We Have Liftoff

The markets have spoken: “Houston, we have liftoff.”

You may have voted red or blue. To the stock market it didn’t matter: it voted green.

The anticipation of the election was exciting or agonizing depending on who you are. I stayed up late to watch which way the scale was tipping. It was neck and neck: at some points, red was ahead. At others, blue.

People generally look to markets to see its opinions on outcomes, unclear as they may be. When we woke up Wednesday the presidential votes were still being counted but the market vote was over. In a landslide, stocks voted green. Growth stocks led the massive charge higher. In my head echoed the words “we have liftoff.”

The action was surprising and even left many scratching their heads. At first it seemed the big news was that there was no clear victor for president. But the real big news was that the blue wave didn’t come: the senate didn’t flip to democrat majority as expected.

This in the market’s eyes, means the eventual president likely won’t matter. That’s because even with a democratic president, and a non-democratic majority senate, there will be gridlock.

It’s hard to get stuff done in partisan Washington. And with no unity of party lines across the House, Senate, and Oval Office, it means much of the tough regulation and tax-talk becomes less likely to push its way through into law… in the market’s eyes.

That sounds great, but remember, here at MAPsignals, we try not to indulge in too much theory: we delve into data. Yesterday’s data had a strong day suggesting higher prices in the future.

We value data above all else. This is why we keep harping on our election study. Remember, history suggested that big money would dump stocks ahead of the vote and bump them shortly after.

It seems perfectly scripted for 2020 too…

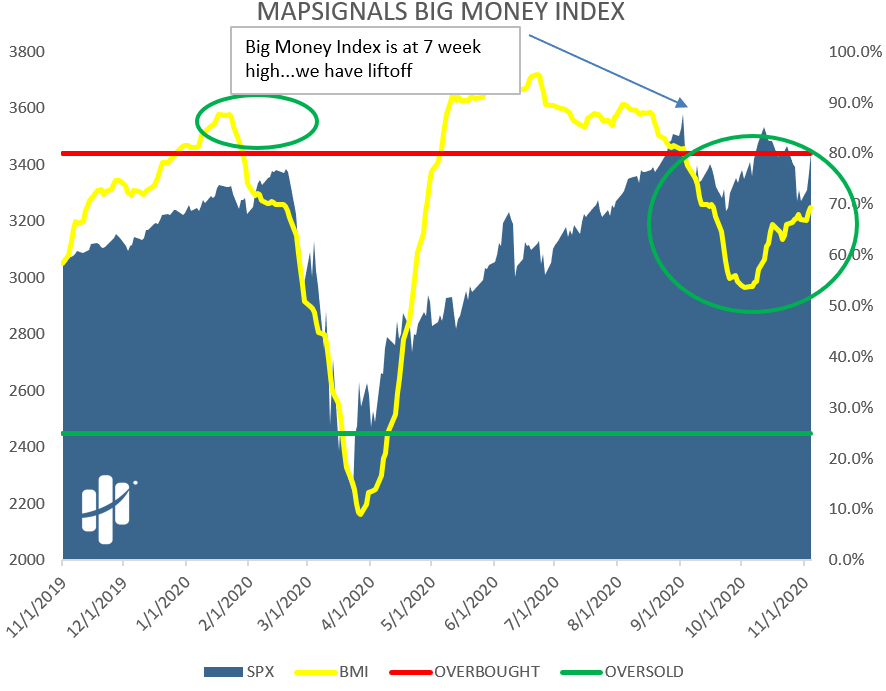

Big Money Index We Have Liftoff

It’s been a rocky few weeks ahead of this election. Big up days were followed by big down days. The Big Money Index held relatively steady…that’s even with last week’s pullback, when we saw the most selling since March lows. Money managers were waiting in the wings heading into November 3rd.

With yesterday’s action we saw 92% buy signals out of 120. That means the BMI is resuming its uptrend. We believe we have market liftoff… more upside is coming.

That’s the top-level trend. Now, let’s dig a little deeper.

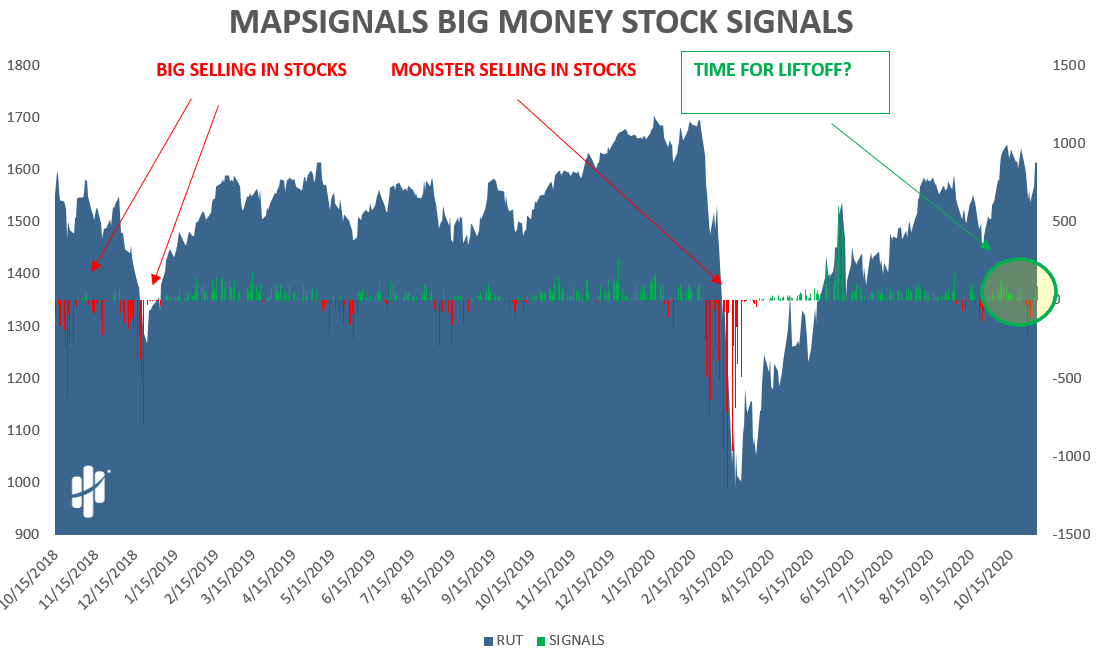

Big Money Stock Signals Rocket Higher

With the monster rally yesterday, it’s logical to expect buy signals. Our analysis says this bump in buying is forecasting more green to come.

As Wayne Gretzky famously said, “…skate to where the puck is going, not to where’s it’s been.” We see a bullish setup with more juice coming.

Below we see the daily stock signals. A green bar means more buyers. A red bar means more sellers. It may be hard to see, but after the red pre-election selling, yesterday was a clear green-bar spike. That action reinforces the “we have liftoff” stance.

Off to the right we’ve circled that latest green shoot. Typically, green bars lead to more green bars. Trends are your friend when it comes to data. And now that the uncertainty of a huge election is behind us (from the perspective of the non-majority Senate), trends are likely to continue for a while.

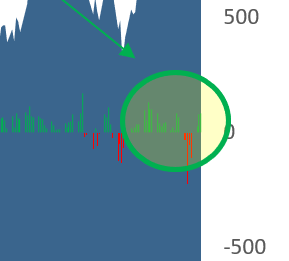

Here is a zoom-in. Rarely is one green day short-lived. They tend to cluster.

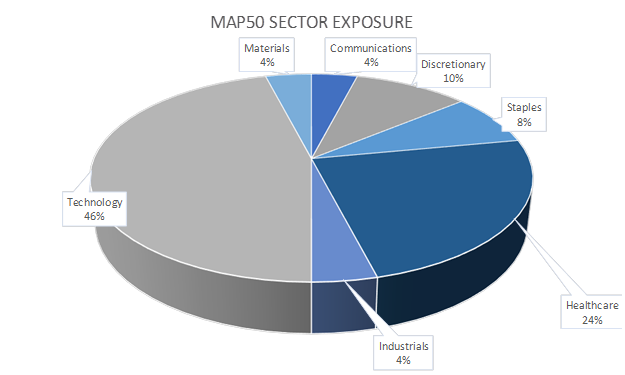

It’s interesting to note that much of the buying was in Health Care and Technology. Those sectors also happen to be the largest concentrations in the MAP 50 from October. So, while it’s new data from yesterday – it’s been the Big Money theme the past 6 months.

Regular readers know that.

But we can’t stop here just yet. We saw even more positive signs for markets. ETFs are reinforcing that we have liftoff, too.

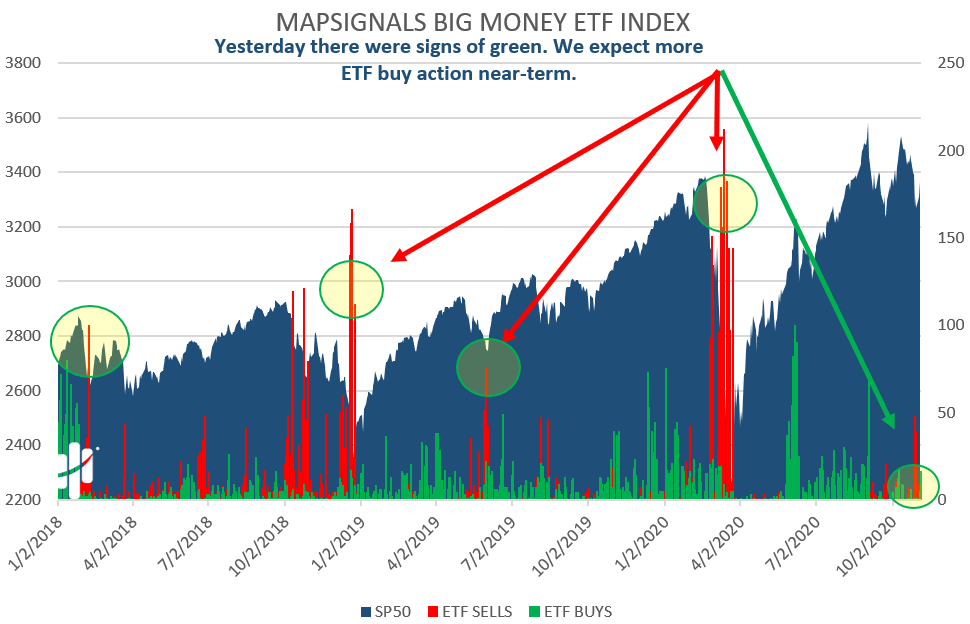

Big Money ETF Action Signals Upside

The ETF selling we saw last week is likely behind us. Nasty sector rotations whip ETFs around as capital looks for safe places to hide ahead of uncertainty. That’s part of the game and always will be. The best way to play it, and anything for that matter is to keep a cool head and practice patience.

Yesterday’s signal data points to ETF buyers beginning to show up. Off to the right we’ve circled the latest green ETF signals. We believe there’s more to follow.

Here’s the bottom line: Our data tells us that the big rotation out of growth is reversing. That’s great news for outlier stocks. As the buying appears in Technology, Healthcare, ETFs, and broad market indexes, that signals “we have liftoff” occurring.

As for what to do next: we discussed the post-election playbook in our podcast. We went over what data we expected to see this morning and how investors might play it.

Tuesday night’s countdown to the presidency turned out to be the stock rocket countdown.

For stocks, this vote wasn’t about red or blue. It was about red and blue. And when it comes to stocks, Big Money’s vote is all that counts.

5,4,3,2,1….

Ladies and gentlemen, we have liftoff in US stocks on a mission to exploring new heights.

Stay tuned for mission updates.