Stock Market Pocket Aces

Hold’em poker is a game of skill. When the odds are in your favor, move your chips to the center.

The same goes for stocks. Bet big when you hold stock market pocket aces.

You may not know this about me, but I used to play a lot of hold’em poker when I was younger. You see, being a new kid to a Wall Street trading desk, I got to hang out with the older guys. They would show me the ropes.

A few of them loved to gamble. The excitement of throwing stocks around all day was too much to let go of. They needed to keep the thrill going. One way they did that was the weekly poker games.

Me being a junior on the desk, they would bring me along. I loved it. The senior guys had 2 rules: Show up with money in your pocket… and have fun!

If you don’t know the game, it goes like this. Each player is dealt 2 pocket cards faced down. Those are your hole cards.

Betting begins. Then there’s a flop comprised of 3 cards dealt faceup for all players to use. There’s more betting. Later in the game 2 more cards are dealt faceup called the turn and finally the river. The goal of the game is to make the best 5 card hand.

Back to my story. After playing hands for a few weeks and months, I got the hang of the game. Play your cards, but more importantly play the field. The latter is probably the most important aspect of the game. The field refers the other players in the game.

When you play enough hands and tournaments, you begin to craft a situational awareness. Certain players keep winning. Others lose. Some players leave tells. A few are incredibly skilled. Momentum is real…etc.

I ended up being a decent player all things considered. I even won a small tournament in Queens.

But the biggest lesson I learned about the game was to guard my chips until I had an edge. And when I had the table beat, get as many chips in the center as possible.

In many ways, the stock market operates the same way. So often, there’s nothing going on. There’s no edge to exploit. But every now and then everything lines up for stocks to explode higher. The odds are stacked in your favor.

What’s going on now in our data is what I call stock market pocket aces. The odds say we’re going higher. For months we’ve told readers to get bullish. It’s been the right stance to be.

Sometimes the data leaves subtle tells. That’s not today. The Big Money says get your chips on the table.

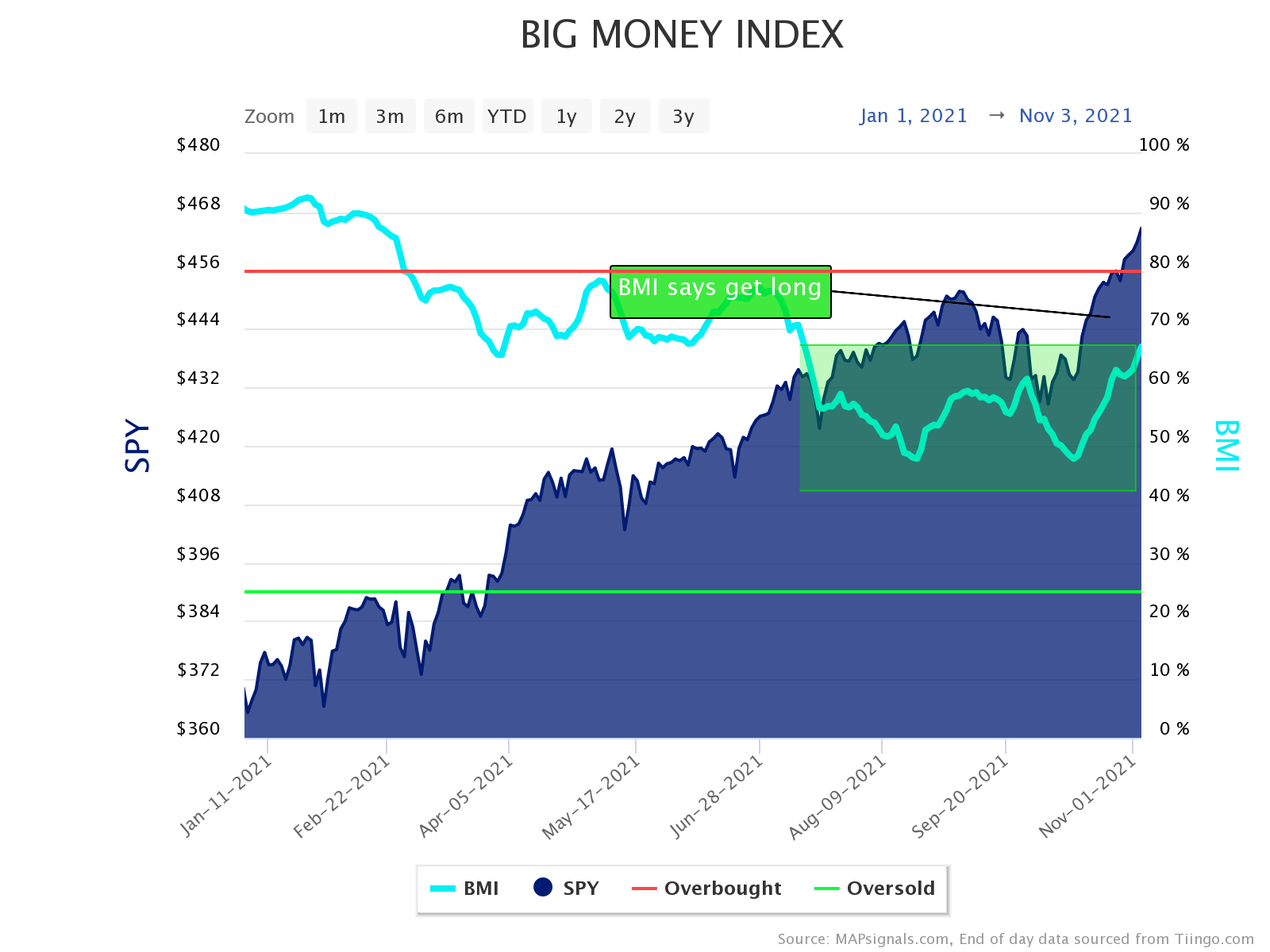

Big Money Index Is Blasting Higher

The overall picture of the market is incredibly bullish. You can see that easily with the Big Money Index. It’s sitting at a 3.5 month high.

The BMI plots the flow of Big Money in and out of stocks. When it ramps like now, take your bear suits off:

When you see the BMI busting at the seams, that’s what we call stock market pocket aces. It means stocks are getting bought in a big way.

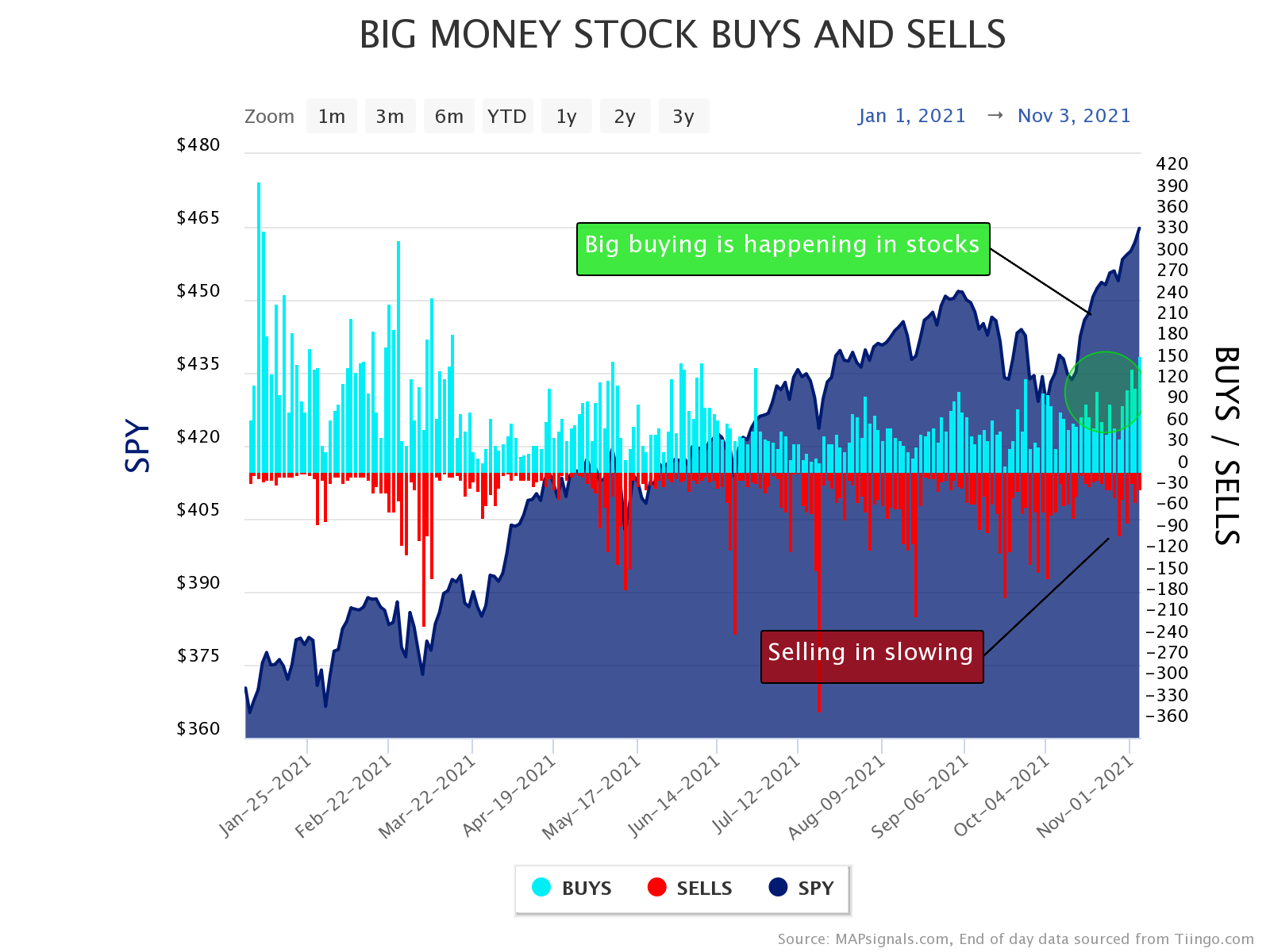

Below are the daily Big Money Stock Buys & Sells. Look how buying is ramping and selling is cratering. When that happens, markets zoom:

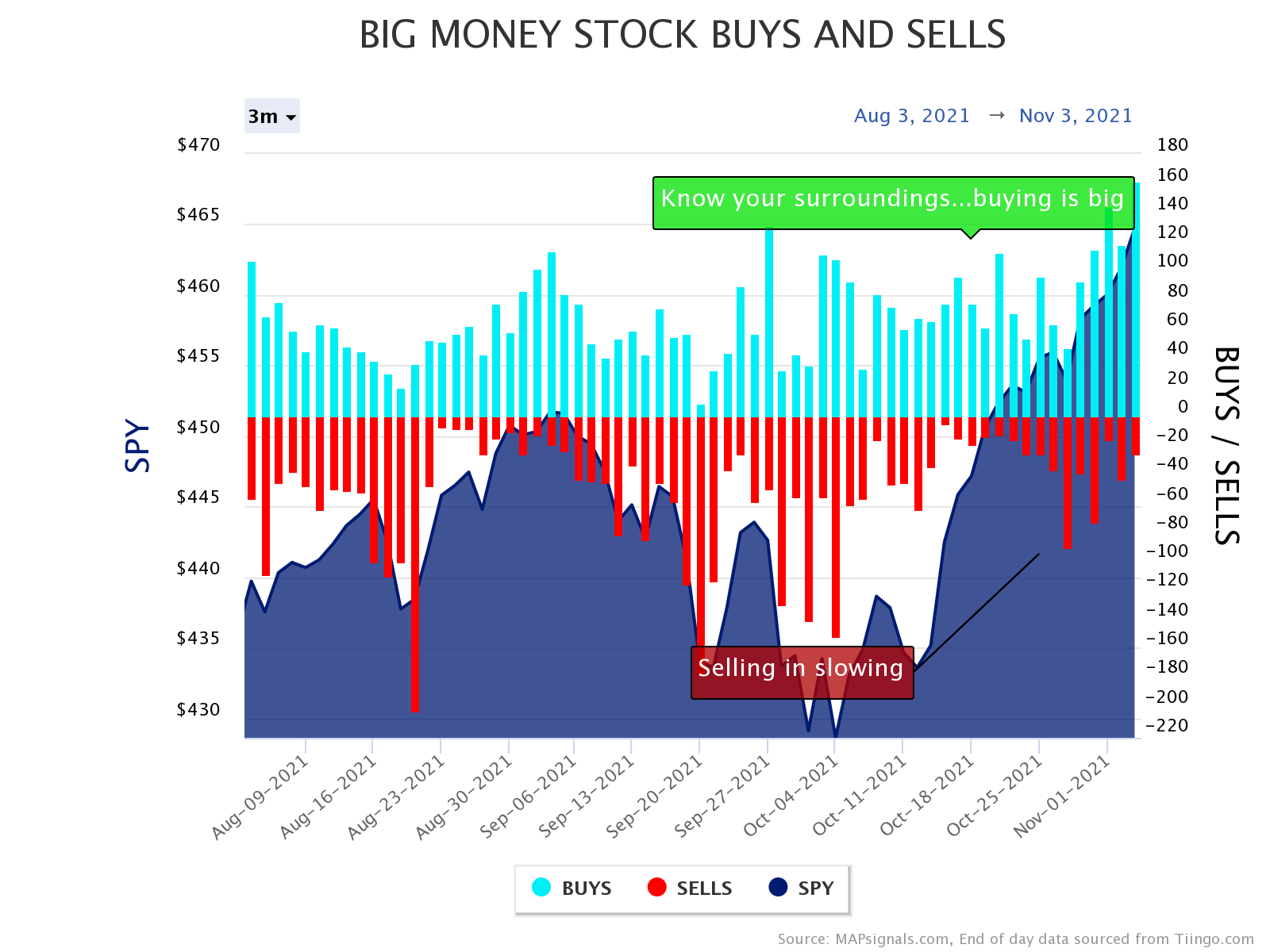

Let me say it again…that’s stock market pocket aces. Let’s zoom in on this chart:

Like I said before, every now and then everything lines up for higher market prices. Today’s action is a buildup after months of rotations. Lift off is finally here.

But let’s dive deeper and size up the field. Sectors show clear patterns.

Sectors Show Stock Market Pocket Aces

When there’s big buying happening under-the-surface, it’s cool to drill down by sector. And you can see where the money’s flowing.

Below are some newer charts for us, soon to be released to subscribers in our portal. Just like our Big Money Stock Buys and Sells chart, we plot the same for sectors.

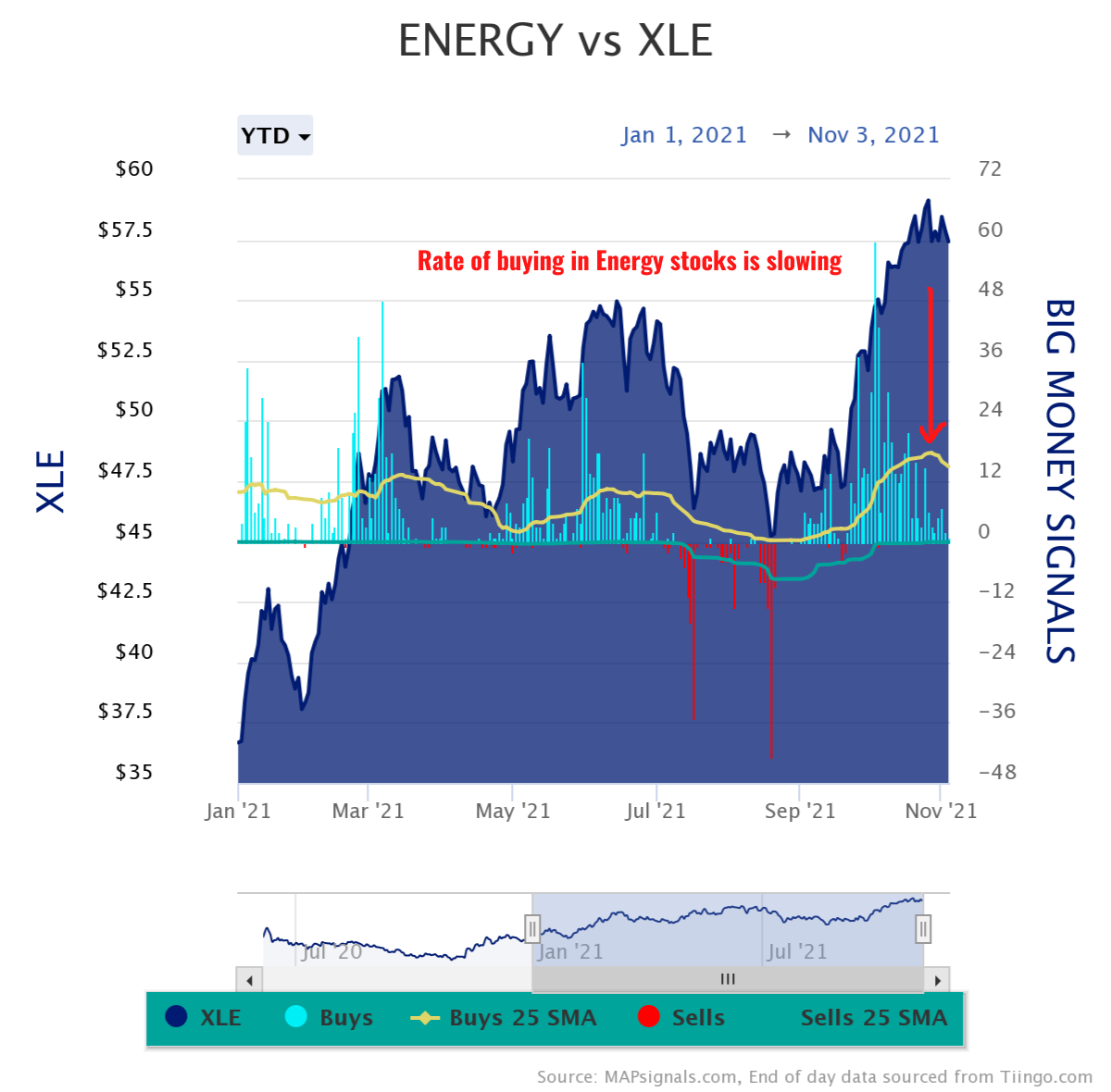

Three sectors are making noteworthy moves right now. Up first is Energy. Most of you know the group has been on fire this year. In 2021, the Energy Select Sector SPDR (XLE ETF) is up 56%.

Epic Big Money has lifted the group to dizzying heights.

But check out how the rate of buying is slowing dramatically. The yellow line is the 25-day moving average of buys. When it falls, that means buying is slowing:

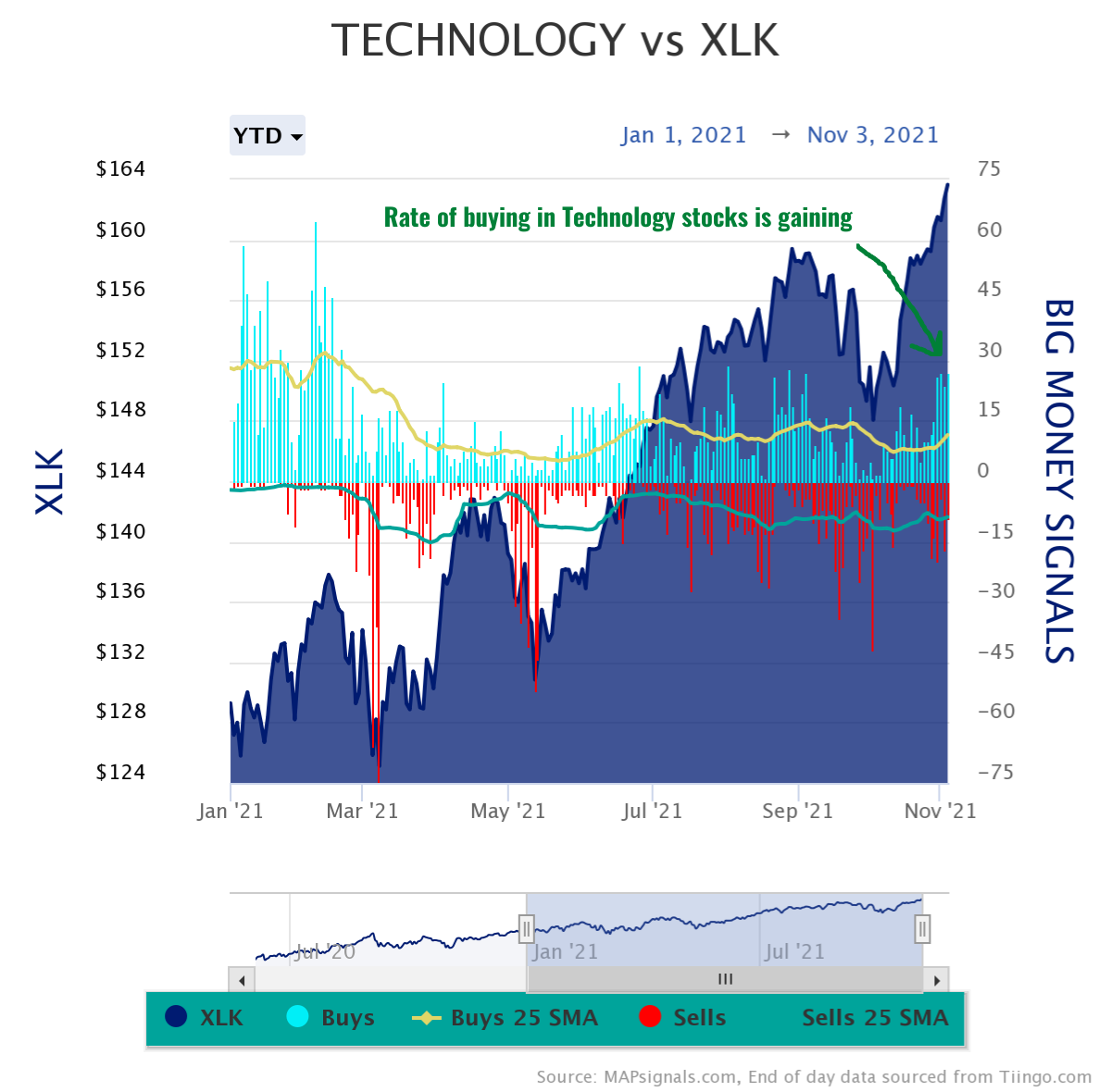

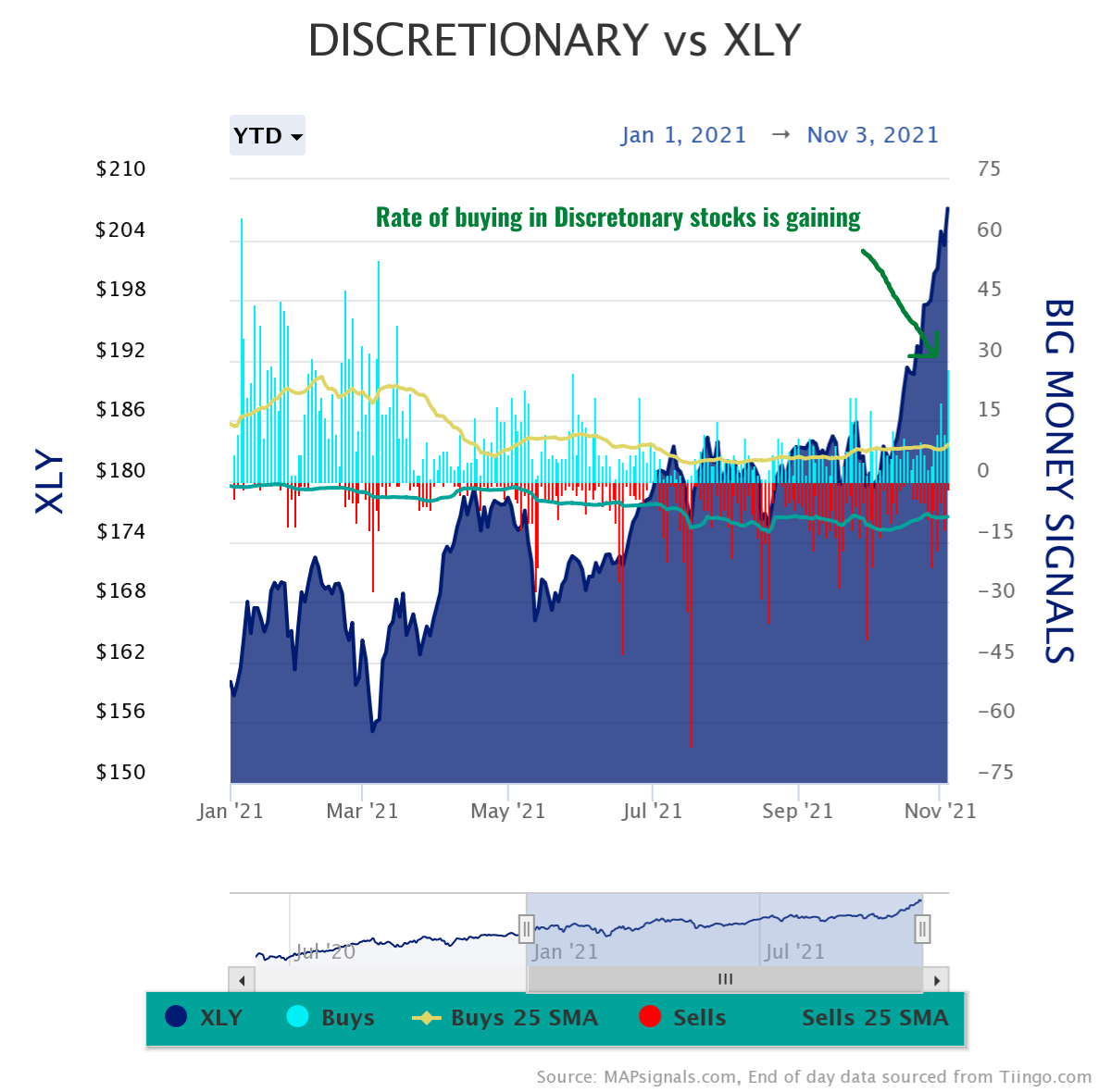

Money appears to be leaving the energy space. So, where’s the money going? It’s flowing into Technology and Discretionary stocks.

Take a look at how Big Money buying is flowing into Tech stocks. For reference, we’ve plotted the XLK ETF (Technology Select Sector SPDR Fund):

You can see the moving average of buys is ready to blastoff (yellow line). Let’s say it again, Technology stocks are being dealt stock market pocket aces!

But let’s keep going. Discretionary stocks are getting the love too. Below we’ve plotted our discretionary buy and sell signals vs the XLY ETF (Consumer Discretionary Select SPDR Fund):

Guys and gals, this is an incredibly bullish setup for stocks in the near-term.

High-quality outliers are leading the way.

Our data has been spot on the last few months. And it’s still signaling that markets have further to go. The field is set.

Let’s wrap this up.

Here’s the bottom line: I played a lot of hold’em poker back in my day. The best players were incredibly skillful and knew when to bet big. The same goes for stocks. When Big Money is racing into markets, put your chips on the table.

The way to make money in a bull market is to be long the best stocks. I see pocket aces for markets. Hopefully you see it too. When you’re sitting on a hot hand, don’t fold. Be bold ????.

If you’re looking for an edge with markets, start a MAPsignals subscription today.

And if you want more, check out my latest video: Best Cheap Stocks To Buy Now for November 2021. Always remember, the process is more important than the stocks.

Enjoy!

Make sure to follow our YouTube channel here so you never miss any of our videos.