3 Stocks Under Heavy Accumulation

Market leadership has been thin in 2022. Even so, there are plenty of stocks powering higher.

That’s the beauty of following large, unusual volumes. Today I’ll showcase 3 stocks under heavy accumulation.

It’s been a wild ride for markets this year. The S&P 500 is down 16% YTD. That doesn’t sound too bad when compared to the tech-heavy NASDAQ 100 ETF (QQQ), down 29% in 2022. No doubt, it’s been rough sledding for many investors.

But if you focus solely on the major indexes, you can easily miss plenty of opportunity. There are many stocks powering higher week after week. And MAPsignals alerts you to them… every day!

Today we’ll quickly look at the health of the overall market, then I’ll laser in on 3 stocks under heavy accumulation.

Let’s go.

3 Stocks Under Heavy Accumulation

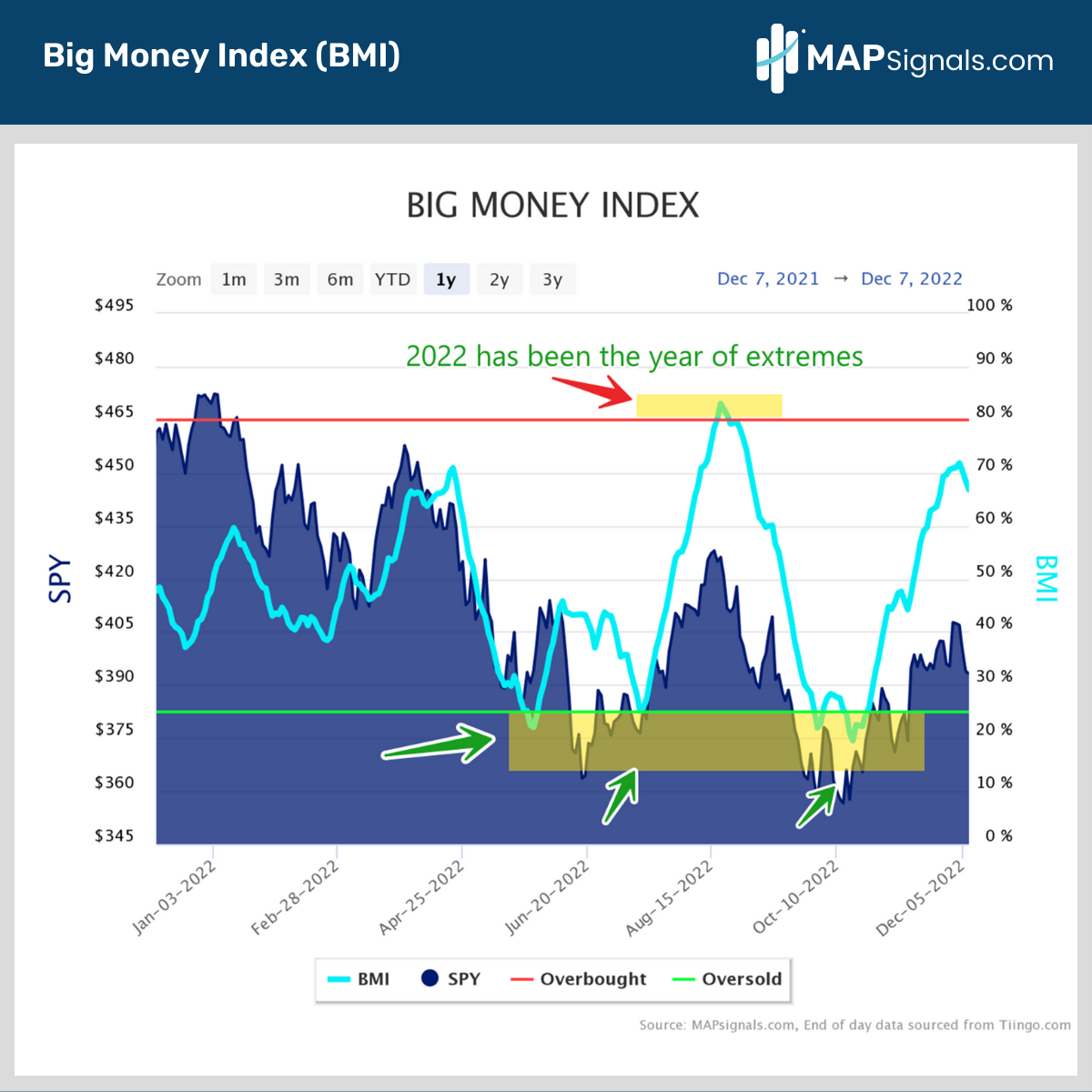

No question, there’s been a lot of tugging and pulling in the market all year. Stocks registered an oversold Big Money Index 4 times in 2022. Then in August we briefly visited overbought territory, prefacing your sell signal to take profits:

With all this bobbing and weaving, it’s easy to put stock picking on the backburner. Most folks aren’t fans of massive volatility, and I don’t blame them.

However, MAPsignals isn’t only about tracking the market’s movements, our algos reveal the stocks ramping higher with outsized volumes. These can be some of the biggest winning names in the market.

Believe it or not, there are equities thriving in this tape. Data helps you spot them.

Let’s dive into 3 of them today.

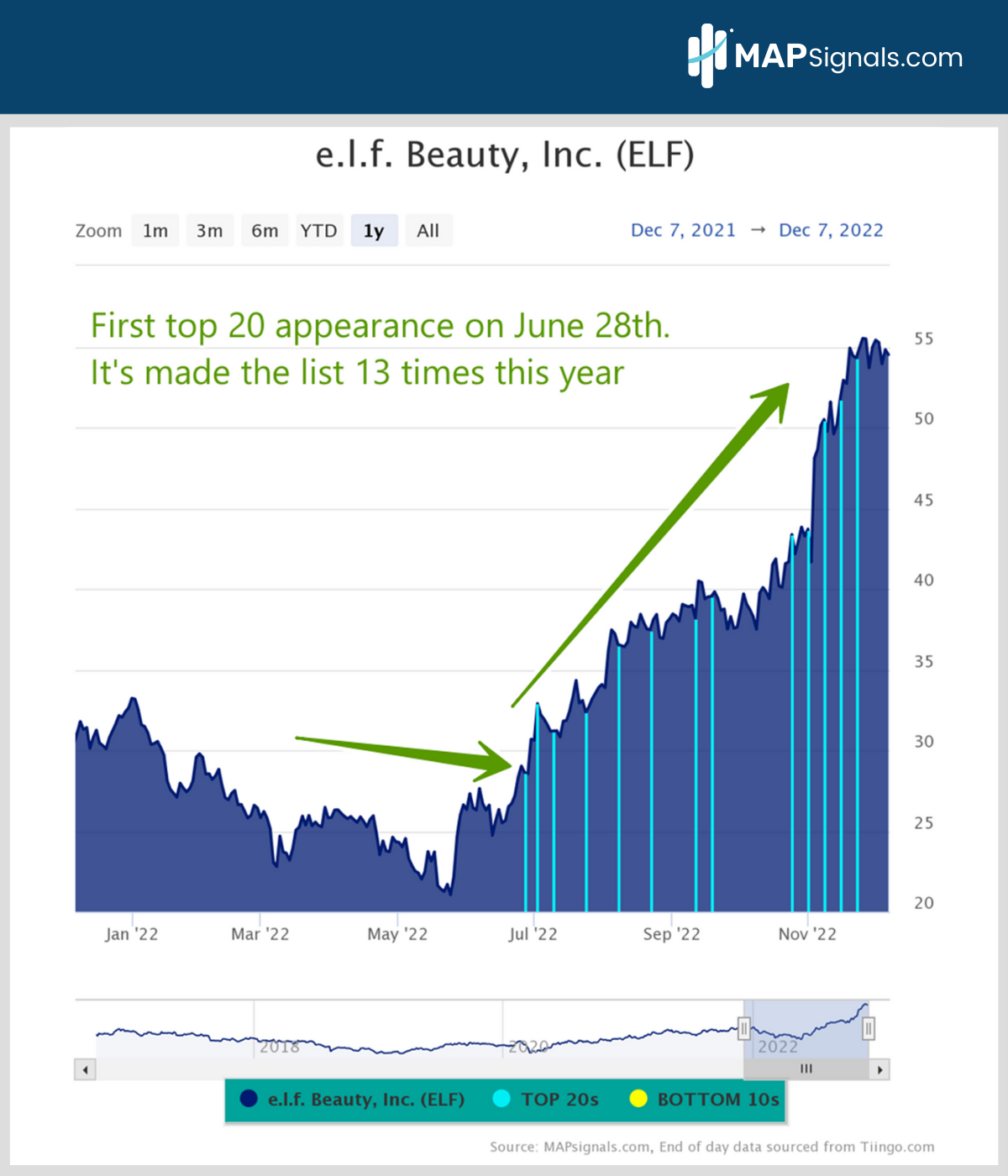

Up first, is under-the-radar e.l.f. Beauty (ELF). The company operates in the cosmetic and skin-care space. Below you’ll see a 1-year chart of ELF stock overlaid with our Top 20 signals. The company has been one of the top ranked stocks in our research 13 times this year.

The firm sports healthy top and bottom-line growth with a 5-year sales CAGR of 11.3%, and 5-year net income CAGR of 32.6%.

That’s a chart:

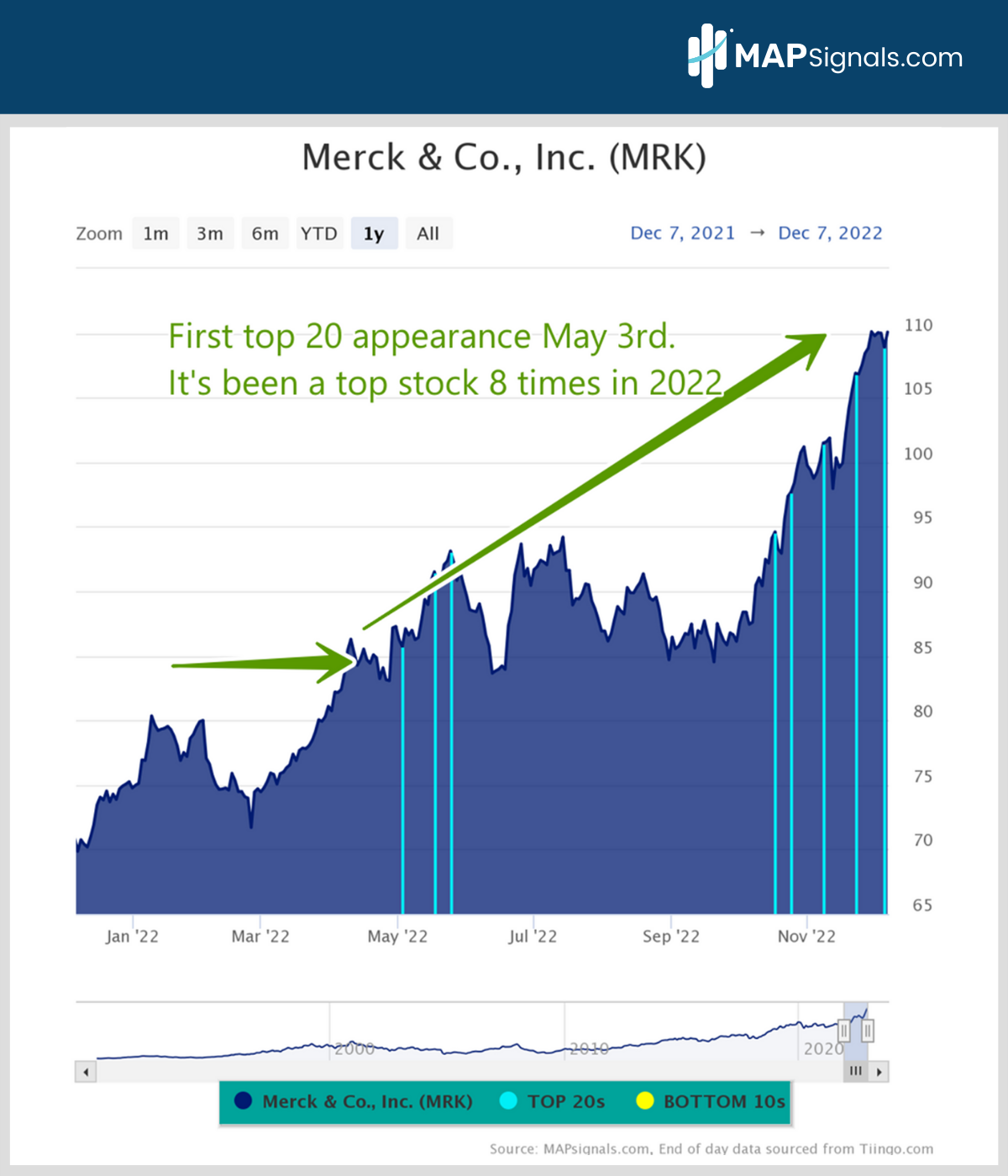

Next up is Merck (MRK). This biopharmaceutical giant has benefited from strong healthcare leadership and its attractive dividend yield of 2.7%.

Like ELF, it has found a spot on our Top 20 list 8 times in 2022. The firm is a slower grower with 5-year sales CAGR of 4.4%, and 5-year net income CAGR of 25.8%.

Full disclosure, I’ve owned shares of MRK in a personal account for years:

And finally, there’s World Wrestling Entertainment (WWE). This media company produces and distributes content through license arrangements. It’s another under-the-radar firm forging higher this year.

Wrestling was a staple in my home growing up in the ‘80s. And in 2022, it’s been a staple in our research. It has the 3 attributes we look for in top-ranked stocks: big inflows, strong fundamentals, and healthy technicals.

This company sports a 5-year sales CAGR of 8.5%, and 5-year net income CAGR of 39.3%.

Have a look at the strong uptrend below:

So, here we have it. Even in a tough bear market, there’s plenty of opportunity when you dive under the surface.

Following stocks under heavy accumulation alongside healthy fundamentals has been a winning recipe. Let’s wrap up.

Here’s the bottom line: Leadership has been thin in 2022. If you only focus on major indexes, you can miss leadership quality stocks.

Many companies out there are pressing higher. And today’s message highlights how you can spot names outside of conventional leading groups like Energy (top ranked sector all year).

Merck, e.l.f., and World Wrestling Entertainment are 3 stocks under heavy accumulation in our research. If you’re looking for single stock ideas with a data-based approach, give MAPsignals a try.

All these charts are made in our automated portal, available to Platinum subscribers.

Remember, there’s a bull market out there, even if thin… and data helps you find it!

Have a great week.