Small Caps Take the Lead

This bear market has been brutal. Between sticky inflation, a hawkish Fed and a looming global recession, bulls can’t seem to catch a break.

2022’s big macro headwinds have hit tech stocks hardest, pressuring the S&P 500 and NASDAQ. It’s been easy to miss better performance under the surface.

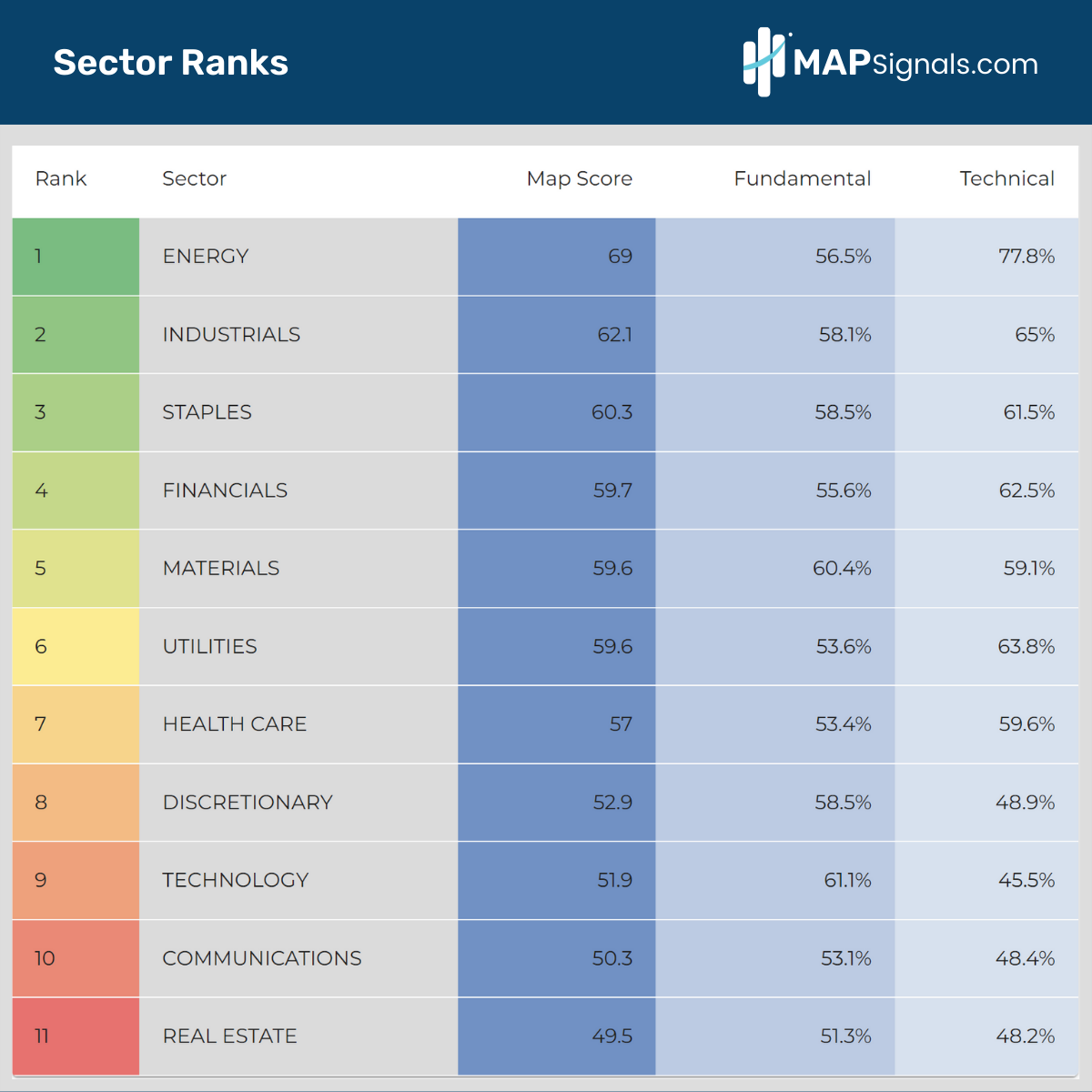

MAPsignals has been highlighting energy and defensive sector leadership all year. Now, we’re seeing big money in-flows emerge in big cyclical sectors like industrials and financials. The rotation is alive and well.

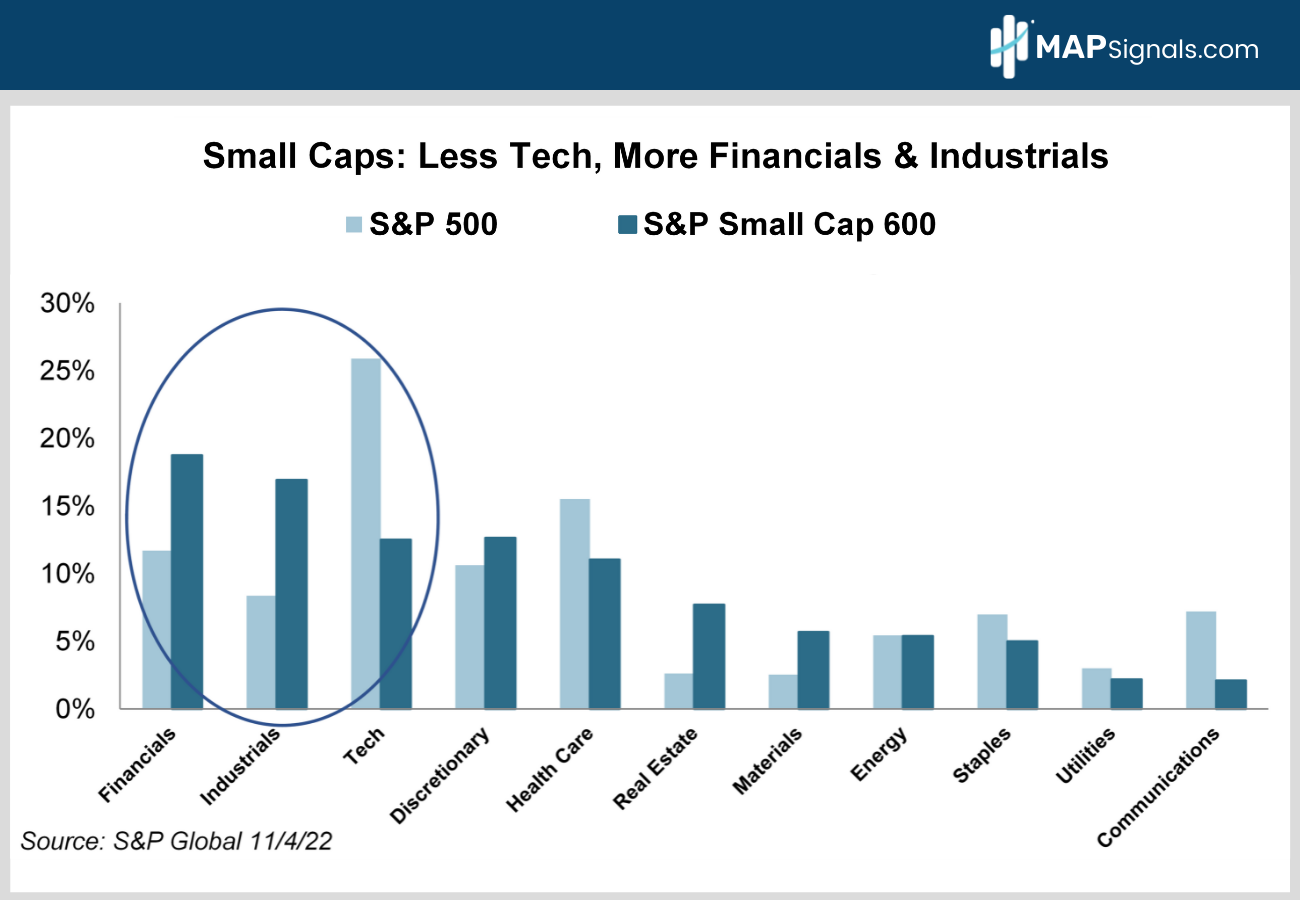

That’s great news for small caps. Major small cap indices are loaded with cyclicals and light on tech and communications. That’s helping small caps take the lead!

Today, I’ll show you whether small cap leadership can last. Then, I’ll lay out which ETF looks best in this environment.

Ok let’s start with some market history.

Small Caps Take the Lead

So, why are smaller companies leading right now? There are a few reasons:

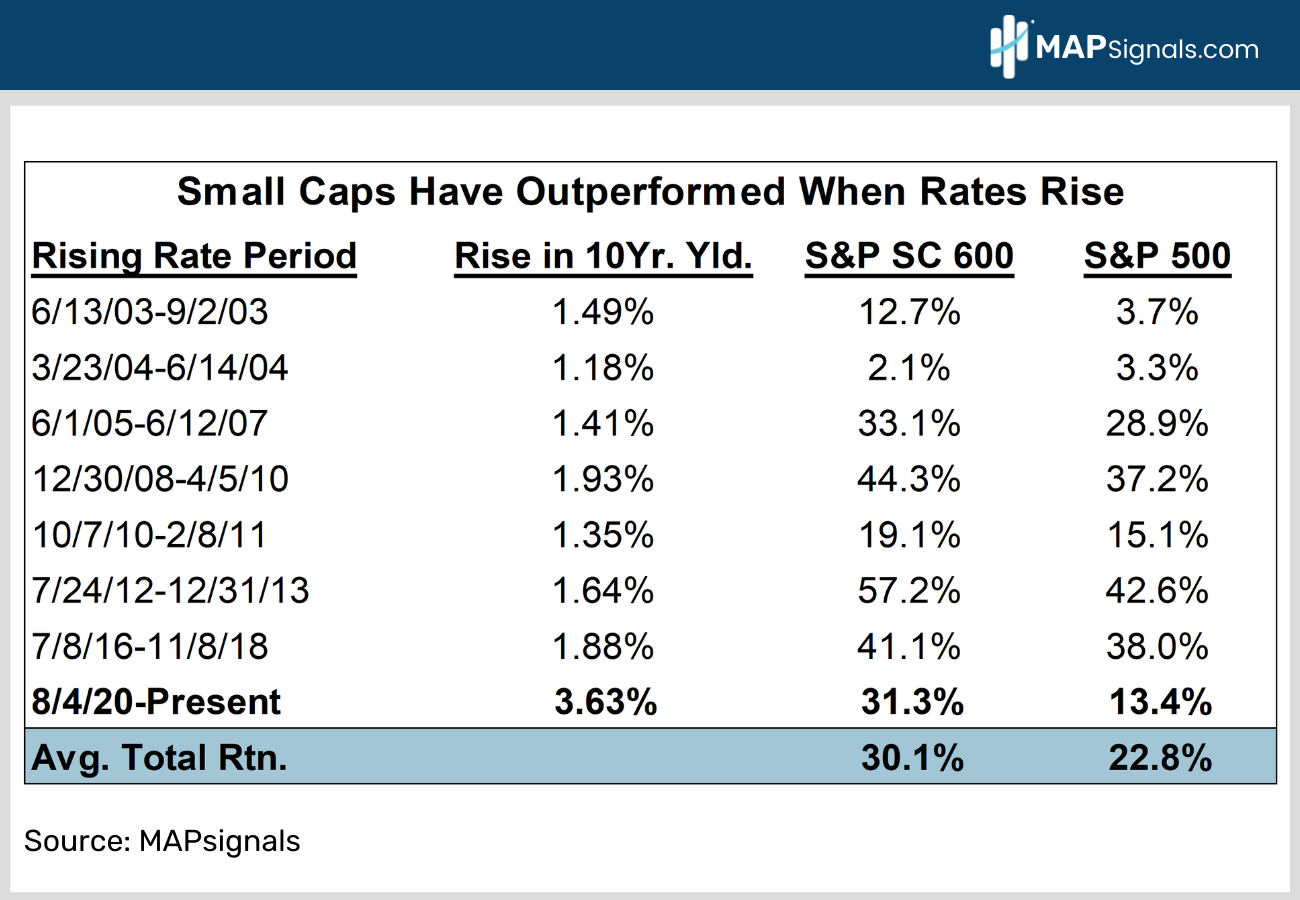

- Less Sensitive to Rising Interest Rates: Small caps have historically outperformed large caps when rates rise (table). That’s definitely held true this cycle. Since rates bottomed in August 2020, small caps are up 31% vs. a much smaller 13% gain for large caps (table).

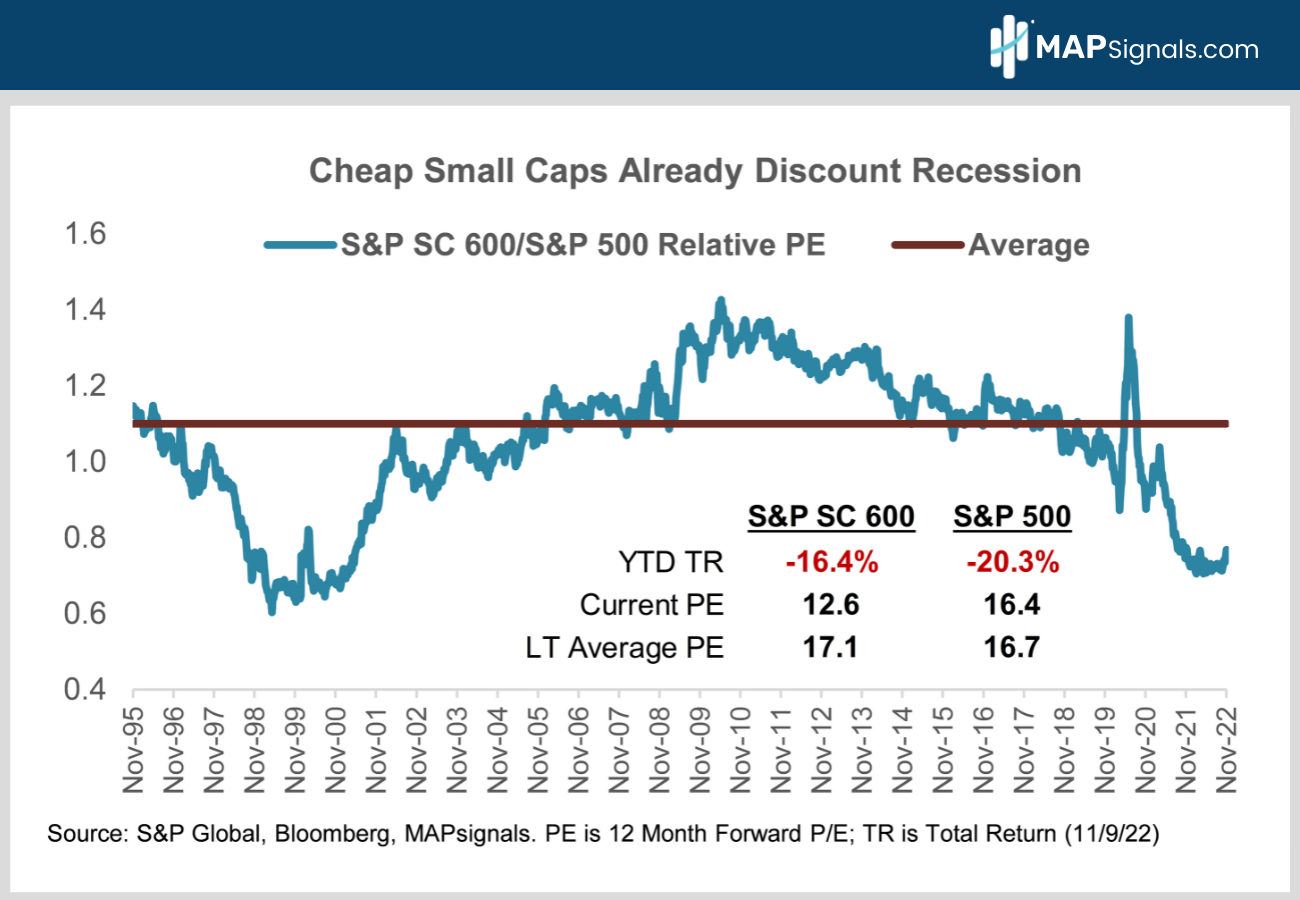

- Cheap Valuations: Investors want stocks whose depressed valuations already discount a recession. Small caps fit the bill. They trade at only 12.6X 12-month forward earnings vs. a long-term average of 17.1X. That’s a 23% discount to the S&P 500’s 12MF valuation of 16.4X (chart).

- Less Sensitive to Dollar Strength: On October 10, I told you the greenback was peaking in Don’t Fear King Dollar. The dollar is down 9% since, but it’s still up 13% from its cycle low in May 2021.

Dollar strength hits large caps hardest because they derive 40% of their sales overseas vs. only 21% for small caps. A firm buck is a double-whammy for big multinationals – it makes their products more expensive overseas, and it dilutes profits when their foreign sales convert into fewer dollars.

With the macro supportive of higher small cap prices, here’s how you can take advantage.

How to Play it

- The two leading small cap ETFs are the $59B iShares Core S&P Small-CapETF (ticker: IJR) with an expense ratio of just 0.06%, and the smaller, $53B iShares Russell 2000 ETF (IWM), which charges 0.19%. IJR has a slightly higher MAPsignals map score of 57 vs. 55 for IWM.

- The S&P 600 index a higher quality slice of the small-cap universe because it requires its constituents be profitable. 30% of Russell 2000 constituents lose money. That makes IJR a better choice if we hit a recession and/or rates keep climbing. Money losing companies rely heavily on debt to stay afloat, leaving them vulnerable as the economy cools or the cost of capital rises.

- Both ETFs give you much less tech than the S&P 500 and lots more exposure to newly outperforming cyclical sectors like industrials and financials (chart). Industrials have the second highest sector map score of 62.1 behind energy at 69. Financials rank fourth at 59.6. In short, small caps’ sector mix is increasingly well suited for this market.

And below is a snapshot from our portal of sector ranks:

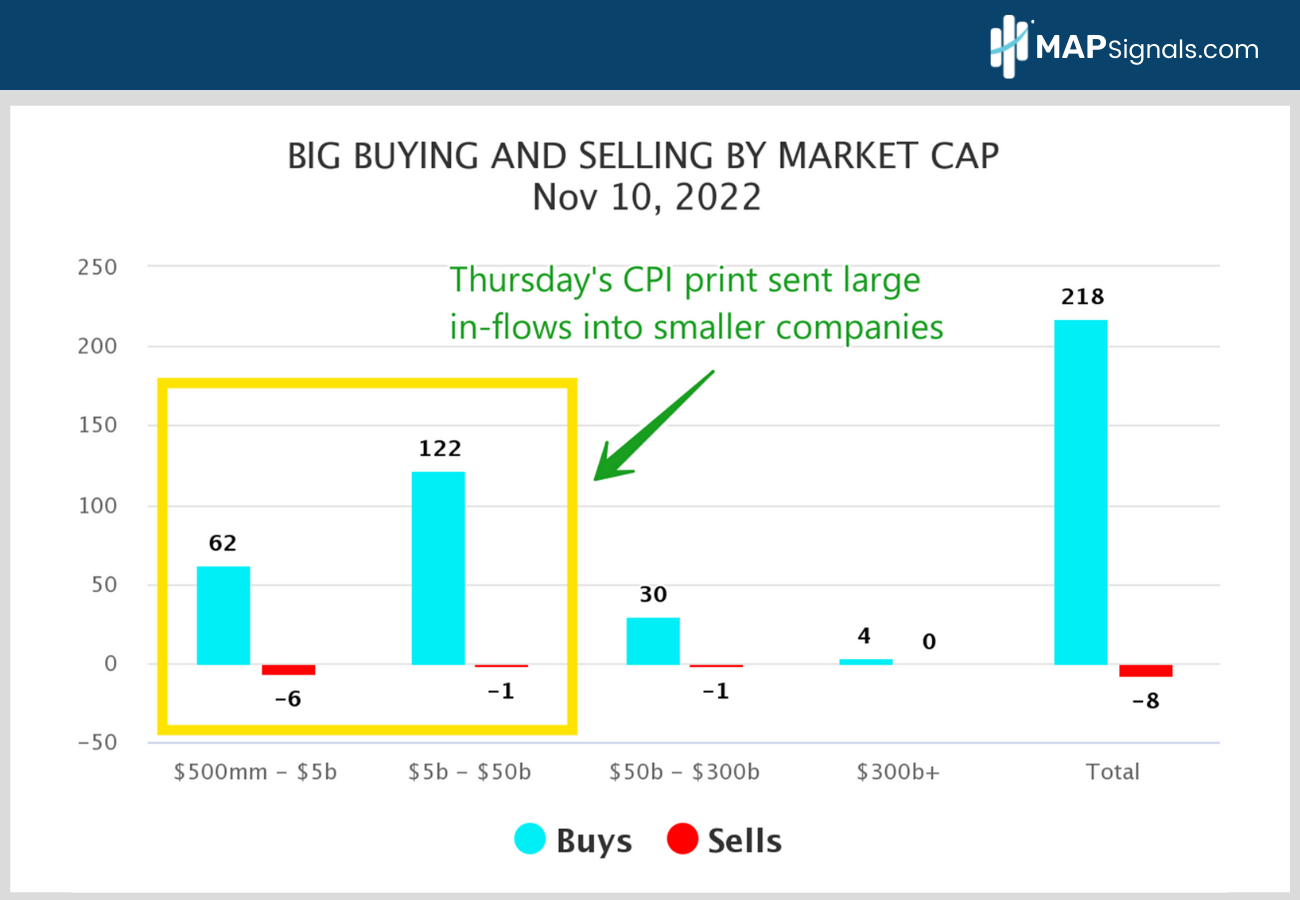

And finally, our data has been tracking lots of money rushing into small-caps the last few weeks. And Thursday’s weaker than expected CPI print only accelerated that theme. See that below in our Buy and Sells chart by market cap.

Thursday saw the most buying in over a year. Nearly 85% of stocks bought were in companies with market caps of $50B or less:

The macro backdrop favors small-caps right now. And the Big Money confirms that message. That’s a strong 1-2 punch!

Bringing It All Together

Everyone’s terrified a recession will devastate profits. The good news is depressed small company valuations already discount dismal earnings. And small caps also have less sensitivity to big macro headwinds like rising rates and dollar strength.

Throw in less exposure to wobbly tech stocks and a bigger allocation to the newly resurgent financials and industrials sectors, and you’ve got a recipe for success.

Add it all up and small caps just offer a better risk reward trade-off than large caps right now. That’s why they’re starting to outperform. Small caps take the lead in my book.

If you’re wanting to get specific small cap stocks ramping with Big Money support, get started with a MAPsignals platinum subscription. It’ll get you access to our portal that updates every morning, showcasing the stocks getting bought and their scores.

There are plenty of names outperforming right now. Let MAPsignals help you find them!

Invest well,

-Alec