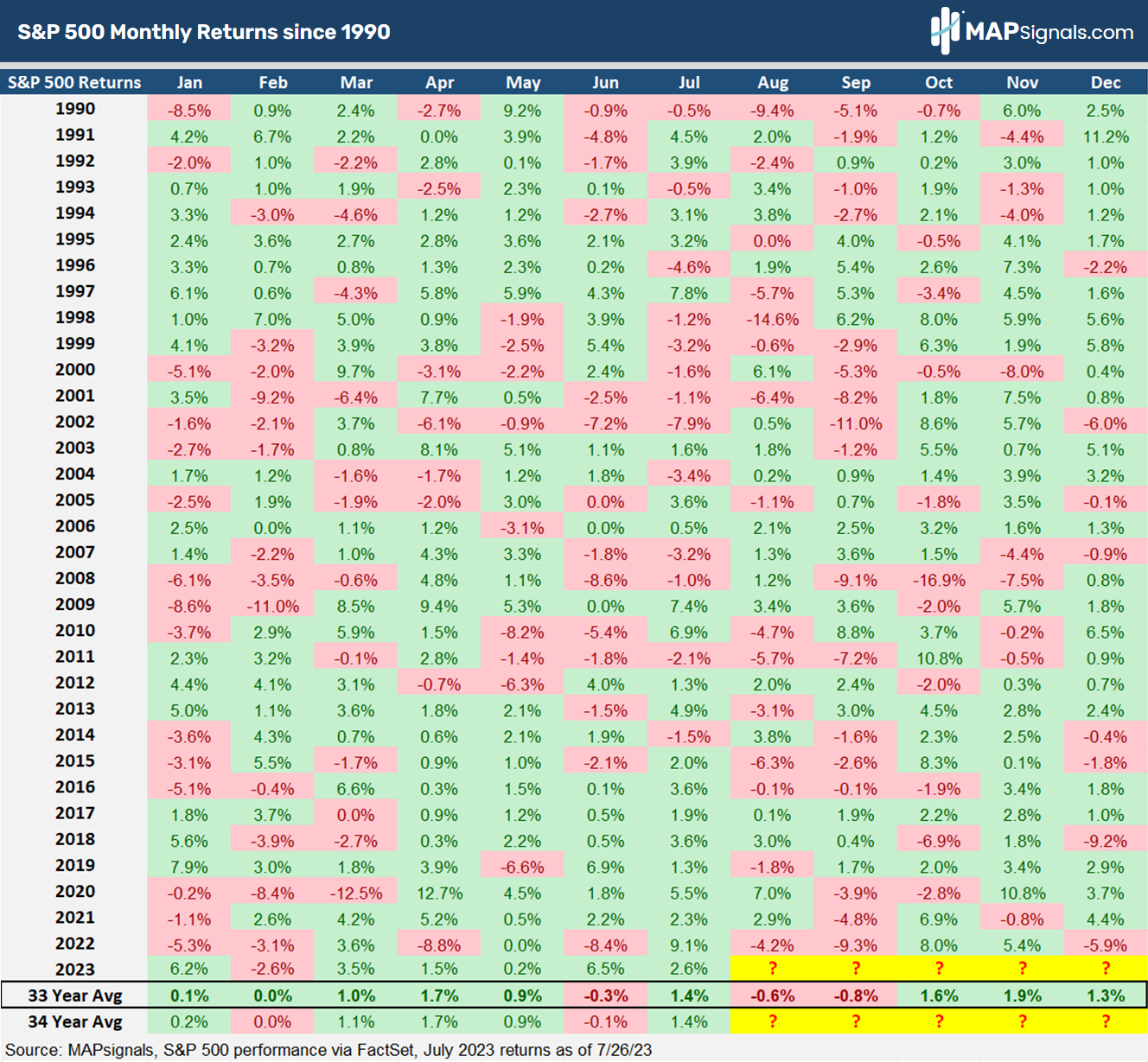

Now you may be wondering why I’m telling you to prepare for a summertime pullback. History proves that August – September is hurricane season for stocks. Recall last year I boldly suggested you prepare for September volatility…boy did it come.

Going back to 1990, August and September are the weakest months of the year by far. The S&P 500 falls an average of -.6% and -.8% respectively:

This’s why you should prepare for a summertime pullback now while the getting is good. Overbought markets coupled with seasonal challenges, could be the perfect bear-infused-cocktail.

So, what’s the prudent move to make as an investor?

Internally, we’re telling our subscribers to watch the BMI, as that’s the line of truth. When it begins to fall, it signals that the bid for stocks is abating. That’s how pullbacks begin.

Focus on best of breed stocks, like those in our research that are under heavy institutional accumulation with the strongest fundamental scores. That’s where the alpha lies…AKA the leaders of tomorrow.

Let’s wrap up.

Here’s the bottom line: Markets are about to hit overbought levels coinciding with a seasonally weak time of year, August and September. Prepare for a summertime pullback by making your equity wish-list now.

As I’ve said all year, we’re in one of the strongest markets in recent memory. Odds are that the dip will be shallow and scooped up quickly.

The crazy days of summer are around the corner.

Don’t get the summertime blues.

Follow the Big Money clues.

If you’re a professional money manager or are serious about investing, get started with a MAPsignals PRO subscription today.