Waiting on the Fat Pitch

Markets are faring better than feared in 2023.

As cash piles build up near record levels, many investors are patiently waiting on the fat pitch to jump back in.

It could come sooner than most expect.

Let’s start with an interesting fact. The 2022 MLB season set a multi-decade record, clocking the lowest batting average of .243 since 1968. Faster pitching speeds and higher velocity are giving batters a challenge.

America’s pastime continues to evolve as hitters adapt to the new shift.

Like baseball, stock investors had a challenging environment to deal with in 2022. Major indices were down double-digits across the board last year. The S&P 500 sank 18%.

Investing batting averages were low as equities dropped due to a challenging macro environment.

As we see it today, however, the investing landscape is improving. Many macro worries are shifting to positive, which we wrote earlier this week.

Today we’ll scan our data and zero-in on one undervalued area of the market. It’s where money’s flowing and worth a swing.

Market Breadth is Improving

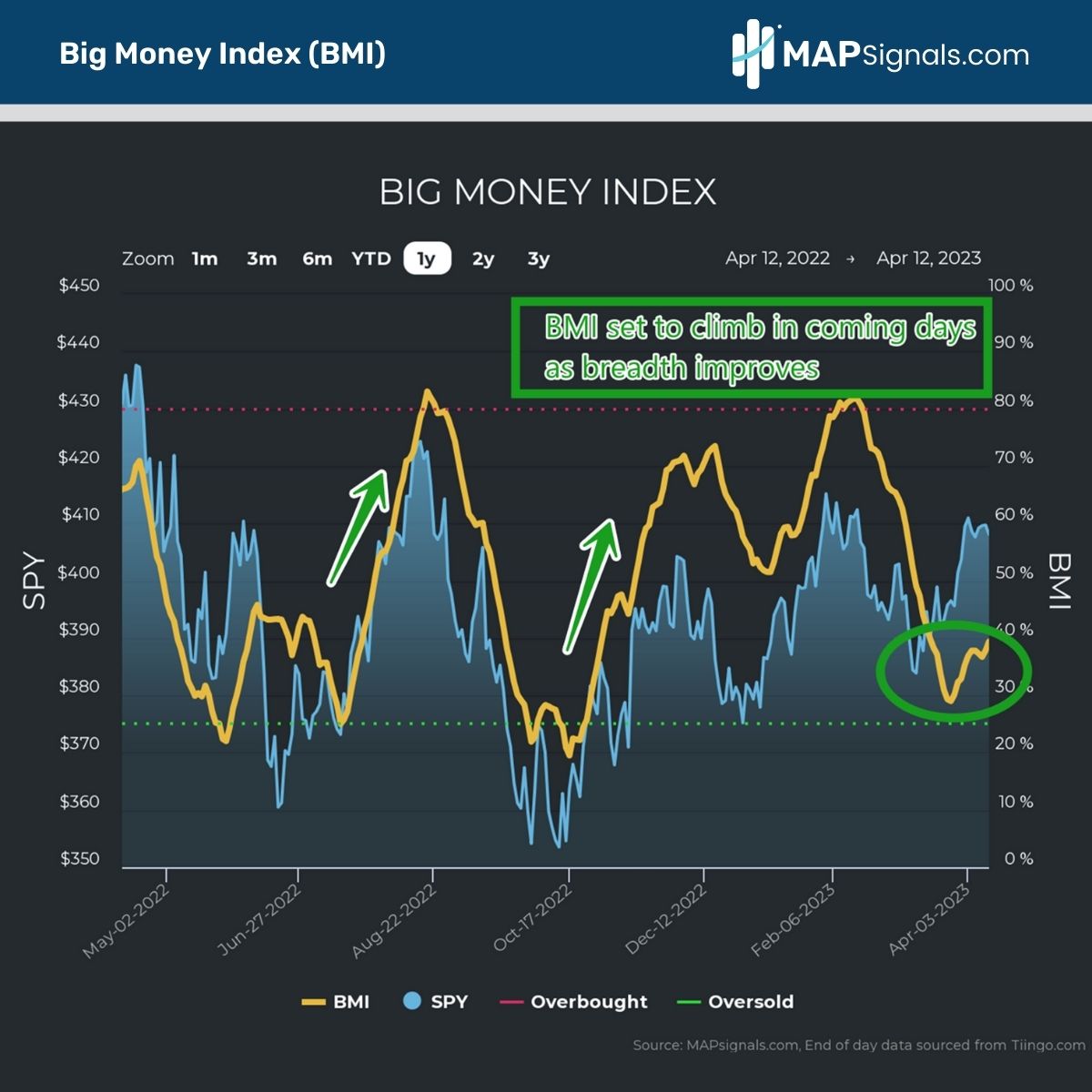

The Big Money Index (BMI) is set to rise in the coming days. The moving average of buys vs sells is climbing.

Notice below how a 39% reading is nearly at a month high. The 29% low mark made in late March appears to be the near-term trough:

A visit to the green zone (oversold 25%) seemed likely as banking stress weighed on markets. But the data changed as massive selling eased.

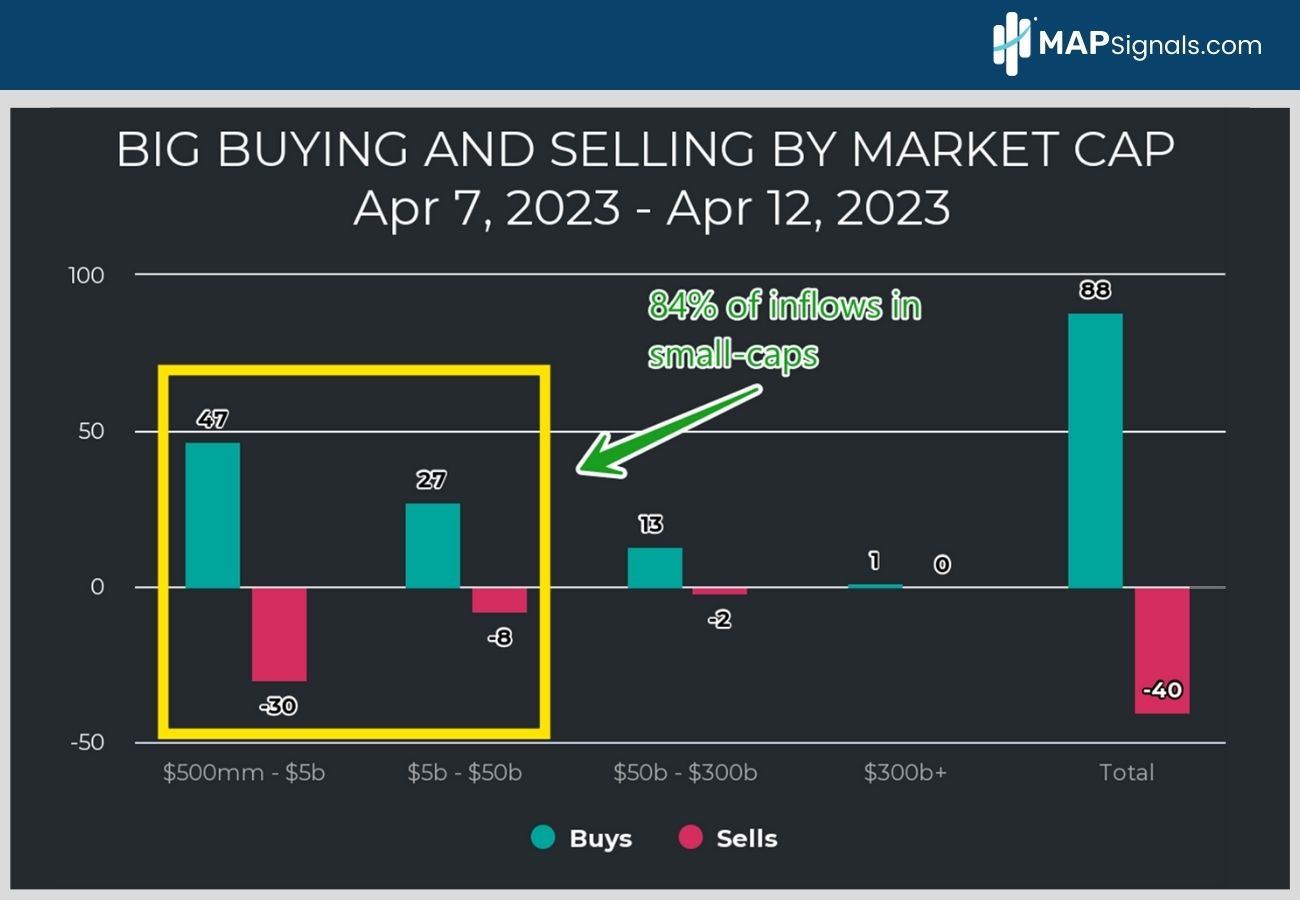

If the BMI’s rising, that means there must be a group of stocks under accumulation. There is. Small-cap names have been thriving lately.

Since April 10th, 84% of all buy signals have been in smaller names. Below, notice how 74 of 88 buy signals this week are in company sizes under $50B:

The mechanical action in the market points to a healthier undertone. Which isn’t surprising given their attractive valuation.

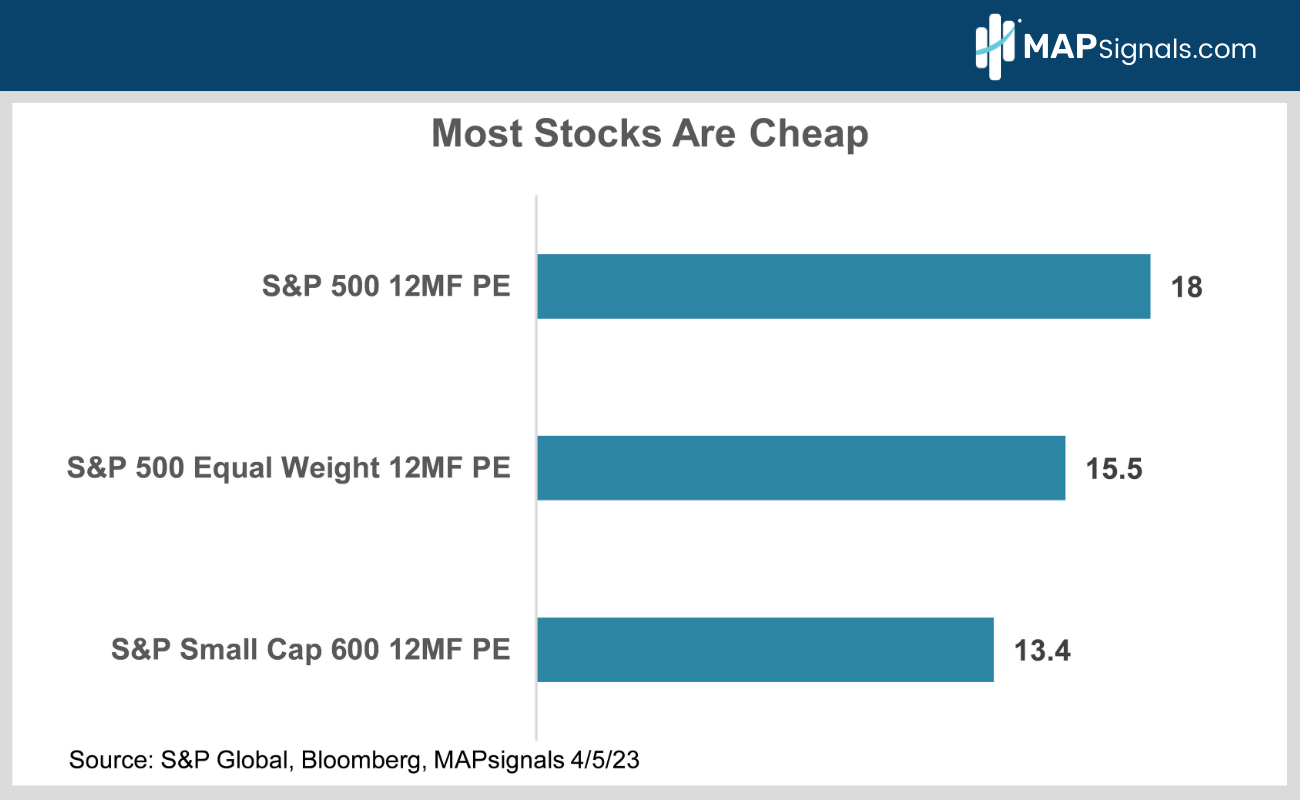

Compared to the market-cap weighted S&P 500, smaller capitalization stocks are cheap. The 12-month forward PE of the S&P Small Cap 600 sits at just 13.4, vastly cheaper than the S&P 500’s 18X.

If you’re waiting on the fat pitch, this could be the area to focus on:

Low valuations coupled with inflows sets the stage for more upside.

Waiting on the Fat Pitch

As I stated weeks ago, patience rewards investors. You don’t need to swing at every pitch. You want to stack the odds in your favor. Those moments tend to come when the crowd least expects it.

Each week, our algos sift through the market noise and showcase the best stocks getting bought with healthy fundamentals. We learned long ago how that’s the recipe for finding the best performing names over the long-term.

Our weekly Top 20 list uncovers diamonds in a rough market. Plenty of small technology and discretionary names are soaring right now as their forward outlook is bright. That’s the area big investors are betting on today.

But, let’s rewind the tape to last season…a very tough environment.

Here’s an example outlier stock from 2022. Back in late June, one lowly trafficked name saw unusual inflows. Keep in mind this was one of the low points for the market.

If you’re waiting on the fat pitch, I’d recommend going shopping during major selloffs.

e.l.f. Beauty (ELF) was bucking the trend and highly ranked in our research. The chart below lists the times when ELF saw inflows, making our weekly Top 20 list:

That’s a powerful chart, highlighting the relentless money pouring into the name. Clearly, the stock is well north of the early innings buy point, so this is not a recommendation.

The MAPsignals process just highlights the importance of being patient and swinging when opportunity strikes.

We see many small-cap stocks in the current environment worthy of investor attention. We’ll keep swinging.

Let’s wrap up.

Here’s the bottom line: Small-cap stocks show signs of life. Healthy buying alongside cheap valuations signals an opportune time to allocate capital.

We’re seeing plenty of stocks under accumulation right now. Many of them are newer unknown names. Chances are tomorrow’s winners are hiding under the surface.

Data can help you uncover them.

Batting wasn’t easy in the MLB last year and neither was stock investing. Don’t quit.

When the right pitch comes down the plate, take a swing!

Pro subscribers get a new lineup of 20 top-ranked stocks every week.

***ALSO, today you can join Jason at 12PM ET at the MoneyShow Virtual Expo as he presents Profiting from the Next Wave of Winning Stocks.

If you want to see our process in action, click the image below to sign up. It’s FREE!

Have a great week!