When Will Stocks Pullback

Investors always want to know, “when will stocks pullback?”

We all know nothing is guaranteed. But today I’ll show you my most reliable way to prepare for the inevitable.

(Plus a HUGE announcement!)

Let me be crystal clear: our data is NOT signaling a pullback. As I’ll show you, it’s actually quite positive right now. So, we’re not changing our tune from the past few weeks.

MAPsignals data is lining up with our prior bullish thesis. Soon, I’ll walk you through some very encouraging signs for higher stock prices. Yet, it would be foolish to pretend the party won’t eventually end.

But we have great news for you: Subscribers can now be better prepared than ever before! And that’s what we’re about to announce…

But before we do, we need to check in on the stock market which is setting up for more juicy highs.

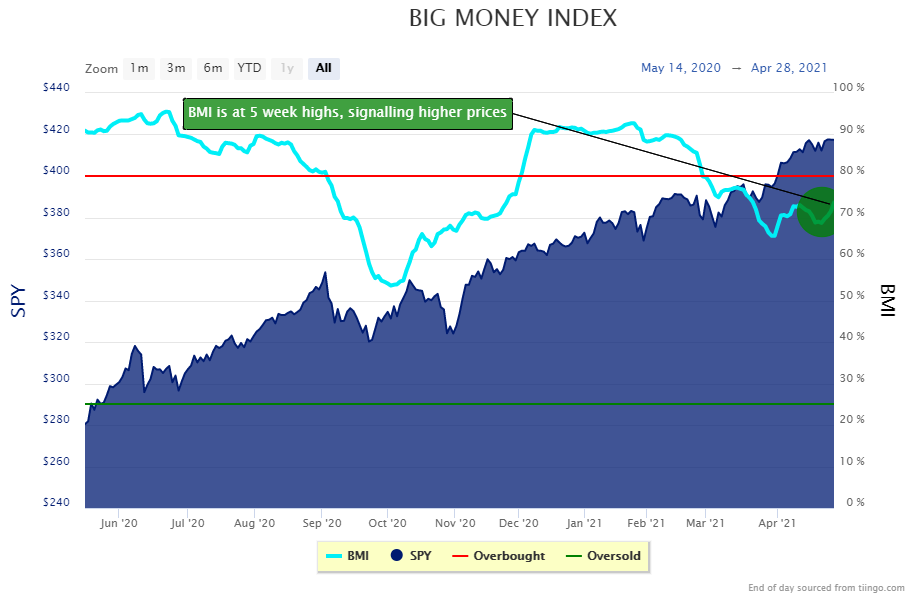

Big Money Index Says Up Up And Away

We’ve been bullish for weeks. Because when there is no selling in our data, we expect higher prices.

Earlier this month we discussed how stock buyers tend to show up gradually, then suddenly. Here at MAPsignals, we’re all about taking our cues from the Big Money Index. Then we work our way down.

Let’s do that right now. The BMI is ramping…

Off to the right, I’ve circled what’s important: The BMI is at the highest levels in over 5 weeks. The momentum of buying is accelerating on margin.

Look– that alone tells me all I need to know: Prepare for JUICE! Naturally you may want to know when stocks will pullback, but based on the Big Money Index chart, today is not the day.

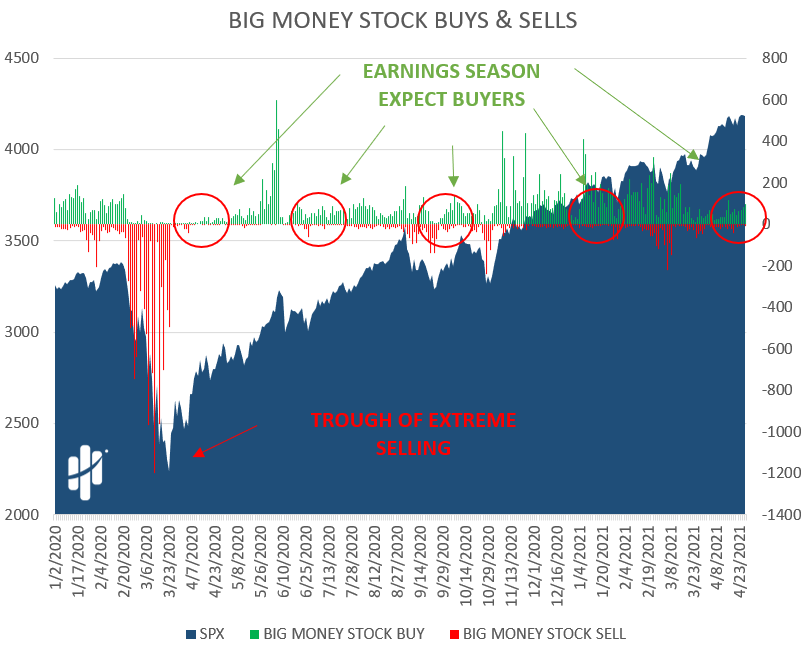

Let’s keep drilling down. That Big Money Index is composed of daily stock buys and sells. We’ve been preaching for weeks how earnings season often brings the buyers.

If Paul Revere were a data analyst, he probably would’ve said: “The buyers are coming! The buyers are coming!”

Here’s why: Below we see our Big Money Stock Buys & Sells chart. This is essentially what the BMI turns into a moving average to see money-flow trends. And following that trend is key. Leading up to earnings season, stocks are usually quiet. Then as things start rolling, buyers show up.

That’s what’s happening right now, as if on cue:

We circled earnings season above to make it clear. Buyers tend to accelerate as solid earnings reports roll in.

I know what you are going to say: ”That’s great and all, but when will stocks pullback?”

Again, sorry to say, according to this chart, it is not today.

But let’s keep going.

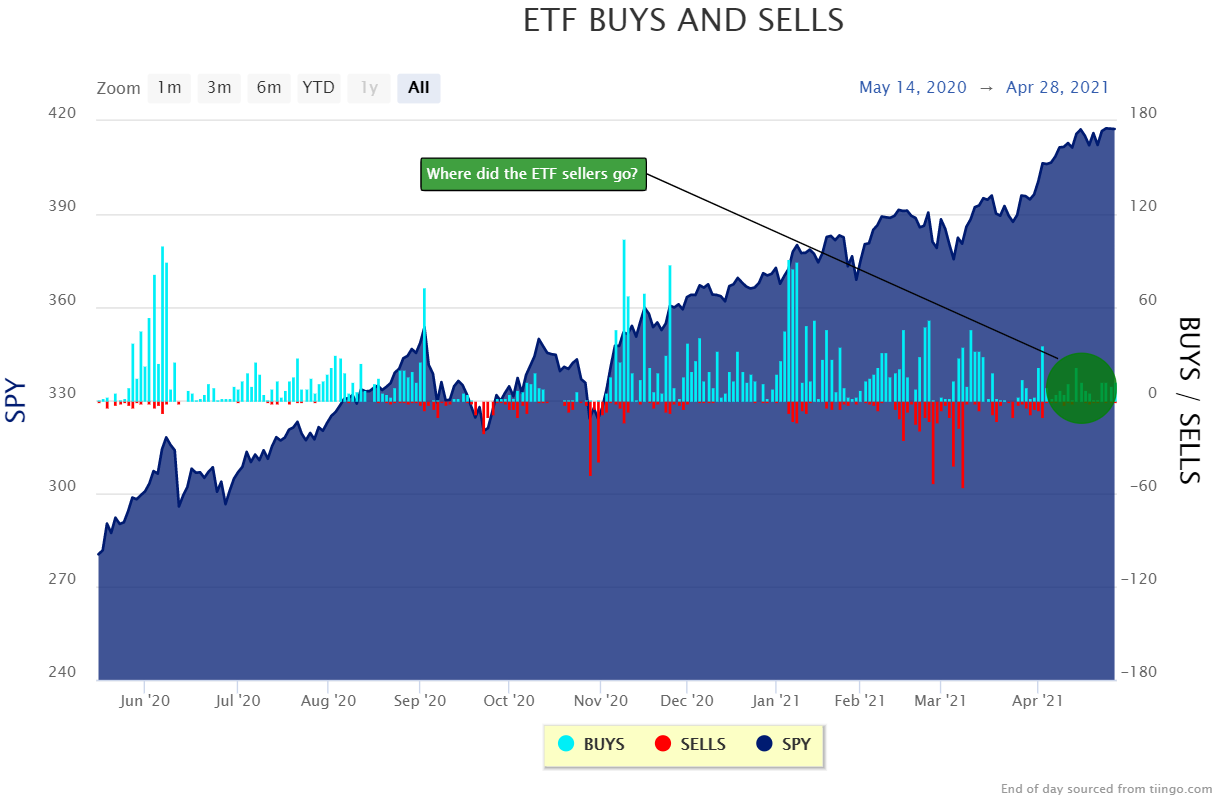

ETF Buying Holds Steady

We see the Big Money Index is racing higher because stock buying is increasing. But what about ETFs?

Usually, they follow stock action. Right now, buyers are stepping into ETFs, too.

Like the chart above, this one shows the daily buys and sells of ETFs. Make no mistake: This is a powerful indicator of what is going on under the surface.

Off to the right you can see that buyers are steady (blue). More importantly, there is no selling (red). To us, this data is bullish.

Again, I’m sure you’re wondering: “when will stocks pullback?”

But looking at this MAPsignals ETF chart, it’s not today…

Which brings me to the biggest announcement MAPsignals has made yet.

When Will Stocks Pullback, Follow The Big Money Index Yourself

Starting today, MAPsignals subscribers now have access to the first and third charts you see above: The Big Money Index & our ETF Buys & Sells. Only, these update early every morning automatically. You can log in and hover your pointer over them to get the values. This way, you don’t need to wait for us to tell you… you can check it yourself usually by 6AM ET every day!

Members of all subscription levels can access them here.

This was hands down your biggest request. You wanted on-demand access to our most popular charts. They are finally here.

As we always find a hidden story in data, there is a hidden story in this announcement too: This is just a first glimpse of what’s to come.

In the coming months we will roll out more functionalities including access to on-demand stock analysis on over 5,000 stocks the MAPsignals way, back-testing our outlier stocks as baskets, and other exciting interactions with our data.

Soon, you’ll be able to “choose your own adventure.” As we work on those other new functions, these two are perfect to start us off!

So, if you’re new to MAPsignals and want to get your feet wet with our data, now you can! And if you’re still sitting on the fence, there’s never been a better time to join us. There is no better way to navigate the market than using a MAP!

Here’s the bottom line: Multiple data points say stocks are headed higher. The Big Money Index is gaining ground, stock buying is ramping, and ETFs are seeing the juice, too.

Near-term we expect more highs, but we all know it won’t last forever. So, let me answer the all-important question: When will stocks pullback?

Unfortunately, I can’t say for certain, but what I can say is Big Money often gives us a heads-up beforehand. And that’s why today’s announcement is so powerful. Because generally the BMI starts falling well in advance of market pullbacks. And ETFs show that extreme buying days, signal near-term tops!

These two powerful indicators are now in your hands if you are a MAPsignals subscriber.

And nothing makes us happier!

If you’re not yet a subscriber and want access to our awesome charts, get started here!

***As a bonus, our latest video series are here: Best Growth Stocks May 2021 & Best Dividend Stocks May 2021.

Check them out!