Where to Invest in a Turbulent Market

Sometimes investing is easy. Other times it isn’t.

Stocks have been in a downtrend for the better part of a year. Fears of recession and high inflation have destroyed confidence. But don’t give up!

Today I’ll show you where to invest in a turbulent market. Staying balanced, defensive, and proactive is the key to success… and always follow the footsteps of the Big Money.

Inflation shock is the latest market headwind. August’s Consumer Price Index proved that consumers are facing rising prices. The year-over-year price gains came in hot at 8.3% vs. expectations of 8.1%. The miss sent stocks tumbling with the S&P 500 dropping 4.32% – ouch.

Jason broke down what a nasty one-day selloff means going forward. History says it’s not a time to panic sell.

But the point is, recession fears continue to paint the headlines.

Many are wondering where to place their chips when uncertainty is this high. It’s true, many groups of stocks are penalized right now, with growth slowing. But a few sectors can offer ballast when volatility comes to town.

Today we’ll size up the current market and view 3 sectors primed to outperform in the current turbulent backdrop. They’re even seeing Big Money inflows recently.

Where to Invest In a Turbulent Market

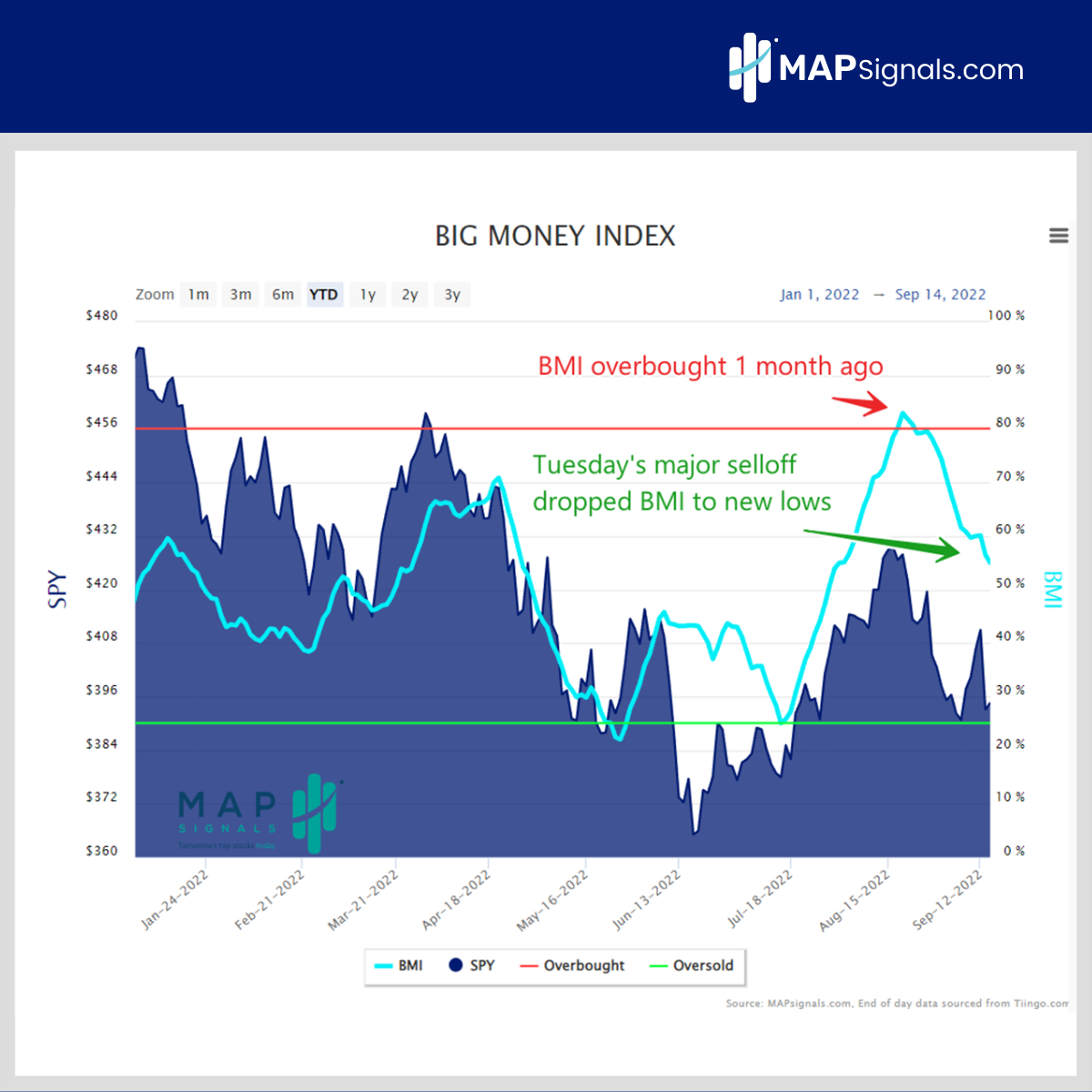

High inflation is no fun for anyone, especially investors. The Big Money Index was already in a downtrend heading into this week, but the August inflation report amplified the move.

We’re now sitting at 55%. Keep in mind we were overbought just a short month ago. Today’s environment fits well within our mid-term election roadmap of weak September action:

But it’s not all doom and gloom everywhere. Under the surface of the market, there are a few areas attracting capital.

When fear is high, it’s best to keep things simple. Focus on the leaders.

Three sectors come into focus: Utilities, Energy, and Health Care. Each of these areas offer stability in the unique climate.

They aren’t the sexiest areas for investing, but they can be profitable.

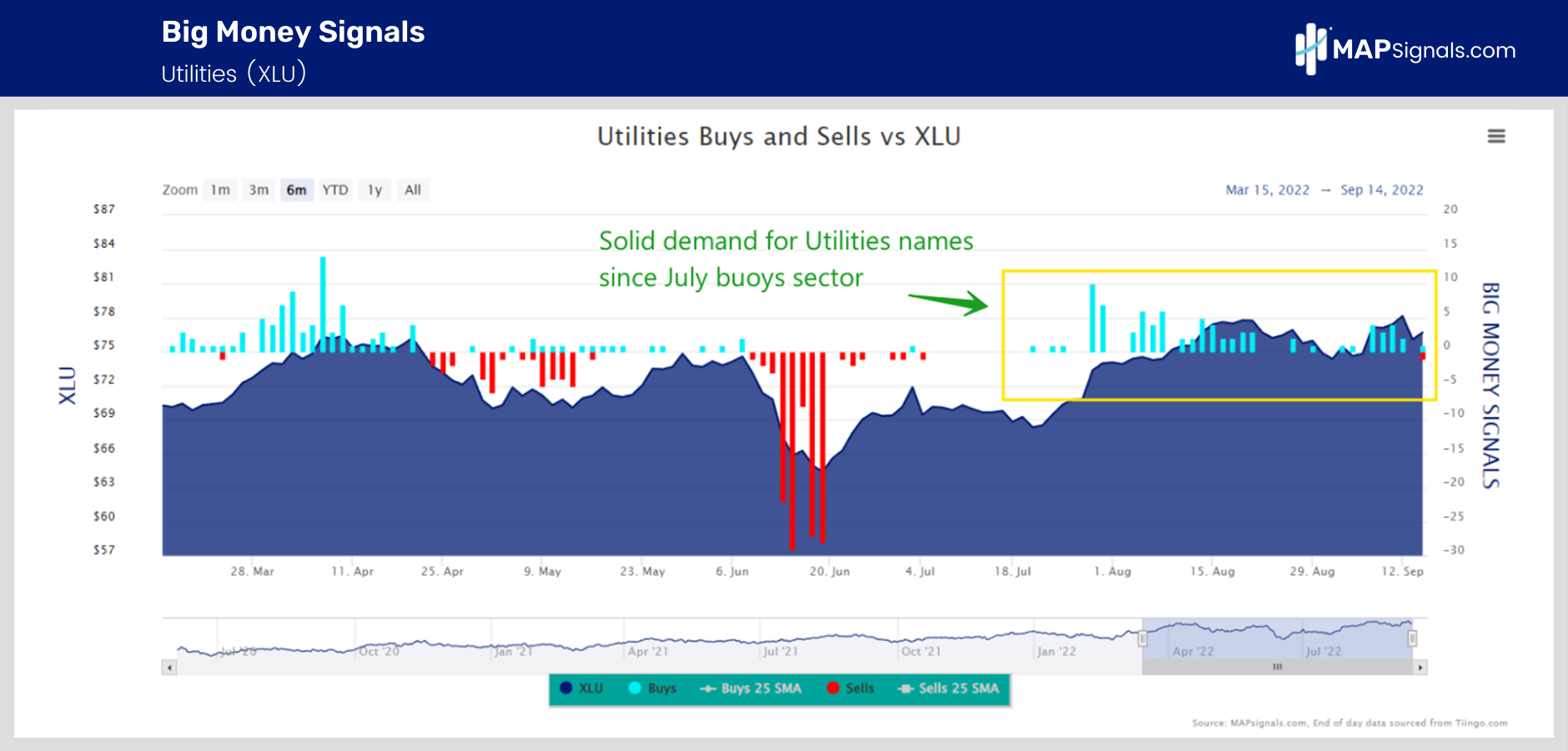

Let’s start with Utilities. This is an area known for stability when the future is unknown. Consumers may face a recession and high inflation, but one of the last areas they’ll cut spending is on power. People tend to keep the lights on no matter what.

Year-to-date the Utilities Select Sector SPDR Fund (XLU) is +8.65%. It’s a great proxy for the overall group. The ETF is full of large stable dividend paying companies, perfect for this environment.

Below you’ll notice that the Big Money action has been on the buy side for months:

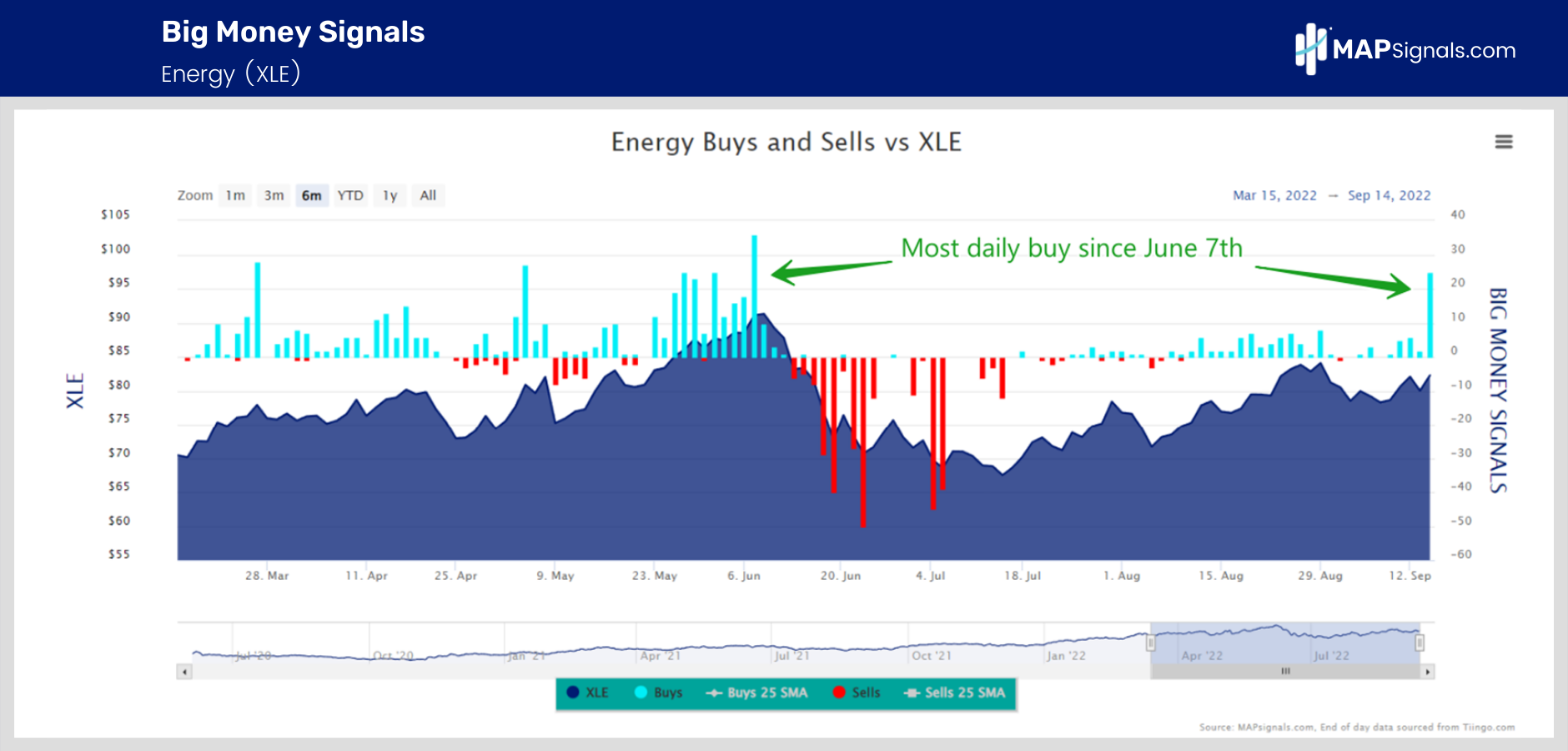

Now let’s look at Energy. This isn’t typically a defensive sector. But given elevated crude oil and gas prices, this is where earnings growth lives. It’s a great inflation play for today’s environment.

And the group has been a Big Money magnet. YTD the Energy Select Sector SPDR Fund (XLE) is up 51%. More importantly, this group saw the most buying yesterday (9/14/2022) in 3 months. Some of our highest ranked stocks in our portal are found in the Energy patch.

If you’re looking for a bull market, this is the focus area. Plenty of these companies offer attractive dividend yields and a cheap valuation vs the market. The Oil & Gas Production Industry sports a 7.11 P/E vs the S&P 500’s 18.5.

Check out the inflows of capital off to the right of the below chart:

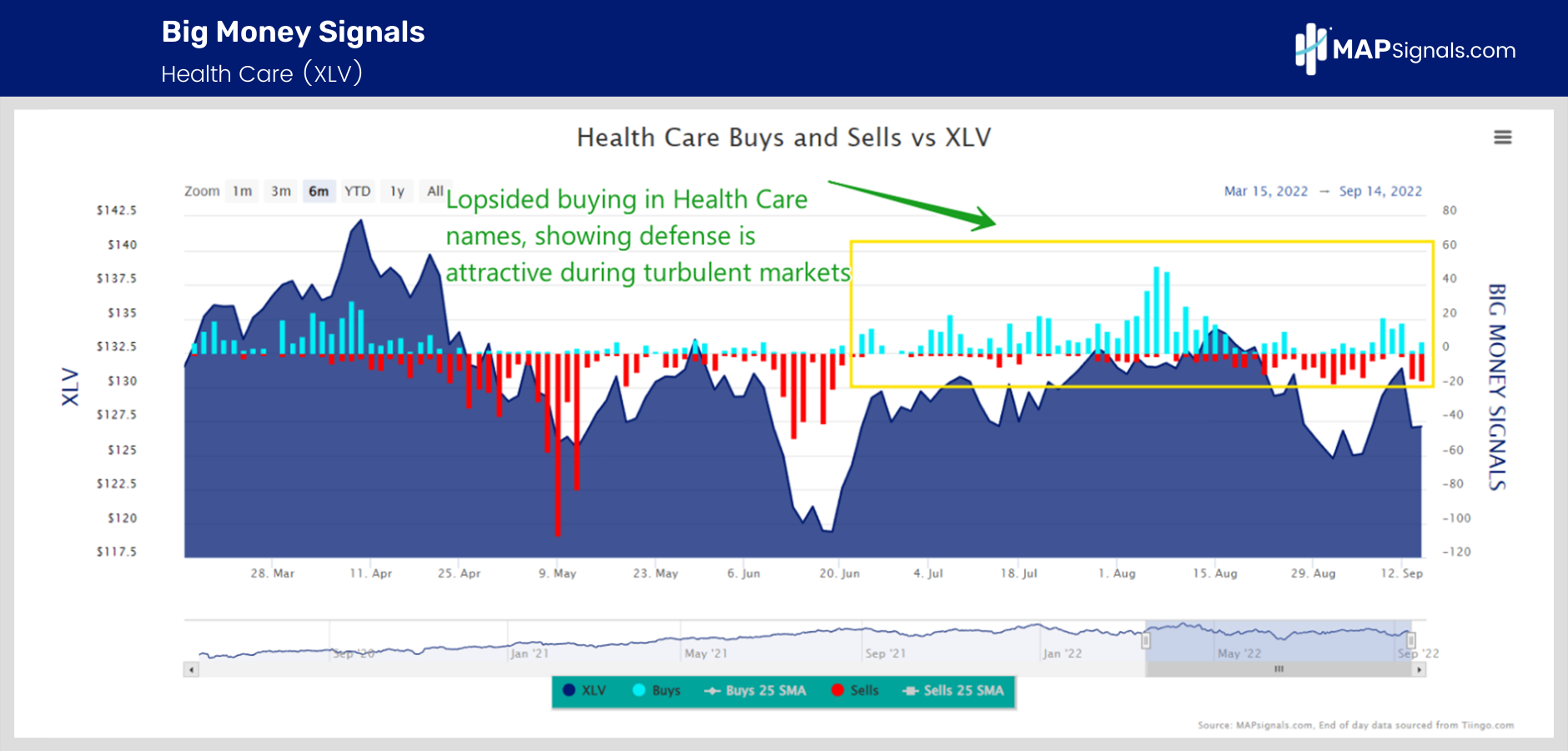

Finally, there’s the Health Care space. Taking care of our health tends to always be a priority. This area can thrive during most environments.

Large Biopharma names with long histories of dividend increases and stable cashflows have been a beacon in 2022.

Below you’ll notice many more blue bars (buys) than red the last few months:

As long as markets remain under pressure, given earnings uncertainty – it pays to play defense. Adding exposures to Utilities, Energy, and Health Care provides needed balance to a portfolio in turbulent times.

These areas have shined this year. And odds are that trend will continue until the macro picture improves.

Let’s wrap up.

Here’s the bottom line: When market turbulence hits, don’t give up. Consider adding less volatile groups like Health Care and Utilities to a portfolio. Both sectors pack healthy dividends and a history of steady cashflows.

And don’t forget Energy stocks. This group has been tops all year as high commodity prices mean more profits for the group. And fresh capital is flowing there recently.

These areas are where to invest in a turbulent market.

And if you’re wanting our top stock ideas, we automate our top ranked stocks list every day here for Platinum subscribers. There are leaders out there and the Big Money process spots them.

If you’re wanting access to which stocks rank the best by sector, get started with a subscription today!