Macro Outlook: Why Stocks Can Be a Good Bet in 2023

By now I’m sure you’ve read a few 2023 market outlooks and you’re probably not expecting much upside.

Sentiment surveys reveal professional and retail investors are universally downbeat. After all, sticky inflation means the Fed will keep raising interest rates, all but ensuring a recession.

From where I stand, the bears may have it wrong.

I’ll make the case of why stocks can be a good bet in 2023. When pessimism is this widespread, it usually pays to take the other side of the trade.

Today, I’ll highlight several powerful, underappreciated bullish macro signals that could make 2023 a much better year than anyone expects. Then, I’ll lay out the best sector to overweight now along with the best ETF to play it.

Why Stocks Can Be a Good Bet in 2023

Let’s take a look at the scariest macro risks keeping investors sidelined to see what the crowd may be missing.

#1 Recession Obsession: This is Wall Street’s #1 worry. Economists are about as downbeat as they get, pegging the odds on a 2023 recession at 65% vs. the 18% long-run average.

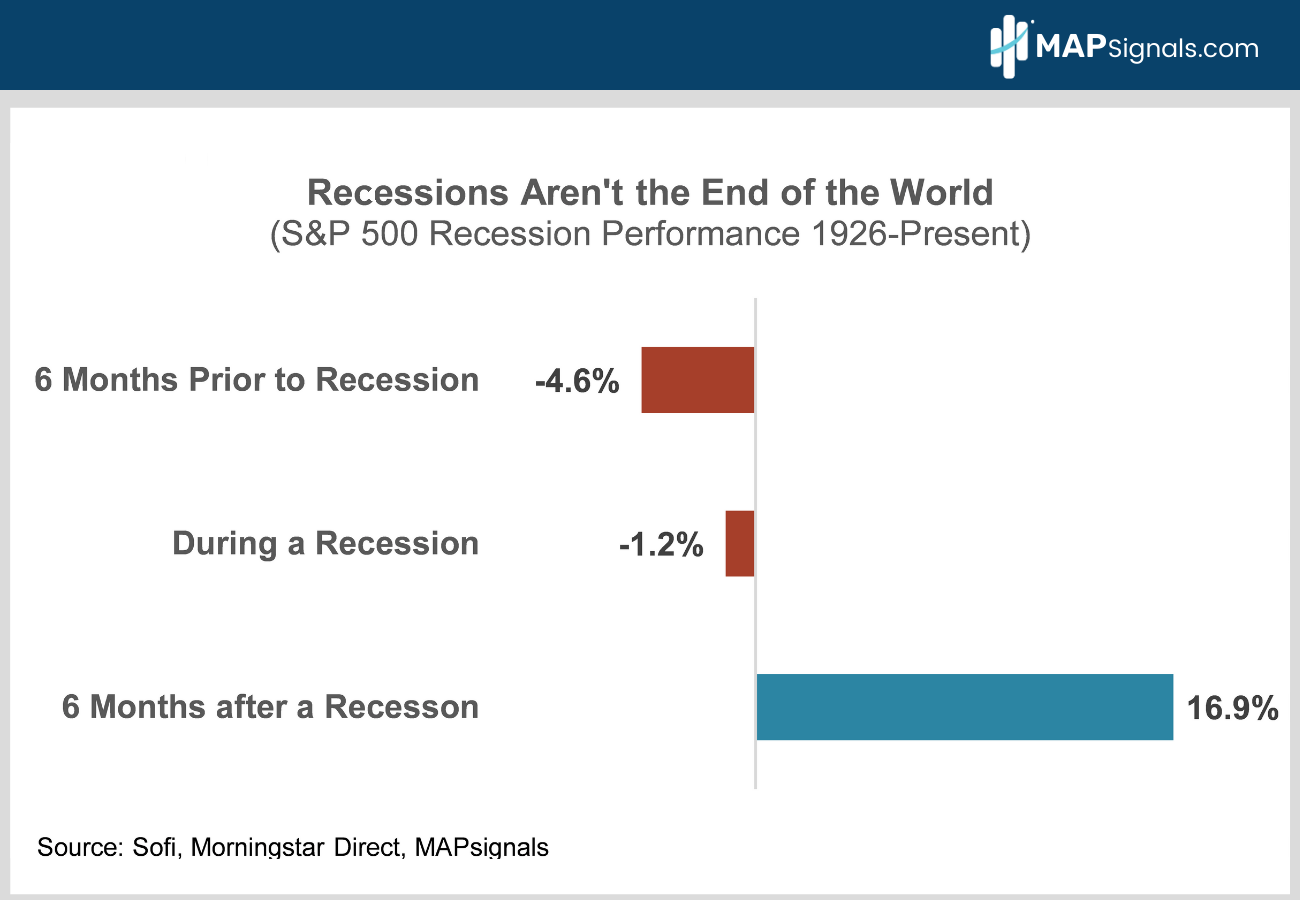

Let’s cut to the chase. No one knows for sure whether a recession will happen or how bad it will be. What we do know is the data says investors shouldn’t assume a recession is terrible for stocks.

Check out this chart. Stocks historically gain a lot more coming out of recession than they lose in the 6 months prior and during the recession itself.

Let’s zero in on what this means now. With the S&P 500 already having suffered a 27% peak to trough decline through mid-October, it’s even more likely market upside currently far exceeds downside risk. This is a big reason why stocks can be a good bet in 2023:

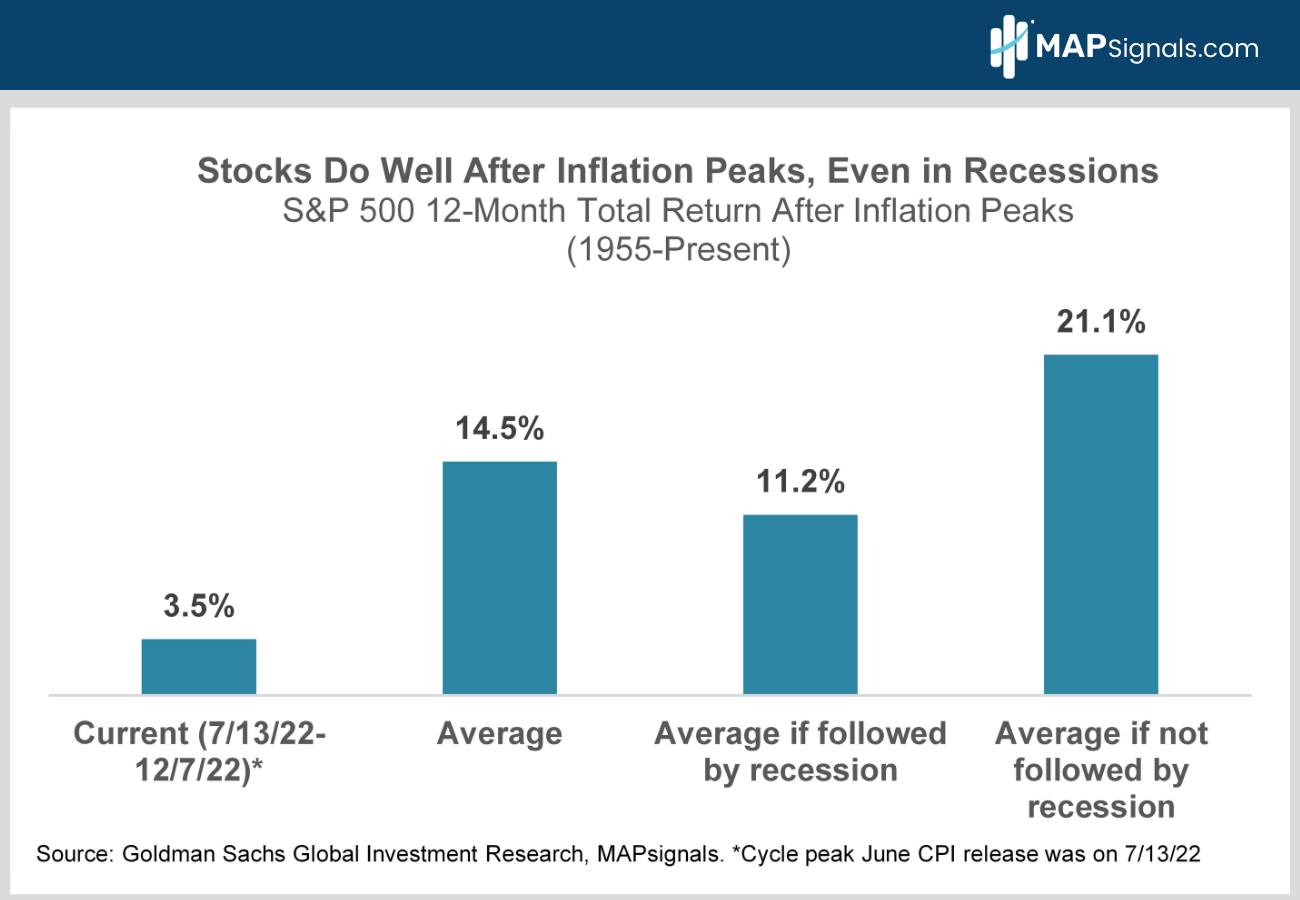

#2 Sticky Inflation: The conventional wisdom is that inflation is still a reason to sell stocks. While prices may have peaked, sticky wage gains will keep interest rates higher for longer. A recession is all but a done deal.

Sounds pretty scary right? Not so fast, check out this chart. Stocks have averaged 14% gains in the 12 months following peak inflation. When a recession followed, peak price stock gains were smaller at 11% vs. 21% when the economy dodged a contraction.

Either way, stocks did very well. The S&P 500 is only up 3.5% since inflation peaked in July. 2023 may be better than you think:

#3 Earnings Apocalypse: Earnings jitters abound. Wall Street analysts are forecasting 3% 2023 earnings growth implying S&P 500 profits will rise to a record $230.

Investors aren’t buying it. How can profits possibly hold up amid a looming recession, higher rates, European war, and a strong dollar? The S&P 500 is bound to retest October’s 3500 low as profits tank.

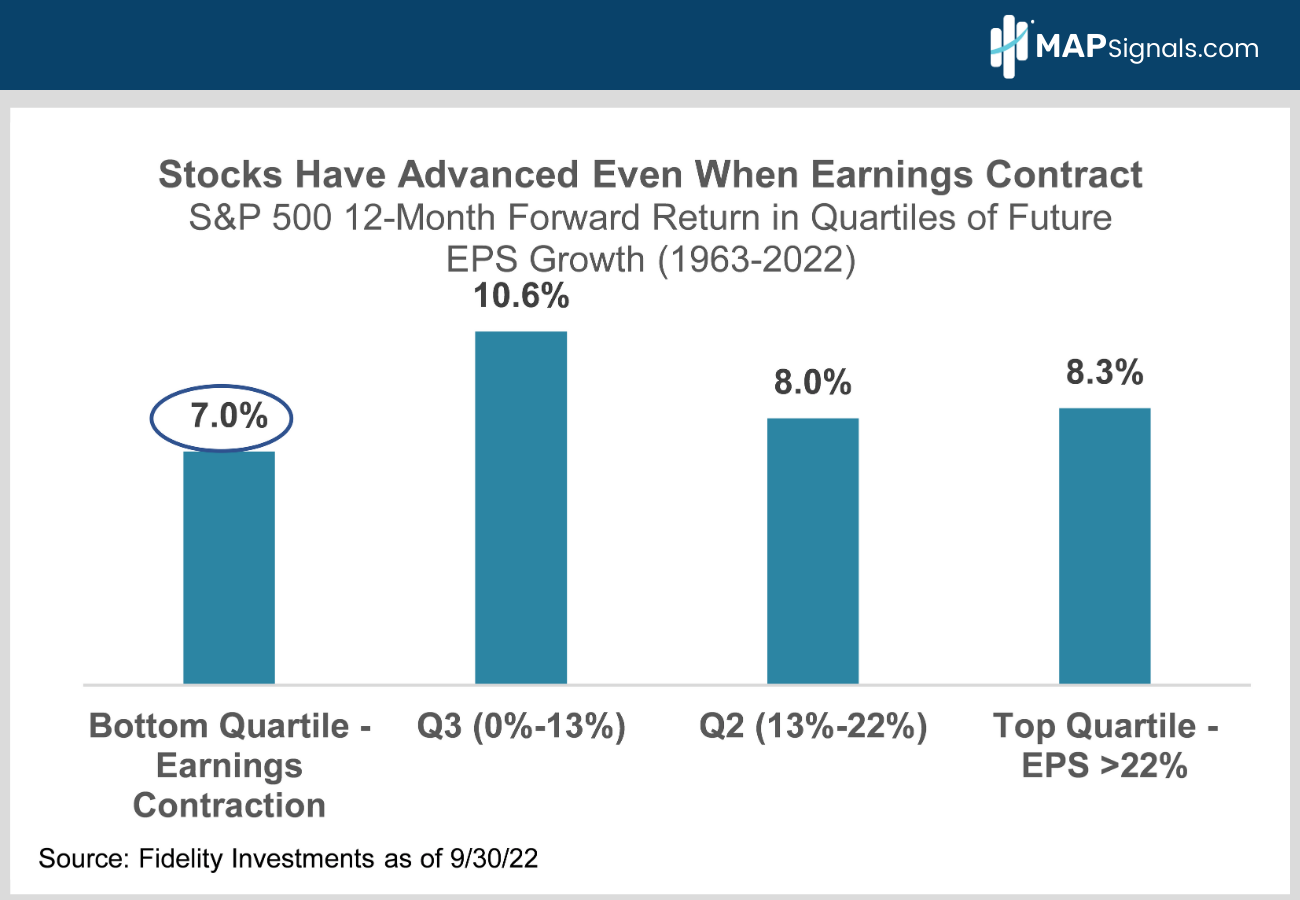

Not so fast. Check out this next chart. The S&P 500 has averaged a 7% gain in years when earnings fell, posting gains nearly 2/3 of the time. Why? Because stocks are a leading indicator – they price in bad news ahead of time.

Stocks have only averaged a tiny 2% gain in years preceding earnings declines. This year stocks fared far worse. By the time earnings are really falling, stocks have already begun to rebound.

#4 Valuations: The S&P 500 is trading at 17.1X 12-month forward earnings, down from 21.5X a year ago. That’s a slight premium to its 16.3X average forward P/E since 1990. The conventional wisdom is that valuations still aren’t compelling because earnings momentum is weakening, meaning stocks are way more expensive than they look.

Let’s unpack that a little.

According to FactSet, analysts have over-estimated year-ahead earnings by an average of 7%. But that drops to only 2% when you exclude 4 nasty years associated with unpredictable macro shocks: the 9/11 attacks, the financial crisis in 2008-2009 and the Covid pandemic in 2020.

Unless 2023 turns into an epic economic downturn, history says 2023 earnings will probably be roughly unchanged from 2022 vs. the Street’s current 3% consensus 2023 EPS growth forecast.

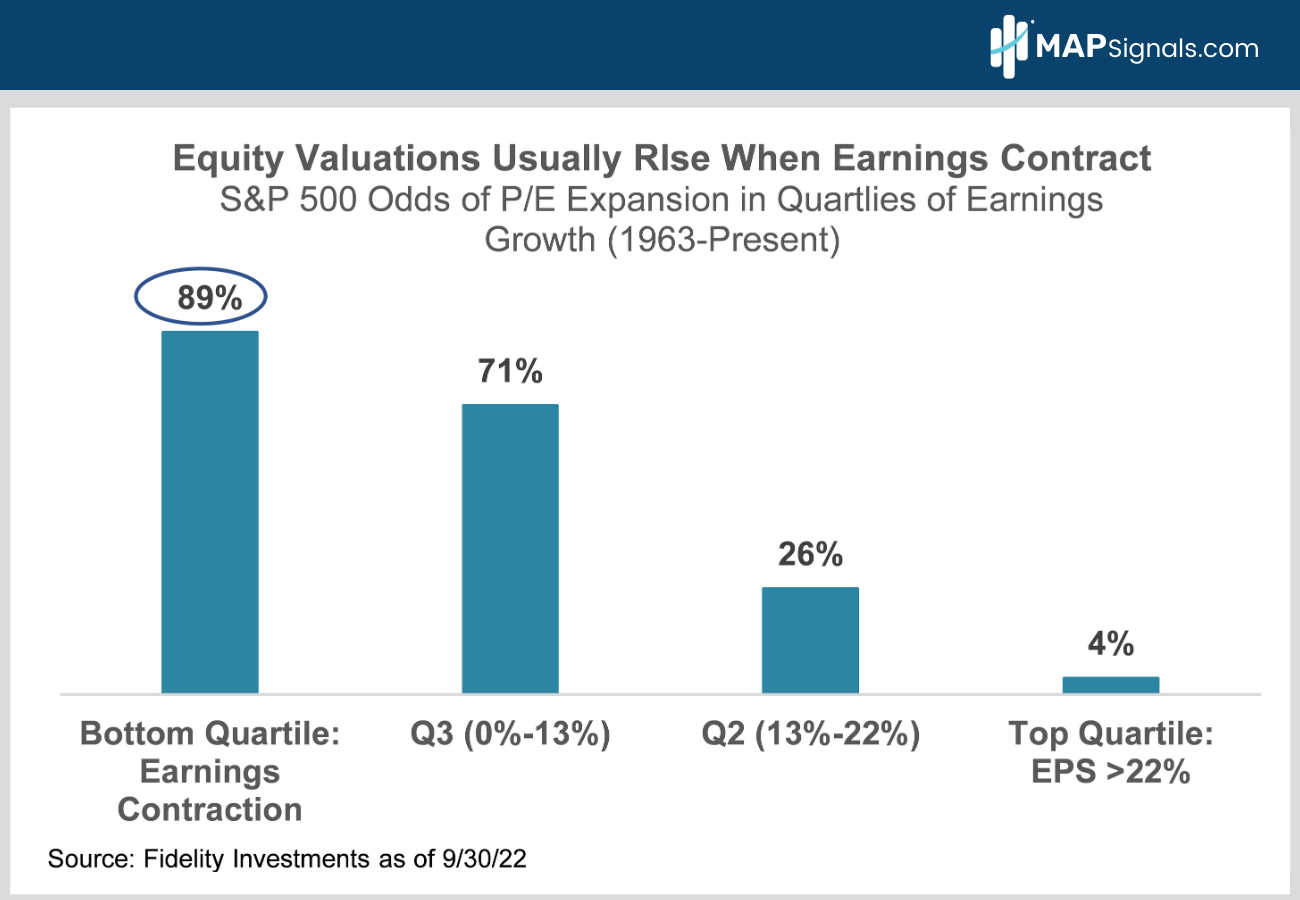

But let’s assume we have an ugly recession, and 2023 profit forecasts get slashed further. Even if that’s the case, falling earnings don’t usually mean falling valuations because stocks have already priced it in by the time it happens. Stocks fell 27% from January through early October for a reason, right?

Check out this chart. When earnings have fallen in the past, valuations have actually expanded 89% of the time. Remember, stocks are leading indicators. By mid-2023, markets will be looking through the valley to better days ahead in 2024 and P/E multiples will rise, not shrink.

Again, it’s further reason why stocks can be a good bet in 2023:

How to Play It

At a high level, the best way to play our bullish 2023 call is not to get scared out of stocks. Keep investing, buy quality on sale and stay the course. The odds are the lows are in. Even if they’re not, the risk-reward is much better than most appreciate.

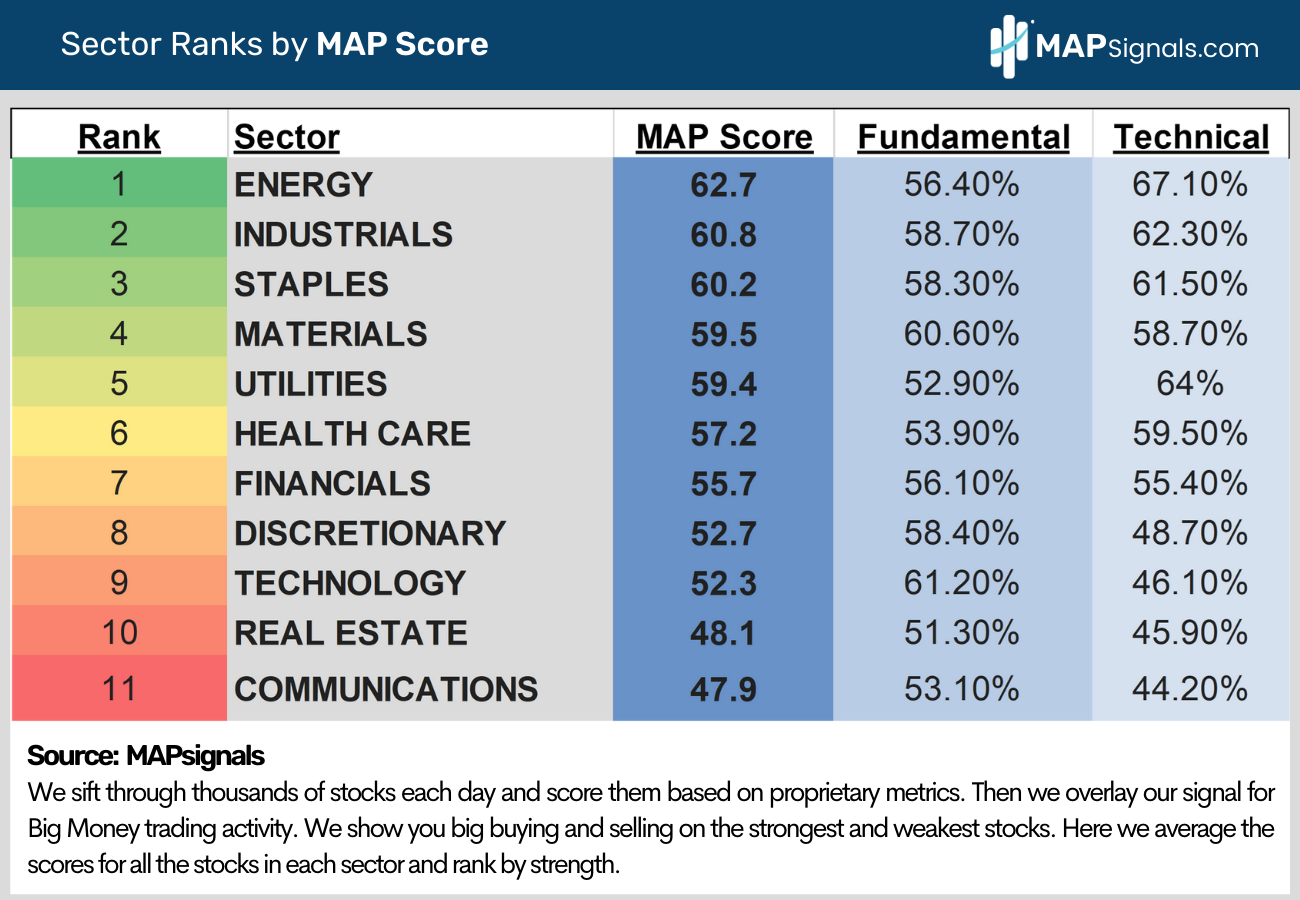

Drilling down to sectors, defensive sectors like staples, health care and utilities keep seeing Big Money buying, we’ve been talking about this all year. What’s new is better performance from cyclical value-oriented sectors like industrials, materials and financials which have joined energy in seeing strong institutional interest.

Winning portfolios need to balance two competing priorities entering 2023. You want downside protection without sacrificing big upside exposure. That’s a tough combination to find in one place. Most sectors offer one or the other. Defensives can protect but upside is limited. Cyclicals offer upside with bigger risk.

Here’s our MAP sector ranks:

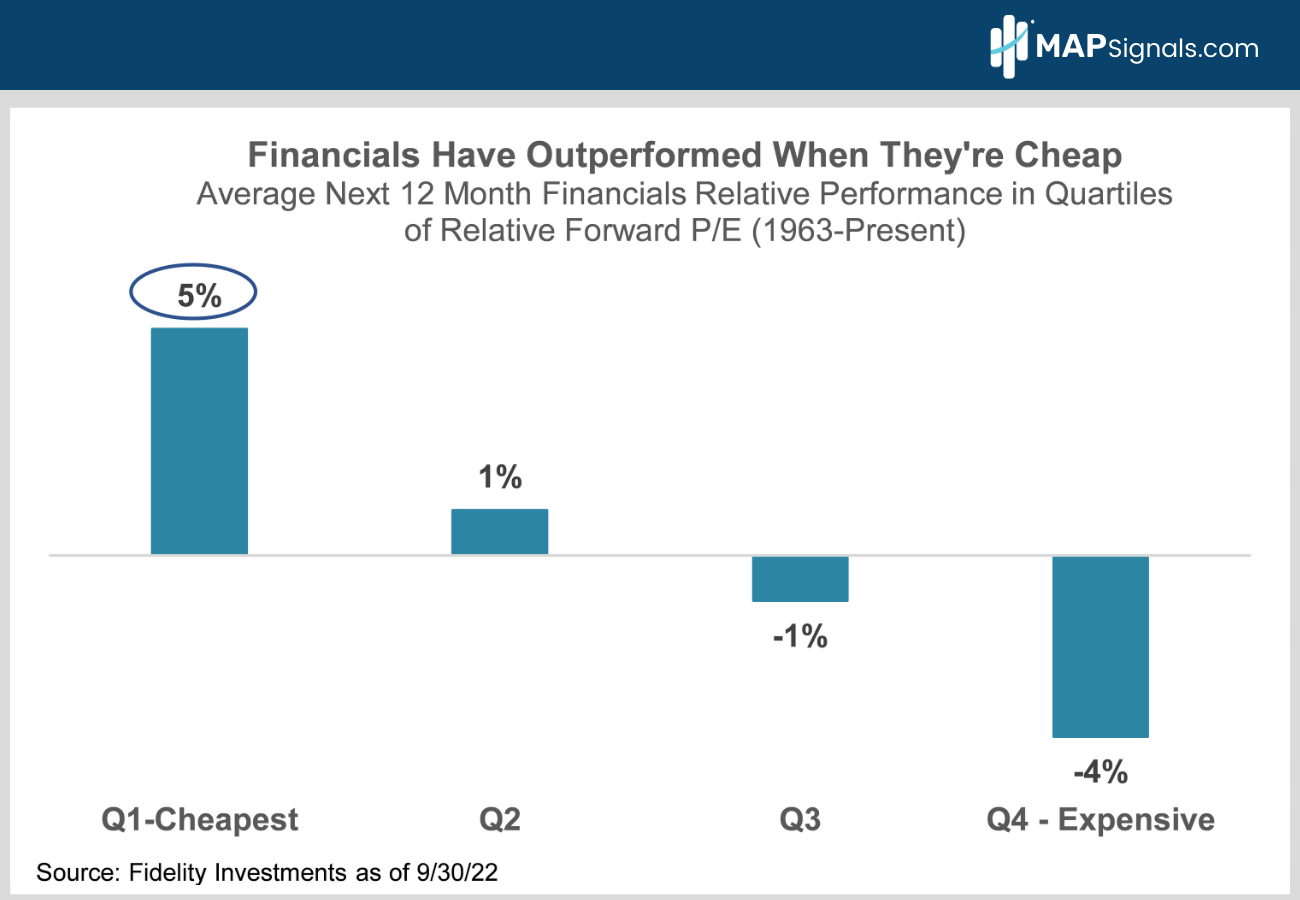

Financials is my top pick for 2023. It gives you the best of both worlds. It’s cyclical – so when stocks eventually rally for real as inflation eases, the Fed stops tightening and recession worries fade, the sector offers plenty of upside.

In the meantime, financials’ low valuation of only 10.5X 12-month forward earnings, combined with its healthy 2.7% dividend yield and 4% buyback yield, limit the downside.

Here’s the best part. Check out this chart. Financials do best when they’re cheap, like they are now, outperforming the S&P 500 by an average of 5% annually. This holds true even in recessions, as long as unemployment stays below 7.5%, double the current jobless rate of 3.7%. That’s a big margin of safety.

At the sector level, the best way to play financials is with the SPDR Financials ETF (XLF). It has a healthy MAPsignals MAP Score of 59. Its fundamental score is 58 and its technical score is 60. Subscribers can also access MAPsignals’ top financial stock picks in our universe.

Bringing It All Together

Macro clouds should part as 2023 unfolds helping stocks surprise to the upside as investors look through the valley to a healthier 2024. But it’s going to be a bumpy ride, especially early in the year as macro uncertainty lingers.

Keep dollar cost averaging into best of breed names seeing strong institutional support. You’ve endured the pain now don’t miss the pay-off.

At the sector level, financials offer the best risk-reward trade-off entering 2023.

The most profitable time to buy stocks is when it feels uncomfortable. If you wait until buying feels good, you’ll pay a big premium. Now is the time to position for an improving macro environment. And remember, stocks can be a good bet in 2023.

Lastly, if you’re an RIA or someone who loves unique research, get access to our data and more by subscribing to a MAPsignals subscription.

Happy Holidays,

-Alec