Why You Should Bet On Discretionary Stocks

It’s always tough to time the market because the biggest rallies always come after the worst selloffs.

It’s really easy to get faked out. 2022’s been a case in point.

After suffering through a 23% drawdown in the worst first half since 1970, the S&P 500 skyrocketed 9.1% in July with first half sector laggards now leading.

Today, I’ll explain why you should bet on discretionary stocks.

On July 11, I told you to Take Growth Over Value. I argued growth stocks would outperform as early signs of easing inflation and recession fears led markets to price in a less hawkish Fed. The call has worked.

With growth scarce, investors are paying up for reliable, “all weather” growers. Technology, consumer discretionary and communication services, which make up 72% of the S&P 500 Growth Index, are the best performing sectors off the lows.

Meanwhile, more economically sensitive value sectors like energy, materials, industrials, and financials have lagged amid nagging recession worries.

Why You Should Bet On Discretionary Stocks

I know many of you are wondering whether this rebound has legs. First I’ll make the case for the consumer discretionary sector. Then I’ll show you how to play it with a leading ETF that’s finally seeing big money buying after months of relentless selling. Subscribers can also check out MAPsignals’ discretionary names seeing the heaviest institutional dip buying.

Many are chalking this rebound up to a bear market bounce that’s doomed to fail. They’re cashing out or staying on the sidelines. That’s understandable. There are still plenty of macro risks out there.

Here’s the bear case in a nutshell. Inflation may have peaked but it won’t collapse overnight. Wage and housing inflation will prove sticky, forcing the Fed to stay hawkish longer than expected. That will tip the economy into an earnings-bruising recession and stop this rally dead in its tracks.

Sounds pretty convincing right? But here’s what the bears miss. Stocks are forward looking and already discount A TON of bad news. Nothing’s been hit harder than the discretionary sector. Its trailing 1-year relative performance has only been worse 1% of the time going back to 1962.

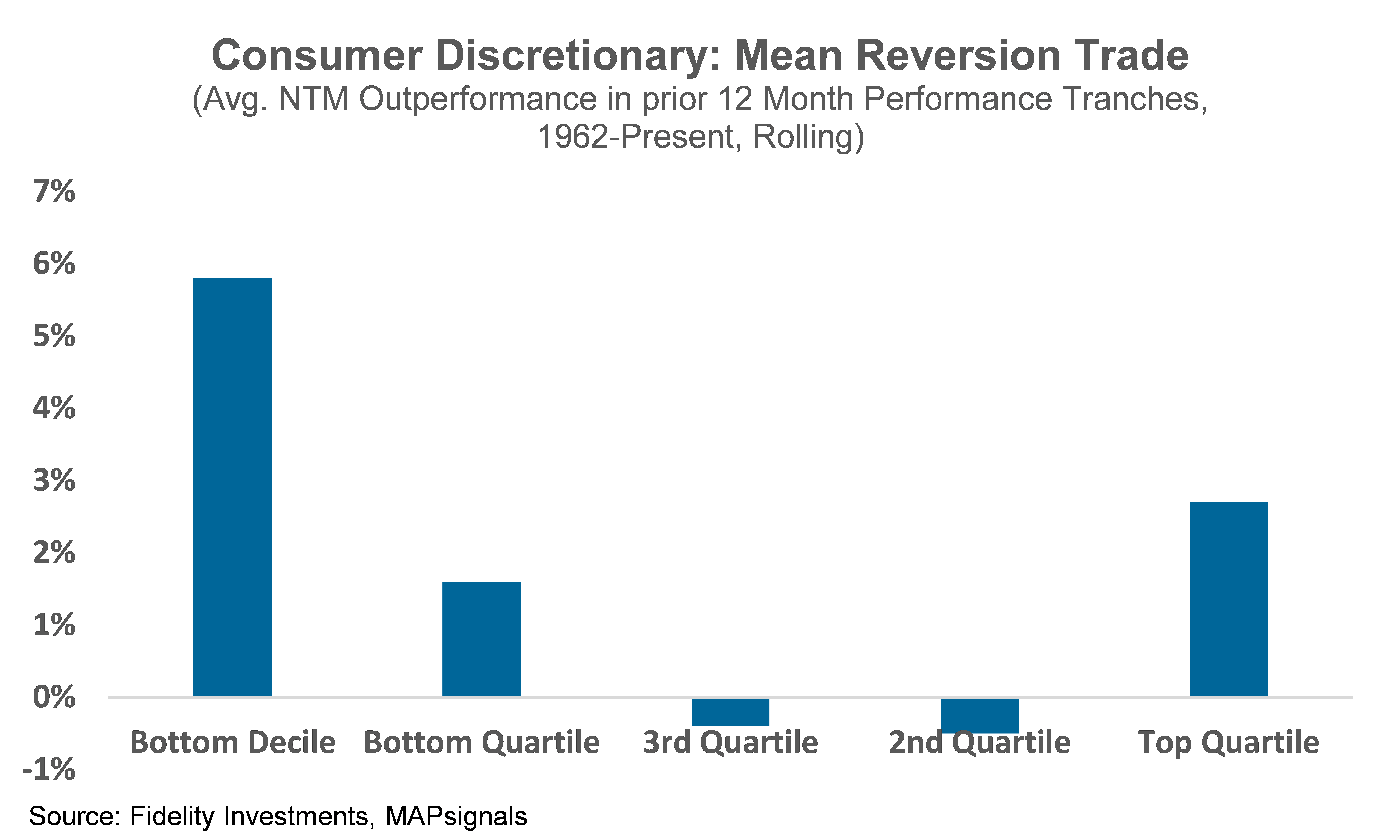

Betting on the discretionary group is a mean reversion trade. The worse performance has been, the better the outlook. It’s outperformed the S&P 500 by an average 5.8% in years following its weakest 12 month stretches (chart).

In the above graphic, the left-most bar is what should jump out to you. When discretionary names get crushed, they tend to rebound in dramatic fashion.

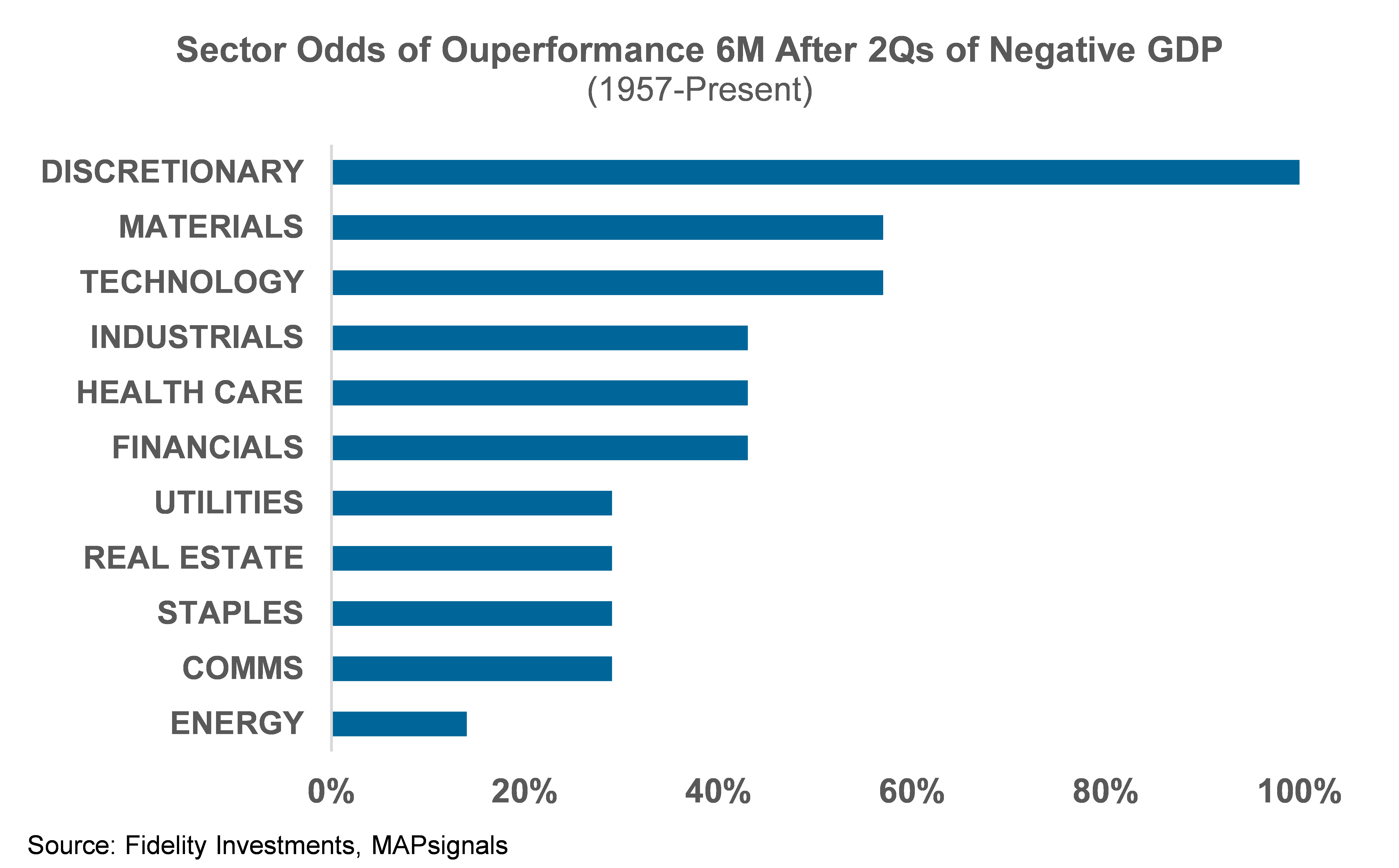

Now, if you’re worried about the macro getting worse, check this out. The recent negative Q2 GDP print has historically been a contrarian buy signal. Since 1957, consumer discretionary is the only sector that’s always outperformed the S&P 500 in the 6 months following 2 quarters of negative real GDP growth (chart).

The bottom line: discretionary always bottoms ahead of fundamentals. Based on a rich history, this chart points to why you should bet on discretionary stocks.

So, how can you take advantage of this theme? Let’s check on that now.

How to Play the Discretionary Sector

The SPDR Consumer Discretionary ETF, XLY, is the biggest and most liquid discretionary ETF. Its top holdings include world-class stocks like Amazon, Tesla, Home Depot, McDonalds’s, Nike, and Starbucks.

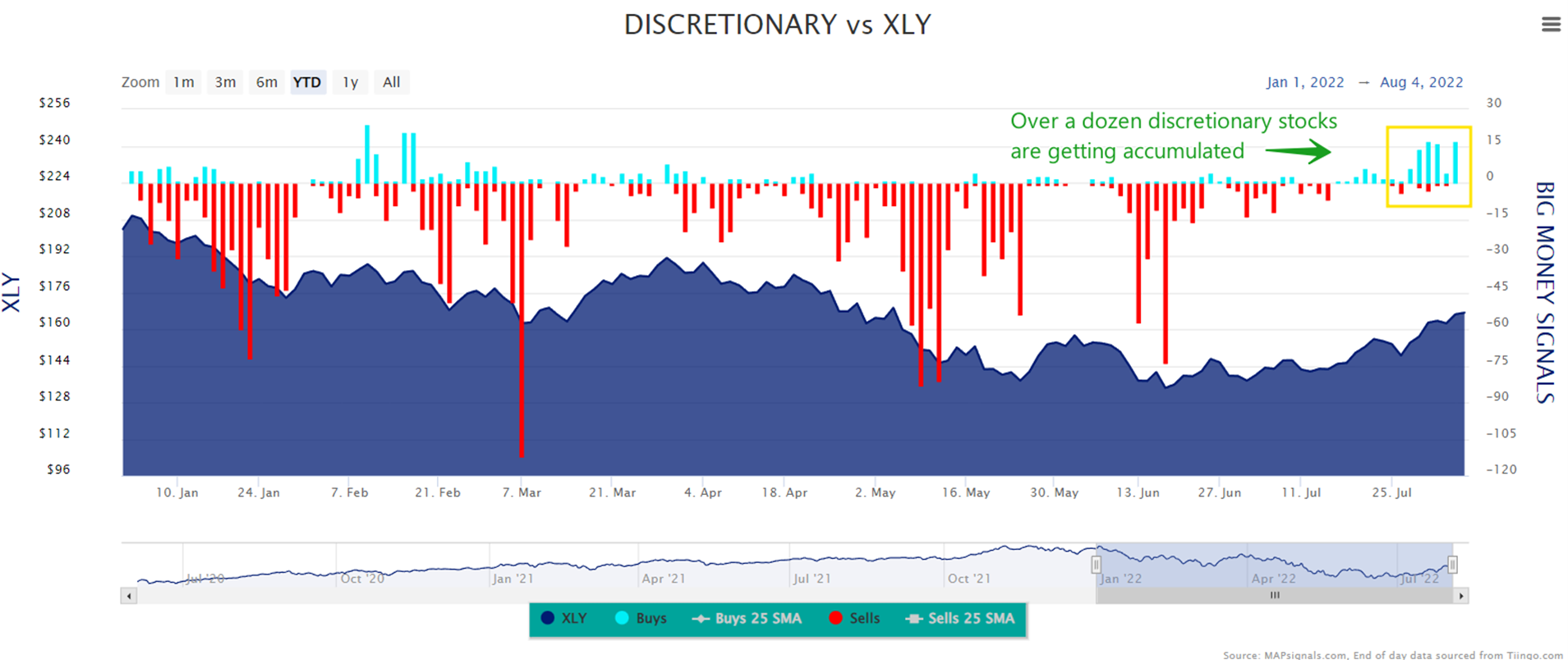

Check out XLY’s chart below. In the wake of the accelerating selling that peaked in mid-June, selling has recently dried up while buying is picking up nicely.

Throw in XLY’s strong fundamental map score of 69 and its strong mean reversion track record and you’ve got a recipe for a winning trade. Our data shows more and more discretionary stocks are getting institutional capital – the most is 6 months:

Bringing It All Together

The discretionary sector is finally outperforming as markets discount a less hawkish Fed amid easing inflation and weak growth. With the economy sluggish, investors are paying up for the sector’s high quality, “all weather” growers.

While wage and housing inflation could prove sticky, forcing the Fed to stay hawkish longer than expected, it’s important to remember that a dismal first half priced in a lot of bad news.

When discretionary sector performance gets really bad, bet on a better outlook. History makes a strong case as to why you should bet on discretionary stocks. If you want to play a basket of discretionary names, consider XLY.

But, if you’re wanting to get specific stocks ramping with Big Money support, get started with a MAPsignals platinum subscription. It’ll get you access to our portal that updates every morning, showcasing the stocks getting bought and sold.

Invest well,

-Alec