Reaching Oversold Conditions

They say the trend is your friend. But sometimes trends reach extreme points, causing snapback conditions.

The flow of money has been one way in 2022: out. But it’s not all gloom. Quickly we are reaching oversold conditions.

The backdrop for stocks has been sour all year. We’re dealing with runaway inflation, war, extremely negative sentiment, and more. There seems to be a never-ending list of reasons to be bearish on markets.

However, potential positives could be setting up for stocks in the months ahead.

Today I’ll give some thoughts on yesterday’s ugly CPI number and then hop into the one MAPsignals indicator flagging my attention.

With all the negativity, it’s time to get more constructive on stocks.

Inflation Keeps Running Hot

The June Consumer Price Index (CPI) came in red hot yesterday. Headline inflation climbed 1.3%. But the sticker shock was the year-over-year rise of 9.1%. That gain is the largest since 1981! On the surface, that’s a nasty print. Those that hoped we were at peak inflation (me included) may have to wait a little longer.

Two of the main culprits for the surge in inflation are areas we’re all familiar with: Energy and food costs. Energy prices soared 7.5% and food rose 1%. Gasoline prices jumped 11.2%, but keep in mind that consumers will see some relief as lower gasoline prices make their way into future CPI prints.

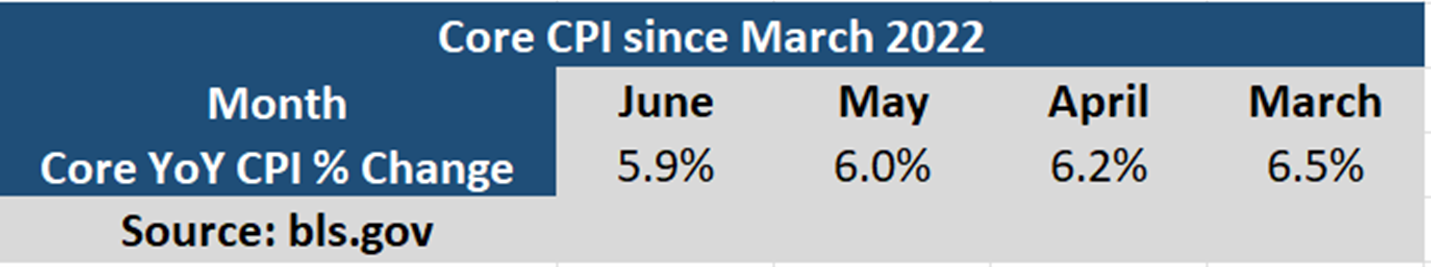

And while it’s hard to paint the CPI with a rose-colored brush, I’ll try. What’s encouraging from yesterday’s number is the slow moderation in core CPI, which removes food and energy costs from the calculation. Since March, core CPI has been decelerating.

Outlined below, core inflation peaked in March 2022 with an annual YoY gain of 6.5%. Every month since, prices have moderated. June’s core rate came in at 5.9%:

Now, 5.9% is not a great number by any stretch, but the trend is declining. While the headline CPI numbers are gross, the core rate is sending a message that peak inflation could come sooner than many believe.

Wrap in the recent fall in energy and commodities, pricing pressures should slide further. That’s good news looking forward. Eventually inflation will peak, and the pace of rate increases will slow… and that will give ballast to stock prices. My guess is Q4 is when the outlook will brighten.

And I’ll be clear, we aren’t out of the woods, yet. But I view times like now, when pain is high, as an opportunity to be proactive. There’s a technical level we’re approaching that’s worth paying attention to.

Reaching Oversold Conditions

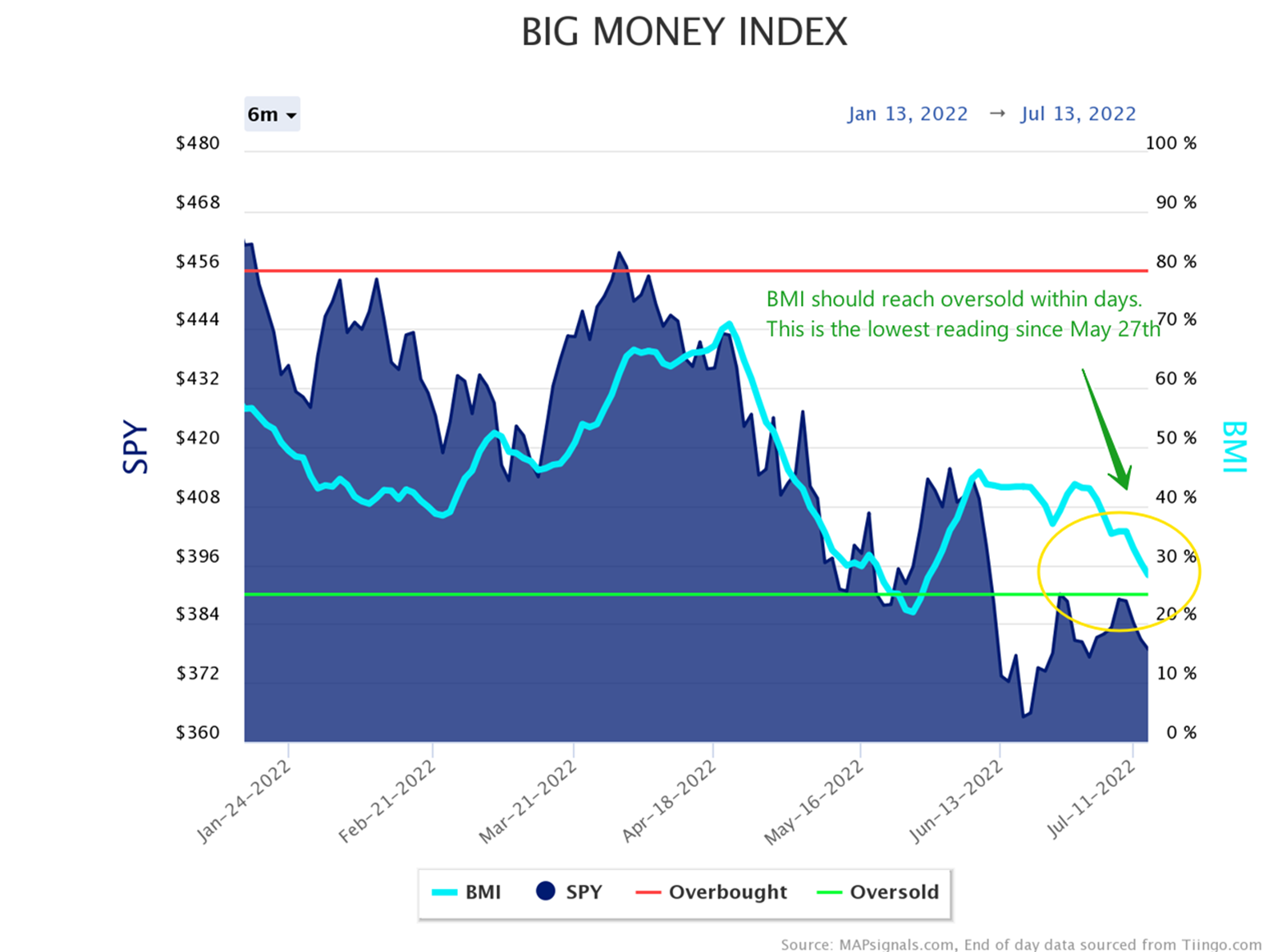

You guys know we love data here at MAPsignals. Following stock volumes allows us to peek into insights not found anywhere else. Our biggest indicator, the Big Money Index (BMI), is quickly approaching oversold levels.

As a reminder, the BMI is a 25-day moving average of our buy and sell signals. In normal markets, we follow the trend. If money is rushing into stocks, we want to be along for the ride. If money is flowing out, odds are stocks are going to fall.

But there are boundaries that once crossed, the selling becomes unsustainable. That level is quickly approaching. Currently, the BMI is sitting just above oversold levels at 28%:

A 25% reading or below is oversold. The last time we breached the green line was back on May 24th, and prior to that was the pandemic lows of March 2020. Odds are we’ll pierce the green zone in the coming days.

Since 1990, we’ve hit oversold 21 times. You can read up more on prior oversold periods here. For value hunters, this is a prime time to be nibbling at high quality stocks.

As a reminder, the forward 1-year returns for the S&P 500 after coming out of oversold is 16%. Two years later it’s a whopping 29.2%.

The important message here is history points to better days ahead for stocks. Sure, there’s a lot of work to be done on the macro front, there’s no denying that. But also keep in mind that selling of this magnitude won’t last forever either.

When everyone’s thrown in the towel, that’s when bottoms begin to form. An oversold BMI indicates a rare opportunity. It’s time to get proactive.

Let’s wrap up.

Here’s the bottom line: Everyone’s fearful right now. Inflation is running super-hot with the latest CPI print surging to levels not seen since 1981. However, core CPI has been moderating. That leads me to believe peak inflation could be here later this year.

But as it relates to data, our Big Money Index should be reaching oversold conditions in the days ahead. Historically, those are incredible opportunities to value hunt. Some of the best pickings come when fear is highest.

And with earnings season here, my bet is new leadership is set to emerge. And that’s what makes the investing game worthwhile.

As Shelby Davis once said, “You make most of your money in a bear market; you just don’t realize it at the time.” I couldn’t agree more!

Where are you looking for opportunity?

***If you’re wanting to follow the Big Money Index live, get started with a MAPsignals subscription. Let data help inform your investing.