Strong Earnings Growth will Fuel the Tech Rally

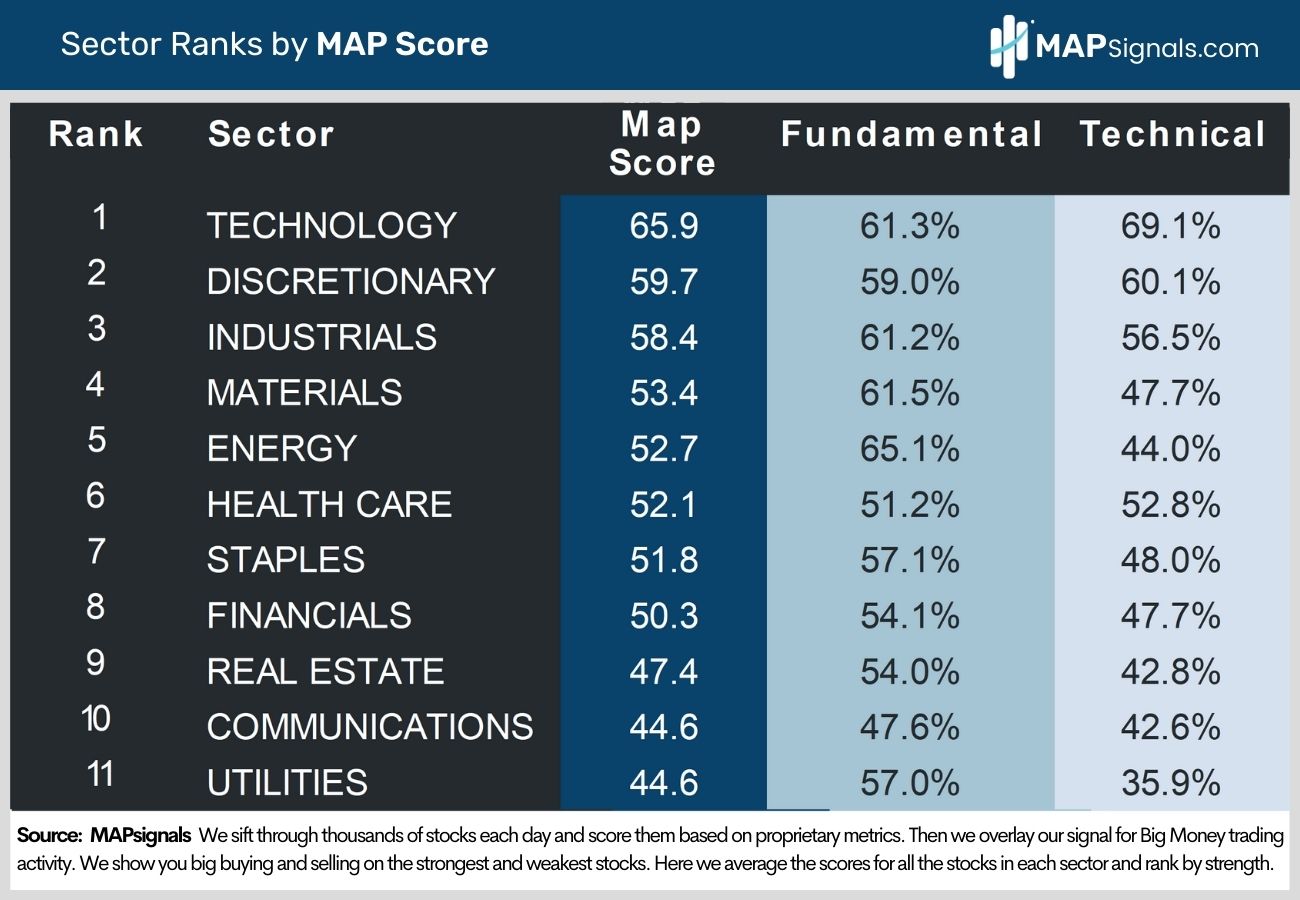

Tech’s been on fire. It’s up 35% YTD, almost triple the S&P 500’s 12.5% gain. Tech’s been MAPsignals’ top ranked sector all year. Strong earnings growth will fuel the tech rally.

The S&P 500’s overall direction tracks tech because the sector’s so big at 28% of the index. Add in communications services – home to Google, Netflix, and Meta – and you’ve got a whopping 37% of the S&P concentrated in blue chip tech. Many factor indexes like quality and growth are also very tech heavy.

Our confidence in tech is the biggest reason we told you to overweight high quality stocks on March 6. It’s also why we told you not to rule out new highs late this year on April 10, and why we told you to favor growth over value on May 8.

All these calls have worked, thanks largely to tech leadership. In this market it’s always a healthy exercise to take a victory lap when it’s warranted.

Below plots the sector leaderboard we’ve positioned for all year: Tech reigns supreme.

But it can’t always be rainbows and butterflies. Now there’s another worry in the marketplace. Many say frothy AI hype has driven tech to nosebleed levels. While the current pace of tech outperformance isn’t sustainable (no sector can triple the S&P 500’s return forever) we still think tech stocks will keep climbing through year-end.

Let’s dig deeper.

Today, I’ll explain why tech stocks can keep climbing. Then I’ll use MAPsignals data to show you how to play it with a leading tech ETF.

Strong Earnings Growth will Fuel the Tech Rally

Letting your winners run is how you outperform markets over the long-run. Just because names have rerated higher doesn’t mean it’s time to ring the register. The forward earnings picture is brighter than many feared. But there’s more.

Why Tech Still Has Legs

- When Growth is Scarce, Tech Shines: With recession fears still elevated, tech’s reliable, all-weather growth is attracting investors.

- Less Fed Uncertainty: As inflation continues to gradually ease, the Fed’s tightening campaign is winding down. Since 1957, the FOMC has only waited an average of 3.4 months between ending rate hikes and beginning to ease policy. Anticipation of Fed rate cuts will keep lifting tech stocks.

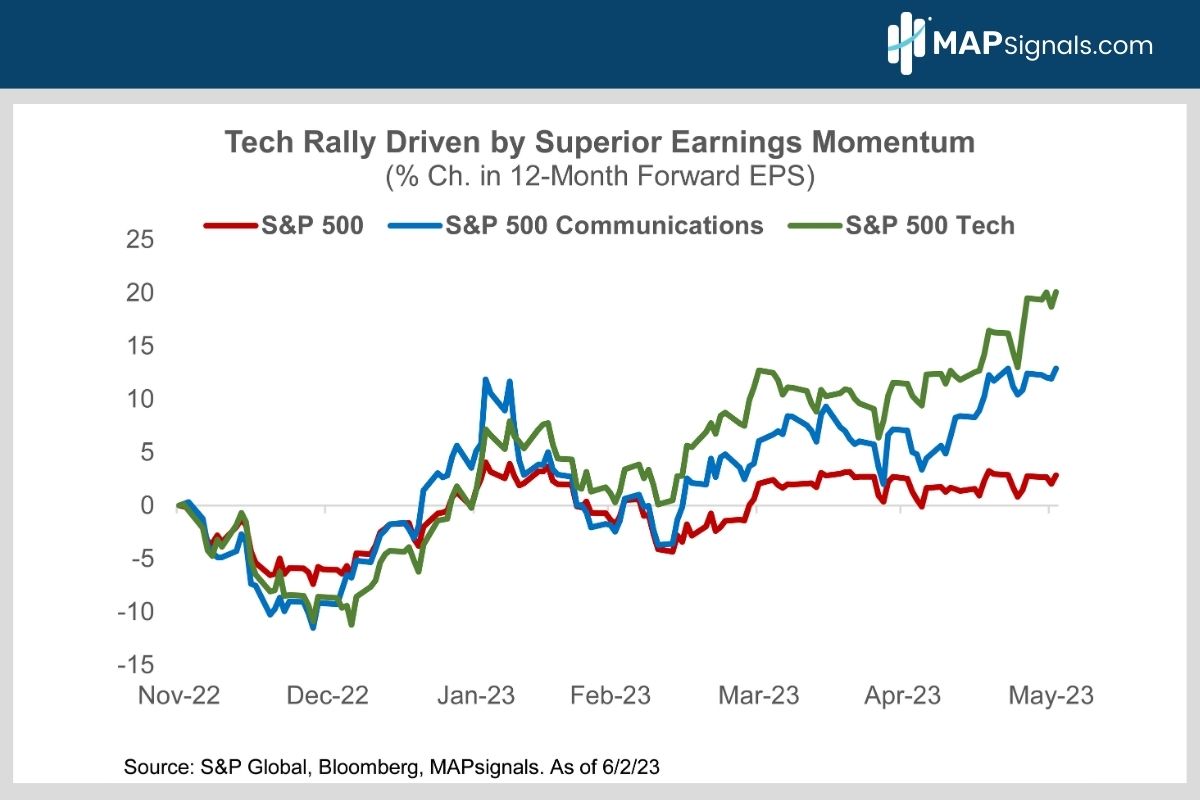

- Top Notch Earnings Momentum: S&P 500 tech sector 12-month forward earnings forecasts have been revised up 20% since November vs. only 3% for the S&P 500. Even better, tech is seen posting 17% CY 2024 EPS growth vs. the S&P’s 11.3%. That’s 33% more profit growth!

As shown below, the tech rally is set to stay as earnings momentum underpins the latest up-move:

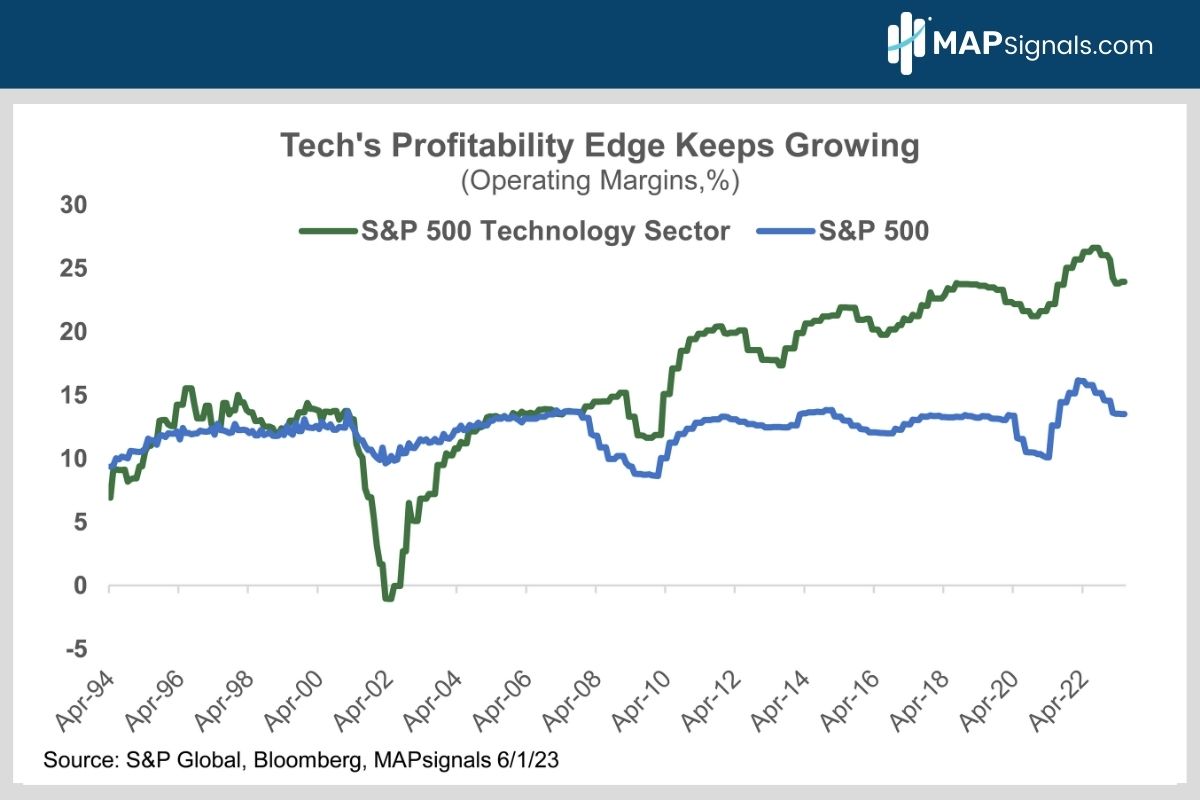

- Fatter Profit Margins Tech’s market leading 24% operating profit margin towers over the S&P’s 13%. The spread between the two has rarely been wider.

- Growth at a Reasonable Price: Tech trades at 27X 12-month forward EPS vs. the S&P’s 19X. The premium valuation is justified by much faster earnings growth.

Below plots the spread in Tech profitability vs the S&P 500’s. This is why Technology stocks deserve higher valuations:

How to Play it

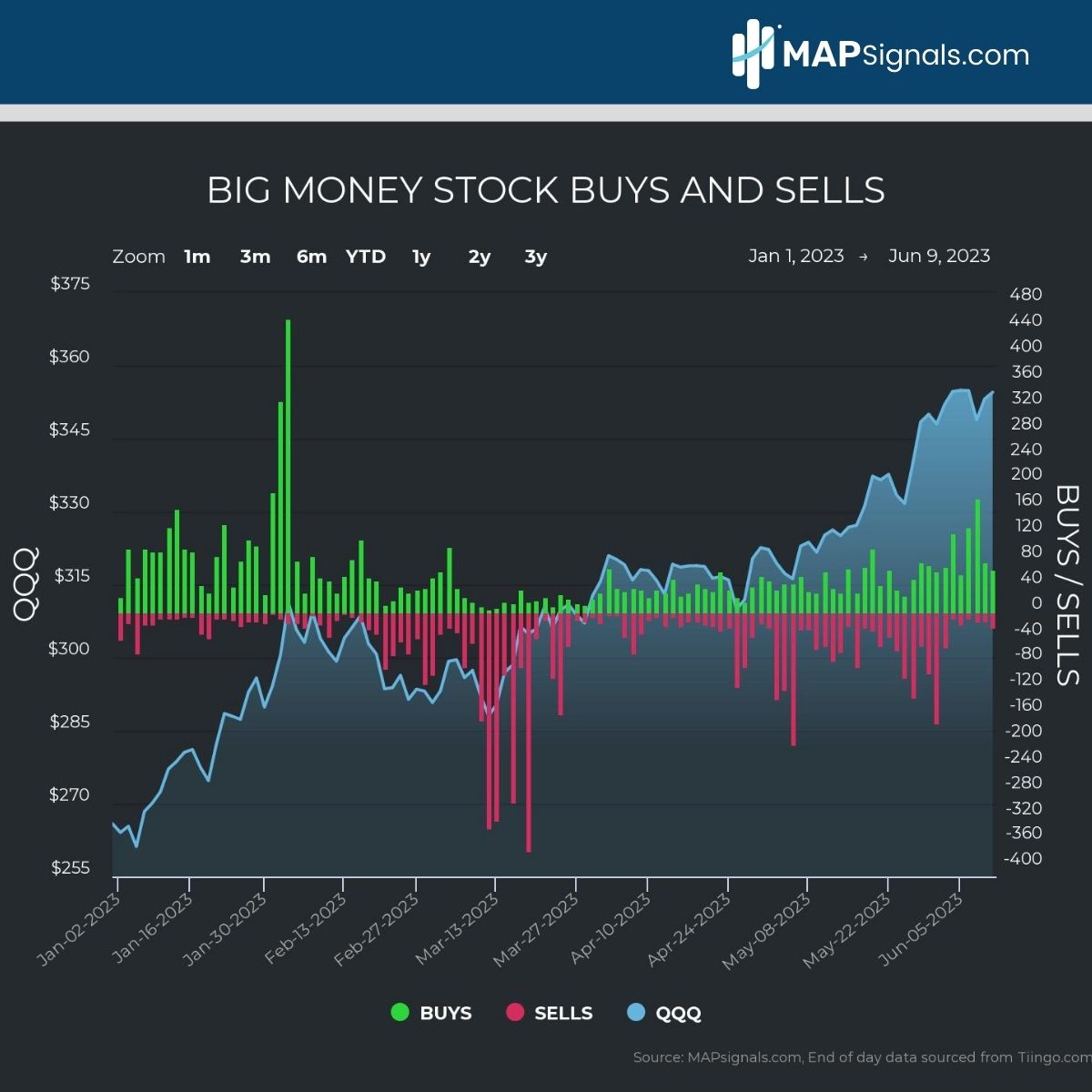

The Nasdaq 100 ETF, QQQ, is the best ETF to play large cap tech. It’s super liquid with $145B in assets, by far the biggest in the category. Even better, it sports a strong 69 map score and a low 0.2% expense ratio.

Top holdings include Microsoft, Apple, Amazon, Nvidia, Meta, Alphabet and Tesla, which account for roughly half of the QQQ’s market cap.

Big investors have also been along for the ride all year. The below chart shows the parabolic move in the ETF. Many of the green stocks keeping it bid are Technology companies:

Bringing It All Together

Tech stocks have crushed it this year. Many think the party’s over. We disagree.

The rally is underpinned by an improving macroeconomic outlook as easing inflation gives the Fed scope to not only wind down tightening, but also begin cutting rates sooner than most appreciate. That, coupled with tech’s market leading earnings momentum justifies more upside.

QQQ is a great way to get broad tech exposure.

Subscribers know we specialize in specific stocks. That’s where the golden opportunity lies. Later today we’re putting together a Pro subscriber update highlighting 3 smaller names Alec believes are primed for AI-fueled upside.

To outperform, use a map!

Tech’s had a great run but there’s more to go. Get started with a subscription here.

Invest well,

-Alec