Take Growth Over Value

2022’s first half was the worst for stocks since 1970. A recent AAII survey showed only 18% bulls, a near 40-year low. More and more investors throw in the towel every day. Cash gets more popular all the time. Take growth over value!

For those still buying stocks, defensive, recession resistant plays are all the rage. On April 18, I told you the best offense is a good defense. The call has worked. Consumer staples and utilities are both down less than 5% YTD on a total return basis.

But after epic outperformance, these safety plays aren’t cheap. Utilities trade at 19.5X forward earnings vs. a long-term average of 14.4X. Staples fetch 20X vs.17X historically. Compare that to 16X for the S&P 500 vs. its 16.4X long run multiple. That doesn’t mean defensives don’t still belong in a well-diversified portfolio, but, looking ahead, I think there’s a better risk-reward profile elsewhere.

Take Growth Over Value

Growth stocks are finally starting to lead. I know many of you are wondering whether the rebound has legs. Today I’ll show you the macro forces driving it. Then I’ll highlight ETFs and stocks with strong fundamentals whose depressed valuations already discount lots of near-term cyclical risks.

The Case for Growth Stocks

- US stocks generally fall into 3 buckets: defensives, growth, and value. We know defensives have crushed it this year. Growth stocks are down twice as much as value stocks YTD as soaring inflation and interest rates have reduced the present value of their future earnings.

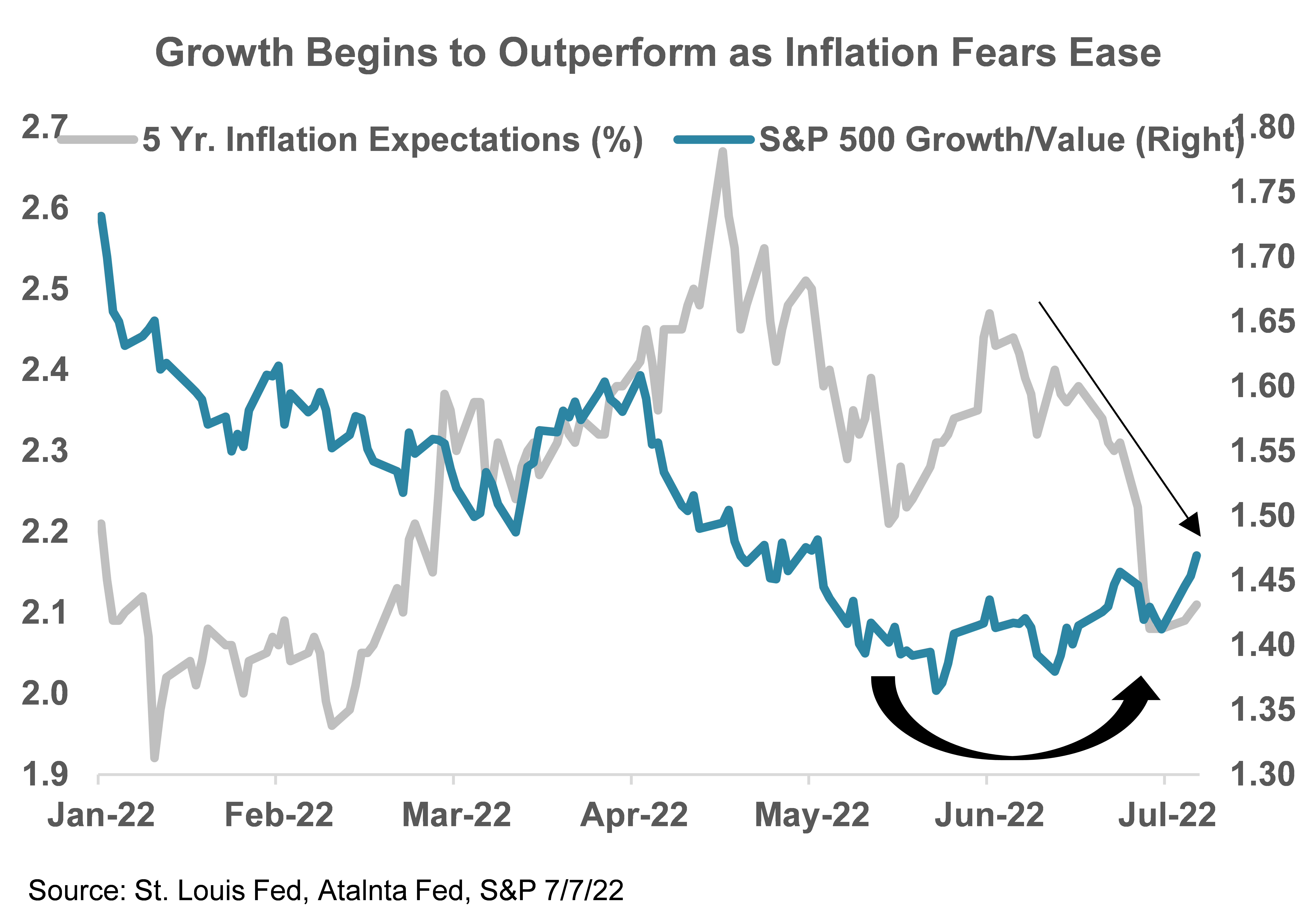

- As recession fears have overtaken inflation worries as the market’s biggest macro risk, growth stocks have begun to outperform more economically sensitive value stocks (chart).

- Easing inflation may give the Fed scope to slow rate hikes in Q4: Growth stocks are the most sensitive to Fed rate hikes. Five-year forward inflation expectations are down to 2.1% from 2.7% in April. Commodity prices, freight rates and interest rates are all down from their spring peaks. And with recession fears swirling, the Fed may slow their tightening.

- When growth is scarce, investors pay up for it. Since 1980, there have been 6 instances when real GDP growth was below 0.5%. Growth stocks have posted their strongest gains in these low growth regimes and have always outperformed value.

- Value tends to lead early in the cycle, coming out of a recession when growth is re-accelerating. With recession worries swirling, take growth over value!

Notice in the chart below how growth is outperforming value as interest rate expectations fall:

How to Play It

Technology makes up 45% of the S&P 500 Growth Index so let’s start there. The Nasdaq 100 ETF, QQQ, has a huge 35% weighting in world-class tech stocks like Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Google (GOOGL) and Nvidia (NVDA).

When it comes to being a contrarian and buying beaten down stocks and ETFs, you’re not going to see a stampede of big buying early on. Instead, you’re looking for subtle clues better days lie ahead. Less selling fits the bill. Check out QQQ’s chart below. In the wake of the most extreme selling since the 2020 Covid lows in mid-June, selling has recently slowed dramatically while buying is starting to pick up.

Throw in QQQ’s great fundamental map score of 75 and a more constructive macro backdrop and you’ve got a recipe for a winning trade.

Let’s shift gears. Check out Home Depot (HD). You wouldn’t know it from the 30% drubbing it’s taken since November, but HD has a fundamental map score of 71. It’s rallied nicely since selling peaked in mid-June.

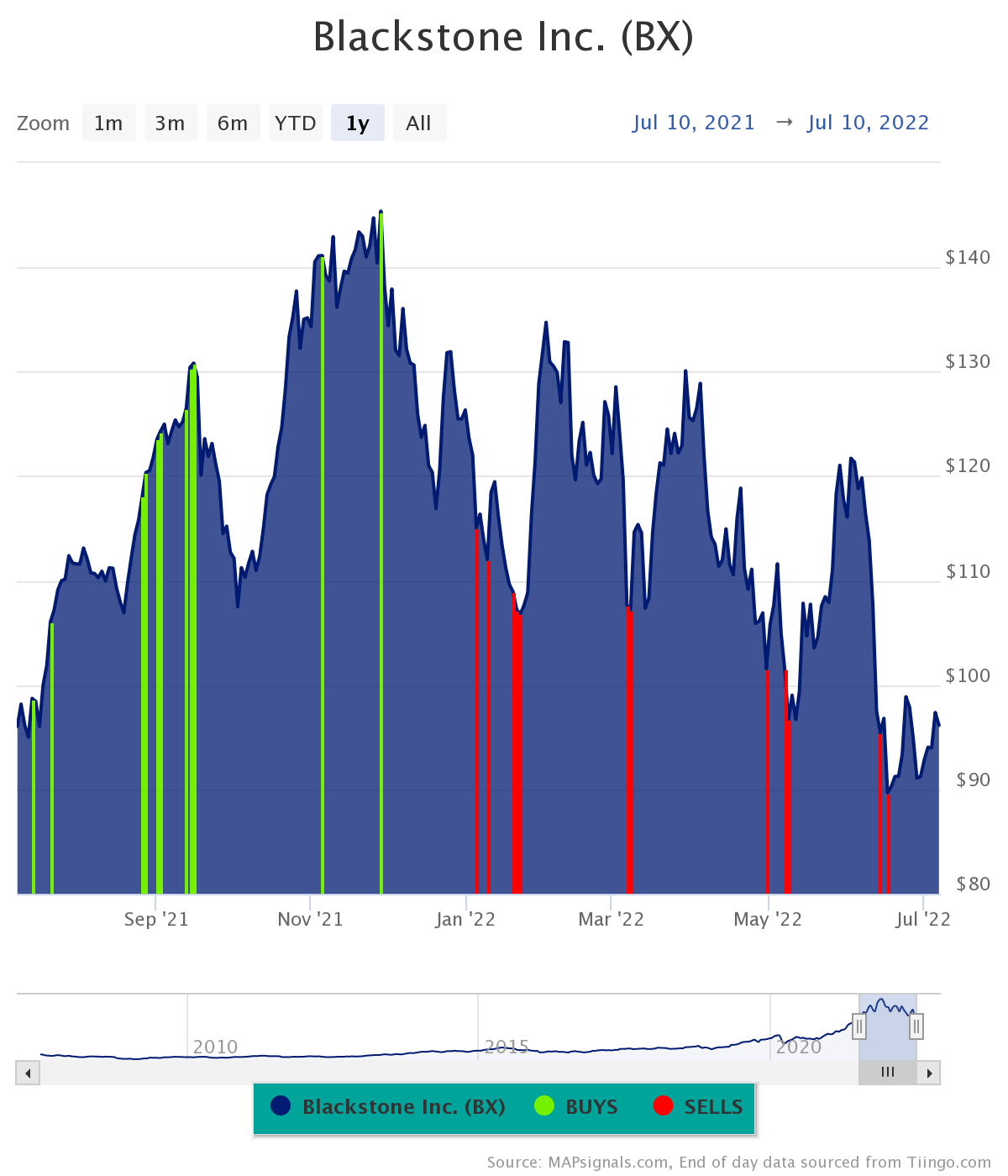

Ditto for Blackstone (BX). It’s also seen a nice rebound since selling exhausted itself in June. It’s the world’s leading alternative asset manager. It sports a juicy 5.5% dividend yield. 2022’s volatility is driving record interest in alternative investments. Blackstone’s fundamental map score is an impressive 79!

Ditto for Blackstone (BX). It’s also seen a nice rebound since selling exhausted itself in June. It’s the world’s leading alternative asset manager. It sports a juicy 5.5% dividend yield. 2022’s volatility is driving record interest in alternative investments. Blackstone’s fundamental map score is an impressive 79!

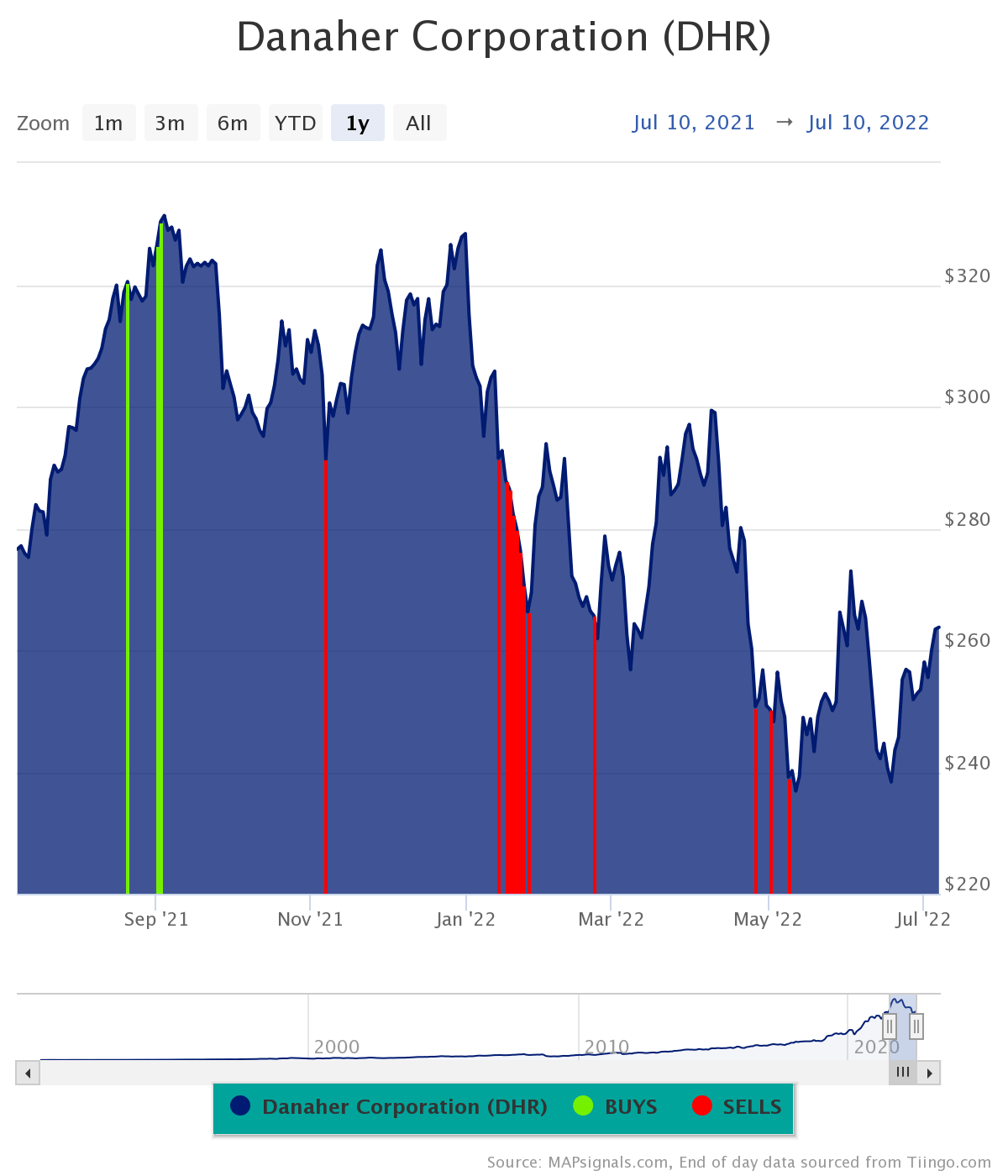

It’s a similar story for Danaher (DHR). It’s a $184B health care leader in life sciences, diagnostic, and environmental solutions. It has a monster fundamental map score of 79. It’s also seen much better price action since selling peaked in May.

It’s a similar story for Danaher (DHR). It’s a $184B health care leader in life sciences, diagnostic, and environmental solutions. It has a monster fundamental map score of 79. It’s also seen much better price action since selling peaked in May.

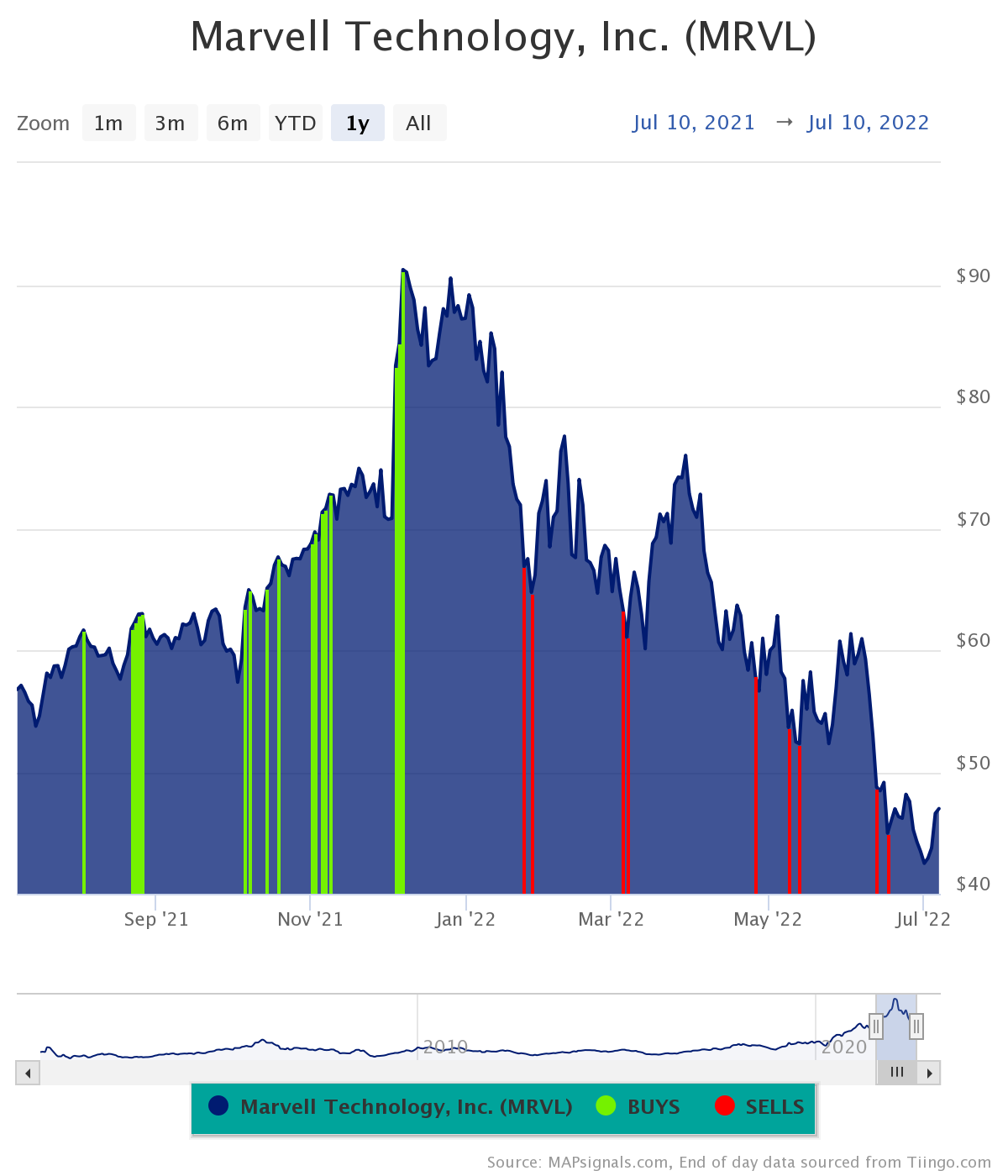

Last but not least, check out Marvell Technologies (MRVL). It’s a cutting-edge semiconductor player with a fundamental map score of 67. Its integrated circuits play in all the best growth areas from AI to 5G. It’s right up there with Nvidia as one of the most respected semi companies around. After being cut in half, it represents growth at a reasonable price. It’s seeing healthier price action since selling peaked last month:

Each of these stocks are decent bets as growth could be ready for more upside.

Bringing It All Together

Growth stocks have been tough to own. But it’s always darkest before the dawn. The macro forces that have held growth back look to be easing.

Inflation’s torrid run is showing early signs of cooling as commodities, interest rates, wages and freight rates are all softening as the global economy downshifts. That could give the Fed cover to slow rate hikes in Q4 and beyond. High quality growth stocks stand to benefit most. When growth is scarce it’s more valuable.

Diversified equity portfolios should always include defensive, value and growth stocks. My macro recommendations are never all or nothing propositions. My focus is always on what’s likely to outperform and where you should be overweight. After a brutal first half, the macro stars are finally aligning for growth stocks. Take growth over value!

Invest well,

-Alec

*If you’re looking for data to help your investing, get started with a MAPsignals subscription today. Let data help inform your investments by following the Big Money.